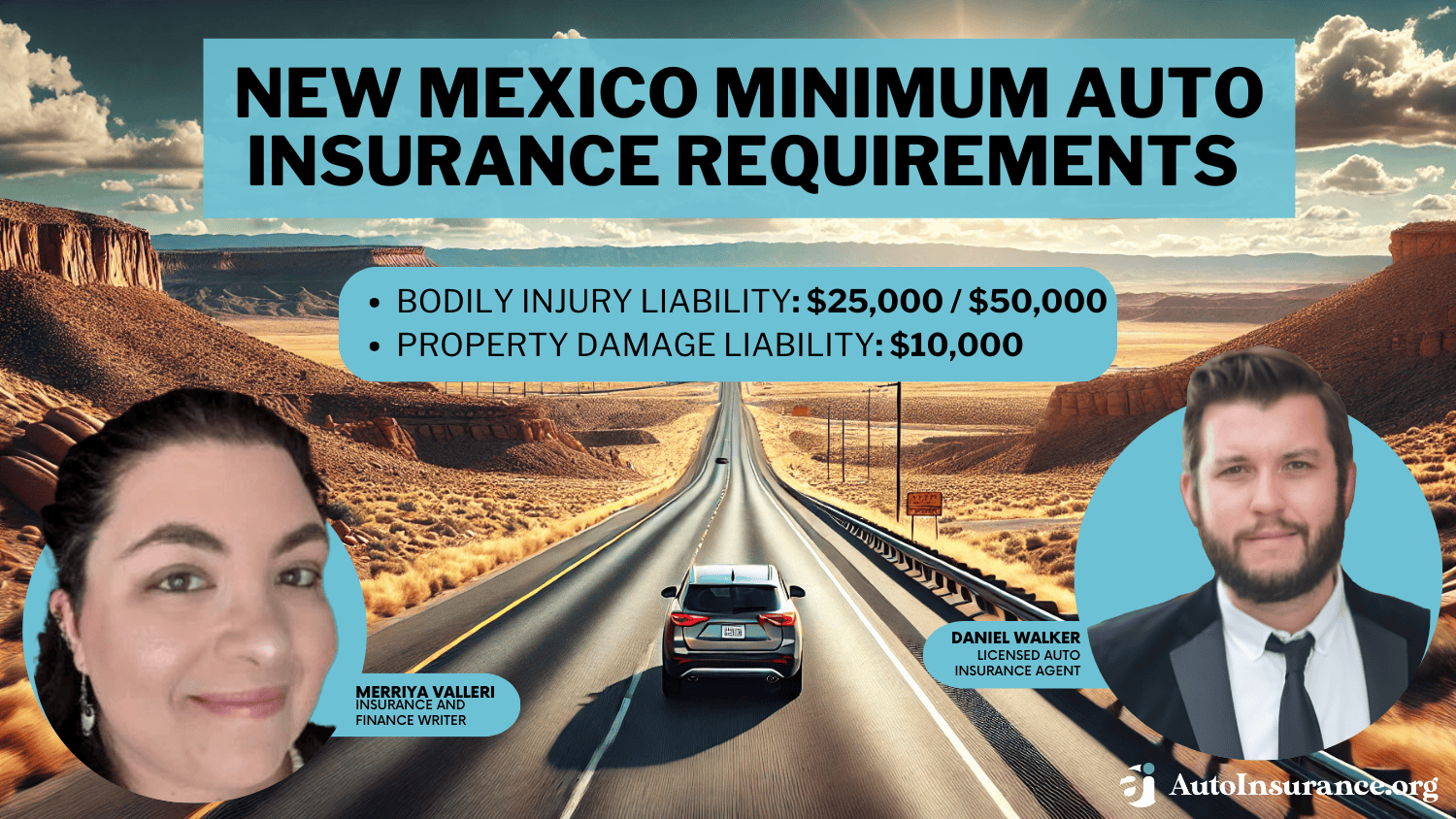

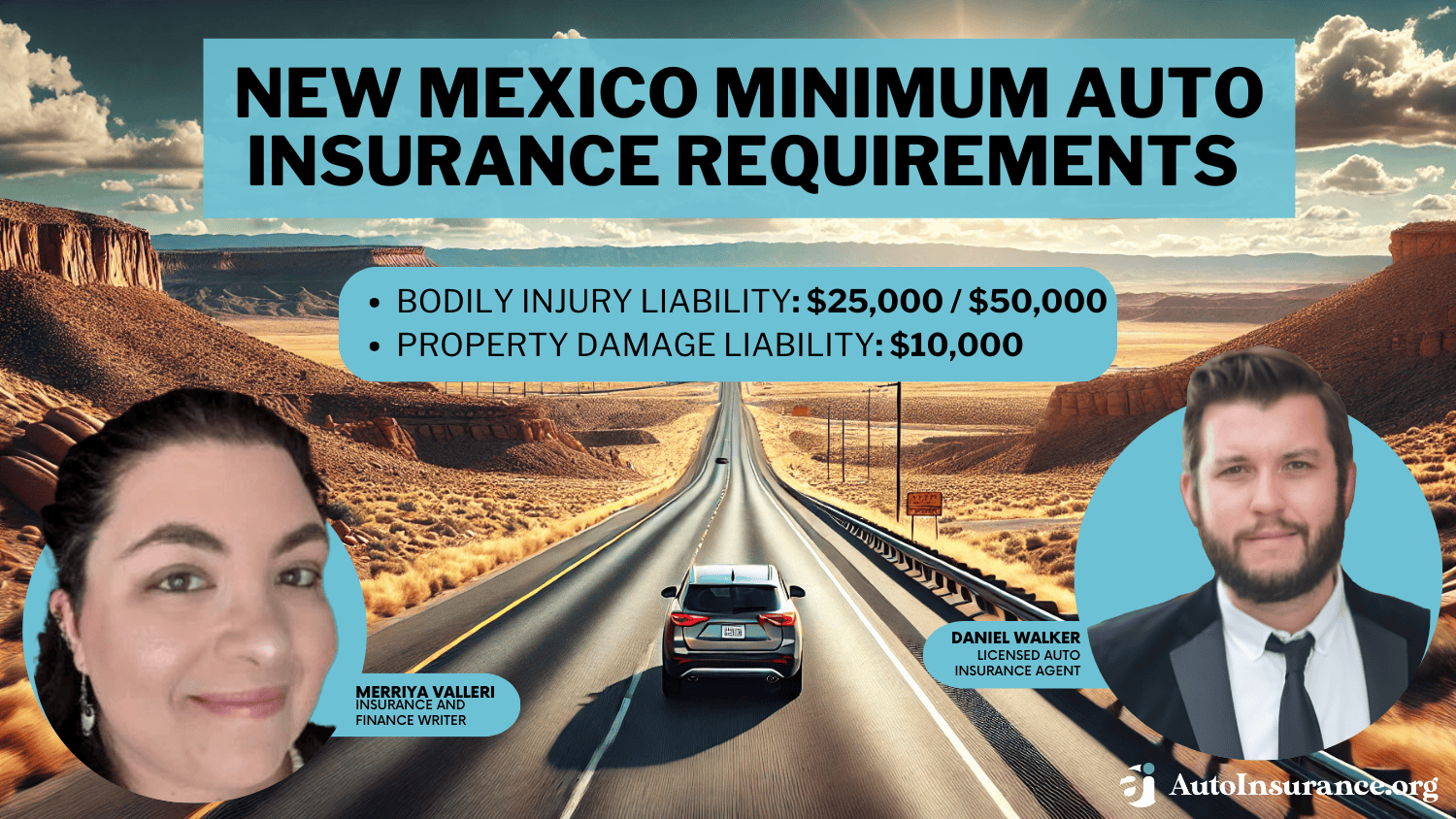

New Mexico Minimum Auto Insurance Requirements for 2025 (NM Mandated Coverage)

New Mexico minimum auto insurance requirements are 25/50/10, meaning drivers should carry coverage up to $25,000 for bodily injury per person, $50,000 for all persons injured in an accident, and $10,000 for property damage. New Mexico car insurance rates start at $23/month, but comparing rates can help you save.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Understanding New Mexico minimum auto insurance requirements is essential, as the state mandates 25/50/10 coverage for bodily injury and property damage to stay legal on the road. Failing to carry this required insurance can lead to steep fines, license suspension, and even jail time.

While car insurance rates in New Mexico start at $23 per month, actual costs depend on factors like driving history, vehicle type, and coverage level.

