8 Best Pay-As-You-Go Auto Insurance Companies in 2025 (See Our Top Picks)

Nationwide, Allstate, and MileAuto are the best pay-as-you-go insurance companies with wide availability and safe driving discounts of up to 40%. Pay-as-you-go insurance can help drivers save money by tracking mileage. Start comparing the best pay-per-mile auto insurance companies to get the right policy.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Mar 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,638 reviews

11,638 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 12 reviews

12 reviewsCompany Facts

Average Monthly Rate For Good Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

12 reviews

12 reviewsNationwide and Allstate are the best pay-as-you-go auto insurance companies for being available in more states than other pay-per-mile car insurance companies.

If you don’t drive often, compare the best pay-as-you-go auto insurance companies to get low-mileage discounts. Allstate Milewise has the lowest rates for high-mileage drivers. Worried about tracking devices? MileAuto only asks for a picture of your odometer.

Our Top 8 Picks: Best Pay-As-You-Go Auto Insurance Companies

Company Rank Good Driver Discount Anti-Theft Discount Best For Jump to Pros/Cons

#1 Up to 40% 5% - 25% Widespread Availability Nationwide

#2 Up to 25% Up to 10% High-Mileage Savings Allstate

#3 Up to 30% 5% - 20% Data Privacy Mile Auto

#4 Up to 52% 5% - 25% Roadside Assistance Root

#5 Up to 40% 5% - 20% Mobile App Metromile

#6 Up to 25% 3% - 15% Short-Term Coverage Hugo

#7 Up to 30% Up to 25% Safe-Driving Discounts Progressive

#8 Up to 40% 5% - 20% Military Savings Noblr

Before signing up for pay-as-you-go insurance, understand that there may be restrictions on how much or where you can drive. Some companies may not insure high-risk drivers or certain types of vehicles.

Get started comparing quotes from the best pay-as-you-go car insurance providers by entering your ZIP code above.

- Pay-as-you-go insurance is best for those who drive less than 8,000 miles per year

- Our top pick, Nationwide SmartMiles, is available in the most states

- Allstate Milewise has cheap pay-as-you-go car insurance for higher-mileage drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Pick Overall

Pros

- Availability: Coverage in 44 states, more than any other pay-as-you-go insurance company

- Low rates for long road trips: Mileage tracking is capped at 250 miles per day

- Rewards safe drivers: Safe drivers earn an additional 10% after the first renewal

Cons

- Not in every state: Not available in AK, HI, LA, NC, NY, or OK

- Better usage-based rates: Learn how to save more money in our Nationwide SmartRide review.

#2 – Allstate: Cheapest for High-Mileage Drivers

Pros

- Low rates for long road trips: Mileage charges capped at 250 miles per day. Learn more in our Allstate auto insurance review.

- Low rates for high-mileage: Allstate has the cheapest pay-as-you-go car insurance, and the Milewise Unlimited program gives higher-mileage drivers a chance to save.

- Unique perks: Drivers can earn Allstate Rewards points for signing up and activating their account.

Cons

- Not in every state: Only available in 21 states

- Rate increases: Bad driving habits can increase rates in some states

#3 – MileAuto: Best for Privacy Concerns

Pros

- No data tracking: Does not use a plug-in device to track driving habits or location

- Cheap rates: Competitively low rates in states where coverage is available. Find coverage near you in our MileAuto insurance review.

- Additional coverage: Offers roadside assistance and rental car reimbursement

Cons

- Not in every state: Only available in 11 states

- Charges for road trips: No daily or monthly mileage caps

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Root: Best for Roadside Assistance

Pros

- Free roadside assistance: Roadside assistance included in every insurance policy (Learn More: Root Auto Insurance Review)

- Additional coverage: Offers rental car and rideshare reimbursement coverage

- Discounts: Additional discounts for vehicles with automated steering features

Cons

- Not in every state: Only available in 34 states

- Does not cover high-risk drivers: Must have a good driving record to be eligible for coverage

#5 – Metromile: Best Mobile App

Pros

- Pay-as-you-go pioneer: Exclusively designed for low-mileage drivers

- Hi-tech perks: pay-as-you-go car insurance app offers additional features that go beyond trip management

- Potential for growth: Recent merger with Lemonade could expand coverage options in the future

Cons

- Not in every state: Only available in AZ, CA, IL, NJ, OR, PA, VA, and WA. Use our Metromile auto insurance review to find coverage near you.

