Best Odessa, Texas Auto Insurance in 2025 (Check Out the Top 10 Companies)

The leading choices for best Odessa, Texas auto insurance are Geico, State Farm, and Progressive with rates starts at $42 monthly. These providers are known for their customizable coverage options, local agent support, and excellent customer service making them as top choice for best Odessa, Texas auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Odessa TX

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Odessa TX

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Odessa TX

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsCompare our best Odessa, Texas auto insurance options from Geico, State Farm, and Progressive, with rates starting at $42 per month. These insurers offer the most competitive rates and comprehensive coverage.

Compare auto insurance in Odessa to other Texas cities, including Houston auto insurance rates, Fort Worth auto insurance rates, and Austin auto insurance rates to see how Odessa, Texas auto insurance rates stack up.

Our Top 10 Company Picks: Best Odessa, Texas Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | A++ | Mechanical Breakdown | Geico | |

| #2 | 17% | B | Local Agent | State Farm | |

| #3 | 14% | A+ | Snapshot Program | Progressive | |

| #4 | 12% | A+ | Multiple Discounts | Allstate | |

| #5 | 22% | A++ | Customer Service | USAA | |

| #6 | 21% | A+ | Financial Stability | Nationwide |

| #7 | 16% | A | Online Tools | Liberty Mutual |

| #8 | 11% | A+ | Bundling Policies | Farmers | |

| #9 | 10% | A++ | Comprehensive Coverage | Travelers | |

| #10 | 20% | A++ | Excellent Coverage | Chubb |

Finding cheapest auto insurance companies in Odessa can seem like a difficult task, but all of the information you need is right here.

We’ll cover factors that affect auto insurance rates in Odessa, Texas, including driving record, credit, commute time, and more. Enter your ZIP code above to get free Odessa, Texas auto insurance quotes.

- The cheapest auto insurance company in Odessa is USAA

- Progressive is the most expensive for teen drivers in Odessa

- The average commute length in Odessa is 21.6 minutes

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico offers some of the most competitive rates starting at $110 per month, making it ideal for budget-conscious Odessa, Texas drivers. Their 18% bundling discount further enhances affordability for Odessa, Texas owners, particularly those who combine multiple policies. Their affordability makes it a top choice for those seeking the best Odessa, Texas auto insurance.

- Strong Online Tools: Their online platform is highly rated for ease of use, allowing users to manage policies, file claims, and access customer support efficiently. The robust online tools contribute to a seamless user experience for Odessa, Texas drivers, making it a strong contender for the best Odessa, Texas auto insurance.

- High Customer Satisfaction: Geico consistently receives positive feedback for its customer service and overall user experience. With an A++ rating from A.M. Best, Geico is recognized for its financial strength and reliability, making it a reliable choice for Odessa, Texas drivers seeking the best Odessa, Texas auto insurance. Find out more in our Geico auto insurance review.

Cons

- Limited Local Agent Presence: Geico operates primarily online and over the phone, which can be less convenient for Odessa, Texas owners who prefer in-person interactions. This might be a drawback for those who value face-to-face customer service.

- Additional Fees: Some customers report additional fees for certain services or policy changes, which can impact overall affordability for Odessa, Texas enthusiasts. These fees can sometimes offset the benefits of lower base premiums, affecting the overall value of the best Odessa, Texas auto insurance.

#2 – State Farm: Best for Local Agent

Pros

- Local Agent Support: State Farm’s extensive local agent network provides personalized service and tailored support, making it a solid choice for Odessa, Texas owners. With a 17% bundling discount, they also offer significant savings when combining auto insurance with other policies. Their local presence contributes to their reputation for providing the best Odessa, Texas auto insurance.

- Multiple Discounts: They offer a variety of discounts, including those for safe driving and policy bundling, which can significantly lower premiums for Odessa, Texas drivers. Their A.M. Best rating of B indicates solid reliability, though not as high as some competitors.

- User-Friendly Mobile App: Their mobile app is well-regarded for managing policies and accessing support, contributing to a positive experience for Odessa, Texas drivers. The app’s functionality is complemented by the strong local agent presence for personalized assistance, making it a contender for the best Odessa, Texas auto insurance.

Cons

- Higher Base Rates: State Farm’s base rates can be higher compared to some competitors, which might be a drawback for Odessa, Texas drivers seeking the lowest initial cost. The higher base rates can affect overall affordability despite available discounts.

- Less Competitive Snapshot Program: While State Farm offers discounts, their Snapshot program may not be as competitive as Progressive’s, potentially limiting savings for safe Odessa, Texas drivers. Learn more in our State Farm review.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program offers potential discounts based on driving habits, making it a great choice for cautious Odessa, Texas drivers. The program can lead to substantial savings for those who drive safely, enhancing the value of their insurance.

