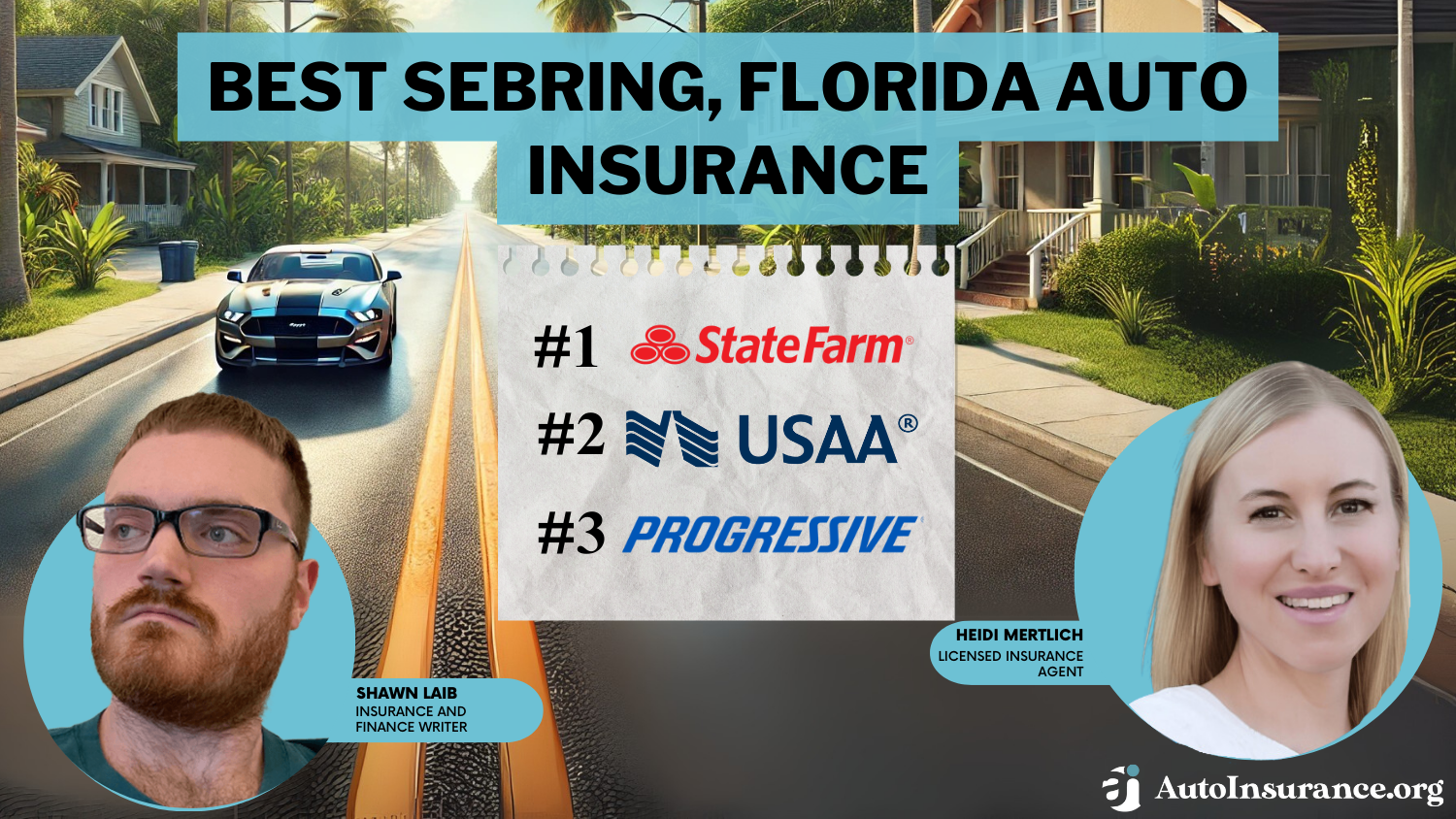

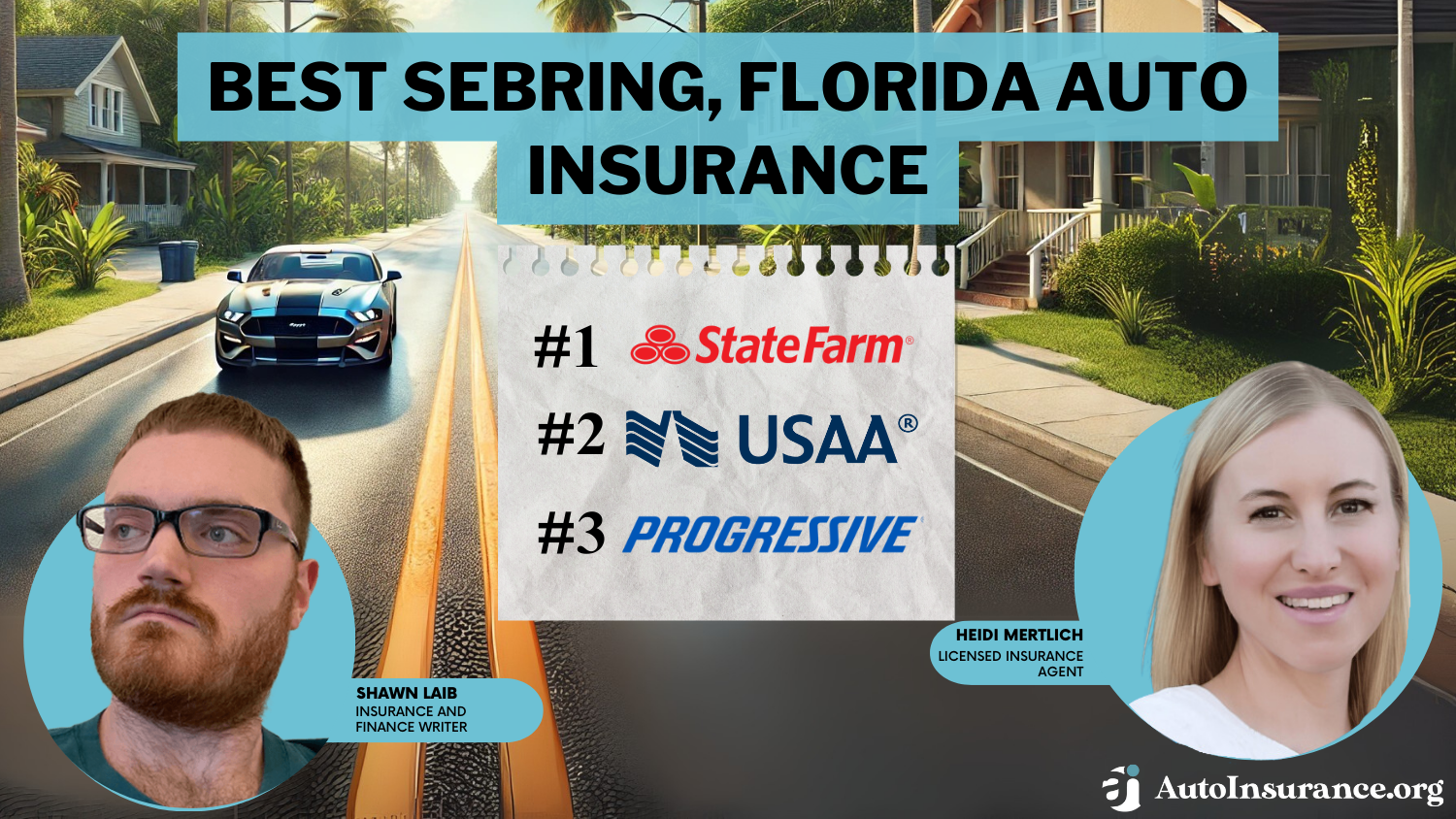

Best Sebring, Florida Auto Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, USAA, and Progressive are our best providers of the best Sebring, Florida auto insurance, with rates beginning at just $80/mo. Discover how to secure the best insurance in Sebring, Florida, by comparing these top picks, considering the city's unique features, and selecting the coverage for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jan 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Sebring Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Sebring Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Sebring Florida

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, USAA, and Progressive are the leading choices for the best Sebring, Florida auto insurance, with premiums starting as low as $80 per month.

- Explore how auto insurance rates change in Sebring with a DUI

- Auto insurance premiums in Sebring differ depending on credit score

- The leading auto insurance company in Sebring, FL is State Farm

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Wide Network of Agents: State Farm offers a vast network of local agents, ensuring personalized service and support, which makes it a strong contender for the best Sebring, Florida auto insurance.

- Variety of Discounts: With a generous 25% bundling discount, State Farm provides significant savings, enhancing its appeal as the best Sebring, Florida auto insurance option. For a complete overview, read State Farm auto insurance review for detailed information.

- Comprehensive Coverage Options: State Farm offers extensive coverage options and add-ons, allowing you to customize your policy, making it a top choice for the best Sebring, Florida auto insurance.