- Requires mobile phone: Plug-in device always requires cell phone service to track mileage

#6 – Hugo: Best for Infrequent Drivers

Pros

- Flexible premiums: Multiple payment options, including micropayments and payment plans. You can learn more in our Hugo auto insurance review.

- Flexible policies: Policies can last for months, weeks, or as few as three days

- Flexible coverage: Drivers can turn off coverage and pay nothing when they’re not driving

- Immediate coverage: Provides same-day coverage and proof of insurance

Cons

- Not in every state: Only available in 13 states. There’s insurance similar to Hugo, so keep scrolling if it’s unavailable in your state!

- Only offers standard policies: Coverage limited to liability, collision, and comprehensive insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Biggest Discounts for Safe Drivers

Pros

- Rewards safe drivers: Safe driving habits can lead to substantial discounts (See More: Progressive Auto Insurance Discounts)

- Quick sign-up: Easy enrollment process through mobile pay-as-you-go insurance app

- No long-term tracking: Stops tracking driving habits after the testing period

Cons

- Rate increases: Automatically tracks driving habits with mileage, which can raise rates

- Limited discounts: Initial participation discount only available to new customers

#8 – Noblr: Best for Military Families

Pros

- Additional coverage: Offers rental car reimbursement and roadside assistance coverage

- Hi-tech perks: Mobile app offers real-time feedback on driving habits

- Savings account: Drivers have the potential to earn money back with the Noblr subscriber savings account

Cons

- Not in every state: Only available in AZ, CO, LA, NM, OH, PA, MD, and TX. Use our Noblr auto insurance review to find local coverage.

- Exclusive for military drivers: Only available to military members and their immediate families

What You Should Know: Pay-As-You-Go Auto Insurance

Are you a driver who doesn’t use their vehicle often? Well, here’s something you should know about: auto insurance pay-as-you-go. This type of coverage just might be the money-saving ticket for you! Pay-as-you-go insurance, sometimes called “pay-per-mile auto insurance,” is a flexible and cost-effective option that allows policyholders to pay premiums based on the actual miles driven, making it ideal for occasional drivers or those with low annual mileage.

By utilizing telematics technology, insurers track mileage, which can lead to significant savings for responsible drivers.

Pay-as-you-go car insurance companies have gotten very popular over the past several years. There are now many pay-as-you-go insurance companies, each with unique features and pricing structures. These companies often provide easy-to-use mobile apps that allow policyholders to monitor their driving habits, track mileage, and manage their policies conveniently.

For those seeking pay-as-you-go full coverage car insurance, it’s essential to compare rates and coverage options from multiple providers. While some companies may offer comprehensive coverage at competitive rates, others may specialize in basic coverage for minimal driving needs. Additionally, some pay-as-you-go insurance companies require policyholders to pay a base rate along with per-mile charges.

For low mileage discounts, check out our article: How to Get a Low Mileage Auto Insurance Discount.

When trying to find the best pay-as-you-go insurance, consider factors such as pricing transparency, customer service reputation, and coverage flexibility.

By leveraging technology and paying only for the miles you drive, pay-as-you-go monthly car insurance can offer significant cost savings compared to traditional auto insurance plans.

It makes sense now why many drivers call it “pay-per-day car insurance” doesn’t it? This innovative type of coverage based on your needs is a perfect option for budget-conscious drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Pay-As-You-Go Auto Insurance Works

Pay-as-you-go auto insurance is often called pay-per-mile insurance since drivers only pay for the miles they drive daily or per month. It’s the best kind of auto insurance for infrequent drivers as some companies sell short-term coverage for three days or three weeks.

A pay-per-mile insurance policy provides the same coverage, including collision auto insurance and comprehensive auto insurance, but charges you based on how much you utilize per mile.Daniel Walker Licensed Auto Insurance Agent

Local pay-as-you-go auto insurance companies will also offer uninsured/underinsured motorist (UM/UIM) and personal injury protection (PIP) to meet state laws, but you won’t always find additional coverages like rideshare insurance or roadside assistance.

Learn More:

- Root Auto Insurance Review

- Metromile Auto Insurance Review

- Noblr Auto Insurance Review

- Allstate Drivewise Review

- Progressive Snapshot Review

Cost of Pay-As-You-Go Auto Insurance

Drivers don’t have to worry about the typical factors that affect auto insurance rates with pay-as-you-go insurance because premiums depend on miles driven. The calculation for pay-as-you-go auto insurance entails base rate + (miles covered in a month × per mile rate). So if your base cost is $50 monthly, your per-mile charge is $.04, and you travel 300 miles, you would spend $62 that month.

