Best Virginia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Discover the best Virginia auto insurance at rates starting from $30 per month, with State Farm, USAA, and Progressive leading the pack. These companies excel in affordability, coverage options, and customer satisfaction. Compare Virginia car insurance quotes today to find the best coverage for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, USAA, and Progressive are the best Virginia auto insurance providers offering rates as low as $30 per month. These companies are known for extensive agent network and personalized service. Compare quotes and find cheap auto insurance in VA that suits your budget and needs.

Virginia auto insurance costs significantly less than the national average for full coverage. Your rates depend on factors like age, ZIP code, and driving history. We’ll help you find a cheap car insurance in VA, meet Virginia auto insurance requirements, and compare different types of auto insurance.

Our Top 10 Company Picks: Best Virginia Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A++ Local Agents State Farm

#2 12% A++ Military Savings USAA

#3 10% A+ Competitive Rates Progressive

#4 12% A+ Infrequent Drivers Allstate

#5 11% A++ Affordable Rates Geico

#6 13% A+ Vanishing Deductible Nationwide

#7 9% A Coverage Options Liberty Mutual

#8 10% A Loyalty Rewards American Family

#9 11% A Group Discounts Farmers

#10 13% A++ Safe Drivers Travelers

Find your cheapest auto insurance quotes by entering your ZIP code above into our free comparison tool.

- Compare Virginia auto insurance rates with State Farm’s tailored service

- Customize coverage based on age, ZIP code, and driving history

- State Farm offers competitive rates and top customer satisfaction in Virginia

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Agent Network: State Farm boasts a vast network of local agents, offering personalized service and easy access for claims and policy adjustments.

- Strong Financial Stability: It boasts excellent financial strength ratings, indicating reliability in claims payment. Check out our page titled State Farm auto insurance review to learn more details.

- Strong Customer Satisfaction: High ratings for customer service and claims handling ensure reliable support during stressful times.

Cons

- Potentially Higher Rates: While competitive, State Farm’s rates might be slightly higher for some demographics compared to direct insurers.

- Limited Discounts: Offers fewer discounts compared to some competitors, potentially limiting savings opportunities.

#2 – USAA: Best for Military Savings

Pros

- Exclusive Membership Benefits: USAA offers specialized services tailored to military members and their families, including unique savings and personalized support.

- Top-Rated Customer Service: Consistently ranks high in customer satisfaction surveys due to its member-focused approach.

- Competitive Rates: As outlined in USAA auto insurance review, the company provides some of the lowest rates, especially for those eligible.

Cons

- Membership Limitations: Only available to military members, veterans, and their families, limiting eligibility.

- Limited Branch Access: Physical branch locations are sparse outside major military installations, relying heavily on digital channels.

#3 – Progressive: Best for Competitive Rates

Pros

- Affordable Pricing: Known for competitive rates and discounts that appeal to budget-conscious consumers.

- Name Your Price Tool: Progressive auto insurance review highlights the unique feature that helps customers find coverage within their budget.

- Wide Range of Discounts: The company provides numerous discount opportunities for safe driving, multi-policy, etc.

Cons

- Mixed Customer Service Reviews: While competitive on pricing, customer reviews vary on claims satisfaction and support.

- Complex Discount Structure: Discounts may be complex, requiring careful navigation to maximize savings potential.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Infrequent Drivers

Pros

- Usage-Based Insurance Options: Provides programs like Drivewise for infrequent drivers to potentially lower premiums based on driving habits.

- Strong Financial Stability: Highly rated for financial strength and stability, assuring policyholders of reliability.

- Drivewise Program: Rewards safe driving habits with discounts. Learn more about all the discounts available in our Allstate auto insurance review.

Cons

- Higher Premiums for Some Drivers: Rates may be higher for certain demographics or coverage types compared to competitors.

- Complex Product Offerings: Range of policy options and add-ons can be overwhelming for some customers.

#5 – Geico: Best for Affordable Rates

Pros

- Low-Cost Options: Geico consistently offers some of the lowest premiums across various driver profiles.

- Ease of Use: Simple online quote process and robust mobile app for policy management.

- Wide Availability: As mentioned in our Geico auto insurance review, Geico is available in all 50 states and Washington D.C.