New Mexico Minimum Auto Insurance Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $10,000 per accident |

Drivers should compare multiple insurance providers to avoid legal troubles and financial risks to find the best rates and coverage options.

Comparing quotes helps secure affordable coverage that meets your needs while ensuring compliance with New Mexico’s auto insurance laws. Start by entering your ZIP code to explore the lowest rates from top insurers today.

- New Mexico minimum insurance requirements mandate 25/50/10 liability coverage

- USAA, State Farm, and Progressive offer affordable rates meeting NM minimums

- Compare quotes to ensure compliance with NM auto insurance requirements

New Mexico Minimum Coverage Requirements & What They Cover

New Mexico car insurance requirements say all drivers must have liability coverage of at least 25/50/10. This means $25,000 for bodily injury liability per person, $50,000 for all injuries in one accident, and $10,000 for property damage. These are the New Mexico auto insurance requirements you need to follow to drive legally.

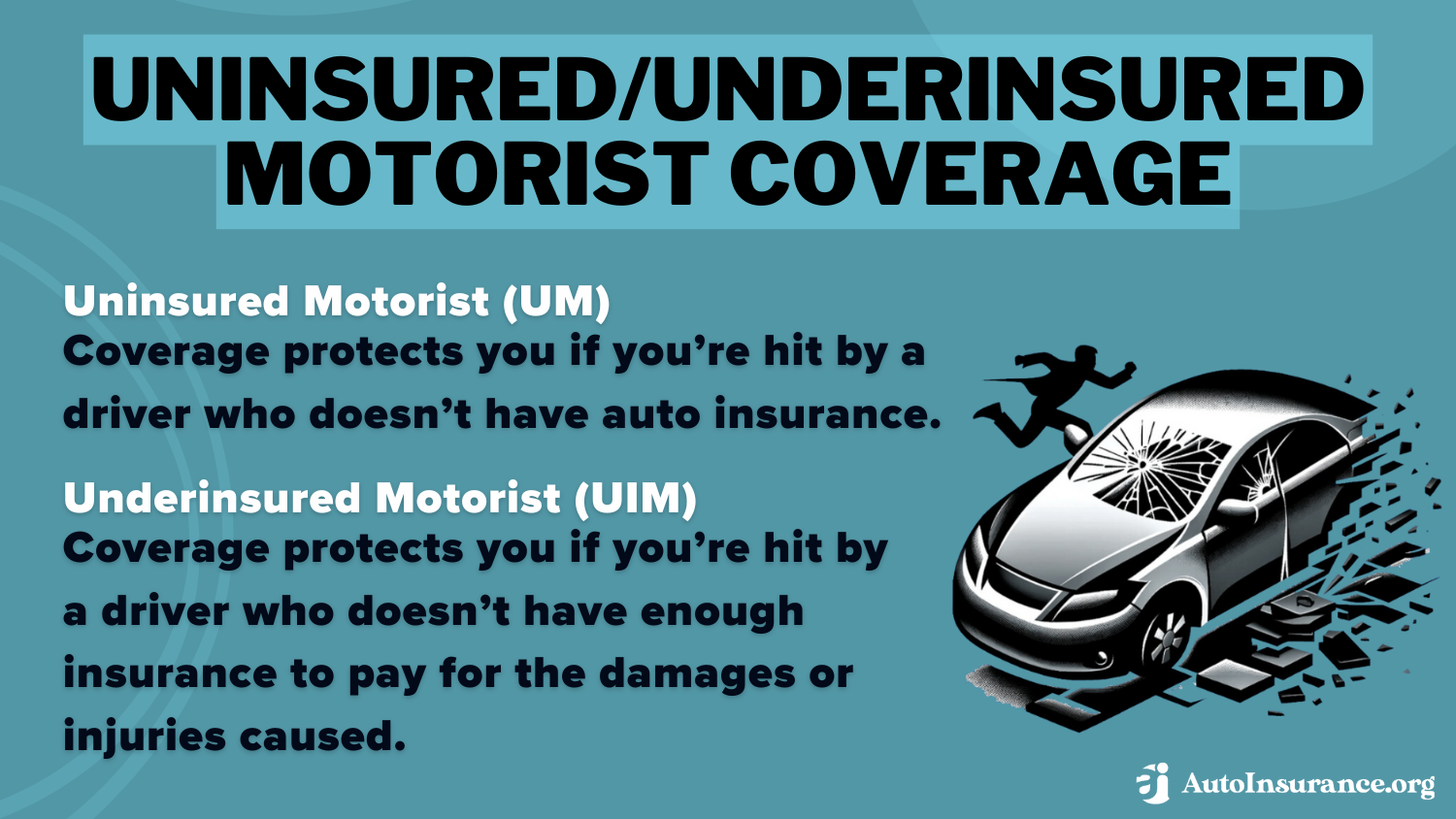

While uninsured motorist in New Mexico coverage isn’t required by law, it’s a smart choice for extra protection against drivers who don’t have insurance. Knowing the New Mexico minimum car insurance requirements can help you avoid fines, losing your license, or paying for accidents out of pocket.

If you’re financing or leasing a car, you’ll need to meet stricter New Mexico liability insurance requirements by carrying full coverage as required by your lender. If you own your car, you can choose coverage that fits your car’s value and budget. Using an auto insurance in New Mexico guide and comparing rates helps you follow New Mexico auto insurance laws while saving money.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in New Mexico

Finding the cheapest car insurance in New Mexico is essential for staying covered while keeping costs low. According to New Mexico car insurance laws, drivers must carry at least 25/50/10 liability coverage, which covers injuries and property damage after an accident. While New Mexico uninsured motorist insurance isn’t required, it’s a smart way to protect yourself against uninsured drivers.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsSince car insurance in New Mexico depends on your driving record, car type, and coverage level, comparing rates is the best way to save. Here’s a breakdown of New Mexico minimum car insurance rates by city, helping you estimate monthly costs based on where you live:

New Mexico Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Alamogordo | $70 |