There are several ways to calculate how much you'll pay per mile. Some companies charge a flat rate for every mile driven, while others charge a higher rate for miles driven during peak hours. For most drivers, their pay-per-mile car insurance bills are divided into a monthly base rate and a per-mile expense.Justin Wright Licensed Insurance Agent

Out of the best pay-as-you-go auto insurance companies on this list, Metromile has the lowest average rate of $29/mo. Unfortunately, Metromile is only the cheapest option in the eight states where coverage is available. Drivers in more states are likely to find and qualify for affordable pay-as-you-go insurance with Nationwide or Allstate.

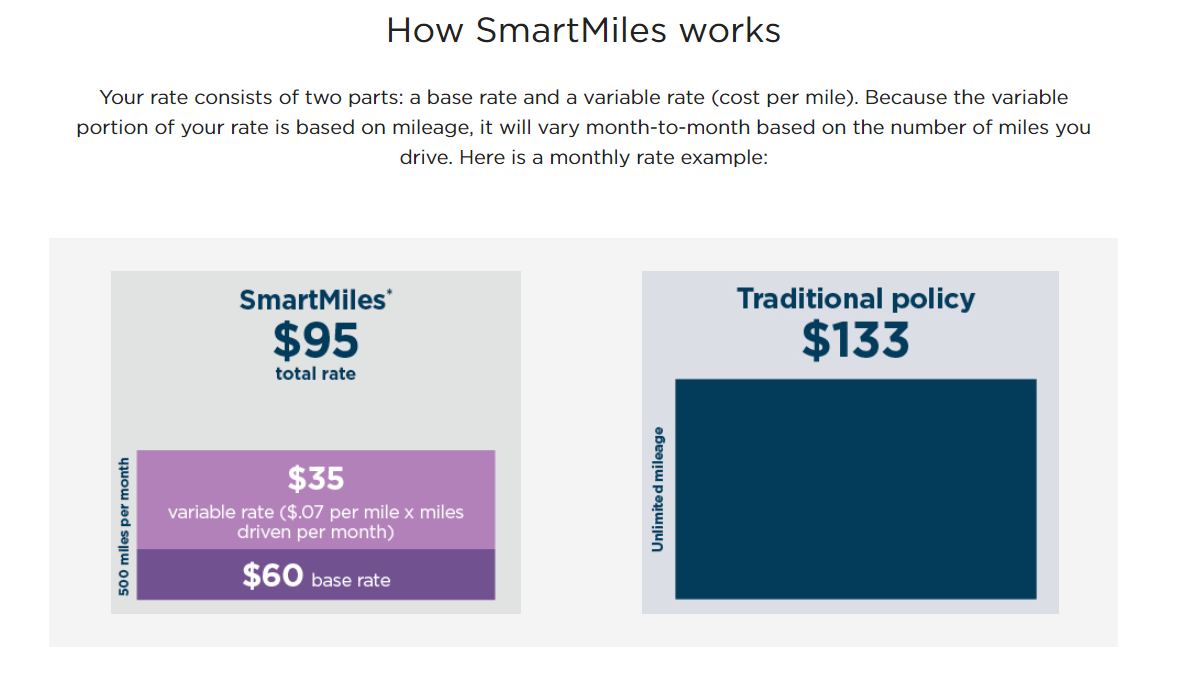

On average, drivers with SmartMiles from Nationwide pay a base rate of $60/mo for insurance by the mile:

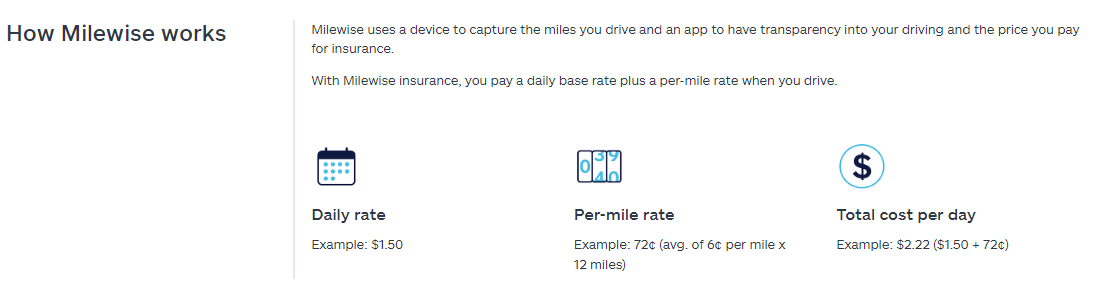

Allstate Milewise charges by the day, with a flat rate of $1.50 plus $.06 per mile, which adds up to the cheapest pay-as-you-go auto insurance rates in more states than Metromile.