Cons

- Limited Personalized Service: Known for direct sales model, which may result in less personalized customer service.

- Potential Coverage Limitations: Some policy options may have fewer coverage choices compared to traditional insurers.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Strong Coverage Options: Extensive range of coverage options catering to diverse needs and preferences.

- Member Resources: Provides various resources and tools for members, including educational materials.

- Vanishing Deductible Feature: Offers the option to reduce deductibles over time for safe driving behavior.

Cons

- Higher Premiums for Some: Premiums can be higher compared to competitors, especially for certain profiles. For more information, read our Nationwide auto insurance review.

- Mixed Customer Reviews: Varied customer experiences with claims processing and overall service satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Coverage Options

Pros

- Customizable Policies: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual provides a wide array of coverage options and add-ons for tailored protection.

- Additional Benefits: Offers perks like accident forgiveness and new car replacement for added peace of mind.

- Tech Savvy: Utilizes technology for easy policy management and claims processing.

Cons

- Higher Premiums: Policies may come at a premium compared to budget-focused insurers.

- Complex Claims Process: Some customers report challenges with claims processing and communication.

#8 – American Family: Best for Loyalty Rewards

Pros

- Personalized Service: As mentioned in our American Family auto insurance review, they focuses on providing personalized service through local agents.

- Loyalty Rewards: Offers substantial discounts and rewards for long-term policyholders, enhancing value over time.

- Community Involvement: Strong commitment to community support and local initiatives.

Cons

- Regional Availability: Limited availability in certain states may restrict options for potential customers.

- Average Customer Service: Reviews suggest variable customer service experiences, impacting overall satisfaction.

#9 – Farmers: Best for Group Discounts

Pros

- Group Discounts: Farmers offers significant discounts for members of affiliated groups and organizations.

- Personalized Service: Local agents provide personalized guidance and support for policyholders.

- Claims Satisfaction: Generally good reputation for claims handling. Check out this page Farmers auto insurance review to know more details.

Cons

- Mixed Reviews: Customer satisfaction ratings vary, particularly regarding claims handling and premium adjustments.

- Policy Complexity: Range of policy options and add-ons can be complex to navigate for some customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Safe Drivers

Pros

- Financial Stability: Strong financial ratings indicate stability and reliability.

- Flexible Coverage Options: Offers a variety of coverage options and customizable policies.

- Discount Opportunities: As outlined in our Travelers auto insurance review, Travelers provides discounts for safe drivers, multi-policy holders, and more.

Cons

- Higher Initial Costs: Initial premiums may be higher compared to insurers with broader discount offerings.

- Limited Coverage Options: Some policyholders may find fewer add-ons and customization options compared to competitors.

Cheapest Auto Insurance Companies in Virginia

Full coverage insurance typically includes liability, comprehensive, collision, and additional protections, whereas minimum coverage meets only state-mandated requirements for liability, offering basic financial protection in Virginia.

The table below outlines monthly insurance premiums for minimum and full coverage offered by various providers in Virginia. These rates reflect the diverse pricing strategies and coverage options available to consumers in the state.

