Best Riverside, California Auto Insurance in 2025 (Check Out the Top 10 Companies)

Geico, State Farm, and Progressive offer the best Riverside, California auto insurance with rates starting at $70/month. Geico is ideal for good drivers, State Farm has the cheapest rates, and Progressive provides flexible plans. Compare these options for affordable coverage in Riverside, California.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Riverside CA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Riverside CA

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Riverside CA

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Riverside, California auto insurance companies are Geico, State Farm, and Progressive, with rates starting at $70/month.

Geico stands out for good drivers, while State Farm offers the cheapest rates, and Progressive provides flexible plan options. Driving record, commute length, and coverage needs are factors that affect auto insurance rates.

Our Top 10 Company Picks: Best Riverside, California Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A++ | Good Drivers | Geico | |

| #2 | 17% | B | Cheap Rates | State Farm | |

| #3 | 12% | A+ | Flexible Plans | Progressive | |

| #4 | 22% | A+ | Full Coverage | Allstate | |

| #5 | 18% | A | Comprehensive Options | Farmers | |

| #6 | 14% | A | Roadside Assistance | AAA |

| #7 | 13% | A++ | Military Benefits | USAA | |

| #8 | 20% | A | Custom Policies | Liberty Mutual |

| #9 | 19% | A+ | Widespread Availability | Nationwide |

| #10 | 11% | A+ | Senior Benefits | The Hartford |

Reading customer reviews and getting quotes from multiple providers can help you make an informed decision. Compare these top companies to find affordable and comprehensive coverage in Riverside, California.

Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Compare the best Riverside, California auto insurance rates based on key factors

- Geico is the top pick for good drivers, with State Farm offering the cheapest rates

- Progressive stands out with flexible plans for various coverage needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Good Driver Discounts: It is a great option for safe drivers since it provides the finest Geico insurance discounts for good drivers in Riverside, California.

- Low Monthly Rates: Geico offers competitive minimum coverage rates at $75 per month for Riverside, California, residents.

- Policies Addressing Bundling: In Riverside, California, Geico provides a 15% reduction on home and vehicle insurance bundles.

Cons

- Restricted Coverage Alternatives: Geico’s auto insurance may lack some advanced coverage options compared to other providers in Riverside, California.

- Help Concerns of Customers: Some customers in Riverside have reported mixed experiences with Geico’s customer service.

#2 – State Farm: Best for Cheap Rates

Pros

- Budget-Friendly Coverage: According to our State Farm auto insurance review, it is a reputable provider of reasonably priced vehicle insurance in Riverside, California, with minimal coverage as little as $80 per month.

- Dependable Discounts: State Farm is a good choice for Riverside clients looking to save money because they may receive a 17% reduction when they bundle insurance.

- Strong Local Accessibility: With plenty of local offices, State Farm makes it easy for Riverside residents to handle insurance matters in person.

Cons

- Moderate Multi-Policy Savings: While State Farm provides bundling discounts, they may not be as competitive as other insurance providers in Riverside, California.

- Basic Online Features: State Farm’s online tools for managing policies in Riverside could be more advanced and user-friendly.

#3 – Progressive: Best for Flexible Plans

Pros

- Tailored Coverage Plans: Progressive provides Riverside, California customers with customizable coverage plans that enable customized coverage to fit unique needs.

- Affordable Rates: Progressive auto insurance review provides minimum coverage rates as low as $78 per month in Riverside, California.

- Bundling Savings: Progressive offers a 12% discount for bundling auto insurance with other policies, helping Riverside residents save more.

Cons

- Claim Satisfaction: Some Progressive customers in Riverside have reported lower satisfaction with the claims process.

- Higher Premiums for High-Risk Drivers: Progressive’s rates can be higher for Riverside residents with a history of accidents or violations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Full Coverage

Pros

- Alternatives for Complete Coverage: When it comes to offering Riverside, California residents complete, full coverage vehicle insurance that protects against a range of risks, Allstate is the best.

- Minimal Coverage Costs: Allstate provides affordable minimal coverage costs in Riverside, with monthly rates beginning at $85 each month.

- Savings on Bundling: Riverside, California homeowners who combine their home and auto insurance policies can receive savings of up to 22% from Allstate auto insurance review.

Cons

- Increased Full Coverage Costs: In comparison to other providers, Allstate’s full coverage insurance in Riverside may be more costly.

- Mixed Claim Experiences: Some Riverside, California policyholders have reported varied experiences with Allstate’s claims handling process.