- Wide Range of Coverage Options: They provide extensive coverage choices, including mechanical breakdown and custom parts, catering to the diverse needs of Odessa, Texas owners. The 14% bundling discount further enhances value when multiple policies are combined, positioning Progressive as a top option for the best Odessa, Texas auto insurance.

- Flexible Payment Plans: Progressive offers flexible payment options, including monthly installments, which helps Odessa, Texas enthusiasts with budgeting and financial planning, making it a valuable choice for the best Odessa, Texas auto insurance. Read more through our Progressive auto insurance review.

Cons

- Customer Service Issues: Some customers report dissatisfaction with Progressive’s customer service, particularly with response times and issue resolution. This can impact the overall customer experience for Odessa, Texas owners despite competitive rates.

- Premium Increases: Drivers might see premium increases after initial policy terms or minor claims, which can affect long-term affordability for Odessa, Texas enthusiasts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Multiple Discounts

Pros

- Multiple Discounts: Allstate offers a range of discounts, including those for bundling policies and safe driving, providing added savings for Odessa, Texas drivers. Their 12% bundling discount provides substantial savings when combining multiple policies.

- Strong Local Agent Network: Allstate’s network of local agents provides personalized service and support, which enhances the customer experience for Odessa, Texas enthusiasts. The local presence contributes to their reputation for providing the best Odessa, Texas auto insurance.

- Good Claims Process: Known for an efficient claims process, Allstate delivers high payout rates and a smooth experience for Odessa, Texas drivers, further solidifying its position as a top choice for the best Odessa, Texas auto insurance, which you can learn about in our Allstate review.

Cons

- Higher Premiums for Some: Premiums can be higher for certain drivers, especially those with a history of claims, which may make Allstate less competitive for Odessa, Texas drivers seeking lower rates. This could affect overall affordability.

- Mixed Customer Service Reviews: Customer service experiences can vary, with some reporting inconsistencies in service quality and claims handling, which can affect the overall satisfaction of Odessa, Texas drivers.

#5 – USAA: Best for Customer Service

Pros

- Exceptional Customer Service: USAA is praised for its excellent customer service and high satisfaction ratings among Odessa, Texas drivers. With a 22% bundling discount, they offer significant savings for military families who combine multiple policies. Their A++ A.M. Best rating indicates top-tier financial strength.

- Competitive Rates for Military Families: USAA provides some of the lowest rates available, especially beneficial for military members and their families. This makes it a top choice for Odessa, Texas drivers seeking the best Odessa, Texas auto insurance. Discover our USAA review for a full list.

- Comprehensive Coverage Options: USAA offers a broad range of coverage options, including comprehensive and collision coverage, tailored to the needs of Odessa, Texas owners. Their policies are designed to meet the specific needs of military families and their vehicles.

Cons

- Eligibility Restrictions: USAA’s services are limited to military members, veterans, and their families, excluding the general public. This restriction limits access for those outside these groups, making it less accessible for the broader Odessa, Texas community.

- Limited Local Agent Presence: USAA operates primarily online and over the phone, which may not appeal to those who prefer in-person interactions with local agents, potentially affecting the overall customer experience for Odessa, Texas owners.

#6 – Nationwide: Best for Financial Stability

Pros

- Financial Stability: Nationwide is recognized for its strong financial stability, ensuring reliable coverage and claim payouts for Odessa, Texas drivers. Their A+ A.M. Best rating underscores their financial health and reliability.

- Diverse Coverage Options: They offer a wide array of coverage options, including specialty coverages for high-value vehicles. Their 21% bundling discount enhances value when combining multiple policies, making Nationwide a strong contender for the best Odessa, Texas auto insurance.

- Good Discounts: Nationwide provides various discounts, including for safe driving and bundling, which can significantly lower premiums for Odessa, Texas drivers. Their robust discount structure adds to overall savings. Find out more in our Nationwide review.

Cons

- Higher Premiums for Younger Drivers: Premiums can be higher for younger drivers or those with less driving experience, which might not be ideal for new or younger Odessa, Texas policyholders.

- Customer Service Variability: Some customers report inconsistent experiences with customer service and claims processing, which can affect overall satisfaction for Odessa, Texas drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Online Tools

#8 – Farmers: Best for Bundling Policies

Pros

- Bundling Discounts: Farmers offers significant discounts for bundling auto insurance with home or other policies. Their 11% bundling discount provides substantial savings for Odessa, Texas owners who combine multiple policies, making it a strong choice for the best Odessa, Texas auto insurance.