| Albuquerque | $80 |

| Carlsbad | $73 |

| Clovis | $72 |

| Deming | $66 |

| Farmington | $76 |

| Gallup | $71 |

| Hobbs | $77 |

| Las Cruces | $75 |

| Los Lunas | $79 |

| Portales | $67 |

| Rio Rancho | $78 |

| Roswell | $74 |

| Santa Fe | $82 |

| Silver City | $68 |

Top companies offering cheap car insurance in New Mexico include USAA, with the average cost of car insurance in New Mexico starting at $23/month, followed by State Farm at $24/month, and Progressive at $30/month.

Comparing quotes from these providers helps you meet New Mexico insurance requirements while sticking to your budget. Use an auto insurance in New Mexico comparison tool to get the best rates and save today.

Read more: Best New Mexico Auto Insurance

Penalties for Driving Without Auto Insurance in New Mexico

Driving without New Mexico car insurance can lead to serious legal consequences, including fines, license suspension, and even jail time. According to NM car insurance requirements, drivers caught without coverage may face a fine of up to $300 and risk revoking their vehicle registration. In severe cases or repeat offenses, courts can impose jail time of up to 90 days and additional fines.

Penalties for Driving Without Auto Insurance in New Mexico

| Penalty Type | Details |

|---|---|

| Fines | Up to $300 |

| License Suspension | 30 to 90 days |

| Vehicle Registration Revocation | Registration can be revoked for non-compliance. |

| Reinstatement Fees | $25 to $50 |

| SR-22 Requirement | Mandatory proof of insurance for 3 years |

| Jail Time | Possible up to 90 days |

If you’re wondering “Is uninsured motorist coverage required in New Mexico?”, the answer is no, but all drivers must carry the state’s minimum liability coverage to avoid these harsh penalties (Read more: Uninsured Motorist Property Damage (UMPD) Coverage).

Once caught, your license and registration are suspended immediately, and law enforcement can confiscate these documents on the spot. Refusing to surrender them can result in an additional $1,000 fine and up to six months in jail.

Car insurance in New Mexico is more than a legal requirement — it’s your best financial protection against accidents and unexpected expenses.Brad Larson Licensed Insurance Agent

To reinstate your driving privileges, you must show proof of NM auto insurance that meets auto insurance requirements in New Mexico. Without proper coverage, you risk repeating the same costly penalties if your insurance lapses again. Understanding car insurance in New Mexico and comparing providers can help ensure you stay compliant while saving money.