#5 – Farmers: Best for Comprehensive Options

Pros

- Solutions for Comprehensive Coverage: In Riverside, California, Farmers is renowned for providing an extensive range of auto insurance solutions, including premium coverage for intricate requirements.

- Reasonably Priced Minimal Coverage: Farmers provides minimal coverage prices for drivers in Riverside, California, beginning at $82 per month.

- Bundling Discount: Farmers auto insurance discounts provides provides up to an 18% discount for bundling auto insurance with other types of coverage in Riverside.

Cons

- Premiums for Custom Coverage: Customized coverage options can lead to higher premiums for Farmers auto insurance in Riverside, California.

- Slower Claims Process: Some Riverside residents have reported slower claims processing times with Farmers.

#6 – AAA: Best for Roadside Assistance

Pros

- Excellent Roadside Assistance: AAA is known for its industry-leading roadside assistance program, making it a great choice for drivers in Riverside, California.

- Competitive Minimum Coverage Rates: AAA offers minimum coverage rates at $90 per month for Riverside residents.

- Bundling Savings: AAA auto insurance review emphasizes up to a 14% discount for bundling auto insurance with other services in Riverside, California.

Cons

- Membership Requirement: AAA auto insurance in Riverside, California requires a membership, which may add to the cost.

- Higher Premiums for Full Coverage: Full coverage policies with AAA in Riverside can be pricier compared to other companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Benefits

Pros

- Tailored Military Advantages: USAA offers unique advantages to active military troops and their families in Riverside, California.

- Attractive Entry-Level Rates: With minimal coverage prices starting at $70 per month, USAA auto insurance review provides very cheap rates for Riverside drivers.

- Making the Most of Discounts: Riverside military people may save up to 13% when they combine their home and vehicle insurance with USAA.

Cons

- Restrictions on Eligibility: Riverside residents who are not military members are not eligible for USAA; it is exclusively offered to military personnel and their families.

- Restricted Local Agents: Riverside customers who prefer in-person service may find it problematic since USAA has fewer physical offices and agents.

#8 – Liberty Mutual: Best for Custom Policies

Pros

- Particularized Insurance Alternatives: Riverside, California drivers may choose from a variety of flexible and personalized vehicle insurance products from Liberty Mutual.

- Reasonably Offered Minimum Coverage Rates: Liberty Mutual offers affordable minimum coverage in Riverside, with monthly rates as low as $88.

- Bundling Benefits: Based on our Liberty Mutual auto insurance review, Riverside residents can get a 20% discount when they bundle their auto and home insurance with Liberty Mutual.

Cons

- High Premiums for Comprehensive Coverage: If you’re considering comprehensive coverage with Liberty Mutual in Riverside, keep in mind that it may come with higher costs.

- Uneven Customer Service Experiences: A few Riverside clients have mentioned varying levels of satisfaction with Liberty Mutual’s customer service.

#9 – Nationwide: Best for Widespread Availability

Pros

- Widespread Availability: Nationwide’s extensive network makes it easy to find coverage and support throughout Riverside, California.

- Low Rates for Minimum Coverage: Nationwide offers competitive minimum coverage rates in Riverside starting at $83 per month.

- Bundling Discount: Our Nationwide auto insurance review highlighted a bundling discount of up to 19% for Riverside, California policyholders who combine home and auto insurance.

Cons

- Higher Costs for Full Coverage: Full coverage auto insurance from Nationwide in Riverside can be pricier than minimum coverage.

- Limited Local Support: Some Riverside residents may find limited access to local Nationwide agents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Senior Benefits

Pros

- Advantages for Seniors: The Hartford is well-known in Riverside, California for providing senior drivers with specific perks for auto insurance.

- Low Rates for Minimum Coverage: According to our guide about The Hartford auto insurance review, it offers reasonable minimum coverage prices beginning at $87 per month in Riverside.

- Bundling Discounts: The Hartford offers an 11% bundling discount for Riverside residents combining auto insurance with other coverage options.

Cons

- Higher Premiums for Younger Drivers: Younger drivers in Riverside may find The Hartford’s premiums higher compared to senior-focused rates.

- Limited Online Tools: The Hartford’s online tools and mobile app could be more user-friendly for Riverside policyholders.

Minimum Auto Insurance in Riverside, California

Riverside, California auto insurance requirements are set by state law. State law mandates minimum liability coverage levels of $15,000 in bodily injury liability per person, $30,000 per accident, and $5,000 in property damage liability. These minimums ensure that drivers are financially responsible in the event of an accident, covering medical costs and damages to other vehicles or property.