- Wide Range of Coverage Options: They offer diverse coverage options, including specialized protections for different vehicle types. Their A+ A.M. Best rating indicates strong financial stability, catering well to Odessa, Texas drivers seeking comprehensive insurance solutions. Read more in our review of Farmers.

- Local Agent Network: Farmers’ strong network of local agents provides personalized service and support, enhancing the customer experience for Odessa, Texas enthusiasts. This local presence contributes to their reputation for delivering reliable coverage.

Cons

- Higher Premiums for Some Drivers: Farmers’ premiums can be higher for drivers with a history of claims or poor credit, which may impact overall affordability for Odessa, Texas drivers seeking lower rates. This could affect the overall value of their insurance.

- Mixed Customer Service Reviews: There are mixed reviews regarding customer service and claims handling, which can affect the overall satisfaction of Odessa, Texas drivers and potentially impact their experience with Farmers.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers provides extensive coverage options, including comprehensive and collision coverage. Their A++ A.M. Best rating indicates strong financial stability and reliability, making them a top contender for the best Odessa, Texas auto insurance.

- Discounts for Safe Driving: They offer discounts for safe driving, including accident-free rewards and usage-based discounts. Their 10% bundling discount adds further value when combining multiple policies, benefiting Odessa, Texas drivers.

- Broad Range of Additional Coverage Options: Travelers offers a variety of add-ons and optional coverages, providing Odessa, Texas drivers with the flexibility to tailor their policies according to their specific needs. Read more through our Travelers auto insurance review.

Cons

- Higher Premiums for Certain Coverage Types: Travelers may have higher premiums for certain types of coverage or for drivers with less favorable profiles, which could impact affordability for Odessa, Texas drivers.

- Customer Service Variability: Some customers report variable experiences with customer service and claims processing, which might affect the overall satisfaction for Odessa, Texas owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Chubb: Best for Excellent Coverage

Pros

- Excellent Coverage: Chubb is known for offering high-quality coverage options, including extensive protections and premium services. Their A++ A.M. Best rating underscores their financial strength and reliability, making them a top choice for the best Odessa, Texas auto insurance.

- High Bundling Insurance Discounts: Chubb provides a 20% bundling insurance discount for combining auto insurance with other policies, offering significant savings for Odessa, Texas drivers who choose to bundle multiple coverages. Read more through our Chubb auto insurance review.

- Superior Customer Service: Chubb is praised for its exceptional customer service, providing a high level of support and personalized service for Odessa, Texas drivers. This high level of service contributes to their strong reputation in the industry.

Cons

- Higher Premiums: Chubb’s premiums can be higher compared to some competitors, which might affect overall affordability for Odessa, Texas drivers seeking lower-cost options. This could be a consideration for those with budget constraints.

- Limited Availability: Chubb’s insurance products might not be as widely available or accessible as those of some other providers, potentially limiting options for some Odessa, Texas owners and drivers.

Minimum Auto Insurance in Odessa, Texas

In Odessa, Texas, auto insurance laws require all drivers to carry at least the state-mandated minimum coverage to ensure financial responsibility in the event of an accident.

This minimum auto insurance includes liability insurance, which covers bodily injury liability insurance and property damage you may cause to others, with required limits of $30,000 per injured person, up to $60,000 per accident, and $25,000 for property damage.

Odessa, Texas Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $52 | $125 |

| Chubb | $44 | $112 |

| Farmers | $53 | $127 |

| Geico | $45 | $110 |

| Liberty Mutual | $55 | $130 |

| Nationwide | $50 | $120 |

| Progressive | $48 | $115 |

| State Farm | $50 | $120 |

| Travelers | $47 | $115 |

| USAA | $42 | $105 |

While not mandatory, personal injury protection (PIP) is automatically included in policies unless declined in writing, providing coverage for medical expenses and lost wages for you and your passengers, regardless of fault.

Additionally, uninsured/underinsured motorist coverage is included unless explicitly rejected, offering protection if you’re involved in an accident with a driver lacking sufficient insurance.