Cons

- Higher Rates for Some Drivers: Rates may be higher for drivers with less favorable profiles, such as younger drivers or those with poor credit, which can affect its status as the best Sebring, Florida auto insurance for high-risk individuals.

- Complex Pricing Structure: The multitude of discounts and coverage options can make understanding the total cost of a policy challenging, impacting its accessibility as the best Sebring, Florida auto insurance.

#2 – USAA: Best for Military Discounts

Pros

- Exclusive Military Discounts: USAA provides unique discounts for military members and their families, including a 27% bundling discount, making it an exceptional choice for the best Sebring, Florida auto insurance for military personnel.

- High Customer Satisfaction: Known for outstanding customer service and support, USAA is widely regarded as one of the best Sebring, Florida auto insurance providers for military families. For a detailed understanding, see our USAA auto insurance review.

- Comprehensive Coverage: Provides a broad range of coverage options and additional perks tailored to military needs, enhancing its status as the best Sebring, Florida auto insurance for eligible members.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families, limiting its reach and making it less accessible as the best Sebring, Florida auto insurance for non-military individuals.

- Limited Local Presence: With fewer physical locations compared to other insurers, it may be less convenient for those who prefer in-person service, affecting its standing as the best Sebring, Florida auto insurance.

#3 – Progressive: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Progressive offers a range of coverage options and customizable plans, including a 12% bundling discount, making it a strong contender for the best Sebring, Florida auto insurance.

- Competitive Pricing: Known for its competitive rates and frequent promotions, Progressive is a notable choice for affordable coverage, enhancing its status as the best Sebring, Florida auto insurance.

- Usage-Based Insurance: The Snapshot program rewards safe driving habits with potential savings, making Progressive a leading option for the best Sebring, Florida auto insurance for safe drivers. Find more information in Progressive auto insurance review for detailed policy insights.

Cons

- Inconsistent Customer Service: Customer service experiences can vary, which may detract from its reputation as the best Sebring, Florida auto insurance for those who prioritize consistent support.

- Complex Policy Details: The extensive range of coverage options and discounts can be overwhelming, potentially making it less user-friendly as the best Sebring, Florida auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Allstate offers a wide variety of coverage options and add-ons, including a 20% bundling discount, making it a top choice for the best Sebring, Florida auto insurance.

- Claims Satisfaction: Generally high ratings for claims handling ensure a reliable experience, contributing to Allstate’s reputation as one of the best Sebring, Florida auto insurance options.

- Local Agent Network: With a large network of local agents, Allstate provides accessible and personalized service, further solidifying its status as the best Sebring, Florida auto insurance.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors, which may affect its affordability as the best Sebring, Florida auto insurance for cost-conscious drivers.

- Mixed Customer Reviews: Customer satisfaction can vary, with some reports of inconsistent service impacting its reputation as the best Sebring, Florida auto insurance. Delve into Allstate auto insurance review for a full breakdown of their policies.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual provides a range of customizable policy options and a 23% bundling discount, enhancing its appeal as the best Sebring, Florida auto insurance. Access Liberty Mutual auto insurance review for a detailed examination of their coverage and services.

- Good for High-Risk Drivers: Provides better rates for high-risk drivers, which can be advantageous for those in this category looking for the best Sebring, Florida auto insurance.

- Strong Financial Stability: Known for its financial stability, Liberty Mutual ensures reliable claim payments, supporting its status as the best Sebring, Florida auto insurance provider.

Cons

- Variable Customer Service: Customer service experiences can be inconsistent, which may affect its reputation as the best Sebring, Florida auto insurance for those seeking reliable support.

- Complicated Policy Options: The variety of policy options and discounts can be overwhelming, making it less straightforward as the best Sebring, Florida auto insurance.

#6 – Nationwide: Best for Policy Discounts

Pros

- Policy Discounts: Offers a range of discounts, including a 26% bundling discount, making it an appealing option for the best Sebring, Florida auto insurance.

- Comprehensive Coverage: Provides extensive coverage options and add-ons to meet diverse needs, enhancing its status as one of the best Sebring, Florida auto insurance providers.

- User-Friendly Website: Features an easy-to-navigate website with tools for managing policies and obtaining quotes, supporting its reputation as the best Sebring, Florida auto insurance. Get the lowdown in Nationwide auto insurance review for a thorough look at their coverage.

Cons

- Higher Premiums for Some: Premiums can be higher for drivers with poor credit or high-risk profiles, potentially making it less attractive as the best Sebring, Florida auto insurance for those individuals.