Virginia Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$71 $168

$57 $135

$68 $163

$47 $113

$89 $211

$59 $140

$42 $99

$43 $103

$50 $120

$30 $71

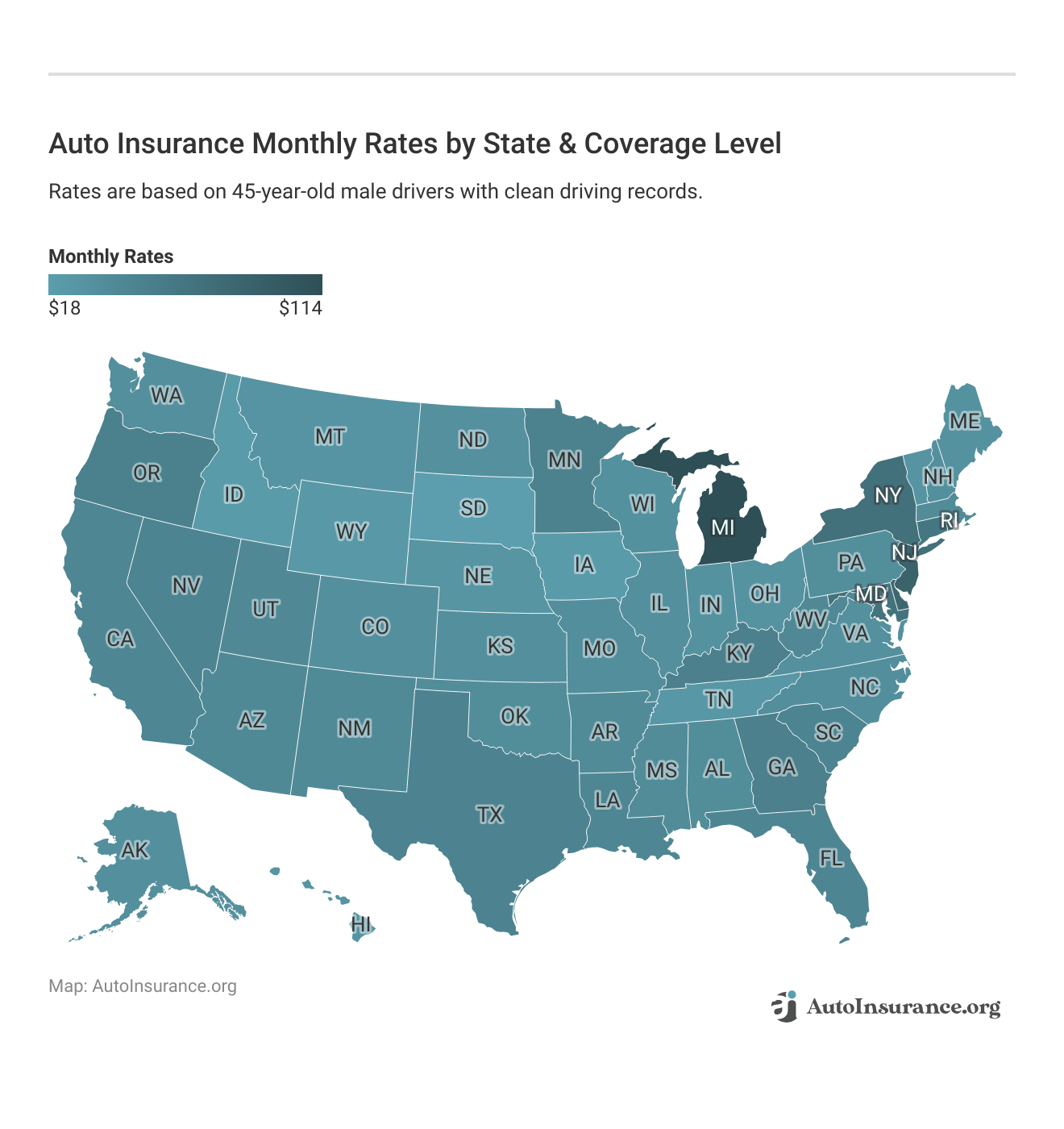

The average car insurance policy in Virginia costs about $85 per month, about 40% less than the national average. To see how that compares with rates across the country, consult the map below:

However, the amount you’ll pay for car insurance depends on various unique factors, such as age, gender, ZIP code, and driving history. The best car insurance companies in Virginia use these factors to craft a price specifically for you, but you can get an idea of how different factors affect Virginia auto insurance rates below.

Virginia Auto Insurance Rates for Minimum Coverage

Drivers who skip Virginia minimum auto insurance requirements must pay an uninsured motorist fee of about $500 to the Virginia DMV. If you decide to buy a minimum amount of liability, you’ll likely pay about $408 per year, which is cheaper than the uninsured motorist fee.

For that reason, getting car insurance is usually recommended for Virginia drivers. USAA auto insurance offers the cheapest average rates for minimum insurance. However, USAA has strict membership rules and only sells insurance to active or retired military members and their families.

If you’re not a military member, State Farm auto insurance and Geico might be your best bet for affordable Virginia auto insurance rates. While minimum insurance is your most affordable option, it doesn’t offer protection to your car. If you want help paying for repairs to your car after an accident, you’ll need full coverage car insurance in Virginia.

