New Hampshire Minimum Auto Insurance Requirements for 2025 (See What NH Requires Here!)

New Hampshire minimum auto insurance requirements are 25/50/25 coverage—$25,000 for bodily injury per person, $50,000 total for injuries, and $25,000 for property damage. While NH doesn’t require insurance for all drivers, it’s still good to have. New Hampshire car insurance rates start at $17/month with USAA.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

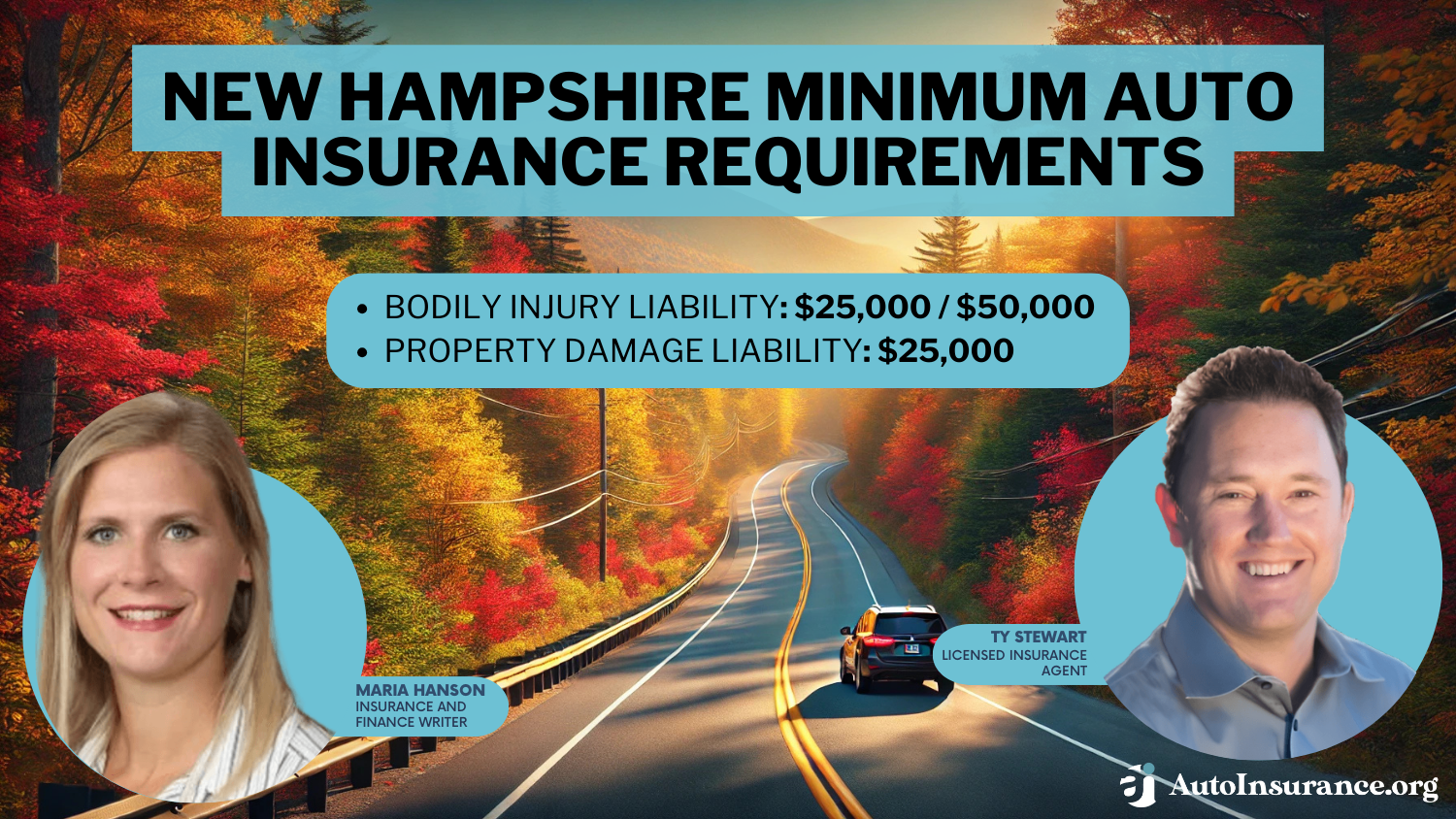

New Hampshire minimum auto insurance requirements mandate $25,000 per person and $50,000 per accident in bodily injury liability, $25,000 in property damage liability, and $1,000 in medical payments coverage.