- Inconsistent Customer Support: Varying experiences with customer support may impact its overall reputation as the best Sebring, Florida auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers is known for its personalized service and attention to individual needs, making it a strong candidate for the best Sebring, Florida auto insurance.

- Diverse Coverage Options: Offers a broad range of coverage options and customizable policies, catering to various needs and enhancing its appeal as the best Sebring, Florida auto insurance.

- Discounts for Safe Drivers: Provides discounts for safe driving and other good habits, which can significantly lower premiums, supporting its status as one of the best Sebring, Florida auto insurance providers. Read more through our Farmers auto insurance review.

Cons

- Higher Premiums: Can be more expensive compared to some competitors, particularly for certain demographics, which may affect its status as the best Sebring, Florida auto insurance for budget-conscious drivers.

- Mixed Customer Feedback: Customer satisfaction can vary, with some policyholders reporting inconsistent service, impacting its reputation as the best Sebring, Florida auto insurance.

#8 – Travelers: Best for Diverse Options

Pros

- Diverse Coverage Choices: Travelers offers a wide variety of coverage options and add-ons, including a 12% bundling discount, making it a top option for the best Sebring, Florida auto insurance.

- Discounts for Safety Features: Provides discounts for vehicles with advanced safety features, enhancing its value as the best Sebring, Florida auto insurance for safety-conscious drivers.

- Flexible Payment Plans: Offers various payment plan options, which can make managing insurance costs easier, supporting its position as the best Sebring, Florida auto insurance. Discover everything you need to know in Travelers auto insurance review.

Cons

- Higher Costs for Younger Drivers: Premiums can be higher for younger drivers, which may impact its attractiveness as the best Sebring, Florida auto insurance for younger individuals.

- Complex Policy Structure: The range of options and discounts can be complex, potentially making it less straightforward as the best Sebring, Florida auto insurance.

#9 – The Hartford: Best for Senior Discounts

Pros

- Senior Discounts: Specializes in discounts for senior drivers, making it an excellent choice for the best Sebring, Florida auto insurance for older individuals.

- Comprehensive Coverage: Offers a variety of coverage options tailored to different needs, enhancing its status as the best Sebring, Florida auto insurance. Read The Hartford auto insurance review for a detailed analysis of their policy offerings.

- Strong Customer Service: Known for reliable customer service and support, contributing to its reputation as one of the best Sebring, Florida auto insurance providers.

Cons

- Limited Discounts for Younger Drivers: May not offer as many discounts for younger drivers, which can affect its appeal as the best Sebring, Florida auto insurance for this demographic.

- Higher Premiums for High-Risk Drivers: Premiums might be higher for high-risk drivers, potentially making it less affordable as the best Sebring, Florida auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Family Friendly

Pros

- Family-Friendly Policies: American Family offers policies designed to meet the needs of families, including a 22% bundling discount, making it a top choice for the best Sebring, Florida auto insurance for households.

- Comprehensive Coverage Options: Provides a range of coverage options and add-ons, enhancing its appeal as one of the best Sebring, Florida auto insurance providers.

- Strong Financial Ratings: High financial stability ratings ensure reliable claims processing, supporting its status as the best Sebring, Florida auto insurance provider. Uncover the details in American Family auto insurance review for a deep dive into their services.

Cons

- Higher Premiums for Some Drivers: Premiums can be higher for certain drivers, which may affect its overall affordability as the best Sebring, Florida auto insurance for those individuals.

- Limited Discounts for High-Risk Drivers: May not offer as many discounts for high-risk drivers, potentially impacting its attractiveness as the best Sebring, Florida auto insurance for this group.

Best Sebring, Florida Auto Insurance Discount

For the best Sebring, Florida auto insurance discount, it’s essential to explore a range of options that cater to various driver profiles. Many insurers offer discounts for safe driving habits, which can be tracked through usage-based insurance programs that monitor your driving behavior.

Sebring, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $225

American Family $92 $222

Farmers $87 $220

Liberty Mutual $88 $210

Nationwide $83 $205

Progressive $80 $200

State Farm $85 $205

The Hartford $90 $230

Travelers $85 $215

USAA $90 $215

Additionally, vehicles equipped with advanced safety features such as anti-lock brakes, airbags, and anti-theft systems often qualify for significant discounts. Bundling multiple policies, such as auto and home insurance, can lead to further savings.

Younger drivers or those with a history of accidents may benefit from good student auto insurance discounts or defensive driving courses.

By comparing these discounts across different providers, you can secure comprehensive coverage at a lower cost, tailored to your specific needs in Sebring. Enter your ZIP code now to begin.