Virginia Auto Insurance Rates for Full Coverage

Full coverage auto insurance isn’t a requirement in any state. However, you might need it if you have a car loan or lease on your vehicle. Even if you own your car outright, full coverage might be a good idea because it protects you and your car from various damages. Full coverage includes liability, comprehensive, collision, uninsured motorist, and either personal injury protection or medical payments.

Once again, USAA, State Farm, and Geico auto insurance offer the cheapest full coverage car insurance in Virginia. However, there are many other factors that Virginia car insurance companies look at when determining your rates, which might make other companies more affordable.

You can add other insurance types to your policy to increase the coverage on your car. Here are some popular options for Virginia drivers:

While adding more insurance to your Virginia auto insurance policy offers better protection for your car, it also increases your rates. While it can be tempting to add as much coverage as possible to your policy, you should only buy what you need.

Virginia Auto Insurance Rates by Age

Age is an integral part of what you’ll pay for car insurance. Finding cheap auto insurance for teens can be difficult because young drivers are statistically more likely to drive recklessly and cause accidents. Similarly, older drivers also see higher rates because they file more claims and are more likely to be injured in an accident.

To get an idea of how much Virginia auto insurance rates may cost for your age group, take a look below:

Virginia Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 30 Male | Age: 30 Female | Age: 45 Male | Age: 45 Female | Age: 60 Male | Age: 60 Female |

|---|---|---|---|---|---|---|---|---|

| $715 | $439 | $221 | $220 | $168 | $177 | $177 | $177 | |

| $590 | $362 | $158 | $134 | $135 | $133 | $122 | $120 | |

| $910 | $558 | $197 | $188 | $163 | $164 | $151 | $141 | |

| $514 | $315 | $150 | $143 | $113 | $117 | $101 | $91 | |

| $953 | $585 | $242 | $212 | $211 | $208 | $193 | $180 |

| $537 | $330 | $165 | $150 | $140 | $139 | $124 | $121 |

| $923 | $567 | $130 | $125 | $99 | $104 | $92 | $91 | |

| $443 | $272 | $131 | $113 | $103 | $103 | $91 | $91 | |

| $1,100 | $675 | $130 | $120 | $120 | $118 | $109 | $108 | |

| $332 | $204 | $99 | $91 | $71 | $72 | $64 | $64 | |

| U.S. Average | $743 | $618 | $162 | $150 | $132 | $134 | $129 | $124 |

While State Farm and Geico are usually affordable options for car insurance in Virginia, Erie auto insurance and Nationwide auto insurance might be your cheapest option for teen coverage.

While auto insurance for teens is expensive, there are ways to save. Teens should look for student discounts, and a parent or guardian can cut their rates in half by adding them to an existing policy. Always compare average auto insurance rates by age to find the most affordable policy for your age group.

Virginia Auto Insurance Rates by Credit Score

Your credit score also affects Virginia car insurance rates. Drivers with low credit scores can pay up to 60% more for insurance than people with excellent scores.

Virginia Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Some insurance companies are warier about low credit scores than others. State Farm — usually an affordable option — is actually more expensive than companies like Nationwide and Geico because it charges drivers with low credit scores more.

While you’ll pay more for your insurance while your credit scores are low, you can decrease how much you pay for coverage by improving your score. You can learn more about auto insurance and your credit score, but the general rule of thumb is, the higher you get your credit score, the lower your insurance rates will be.

Virginia Auto Insurance Rates After an At-Fault Accident

One of the most significant factors that affect your rates when looking for cheap car insurance in Virginia is your driving record. Drivers with clean records will pay much less for insurance than people with an at-fault accident.

Virginia Full Coverage Auto Insurance Monthly Rates & Provider One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $270 | $168 | |

| $204 | $135 | |

| $232 | $163 | |

| $176 | $113 | |

| $285 | $211 |

| $140 | $140 |

| $166 | $99 | |

| $122 | $103 | |

| $168 | $120 | |

| $98 | $71 | |

| U.S. Average | $196 | $132 |

USAA has much cheaper rates for military members, but State Farm and Nationwide offer nearly identical rates for everyone else.

An at-fault accident will increase your Virginia auto insurance rates for about three years. If you keep your record clean during those three years, your rates will gradually return to normal.

Virginia Auto Insurance Rates After a DUI

After years of relentless efforts to decrease DUI arrests and fatalities, Virginia currently has a relatively low number of intoxicated drivers. However, despite fairly serious consequences, the Old Dominion State still struggles with DUIs.