Here’s a breakdown of average monthly premiums for both minimum auto insurance and full coverage from top providers in Riverside, California:

Riverside, California Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $155 |

| $85 | $150 | |

| $82 | $147 | |

| $75 | $130 | |

| $87 | $152 |

| $88 | $160 |

| $83 | $148 |

| $78 | $140 | |

| $80 | $145 | |

| $70 | $125 |

Geico and USAA offer some of the lowest rates for both minimum and full coverage. Keep in mind that rates can vary based on factors like driving history, vehicle type, and credit score.

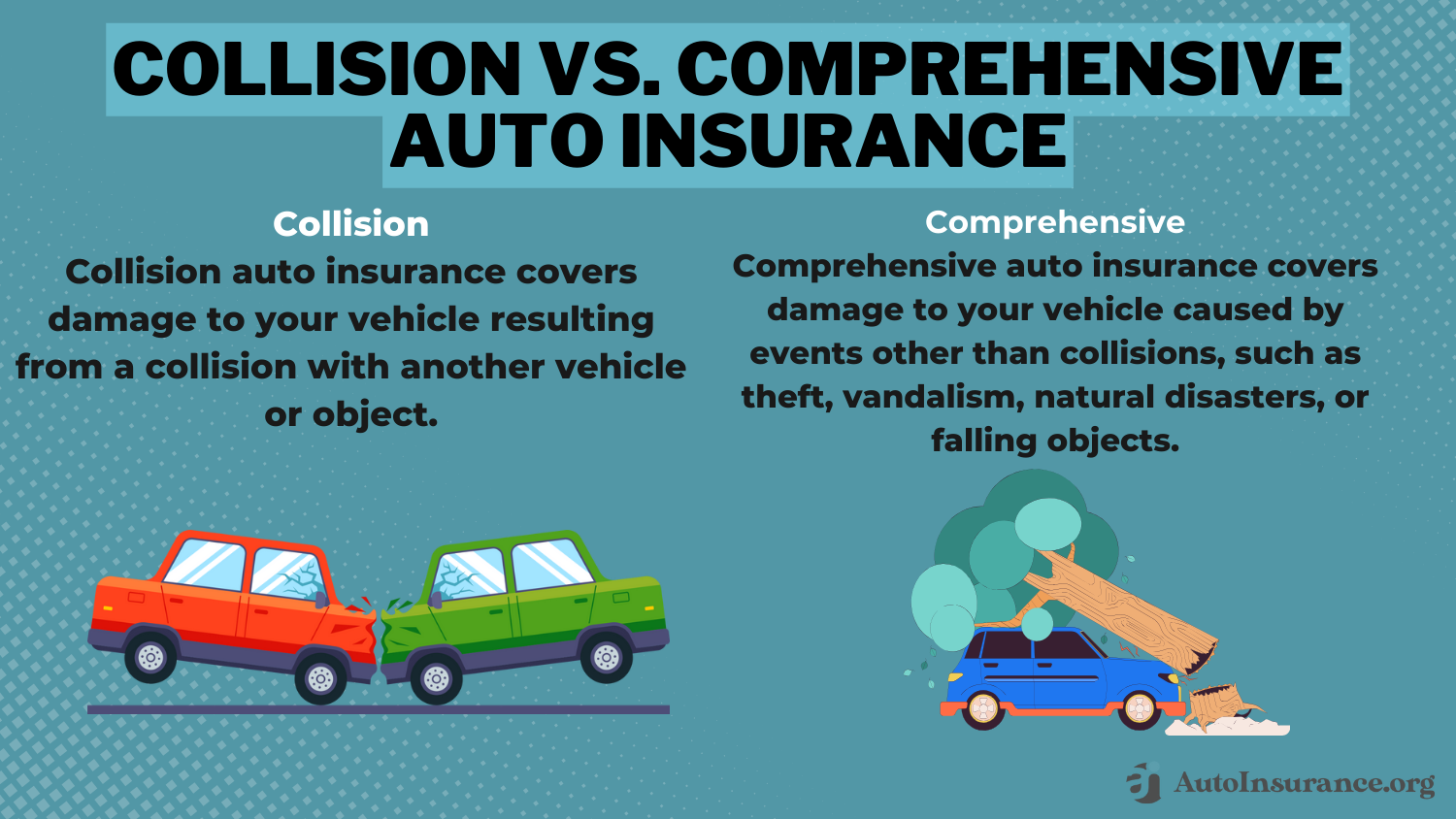

While meeting these requirements is essential, opting for higher coverage or full coverage may be wise, especially if you own a more expensive vehicle or want added protection. Full coverage typically includes collision and comprehensive coverage, which protect your vehicle from damages caused by accidents, weather, or theft.