Many people refer to this type of coverage as “prepaid car insurance” because users only pay for the extra miles they drive after the set base cost. Insurance companies track mileage through a device installed in the car or through self-reporting. The plug-in device communicates with the mobile app on your phone so drivers can see how rates change with each trip.

Learn More:

The Difference: Usage-Based Insurance vs. Pay-As-You-Go Insurance

Usage-based auto insurance (UBI) and pay-per-mile coverage are similar in many ways. Both provide state minimum and full coverage policies, and both often require plug-in devices to track driving behavior to determine rates.

The biggest difference between the two is the pay-as-you-go feature. Only pay-per-mile coverage allows drivers to pay rates solely based on miles driven, sometimes per trip, while UBI relies on safe driving habits to generate a discount.

Usage-based insurance companies also still charge a monthly or annual rate based on demographics like age and gender.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pay-As-You-Insurance: Great Choice for Teens and Seniors

Finding the right car insurance can be particularly challenging for young drivers and seniors. Trying to find affordable pay-as-you-go insurance for young drivers and the best car insurance for seniors, can be very difficult. Teens and senior’s insurance needs often differ from those of other age groups.

For young drivers, pay-as-you-go insurance is an excellent chance for savings opportunities. Due to new drivers having less experience and higher accident rates, they unfortunately can’t avoid having to pay higher rates than other drivers.

Pay-as-you-go car insurance for young drivers is a flexible, cost-effective option. Pay-as-you-go young driver insurance can be the affordable option that teens (and their parents) are desperately searching for.

This type of insurance allows policyholders to pay premiums based on their actual mileage, which can be beneficial for those who drive less frequently or only for short distances – which is often the case for senior drivers. It helps young drivers and seniors alike manage their insurance costs while maintaining the coverage they need.

Read More: Cheap Auto Insurance for Drivers Over 80

Pay-As-You-Go Auto Insurance by Location

Navigating car insurance options in specific regions involves exploring tailored solutions. Pay-as-you-go car insurance in Texas and pay-per-mile car insurance in California have become how money-conscious drivers shop for their auto insurance coverage. These customized pay-as-you-go options cater to drivers’ needs and offer more flexible, cost-effective coverage than traditional auto insurance models.

Pay-per-mile car insurance in Florida has been very successful. It is designed to meet the unique requirements of drivers in the Sunshine State, aligning premiums with actual driver usage patterns.

Pay-as-you-go car insurance in Florida is growing in popularity as it provides an alternative to conventional insurance plans, allowing policyholders to pay premiums based on their actual mileage.

If you are considering your insurance options in Florida, it’s important to review specific Hugo Insurance Florida reviews (and other pay-per-mile coverage options) to make an informed decision about which provider and level of coverage you choose.

Drivers looking for cheap car insurance in PA, MD, and SC have reported this mileage-based, prepaid auto insurance as the winner for the most affordable option in their area, emphasizing affordability and value.

Learn More Here: Auto Insurance Rates by State

Ultimately, selecting the right insurance coverage requires careful consideration of regional regulations, individual needs, and budgetary constraints, and pay-as-you-go turns up a winner repeatedly.

Pros and Cons of Pay-As-You-Go Insurance Coverage

Many pay-as-you-go auto insurance companies are new, not verified by A.M. Best or the Better Business Bureau, and don’t operate in many states. However, many drivers are using these companies to find an insurance policy that better suits their lifestyle.

Here is a quick guide on the pros and cons of this type of car insurance.

Pros

- You only pay for the miles you drive.

- The policy saves you money on your car insurance rates.

- Compared to traditional policies, car insurance by mileage provides drivers with greater flexibility.

- Drivers with low mileage can save regardless if they have any driving offenses or at-fault claims.

Cons

- Pay-per-use auto insurance is unavailable in some states.

- There may be penalties for exceeding your allotted mileage.

- Pay-as-you-go auto insurance companies do not have many policy or discount options.

- Your insurance bill may vary each month, making budgeting and comparing quotations more difficult.