The consequences for a DUI in Virginia include the following:

- First Offense: Up to $2,500 fine, mandatory alcohol education classes, the installation of an interlock device on your car, license suspension for 12 months, and up to 12 months in jail.

- Second Offense: Up to $2,500 fine, mandatory alcohol education classes, the installation of an interlock device on your car, license suspension for 36 months, and up to 12 months in jail.

Expect auto insurance for drivers with a DUI to be more expensive. If you’re charged with a DUI in Virginia, your insurance rates can increase by 99%. Some Virginia auto insurance companies might refuse to cover you, especially if you have multiple violations.

Virginia Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $103 | $166 | $246 | $217 | |

| $83 | $125 | $224 | $157 | |

| $100 | $143 | $227 | $203 | |

| $69 | $108 | $310 | $113 | |

| $129 | $175 | $380 | $257 |

| $86 | $86 | $246 | $169 |

| $61 | $102 | $132 | $132 | |

| $63 | $75 | $113 | $113 | |

| $73 | $103 | $250 | $163 | |

| $43 | $60 | $131 | $84 | |

| U.S. Average | $119 | $173 | $161 | $169 |

At $113 monthly, State Farm is one of the best auto insurance companies for drivers with a DUI in Virginia. If you already have car insurance, you should still compare rates with other companies after a DUI conviction. One of the best ways to save money after a DUI is to see what other companies can offer you.

While car insurance quotes in Virginia are much higher after a DUI, they don’t stay high forever. Just like insurance after an accident, your rates will decrease if you keep your record clean. However, DUIs stay on your record for about seven years.

Cheapest Virginia Auto Insurance by City

An essential aspect of Virginia auto insurance rates is your location. While Virginia car insurance rates are about 40% cheaper than the national average, there can be some big differences in auto insurance rates by ZIP codes and cities.

Cities like Norfolk, Burke, and Woodlawn have some of the most expensive insurance in Virginia. While the reason for higher rates varies, some cities are more expensive for insurance because of more car thefts, heavier traffic, and more car accidents.

On the other hand, you can get the cheapest car insurance in Virginia cities like Harrisonburg and Winchester. Both cities have relatively small populations and are far enough from the coast that cars are unlikely to be damaged by hurricanes and other coastal storms.

