Best Sioux Falls, South Dakota Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Sioux Falls, South Dakota auto insurance starts with Geico, AAA, and Erie, which offer extensive coverage. These companies are the top picks for drivers looking for reliable insurance because they give excellent service, have starting rates as low as $78/mo, and provide several discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Sioux Falls South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage in Sioux Falls South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Sioux Falls South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsThe best Sioux Falls, South Dakota auto insurance options are Geico, AAA, and Erie. These leading companies are renowned for offering comprehensive coverage at cheap rates, with monthly premiums as low as $78 per month.

They are excellent at providing diverse coverage options catered to local needs, substantial discounts, and reasonably priced rates. Get more insights by reading our expert “What does proper auto insurance cover?” advice.

These firms offer a balance between value and client satisfaction, regardless of your preference for complete coverage or basic liability insurance.

Our Top 10 Company Picks: Best Sioux Falls, South Dakota Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Roadside Assistance | Geico | |

| #2 | 25% | A | Local Agents | AAA |

| #3 | 10% | A+ | Affordable Rates | Erie |

| #4 | 12% | A+ | Innovative Discounts | Progressive | |

| #5 | 20% | A | Comprehensive Coverage | Farmers | |

| #6 | 20% | B | Reliable Support | State Farm | |

| #7 | 25% | A+ | Broad Coverage | Allstate | |

| #8 | 10% | A++ | Military Focus | USAA | |

| #9 | 20% | A+ | Flexible Options | Nationwide |

| #10 | 25% | A | Personalized Discounts | Liberty Mutual |

These options guarantee high-quality protection at affordable prices for Sioux Falls residents. See if you’re getting the best deal on car insurance by entering your ZIP code above.

- State Farm offers the cheapest auto insurance in Sioux Falls, SD, but rates vary

- South Dakota requires minimum liability coverage of 25/50/25 for auto insurance

- Drivers should consider higher coverage to avoid significant out-of-pocket expenses

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Pricing: Geico offers some of the most competitive auto insurance rates in Sioux Falls, SD, particularly for those with a clean driving record and good credit scores.

- Mobile App: Mobile app is efficient, allowing drivers in Sioux Falls, South Dakota, to manage their policies, file claims, and access roadside assistance easily, according to Geico auto insurance review.

- Accident Forgiveness: In Sioux Falls, South Dakota, eligible Geico drivers benefit from accident forgiveness, the cost of which does not go up after the first at-fault collision.

Cons

- Limited Agents: Geico has fewer local agents in Sioux Falls, which makes it difficult for those who prefer in-person services and consultations.

- Coverage Options: While adequate, Geico’s coverage options in Sioux Falls, South Dakota, may not offer as much flexibility or customization as some competitors.

#2 – AAA: Best for Personalized Service

Pros

- Customized Service: Drivers in Sioux Falls, SD have the ability to customized coverage and get in person consultaion who prefer a personal approach.

- Roadside Assistance: This company offers reliable and prompt towing, flat tire replacement, and lockout services in Sioux Falls, as highlighted in our AAA auto insurance review.

- Payment Plans: AAA provides drivers in Sioux Falls, SD, with payment choices and the option to select the payment terms that are convenient for them.

Cons

- Online Features: AAA’s online platform may not be as advanced as other insurers for Sioux Falls, South Dakota residents who prefer managing their policies digitally.

- Processing Claims: Some Sioux Falls, SD customers experience long wait times for claims processing, which might be inconvenient to them.

#3 – Erie: Best for Affordable Rates

Pros

- Affordable Rates: Erie provides some of the lowest auto insurance rates in Sioux Falls, South Dakota, making it an attractive option for budget-conscious drivers.

- Accident Forgiveness: Eligible Sioux Falls, South Dakota drivers can take advantage of Erie’s accident forgiveness program, which prevents premium increases after a first at-fault accident.

- Comprehensive Discounts: Sioux Falls, South Dakota drivers can access multiple discounts, including bundling policies, being claim-free, and vehicle safety features.

Cons

- Outdated Platform: Erie’s digital tools and website for Sioux Falls, South Dakota customers may not be as feature-rich or easy to use as those of other national rivals, according to Erie auto insurance review.

- Coverage Restrictions: Some policyholders may have fewer options because not all drivers in Sioux Falls, South Dakota, may be eligible for certain specific coverages.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Customizable Coverage

Pros

- Customizable Coverage: Customizing insurance is an option available to drivers in Sioux Falls, SD, and it will assist them in selecting the ideal level of protection that fits their budget.

- 24/7 Claims Support: According to Progressive auto insurance review, Progressive provides drivers in Sioux Falls, South Dakota, with 24/7 claims support to ensure that assistance is always available.