Although New Hampshire is the only state that doesn’t require all drivers to buy mandatory auto insurance, some drivers are required to purchase insurance and submit proof to the New Hampshire DMV.

New Hampshire Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

If you need to provide an SR-22 form, your driver record will state, “Proof of financial responsibility is required.” Individuals convicted of driving under the influence (DUI) in New Hampshire are also required to buy car insurance.

Compare quotes for the coverage you need. Enter your ZIP code into our free rate tool to find the right insurance.

- New Hampshire is the only state without a mandatory car insurance law

- New Hampshire requires 25/50/25 coverage if you choose to have insurance

- If involved in an accident, NH drivers must provide proof of insurance

New Hampshire Minimum Car Insurance Requirements & What They Cover

If you don’t have car insurance in New Hampshire, you must file proof with the state that you meet the New Hampshire motor vehicle financial responsibility requirements.

If you choose to buy car insurance in New Hampshire, the state has specific minimum coverage requirements. You’ll need at least $25,000 in bodily injury liability for one person, $50,000 for two or more people per accident, and $25,000 for property damage.

You must also buy at least $1,000 in medical payments coverage and uninsured motorist coverage. New Hampshire doesn’t specify any minimum for uninsured motorist coverage.

The New Hampshire DMV advises drivers that underwriting and rating determine the price insurance companies charge for each type of auto insurance coverage.

Learning insurance categories and terms will help you comply with New Hampshire auto insurance laws and also choose the best value for your driving needs.

Car insurance policies have as many as six different parts. Prices for each part differ depending on your driving history, type of vehicle, and many other factors.

Bodily Injury Liability

If an accident occurs, bodily injury liability auto insurance coverage pays for injuries suffered by people in the other car, not your own. Bodily injury liability also covers your injuries if you drive someone else’s car with permission.

You could be sued by the insurance company and individuals in another vehicle if you are in an accident.

The Insurance Information Institute advises you to consider the value of your home and savings when deciding how much bodily injury liability coverage you should have.

Personal Injury Protection (PIP) / Medical Payments

Personal injury protection or medical payment coverage pays for medical treatment incurred in an accident.

Medical coverage can also cover lost wages or help pay for necessary services while injured, including child care and elder care.

Property Damage Liability

If you damage someone else’s property while driving, such as a fence, wall, or light post, property damage liability will pay for repairs minus a deductible amount.

This coverage will also pay for damage to another person’s car if you’re involved in an accident. Learn more about the best property damage liability (PDL) auto insurance companies to find affordable and reliable options.

Collision

Collision auto insurance coverage pays for damage to your car in an accident, even if you are found to be at fault. The catch is you are responsible for your deductible amount. The insurance company will pay for costs after you pay the deductible.

Auto insurance deductible amounts range between $250 and $1,000. The lower your premium for collision coverage, the higher the deductible.

Comprehensive

Comprehensive auto insurance coverage will reimburse your repair costs if your car isn’t moving but is somehow damaged. Comprehensive coverage will pay for damage from the following:

- Floods

- Fires

- Vandalism

- Collision with an animal

A typical comprehensive deductible amount ranges from $100 to $300.

Uninsured and Underinsured Motorist Coverage

Uninsured (UM) and underinsured (UIM) coverage is particularly important in New Hampshire because all drivers aren’t required to have insurance. The state’s minimum insurance amounts can cause some drivers to be underinsured (Read More: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in New Hampshire

Shopping for car insurance in New Hampshire can be tricky since not everyone is required to have it. But for those who do, there are plenty of options to keep costs down.

Some companies offer rates starting as low as $25 a month, though your actual premium will depend on factors like your driving record, the car you drive, and the coverage you pick.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in New Hampshire

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in New Hampshire

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in New Hampshire

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsWhen shopping for coverage, don’t just settle on the first quote you get. Comparing rates from multiple providers is the best way to make sure you’re getting a great deal. To help you get started, check out the average monthly rates for auto insurance in New Hampshire below.

Monthly Minimum Auto Insurance Rates from Top Providers in New Hampshire

| Insurance Company | Average Monthly Rate |

|---|---|

| $67 | |

| $32 | |

| $42 | |

| $21 | |

| $40 |

| $56 |

| $34 | |

| $24 | |

| $50 | |

| $17 |

These rates can vary depending on your age, driving history, coverage level, and location. In fact, where you live can play such a big role that it could change your premiums quite a bit.