Understanding the Basic Auto Insurance in Sebring, Florida

Understanding the basic auto insurance requirements in Sebring, Florida is crucial for ensuring that you are financially protected in the event of an accident.

Florida law mandates that all drivers carry a minimum level of auto insurance coverage, which includes at least $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL).

However, while these minimum auto insurance requirements satisfy legal obligations, many drivers in Sebring choose to purchase additional coverage, such as bodily injury liability (BIL) and uninsured/underinsured motorist coverage, to provide more comprehensive protection.

Jeff Root

Licensed Insurance Agent

These minimums are designed to cover medical expenses and property damage for yourself and others if you're involved in an accident, regardless of fault.

It’s important to regularly review your policy to ensure that your coverage aligns with your financial needs and the specific risks you may face on the road in Sebring.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Sebring, Florida Auto Insurance Quotes

Before purchasing auto insurance in Sebring, Florida, it’s crucial to compare quotes from various insurance companies to ensure you get the best deal.

Rates can vary significantly depending on factors such as your driving history, the type of vehicle you drive, and the coverage levels you choose.

One important aspect to consider is getting an anti-theft auto insurance discount, which can lower your premium if your vehicle is equipped with advanced security features.

By entering your ZIP code, you can access free, personalized insurance quotes from multiple providers, allowing you to evaluate different options, identify potential discounts, and make an informed decision based on your specific needs and budget.

Frequently Asked Questions

What are the minimum auto insurance requirements in Sebring, Florida?

The minimum auto insurance requirements in Sebring, Florida, according to state laws, are 10/20/10 coverage.

This means you must have at least $10,000 in bodily injury liability coverage per person, $20,000 in bodily injury liability coverage per accident, and $10,000 in property damage liability coverage.

How can I find the best cheap auto insurance in Sebring, Florida?

To find the best cheap auto insurance in Sebring, Florida, it is recommended to compare quotes from multiple companies.

By comparing rates, you can find the most affordable options that meet your coverage needs. Enter your ZIP code now.

How do factors like age, gender, and marital status affect auto insurance rates in Sebring, Florida?

When evaluating auto insurance quotes in Sebring, Florida, factors like age, gender, and marital status can significantly impact the rates you receive.

For instance, younger drivers, particularly teenagers, often face higher rates due to their lack of driving experience.

Male drivers may experience higher premiums compared to females, and unmarried individuals might also see slightly elevated rates.

Understanding these variables can help you better assess your insurance options and find the most suitable coverage for your needs.

Are there specific auto insurance rates for teen drivers in Sebring, Florida?

Yes, auto insurance rates for teen drivers in Sebring, Florida are generally higher compared to older and more experienced drivers.

Teenagers are considered higher risk due to their limited driving experience.

However, rates can vary depending on factors such as the type of vehicle and the teen’s driving record.

What are the auto insurance rates for seniors in Sebring, Florida?

Auto insurance rates for seniors in Sebring, Florida can vary depending on various factors such as driving record, type of vehicle, and coverage needs.

Generally, seniors with a clean driving record and safe driving habits may qualify for lower rates compared to those with accidents or violations on their record. Enter your ZIP code now.

Which insurance provider offers the highest bundling discount for auto insurance in Sebring, Florida?

How does USAA’s military discount enhance its reputation as a top auto insurance option in Sebring, Florida?

USAA’s 27% military discount provides significant savings for eligible service members and veterans, bolstering its reputation as the best Sebring, Florida auto insurance for military families.

This discount highlights USAA’s commitment to supporting those who serve.

What are the key benefits of Progressive’s flexible coverage options for Sebring, Florida drivers?

Progressive offers a variety of flexible coverage options, allowing drivers in Sebring, Florida to tailor their policies to specific needs and preferences.

This adaptability makes it a strong contender for the best Sebring, Florida auto insurance. Enter your ZIP code now.

Why might Allstate be considered a top choice for comprehensive auto insurance coverage in Sebring, Florida?

Allstate is noted for its extensive range of comprehensive auto insurance coverage options, which cater to a wide array of driver needs in Sebring, Florida. Its ability to provide detailed protection contributes to its reputation as a leading choice for auto insurance.

What makes Liberty Mutual a strong contender for customizable auto insurance policies in Sebring, Florida?

Liberty Mutual offers highly customizable policies with a 23% bundling discount, allowing Sebring, Florida drivers to adjust coverage to fit their unique requirements.

This flexibility and savings potential make it a notable option for tailored auto insurance solutions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.