Navigating Affordable Auto Insurance in Riverside, California

Finding cheap auto insurance in Riverside can seem like a difficult task, but all of the information you need is right here. Below, we explore some key factors, starting with the most common types of claims in the area and followed by comparisons to other cities, discount opportunities, and an overall evaluation of Riverside’s auto insurance landscape.

5 Most Common Auto Insurance Claims in Riverside, California

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-end Collision | 35% | $4,800 |

| Single Vehicle Accident | 25% | $6,500 |

| Weather-related Damage | 15% | $5,200 |

| Vandalism/Theft | 12% | $3,400 |

| Animal Collision | 8% | $3,100 |

Rear-end collisions and single-vehicle accidents dominate claim reports in Riverside, with claims costing thousands of dollars. These figures emphasize the importance of finding coverage that can protect you from costly out-of-pocket expenses.

Comparing Riverside’s rates to other California cities like San Francisco auto insurance rates, Anaheim auto insurance rates, and Sacramento auto insurance rates, can also help you understand how competitive rates are in Riverside.

Finding affordable auto insurance in Riverside can feel overwhelming, but with the right information, it’s entirely manageable. Below, we provide essential data on common claims, city-by-city comparisons, and available discounts to help you make an informed decision.

Riverside, California Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Corona | 850 | 700 |

| Hemet | 500 | 400 |

| Moreno Valley | 900 | 750 |

| Riverside | 1,400 | 1,200 |

| Temecula | 700 | 550 |

With 1,400 accidents and 1,200 claims annually, Riverside leads in incidents compared to neighboring cities, further underlining the importance of comprehensive auto insurance coverage. To gain full details, read our guide on how to file an auto insurance claim.

Riverside, California Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Good Driver Discount | A | 15% | State Farm, Geico, Allstate |

| Multi-Policy Discount | A- | 12% | Farmers, Liberty Mutual, USAA |

| Safe Vehicle Discount | B+ | 8% | Progressive, Nationwide |

| Defensive Driving Course | B | 7% | Allstate, State Farm |

| Low Mileage Discount | B- | 6% | Liberty Mutual, Geico |

These discounts can significantly reduce your premium, with savings reaching up to 15% for good drivers. Many major providers in Riverside offer these benefits, making it easier to find cost-effective coverage.

Riverside, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Coverage Options | A | Wide variety of coverage options across providers. |

| Discount Availability | A- | Many providers offer a range of discounts. |

| Overall Affordability | B | Premiums are higher than the national average. |

| Customer Service | B | Mixed customer satisfaction, depends on provider. |

| Claims Processing | B- | Some delays, but generally resolved within a reasonable time. |

Riverside’s premiums tend to be higher than the national average, but the wide selection of coverage options and discounts helps to offset costs for drivers.

Best Deals on Riverside, California Auto Insurance by Age, Gender, and Marital Status

In Riverside, California, auto insurance rates are affected by age, gender, and marital status. See how demographics impact the annual cost of insurance.

Riverside, California Full Coverage Auto Insurance Monthly Rates by Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $252 | $252 | $184 | $185 | $702 | $884 | $324 | $356 | |

| $239 | $239 | $216 | $216 | $760 | $1,243 | $283 | $315 | |

| $149 | $149 | $140 | $140 | $454 | $461 | $214 | $219 | |

| $198 | $187 | $184 | $178 | $431 | $460 | $222 | $225 |

| $275 | $262 | $241 | $227 | $703 | $776 | $328 | $324 |

| $153 | $157 | $130 | $154 | $408 | $492 | $220 | $237 | |

| $299 | $299 | $268 | $268 | $553 | $686 | $331 | $342 | |

| $213 | $206 | $188 | $186 | $441 | $505 | $277 | $271 | |

| $159 | $151 | $155 | $156 | $362 | $365 | $220 | $208 |

Finding cheap teen auto insurance in Riverside, California, can be challenging. It would be best if you compare companies with the cheapest teen auto insurance. Here are the monthly rates.