If you’re unsure if the low-miles car insurance is right for you, ask your provider about a test drive. It can offer you a reduced rate for a limited amount of time so that you can try out the service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Bottom Line on The Best Pay-As-You-Go Auto Insurance Companies

Nationwide SmartMiles is available in more states, allowing more drivers to save money with the ever-popular type of cheap car insurance, pay-as-you-go auto insurance. However, if you live in a state where MileAuto, Metromile, or Hugo Insurance are available, you will get cheaper, more flexible coverage. Further, MileAuto is the only company on this list that does not use a tracking device for drivers concerned about data breaches.

Pay-per-mile insurance may not be the best option for everyone, but it is worth considering if you don’t drive frequently, especially when Allstate Milewise offers an unlimited policy. You may also want to look at Allstate Milewise and Progressive Snapshot for good driver auto insurance discounts to help lower rates for higher-mileage drivers.

The best way to find cheap pay-per-mile car insurance companies is to compare auto insurance quotes online and make sure you choose a policy that best fits your needs. Enter your ZIP code below to get started on quote comparison.

Frequently Asked Questions

How much is pay-as-you-go car insurance?

The cost of pay-per-mile insurance varies depending on several factors, including your driving habits, mileage, location, vehicle type, and insurance provider. Generally, with pay-per-mile insurance, policyholders pay a base rate, often referred to as a “base premium,” along with a per-mile charge.

The per-mile charge can range from a few cents to over a dollar per mile driven, depending on the insurance company and your individual circumstances.

Some insurers offer discounts or incentives for safe driving behaviors, which can drastically lower your monthly bills.

Pay-as-you-go full coverage insurance will cost more than minimum coverage, so the coverage level you choose will determine your final cost.

To get an idea of the cost of pay-per-mile insurance for your specific situation, use our free online quote tool to get a personalized quote based on your driving profile and mileage estimates.

Is pay-per-mile auto insurance cheaper?

It can be, depending on how much you drive. Pay-per-mile car insurance is best for people who don’t drive frequently, and it can save them money. However, it may not be as cost-effective for those who drive more often.

How do auto insurance companies check mileage?

Insurance companies may use various methods to track your mileage, including odometer readings, global positioning systems (GPS), and plug-in devices.

Ensure you understand how your company tracks mileage before signing up for a pay-per-mile plan.

What happens if you exceed your annual mileage?

Some pay-per-mile insurance plans have penalties for exceeding your annual mileage limit. In contrast, others allow you to buy additional miles at a predetermined cost.

Therefore, it’s important to keep track of how many miles you drive so you don’t end up paying more than expected.

What is the best pay-as-you-go auto insurance company?

There is no one “best” pay-per-mile car insurance company. Instead, you will need to do your research to find the company that best suits your needs.

Among the factors to consider are the policy’s cost, the number of miles you drive each year, and the company’s customer service record.

What is the best pay-as-you go car insurance in California?

When it comes to finding the best pay-per-mile car insurance in California, several factors should be considered to find the ideal fit for your needs.

Metromile, Root Insurance, and MileAuto are top contenders for the best pay-as-you-go insurance policies in California

To find the best mileage-based auto insurance in California, consider factors such as coverage options, pricing, customer service, and discounts offered by the insurance provider.

It’s essential to compare quotes and review customer feedback to make an informed decision that aligns with your driving habits and budget. Use our free tool to get quotes today!

What is the best pay-as-you go car insurance in Florida?

In Florida, several reputable providers offer pay-as-you-go coverage tailored to drivers’ needs. The three below have big reasons to be among the BEST:

- Metromile: Known for its pay-as-you-drive insurance model (and best app!), Metromile offers pay-per-mile car insurance in Florida that allows drivers to pay premiums based on their actual mileage. It provides lower rates for those who drive less often.

- Root Insurance: Root Insurance offers a telematics-based approach to car insurance, allowing drivers to save money based on their driving – best for its free roadside assistance! Its pay-as-you-go auto insurance Florida option is a great choice for those looking for personalized coverage.

- Progressive Snapshot: Progressive’s Snapshot program utilizes telematics technology to track driving and adjust premiums accordingly. This cheap pay-as-you-go insurance Florida option has the best discounts for safe drivers.

These providers offer pay-per-mile insurance Florida options that cater to drivers’ individual needs, providing some of the cheapest auto insurance options in the state.

When exploring pay-as-you-go coverage in Florida, it’s essential to compare quotes (Try our free tool!), coverage options, and customer reviews to find the best fit for your specific situation.

Does Hugo insurance offer full coverage auto insurance?

Yes, Hugo offers full coverage auto insurance.

Hugo Insurance provides pay-as-you-go insurance, which, at a minimum, will provide you with liability, collision, and comprehensive auto insurance coverage.