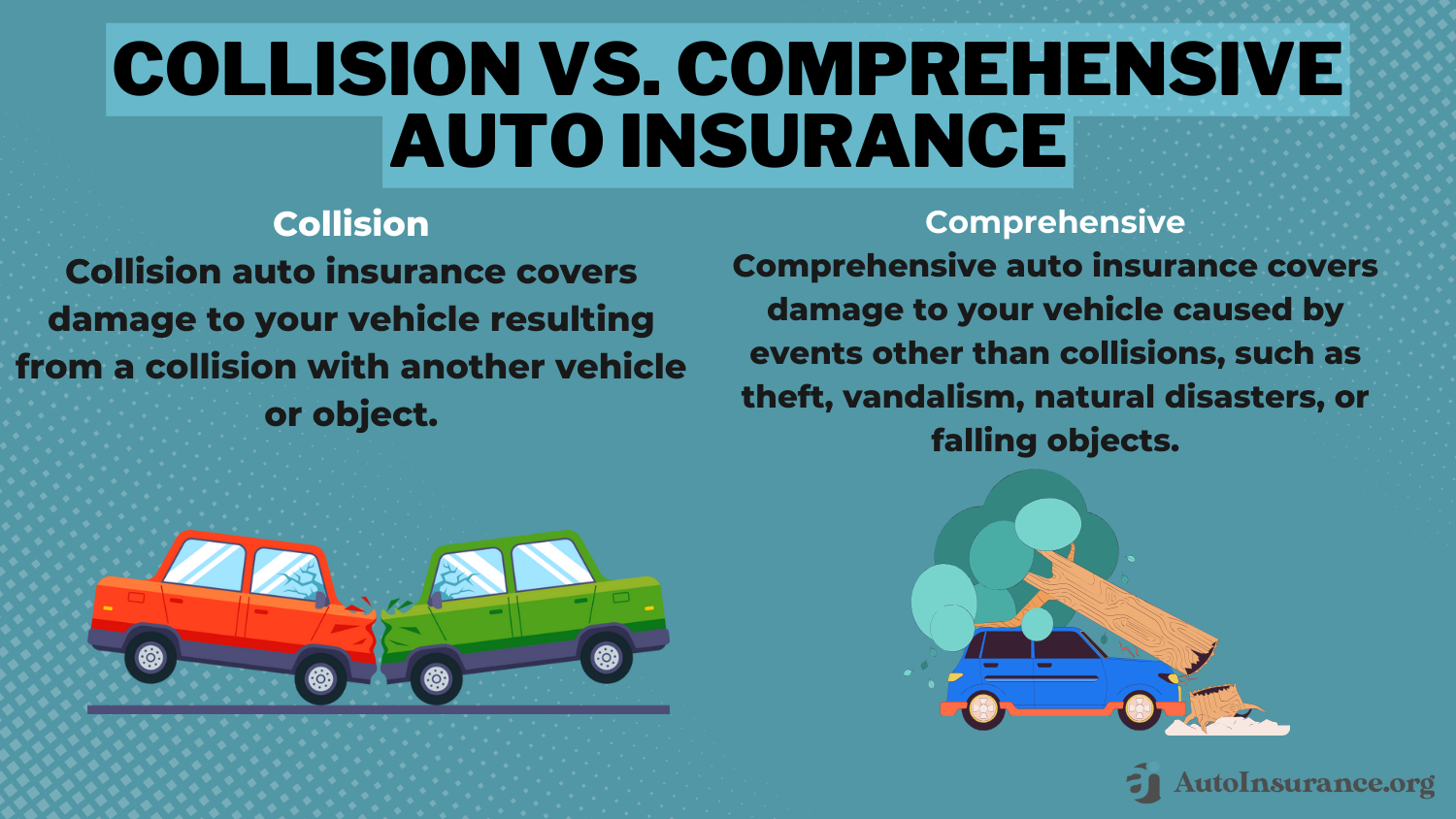

Although comprehensive and collision auto insurance coverage are not legally required, many drivers in Odessa choose to add these options to protect their own vehicles against non-collision incidents like theft or natural disasters and collisions, regardless of fault.

Understanding and adhering to these insurance requirements is crucial for staying compliant with state laws and ensuring you have adequate protection in case of an accident.

Cheap Odessa, Texas Auto Insurance by Age, Gender, and Marital Status

Auto insurance rates in Odessa, Texas are affected by age, gender, and marital status.

See how demographics impact the monthly cost of insurance and find ways to secure the best rate for your profile.

These factors can significantly influence your premium, with younger drivers and males often facing higher costs.

However, by comparing rates from multiple providers, you can discover options that offer competitive pricing and potentially reduce the financial burden on families.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best By Category: Cheapest Auto Insurance in Odessa, Texas

Compare the cheapest auto insurance companies in Odessa, Texas in each category to find the company with the best rates for your personal needs.

This comparison will help you find the insurer that offers the most competitive rates tailored to your personal needs and driving profile.

The Cheapest Odessa, Texas Auto Insurance Companies

What auto insurance companies in Odessa, Texas are the cheapest? Compare the top Odessa, Texas different types of auto insurance coverage on our top companies to find the best monthly rates.