Riverside, CA Auto Insurance Monthly Rates for Teens

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| $702 | $884 | |

| $760 | $1,243 | |

| $454 | $461 | |

| $431 | $460 |

| $703 | $776 |

| $408 | $492 | |

| $553 | $686 | |

| $441 | $505 | |

| $362 | $365 |

What are senior auto insurance rates in Riverside, California? Take a look at the monthly average rates for male and female senior drivers aged 60 in Riverside

Riverside, California Auto Insurance Monthly Cost for Seniors

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| $184 | $185 | |

| $216 | $216 | |

| $140 | $140 | |

| $184 | $178 |

| $241 | $227 |

| $130 | $154 | |

| $268 | $268 | |

| $188 | $186 | |

| $155 | $156 |

These rates reflect an average comparison, and the actual amount seniors pay can vary depending on additional factors such as specific coverage needs, driving record, and available discounts for senior drivers.

Affordable Coverage in Riverside, California Based on Driving Record

Driving record has a big impact on your auto insurance rates. See the annual auto insurance rates for a bad record in Riverside, California compared to the annual auto insurance rates with a clean record in Riverside, California.

Riverside, California Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $236 | $310 | $398 | $625 | |

| $325 | $438 | $442 | $550 | |

| $168 | $209 | $260 | $326 | |

| $226 | $240 | $303 | $274 |

| $274 | $351 | $351 | $593 |

| $160 | $230 | $271 | $315 | |

| $272 | $315 | $324 | $612 | |

| $190 | $281 | $311 | $361 | |

| $147 | $162 | $220 | $359 |

Additionally, finding cheap auto insurance after a DUI in Riverside, California is not easy. Compare the monthly rates for DUI auto insurance in Riverside, California to find the best deal.

Riverside, CA Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| $625 | |

| $550 | |

| $326 | |

| $274 |

| $593 |

| $315 | |

| $612 | |

| $361 | |

| $359 |

As the table shows, monthly premiums can vary significantly depending on the insurer. Liberty Mutual offers the lowest rate at $274.

Schimri Yoyo Licensed Agent & Financial Advisor

While Allstate’s rate is one of the highest at $625. By comparing quotes from different providers, drivers with a DUI can still find competitive rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Low-Cost Auto Insurance Rates in Riverside, California by ZIP Code

Auto insurance rates by ZIP code in Riverside, California can vary. Compare the annual cost of auto insurance by ZIP code in Riverside, California to see how car insurance rates are affected by location.

Riverside, California Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 92501 | $442 |

| 92503 | $443 |

| 92504 | $443 |

| 92505 | $438 |

| 92506 | $414 |

| 92507 | $446 |

| 92508 | $429 |

| 92521 | $441 |

The rates range from $414 to $446 per month, with ZIP code 92506 offering the lowest average rate at $414, while 92507 has the highest at $446.

These differences may seem minor, but over the course of a year, they can lead to substantial savings. Living in a ZIP code with lower rates can make a significant impact on your annual premium, so it’s worth considering these variations when shopping for insurance.

Lowest Priced Auto Insurance in Riverside, California by Commute

Commute length and annual mileage affect Riverside, California auto insurance. Find the cheapest annual Riverside, California auto insurance by commute length. Here’s a comparison of how annual mileage impacts monthly full coverage auto insurance rates across various providers:

Riverside, California Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $354 | $431 | |

| $398 | $479 | |

| $219 | $263 | |

| $239 | $282 |

| $346 | $438 |

| $221 | $267 | |

| $367 | $395 | |

| $257 | $315 | |

| $205 | $239 |

Still, wondering how annual mileage affects your auto insurance rates? Let’s take a look at the table shown above. Driving fewer miles per year can significantly lower your monthly premiums. Geico charges $219 for drivers who cover 6,000 miles annually, compared to $263 for those driving 12,000 miles. The same pattern holds true for most companies, so reducing your annual mileage can help secure more affordable coverage in Riverside.

Key Factors Affecting Auto Insurance Rates in Riverside, California

There are a lot of reasons why auto insurance rates in Riverside, California are higher or lower than in other cities. These include traffic and the number of vehicle thefts in Riverside, California. Many local factors may affect your Riverside auto insurance rates.