We suggest you bulk up your usage-based auto insurance with Hugo’s full coverage at a higher base rate.

This full coverage will typically include liability, collision, comprehensive, and other add-on types of coverage such as uninsured/underinsured motorist coverage, medical payments coverage, and rental reimbursement.

Does Hugo insurance cover Georgia?

“Pay-as-you-go car insurance Georgia” is a top search these days. Georgia drivers are taking notice of the most affordable providers in the game.

And, yes, although Hugo is currently only in less than half of the U.S., they do in fact, offer pay-per-mile insurance in Georgia.

Here are the 13 states where Hugo car insurance is available:

- Alabama

- Arizona

- California

- Florida

- Georgia

- Illinois

- Indiana

- Mississippi

- Ohio

- Pennsylvania

- South Carolina

- Tennessee

- Texas

It makes sense why this is a top question because Hugo’s pay-as-you-go coverage, more often than not, proves to be the cheapest insurance in GA.

Are there pay-as-you-go insurance companies like Hugo?

Hugo is one of the newer players in the pay-as-you-go insurance market, so their coverage area isn’t nationwide…yet. For this reason, people are often searching for car insurance like Hugo.

Luckily, there are many companies like Hugo insurance pay-as-you-go. In fact, every state has pay-as-you-go insurance providers for you to choose from.

Even if Hugo isn’t offered in your state, you can still get insurance like Hugo, and many providers use apps like Hugo insurance does too.

Some of the most popular pay-as-you-go insurance companies that operate in multiple states include:

- Metromile: Metromile is one of the largest pay-per-mile insurance providers and offers coverage across the United States.

- Root Insurance: Root Insurance is known for its usage-based insurance model, which tracks driving behavior through a mobile app.

- MileAuto: MileAuto provides pay-as-you-go insurance and is available in many states, offering coverage based on miles driven.

- Allstate Milewise: Allstate offers Milewise, a pay-as-you-go insurance option where premiums are based on the number of miles driven.

Before choosing a pay-as-you-go insurance provider, compare quotes and coverage options from multiple providers to find the best fit for your needs. Get started comparing quotes today from the best providers near you with our free insurance quote tool.

Who should get pay-as-you-go auto insurance?

Pay-as-you-go car insurance is a good choice for people who don’t drive very often.

Those who work from home or take public transportation, students in college, and drivers with another car idling at home could all save money with pay-per-mile insurance.

Is pay-per-mile car insurance worth it?

Whether pay-per-mile insurance is worth it depends on your specific driving habits and needs. It can be a good option for those who don’t drive frequently, but it’s important to compare rates and consider any discounts you may be eligible for before making a decision. Ultimately, choose the policy that best fits your needs.

Is Allstate Milewise a good option for pay-as-you-go auto insurance?

Allstate Milewise is a good option if you drive closer to 10,000 miles per year but don’t want to worry about annual premiums.

The Milewise program offers the choice between either a pay-per-mile or an unlimited plan based on your distance driven, and the plug-in device is simple to install.

Does pay-per-mile auto insurance include full coverage?

Pay-per-mile insurance usually includes liability, collision, and comprehensive coverage. Most companies also over uninsured motorist (UM) and personal injury protection (PIP) to meet certain state minimums. Confirm with your insurance provider as coverage options may vary.

Can I get car insurance discounts with pay-per-mile auto insurance?

You may be eligible for the same discounts with car insurance pay as you go as you would with traditional car insurance, such as a safe driver discount or low mileage discount. Be sure to ask your insurance provider about any discounts you may qualify for.

What is usage-based auto insurance?

Usage-based auto insurance companies still charge a monthly or annual rate, but drivers can track their mileage and driving habits to earn additional discounts on their premiums.

Is usage-based auto insurance available to everyone?

Eligibility and availability may vary by insurance provider and state. Some insurers may have specific requirements or limitations regarding vehicle types, driver age, or location.

Is my privacy compromised with pay-as-you-go auto insurance?

Usage-based and pay-per-mile auto insurance involve collecting data about your driving habits. Privacy concerns may arise regarding the collection and use of this data.

However, insurance companies are generally required to adhere to privacy regulations and policies, so it’s important to review these documents before you buy pay-as-you-go auto insurance to understand how your data will be collected, used, and protected.

Can you save with usage-based auto insurance?

The best way to find out is by comparing usage-based auto insurance quotes with traditional policies. If you aren’t a safe driver or often drive at night, you will likely save more money with traditional or pay-per-mile car insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.