To help give you a better idea, here’s a breakdown of the average monthly rates for minimum coverage auto insurance in different cities across New Hampshire.

New Hampshire Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Claremont | $65 |

| Concord | $73 |

| Derry | $72 |

| Dover | $69 |

| Keene | $68 |

| Laconia | $66 |

| Lebanon | $67 |

| Londonderry | $72 |

| Manchester | $78 |

| Merrimack | $71 |

| Nashua | $75 |

| Portsmouth | $77 |

| Rochester | $70 |

| Salem | $74 |

| Somersworth | $68 |

Want more tips? Head over to our guide on the best New Hampshire auto insurance for a closer look at your options.

Penalties for Driving Without Insurance in New Hampshire

While New Hampshire doesn’t require all drivers to carry insurance, that doesn’t mean you can drive around without it and not face consequences. If you’re involved in an accident and don’t have insurance, the penalties can be serious—and expensive.

For example, if the damages in the accident exceed $1,000 or someone gets injured, the state may suspend your driver’s license and your vehicle registration. On top of that, you’ll be required to show proof of insurance for the next three years.

This isn’t just a minor inconvenience; if you fail to get insurance after being in an accident, you’ll likely face higher premiums when you do get coverage. And, in some cases, you could have to pay for the damages out of pocket, which could quickly add up to a hefty amount.

Not carrying insurance in New Hampshire may save you a few bucks in the short term, but it can cost you a lot more if something goes wrong. The fines, license suspension, and high premiums you could face are often more expensive than just having insurance in the first place.Michelle Robbins Licensed Insurance Agent

While New Hampshire doesn’t require insurance for everyone, driving without auto insurance can be risky. The financial fallout could be significant if you’re involved in an accident.

Other Coverage Options to Consider in New Hampshire

New Hampshire’s minimum coverage may get you by, but adding a few extra options can provide valuable protection.

- Gap Insurance: If you’re still paying off a new car loan, gap insurance covers the difference between what you owe on your loan and the car’s actual value if it’s totaled.

- Non-Owner Car Insurance: Non-owner insurance can provide liability coverage if you don’t own a car but still drive occasionally. It’s a great option for people who rent or borrow cars frequently.

- Rental Car Reimbursement Coverage: If your car is being repaired after an accident, this coverage helps pay for a rental car while you wait for your vehicle to be fixed.

- Roadside Assistance: Roadside assistance can save the day if you run out of gas, get a flat tire, or need a tow.

- Ridesharing Insurance: Your personal auto insurance might not apply if you drive for a rideshare company, so this is a smart addition if you regularly use your car to earn money (Read More: Best Rideshare Auto Insurance).

These extra coverages can make a big difference in the long run. They’re especially helpful if you have a newer car, a lot of driving to do, or if you’re using your car to make money through ridesharing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Proof of Insurance and Financial Responsibility

New Hampshire accepts proof of financial responsibility or insurance coverage using form SR-22, which can be provided through the mail or electronically. When comparing car insurance, confirm that the company is licensed to provide coverage in New Hampshire. Read more about SR-22 auto insurance coverage in our guide.

The state’s Bureau of Financial Responsibility receives SR-22 forms directly from insurance companies, which provide proof of financial responsibility. If there are any problems, the Bureau will notify your insurance company or you through the mail.

New Hampshire Car Insurance: How to Find the Right Coverage

In New Hampshire, not everyone is required to carry car insurance, but driving without it can lead to costly consequences if you’re involved in an accident.

Even if you’re not legally obligated to have full coverage, opting for the right protection—whether it’s collision, comprehensive, or gap insurance—could save you a lot of money and stress down the road. With rates that can vary based on where you live and your driving habits, it’s smart to compare auto insurance quotes before deciding.

Compare car insurance quotes to find the coverage you need at the best rate. Enter your ZIP code to get started!

Frequently Asked Questions

What are the minimum New Hampshire auto insurance requirements?

New Hampshire car insurance requirements are 25/50/25 of bodily injury and property coverage.

What is the average rate for auto insurance in New Hampshire?

The average auto insurance cost per month in New Hampshire is around $38.

Do all drivers in New Hampshire need to buy mandatory auto insurance?

Two common questions among NH drivers are, “Does New Hampshire require car insurance for all drivers? and “Do you need car insurance in New Hampshire?”

The answer to both questions is no. Car insurance is optional in New Hampshire. However, according to New Hampshire car insurance laws, drivers who choose to have insurance must meet certain coverage requirements and may need to provide proof to the New Hampshire DMV.