Other Coverage Options to Consider in New Mexico

In addition to the minimum liability coverage required by New Mexico car insurance laws, drivers can explore additional coverage options for extra protection. While these coverages aren’t required, they can help reduce out-of-pocket expenses after an accident or unexpected event. Here are some types of auto insurance coverage in New Mexico you may want to consider:

- Collision Coverage: Pays for damage to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damage caused by non-accident events like theft, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver without insurance or with insufficient coverage.

- Medical Payments (MedPay): Helps pay for medical bills for you and your passengers after an accident.

- Rental Reimbursement: Rental car reimbursement covers rental car costs while your vehicle is being repaired after a covered claim.

- Roadside Assistance: Provides towing, fuel delivery, and other emergency roadside services.

Adding these options to your New Mexico auto insurance policy can offer peace of mind and better financial protection. While NM car insurance requirements only mandate liability coverage, customizing your policy ensures you’re covered in various situations. Compare quotes and explore different policies to find the best balance between cost and coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tips for Making Insurance More Affordable

If you know what to do, saving money on New Mexico car insurance is possible. Start by checking your credit score since insurance companies use it to set your rates. A good credit score can mean lower costs, so check your credit report for mistakes and pay off any debts before you shop for insurance.

You can also lower your premiums by asking your insurance company about auto insurance discounts. Some common New Mexico auto insurance discounts include multi-car discounts if you insure more than one vehicle, low-mileage discounts for drivers who don’t drive much or work from home, and military discounts for active-duty service members and their families.

Finally, compare rates from several insurance providers before choosing a policy. Use an auto insurance New Mexico comparison tool to find the best deals. This helps you get the coverage you need at a price that fits your budget. Enter your ZIP code below to find affordable car insurance in New Mexico today.

Frequently Asked Questions

How much is car insurance in New Mexico?

The average cost of car insurance in New Mexico is about $41 to $80 per month, depending on factors like your driving record, vehicle type, location, and coverage level. Rates can be as low as $25/month with companies like USAA for minimum coverage.

Read more: How Auto Insurance Companies Check Driving Records

What are New Mexico’s minimum car insurance requirements?

New Mexico requires drivers to carry at least 25/50/10 liability coverage, which includes $25,000 per person for bodily injury, $50,000 per accident for all injuries, and $10,000 for property damage. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Is uninsured motorist coverage required in New Mexico?

No, uninsured motorist coverage is not required by law in New Mexico. However, insurance companies must offer it, protecting against drivers without insurance.

What happens if I drive without car insurance in New Mexico?

Driving without car insurance in New Mexico can result in fines up to $300, license suspension, registration revocation, and even jail time for repeat offenses. You’ll also need to file an SR-22 certificate to reinstate your driving privileges.

Can I drive in New Mexico with out-of-state insurance?

Yes, if you’re visiting or passing through, your out-of-state insurance must meet your home state’s requirements. However, if you move to New Mexico, you must get a policy that meets New Mexico’s car insurance laws within 30 days of establishing residency.

Does New Mexico require full coverage for financed cars?

Yes, if you lease or finance your car, lenders usually require full coverage, including collision insurance and comprehensive auto insurance, until the loan is paid off. This goes beyond the state’s minimum liability coverage requirements.

How can I lower my car insurance rates in New Mexico?

To lower your car insurance rates in New Mexico, maintain a clean driving record, bundle policies, ask about discounts like multi-car or military, and shop around for the best quotes. Improving your credit score can also reduce premiums.

Can my car insurance be canceled if I miss a payment in New Mexico?

Yes, missing a car insurance payment can lead to policy cancellation. Most insurers provide a grace period, but repeated missed payments can result in termination, requiring you to pay more for future coverage or file an SR-22 auto insurance.

Do I need additional car insurance coverage in New Mexico?

While New Mexico only requires liability insurance, additional coverage like collision, comprehensive, uninsured motorist, and medical payments coverage is recommended for better financial protection in case of accidents or theft.

Are car insurance rates higher in certain New Mexico cities?

Yes, car insurance rates vary by city due to factors like traffic, accident rates, and crime. Larger cities like Albuquerque tend to have higher rates, while smaller towns like Deming or Gallup may offer cheaper insurance. Use our free comparison tool to see what auto insurance quotes look like in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.