Auto Insurance Discounts From the Top Providers in Riverside, California

| Insurance Company | Available Discounts |

|---|---|

| AAA Member, Longevity, Group Affinity, Multiple Student, Automatic Payments |

| Responsible Payer, Early Signing, EZ Pay Plan, Deductible Rewards, New Car Replacement | |

| Business/Professional Group, Signal (Telematics), Mature Driver, Alternative Fuel, Shared Family Car | |

| Federal Employee, Seat Belt Use, Military, Emergency Deployment, Airbag, Five-Year Accident-Free | |

| New Graduate, Advanced Safety Features, New Car Replacement, Better Car Replacement, Newly Married |

| SmartRide (Telematics), Farm Bureau, Accident Forgiveness, Vanishing Deductible, Paperless Documents |

| Snapshot (Telematics), Homeowner, Paperless Billing, Sign Online, Continuous Coverage |

| Drive Safe & Save (Telematics), Safe Vehicle, Good Student, Steer Clear (For Young Drivers), Homeowner | |

| AARP Member, Paid-In-Full, Hybrid Vehicle, RecoverCare, Defensive Driver Course | |

| Family Legacy, Garaging On Base, Military Installation, Stored Vehicle, Annual Mileage |

More theft means higher auto insurance rates because auto insurance companies are paying more in claims. According to the FBI’s annual Riverside, California auto theft statistics, there have been 1,845 auto thefts in the city.

Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Riverside, California commute length is 45.5 minutes according to City-Data.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Finding the Best Riverside, California Auto Insurance

When finding the best Riverside, California auto insurance, comparing different providers can help you secure the lowest rates and best coverage. These highlight how Riverside drivers found the ideal insurance by evaluating factors like driving records, coverage options, and personal needs.

- Case Study #1 — Good Driver Saves With Geico: A Riverside driver with a clean driving record was paying $120/month with their current provider. After comparing rates, they switched to Geico, securing a new rate of $70/month. The driver benefitted from Geico’s discounts for good driving.

- Case Study #2—Affordable Rates for Young Drivers: A young driver in Riverside struggled to find affordable insurance after their policy renewal increased rates. By switching to State Farm, they locked in a lower rate that matched their budget. State Farm offered competitive prices tailored explicitly to younger drivers.

- Case Study #3 — Flexible Coverage: A Riverside driver with a long daily commute needed a policy that could adjust to their changing mileage needs. After comparing quotes, they opted for Progressive’s flexible plan, which allowed them to customize their coverage as their driving habits changed.

By comparing the best Riverside, California auto insurance providers, drivers found the right mix of affordability and coverage tailored to their unique situations (Learn more: Why Get Multiple Auto Insurance Quotes)

Geico offers the best rates for good drivers in Riverside, California, starting at just $70 per month.Michelle Robbins Licensed Insurance Agent

These case studies show how choosing the right insurer can lead to savings and peace of mind. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What is the minimum auto insurance coverage required in Riverside, California?

California law requires at least 15/30/5 in liability coverage, which includes $15,000 for bodily injury liability per person, $30,000 per accident, and $5,000 for property damage.

Does my driving record affect my auto insurance rates in Riverside?

Yes, a clean driving record can lead to lower premiums, while accidents or violations typically result in higher rates. Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

How does commute length impact auto insurance rates in Riverside, California?

Longer commutes often result in higher premiums since more time on the road increases the risk of accidents.

How can I lower my auto insurance rates in Riverside, California?

You can lower your rates by maintaining a clean driving record, bundling policies, increasing auto insurance deductibles, or qualifying for discounts like low mileage or safe driver rewards.

Can I get auto insurance in Riverside if I have a DUI on my record?

Yes, but your rates will likely be higher due to the increased risk, and you may need to file an SR-22 auto insurance certificate for proof of insurance.

What discounts are commonly available for auto insurance in Riverside, California?

Common discounts include safe driver, multi-vehicle auto insurance discounts, bundling with home insurance, and discounts for having anti-theft devices or completing a defensive driving course.

How does my vehicle type affect my auto insurance premium in Riverside?

Luxury or high-performance vehicles typically have higher premiums due to their cost to repair or replace, while safer, more economical cars may qualify for lower rates.

Is full coverage necessary in Riverside, California?

Full coverage, which includes collision auto insurance and comprehensive insurance, is not required by law but is recommended if your vehicle is new or valuable.

How does age impact auto insurance rates in Riverside, California?

Younger and older drivers often face higher premiums due to their higher risk profile, while middle-aged drivers generally enjoy lower rates.

Can I get auto insurance without a California driver’s license?

Yes, many insurance companies offer coverage to non-California or international drivers, though rates may vary based on driving experience and other factors. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.