How can I understand the car insurance requirements in New Hampshire?

Getting a handle on New Hampshire’s car insurance requirements starts with understanding the various types of coverage and key insurance terms. Familiarize yourself with bodily injury liability, personal injury protection (PIP)/medical payments, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

What penalties could I face if I don’t have the mandatory insurance?

New Hampshire doesn’t require car insurance, but you must buy insurance for at least three years if you are in an accident while uninsured.

If you are in an accident and the combined damages are over $1,000 or someone is injured, New Hampshire may suspend your driver’s license and auto registration.

Read More: Does a suspended license affect auto insurance rates?

New Hampshire requires minimum insurance coverage if you choose to buy car insurance. Basic bodily injury liability coverage of $25,000 per person will run out quickly in case of a serious accident.

If you are in an accident, you could be sued for a large sum. New Hampshire’s Insurance Department tells drivers that if they are sued after an accident and only have minimum insurance, they could lose their savings, future wages garnished, and even homes.

What if I’m not driving my car, or it’s in storage?

Do you need auto insurance if you don’t drive your car? No, you don’t need to purchase driving-related insurance if you’re not driving or are just storing your car in New Hampshire. But you may want to investigate insurance that would pay to replace or repair the vehicle in case of property damage.

Another option is to contact your insurance company, notify them you’ve stored your car, and receive reduced premiums.

What do New Hampshire auto insurance laws require for drivers?

NH car insurance laws do not require all drivers to have insurance, but if you choose to carry it, you must have 25/50/25 coverage. This means $25,000 for bodily injury per person, $50,000 for total injuries in an accident, and $25,000 for property damage.

How long do you need an SR-22 in NH?

How long is an SR-22 required in NH? In New Hampshire, drivers who are required to file an SR-22 (often due to a serious driving violation like a DUI) must maintain it for three years. The exact duration can vary depending on the specific violation or court order.

What happens if you don’t have car insurance in NH?

If you don’t carry insurance in New Hampshire, you’re not breaking the law—unless you’re at fault in an accident or caught driving recklessly. In such cases, you may be held financially responsible for all damages. You could face penalties like suspension of your driving privileges until you meet financial responsibility requirements (e.g., filing an SR-22).

Who is required to buy car insurance in New Hampshire?

Individuals convicted of driving while intoxicated (DWI) and those whose licenses have been decertified are required to buy car insurance in New Hampshire.

Is NH a no-fault accident state?

No, New Hampshire is not a no-fault state. Instead, it follows a tort system, meaning the driver at fault in an accident is responsible for covering damages, either out of pocket or through their insurance.

What percentage of NH drivers are uninsured?

According to the Insurance Research Council, approximately 11% of New Hampshire drivers are uninsured. This rate is lower than the national average, around 14%.

Read More: How many drivers don’t have auto insurance?

Which states don’t require car insurance?

New Hampshire and Virginia are the only states that don’t mandate car insurance for all drivers. In Virginia, drivers can pay a $500 uninsured motor vehicle fee instead of carrying insurance, but if they choose to buy coverage, they must meet Virginia minimum auto insurance requirements. Meanwhile, New Hampshire allows drivers to forgo insurance if they meet financial responsibility laws.

Why don’t you need car insurance in New Hampshire?

New Hampshire’s lack of a car insurance mandate stems from its emphasis on individual freedom and personal responsibility. Instead of requiring insurance, the state enforces financial responsibility laws, holding drivers accountable for damages they cause in an accident.

What happens if the person at fault in an accident has no insurance in NH?

If an at-fault driver doesn’t have insurance in New Hampshire, they’re personally responsible for all damages. The injured party can sue to recover costs. However, this often leads to difficulties collecting compensation, which is why uninsured/underinsured motorist coverage is strongly recommended. Learn more about how at-fault accidents impact drivers in our guide.

Does insurance follow the car or the driver in New Hampshire?

In New Hampshire, insurance typically follows the car, not the driver. So, if someone else drives your car and gets into an accident, your insurance will likely cover the damages, provided the driver had permission to use the vehicle.

Read More: Does insurance follow the car or the driver?

Do I need proof of insurance to register a car in NH?

No, you don’t need proof of insurance to register a car in New Hampshire. However, if you’ve been involved in certain violations, you may be required to show proof of financial responsibility, such as an SR-22. Ready to find affordable coverage? Use our free comparison tool to compare quotes from top insurers and secure the best deal for your needs. Enter your ZIP code to get started.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.