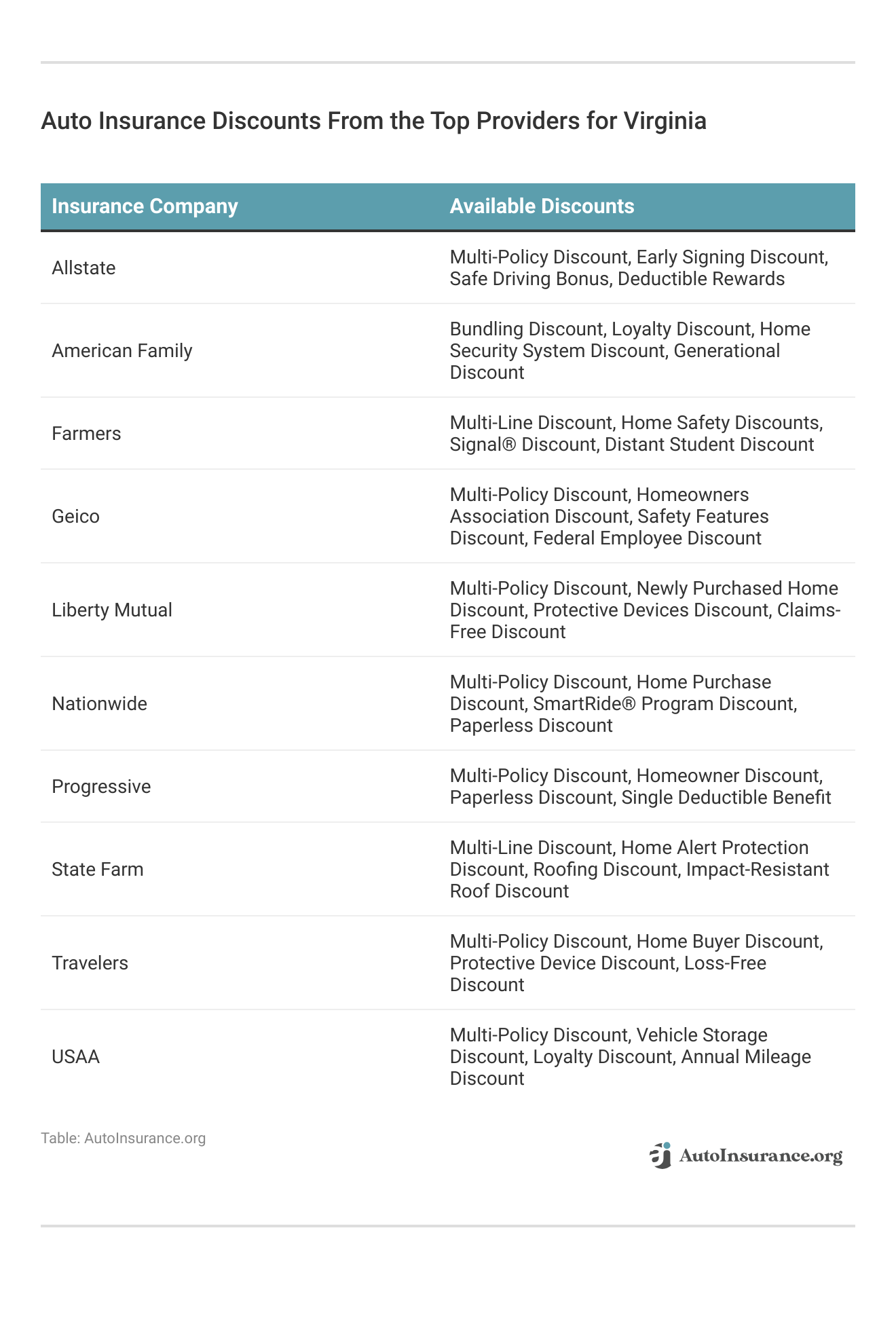

Explore the range of discounts offered by leading insurance providers. These discounts can help policyholders save on premiums by leveraging factors like multi-policy bundling, safe driving records, and home security measures.

These discounts not only save policyholders on premiums but also promote safer driving, encourage home security, and foster customer loyalty, enhancing overall coverage and protection affordably.

Auto Insurance Costs In Virginia Cities

This table provides a quick comparison of auto insurance costs in multiple Virginia cities. Knowing these differences is crucial for residents to choose the right coverage.

Virginia Auto Insurance Cost by City

Whether in urban hubs like Richmond or coastal areas like Virginia Beach, drivers can use this data to find competitive rates tailored to their location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Virginia Auto Insurance Laws

While Virginia auto insurance laws don’t include liability auto insurance, there are other insurance statutes to know about.

According to Virginia car insurance laws, to register a car, you must provide proof of insurance or pay the uninsured motorist fee. We recommend Virginia drivers to carry insurance for protection from financial hardship after an accident, especially since low coverage amounts cost less than the uninsured motorist fee.

State Farm leads with its extensive agent network and personalized service.Jeff Root LICENSED INSURANCE AGENT

In addition, if you choose to buy insurance, you should always keep proof of it in your car.

Whatever you choose, you should always keep everything up to date. If your insurance lapses or you don’t pay the uninsured motorist fee, you risk having your driving privileges revoked.

If your license is suspended, you’ll have to pay a $600 reinstatement fee and file SR-22 insurance forms for three years.

Virginia SR-22 Auto Insurance Requirements

Virginia drivers might be required to file either an SR-22 or FR-44 after serious driving infractions and license suspensions. SR-22 is usually required after a license suspension, while FR-44 insurance is for DUI convictions.

Whichever you need to file, they’re not actually insurance. Instead, they prove to Virginia’s DMV that you have a minimum amount of insurance. While SR-22 or FR-44 insurance might seem inconvenient, it’s usually an easy process.

Getting SR-22 auto insurance is easy, especially if you already have a policy. When you have a policy, simply call an insurance representative and ask about filing SR-22 insurance. You’ll have to pay a fee, but your Virginia auto insurance company will know what to do.