By evaluating their monthly rates, coverage options, and discounts, you can identify which insurer offers the most affordable and comprehensive coverage for your needs.

Factors Affecting Auto Insurance Rates in Odessa, Texas?

Auto insurance rates in Odessa, Texas, can vary significantly compared to other cities, influenced by several local factors. One of the primary reasons is traffic conditions; high congestion and accident-prone areas often lead to increased premiums due to the heightened risk of collisions insurance.

Additionally, the number of vehicle thefts in Odessa plays a crucial role in determining insurance costs. Areas with higher crime rates, particularly auto theft, typically experience higher insurance rates as insurers account for the increased likelihood of claims.

Other local factors such as weather conditions, road infrastructure, and even the average age and driving habits of the population can also impact the rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Odessa, Texas Auto Insurance Quotes

Before purchasing auto insurance in Odessa, Texas, it’s crucial to compare rates from multiple companies to ensure you’re getting the best deal for your coverage needs.

Shopping around allows you to evaluate different policies, discounts, and customer service quality, including how to get a membership auto insurance discount, helping you make an informed decision.

It's essential to understand and follow these insurance requirements to stay compliant with state laws and ensure you're adequately protected in case of an accident.Michelle Robbins Licensed Insurance Agent

To simplify this process, you can enter your ZIP code below to receive free auto insurance quotes tailored to the Odessa area, making it easier to find the most affordable and suitable option.

Frequently Asked Questions

What is the minimum auto insurance coverage required in Odessa, Texas?

In Odessa, Texas, the minimum auto insurance coverage required by law includes liability insurance with limits of $30,000 per injured person, $60,000 per accident, and $25,000 for property damage.

Additionally, Personal Injury Protection (PIP) and uninsured/underinsured motorist coverage are included unless explicitly declined.

How does age, gender, and marital status affect auto insurance rates in Odessa, Texas?

Age, gender, and marital status can impact auto insurance rates in Odessa, Texas. Demographics play a role in determining the monthly cost of insurance. Enter your ZIP code above to get free Odessa, Texas auto insurance quotes.

What are the average annual auto insurance rates for teen drivers in Odessa, Texas?

Finding cheap auto insurance for teen drivers in Odessa, Texas can be challenging. The monthly rates for teen drivers tend to be higher compared to other age groups.

How do driving records affect auto insurance rates in Odessa, Texas?

how do auto insurance companies check your driving records, have a significant impact on auto insurance rates. Odessa, Texas drivers with a bad record can expect higher monthly insurance rates compared to those with a clean record.

Does credit history affect auto insurance rates in Odessa, Texas?

Yes, credit history significantly affects auto insurance rates in Odessa, Texas. Drivers with better credit scores typically receive lower premiums, while those with poorer credit may face higher rates due to the perceived risk. Enter your ZIP code above to get free Odessa, Texas auto insurance quotes.

What factors should Odessa, Texas drivers consider when choosing auto insurance to ensure they get the best coverage for their needs?

Odessa, Texas drivers should consider factors like coverage limits, auto insurance deductibles, and additional options such as uninsured motorist protection to ensure they have adequate protection.

They should also evaluate the insurer’s customer service and claims process to ensure a smooth experience in case of an accident.

How do bundling insurance discounts impact the overall cost of auto insurance for Odessa, Texas owners, and what other types of discounts are commonly available?

Saving money through bundling insurance discounts can significantly lower the overall cost of auto insurance by combining multiple policies, such as home and auto, with the same provider. Other common discounts include those for safe driving, low mileage, and membership in certain organizations or associations.

What are the benefits of having a local agent versus using an online platform for managing auto insurance, especially for Odessa, Texas enthusiasts?

A local agent provides personalized service and can offer tailored advice based on the specific needs of Odessa, Texas enthusiasts. Online platforms offer convenience and often have tools for instant policy management and quotes but may lack the personalized touch of face-to-face interactions. Compare rates from multiple companies by Entering your ZIP code.

How can Odessa, Texas drivers effectively use online tools and mobile apps to manage their auto insurance policies and claims?

Odessa, Texas drivers can use online tools and mobile apps to track their policy details, make payments, and file claims quickly. These tools often provide real-time updates and easy access to customer service, streamlining the insurance management process.

What are some strategies Odessa, Texas drivers can use to maximize their savings on auto insurance without compromising coverage quality?

Odessa, Texas drivers can maximize savings by comparing quotes from multiple insurers and taking advantage of available discounts, such as for safe driving or low mileage discounts.

Regularly reviewing and adjusting coverage levels to match current needs can also help in maintaining cost-effective insurance while ensuring adequate protection.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.