If you don’t have insurance — or your old company dropped you — you should be upfront that you’ll need SR-22 insurance when you request a Virginia auto insurance quote. Needing SR-22 insurance might disqualify you from some companies, and your rates will be higher, but most companies will offer high-risk auto insurance.

Filing SR-22 insurance is required to reinstate your driver’s license, but what happens if you don’t have a car?

In this case, you should consider non-owner auto insurance. Non-owner auto insurance provides you coverage when you occasionally drive someone else’s car. Not only does non-owner insurance allow you to file your SR-22 or FR-44 form, but it’s also cheaper than standard policies.

Find the Best Auto Insurance in Virginia

On average, you’ll pay $132 monthly for Virginia full coverage auto insurance. While you can choose not to carry coverage, the affordability of car insurance in Virginia makes it a safer option. Read More: What is full coverage auto insurance?

If you’re wondering how much car insurance is in Virginia, the best way to find out is to compare quotes. Although State Farm, Geico, and USAA offer the cheapest average rates, you might find that other companies offer you better prices.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the average cost of car insurance in Virginia?

The average car insurance cost in Virginia is $132 monthly. However, you might see much different rates based on your unique situation.

Who has the cheapest car insurance in Virginia?

The cheapest auto insurance quotes in Virginia generally come from USAA, State Farm, and Geico. However, Nationwide and Erie provide the cheapest rates to drivers with lower credit scores or at-fault accidents.

Can you drive without insurance in Virginia?

You have two options to meet Virginia auto insurance requirements: buy car insurance or pay a $500 uninsured motorist fee. If you pay the fee, you won’t have any financial protection if you cause an accident.

Find your cheapest car insurance quotes in VA by entering your ZIP code below into our free comparison tool.

What type of auto insurance is required in Virginia?

Virginia auto insurance laws require drivers to carry a minimum level of liability coverage. Failure to maintain valid Virginia auto insurance limits can result in penalties and fines.

However, liability coverage is inexpensive, offering you the cheapest car insurance in Virginia. Virginia liability auto insurance costs $36 monthly on average. So, shop around for the best liability car insurance in Virginia to ensure you meet requirements.

What are the minimum auto insurance requirements in Virginia?

In Virginia, drivers are required to maintain certain minimum auto insurance coverage limits. These include $25,000 for bodily injury liability per person, $50,000 for bodily injury liability per accident, and $20,000 for property damage liability per accident. These minimum coverage requirements ensure that drivers have basic financial protection in case they are found at fault in an accident involving injuries or property damage.

Read more: Minimum Auto Insurance Requirements by State

Can I opt for additional coverage beyond the minimum requirements?

Yes, you can choose to purchase additional coverage beyond the minimum requirements. We recommend you consider additional coverage options, such as comprehensive and collision coverage, to provide better protection for your vehicle and yourself in the event of an accident.

How much is car insurance in Virginia?

Auto insurance rates in Virginia are determined by several key factors. These include your driving record, age, gender, marital status, type of vehicle you drive, location where you reside, credit history, the specific coverage options you choose, and the deductible amount you opt for.

Each of these factors is assessed by insurance companies to calculate the level of risk you pose as a driver and the likelihood of you filing a claim.

What factors can affect my auto insurance rates in Virginia?

Auto insurance rates in Virginia can be influenced by various factors including your driving record, age, credit score, ZIP code, the type of vehicle you drive, and the coverage options you choose. These factors help insurance companies assess the level of risk you present and determine your premium accordingly.

Read more: Auto Insurance Premium Defined

Is it possible to lower my auto insurance rates in Virginia?

Yes, there are several strategies to potentially lower your auto insurance rates in Virginia. These include maintaining a clean driving record, improving your credit score, bundling your policies (e.g., combining auto and homeowners insurance with the same provider), opting for higher deductibles, and taking advantage of available discounts such as safe driver discounts or discounts for completing defensive driving courses.

What should I do if I’m involved in an accident in Virginia?

If you’re involved in an accident in Virginia, first ensure the safety of all individuals involved and then exchange insurance information with the other party. It’s crucial to report the accident to your insurance provider promptly, even if you’re not at fault. Your insurer will guide you through the claims process and provide assistance as needed. It’s important to follow Virginia’s specific laws and regulations regarding reporting accidents and complying with insurance requirements.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.