- Safe Drivers Discounts: This is a program in Sioux Falls, SD, where drivers who are responsibly driving can get discounts that can lower their premium, which encourages safe driving habits.

Cons

- Higher Rates: Drivers in Sioux Falls, South Dakota, with poor driving records or low credit scores may find Progressive’s rates less competitive.

- Complex Pricing Structure: Sioux Falls, South Dakota residents might find Progressive’s pricing difficult to understand due to its usage-based Snapshot program and other dynamic factors.

#5 – Farmers: Best for Online Platform

Pros

- Online Platform: Sioux Falls, South Dakota drivers benefit from Farmers’ user-friendly digital tools, including online policy management and mobile claim filing options.

- Generous Discounts: Farmers offers multiple discount opportunities in Sioux Falls, South Dakota, such as multi-vehicle, good student, and safe driver discounts, to help reduce costs.

- Claims Service: Helps customers in Sioux Falls, SD, by processing their claims when needed promptly and ensuring the customer gets assistance quickly, as noted in our Farmers auto insurance review.

Cons

- Limited Discounts: Even though Farmers offers a lot of discounts, drivers in Sioux Falls, South Dakota, who have been in accidents or have infractions might not see a big drop in price.

- Average Customer Satisfaction: While generally reliable, some Sioux Falls, South Dakota drivers have reported average satisfaction with Farmers’ customer service, particularly with claim resolutions.

#6 – State Farm: Best for Competitive Rates

Pros

- Competitive Rates: State Farm provides competitive pricing to those drivers in Sioux Falls that has a clean driving record.

- Discount Programs: This firm offers a variety of discounts, such as student driver, multi-policy, and multi-car discounts, to reduce rates.

- Coverage Options: Offers coverage options in Sioux Falls that customers can customize based on their needs and budget.

Cons

- Claim Processing: Some Sioux Falls, South Dakota residents have reported delays in claims processing, which can be inconvenient during urgent situations, as noted in our State Farm auto insurance review.

- Roadside Assistance: In Sioux Falls, this program may not cover as many services as other competitors, which could disadvantage those who frequently travel in rural or remote areas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: In Sioux Falls, South Dakota, drivers can enroll in Allstate’s Drivewise program to monitor their driving habits and earn discounts for safe driving.

- Coverage Options: In Sioux Falls, South Dakota, drivers can choose from extensive coverage options with Allstate, including accident forgiveness and new car replacement coverage.

- Discounts: Provides substantial discounts to Sioux Falls, South Dakota consumers who bundle multiple products, such as auto and home insurance, according to Allstate auto insurance review.

Cons

- Program Requirements: Some customers in Sioux Falls need to add some programs like Drivewise in order to qualify for some discounts, which may not suit all customers.

- Local Agent: While Allstate has a strong local presence in Sioux Falls, South Dakota, the quality of service can vary depending on the agent, affecting overall customer satisfaction.

#8 – USAA: Best for Military Rates

Pros

- Military Rates: Sioux Falls, South Dakota, military personnel and veterans enjoy USAA’s highly competitive rates, making it a top choice for those eligible, as noted in our USAA auto insurance review

- Comprehensive Coverage: Sioux Falls, South Dakota drivers can choose from a wide array of coverage options, including rental reimbursement and roadside assistance tailored for military needs.

- Digital Tools: Sioux Falls, South Dakota drivers benefit from USAA’s easy-to-use mobile app, which allows for convenient management of policies, filing claims, and accessing roadside assistance.

Cons

- Eligibility Limitations: Only military members, veterans, and their families are eligible for USAA’s auto insurance in Sioux Falls, South Dakota, limiting its availability to the general population.

- Higher Rates for Non-Military Family Members: Sioux Falls, South Dakota residents who are family members of military personnel may not receive the same level of discounts as active service members.

#9 – Nationwide: Best for Policy Options

Pros

- Numerous Discounts: Residents of Sioux Falls, South Dakota, are eligible for a number of discounts, such as multi-policy, good student, and safe driver discounts, which can drastically reduce premiums.

- Policy Options: Sioux Falls, South Dakota drivers can choose from an extensive range of coverage options with Nationwide, including accident forgiveness and vanishing deductible programs.

- Claims Service: This company ensures that claims processing is efficient and incidents are settled accurately and promptly in Sioux Falls, SD.

Cons

- Customer Service: While generally reliable, some Sioux Falls, South Dakota policyholders report mixed experiences with Nationwide’s customer service.

- Complex Discounts: Drivers in Sioux Falls, South Dakota, may find it difficult to meet the complicated eligibility requirements for some discounts, according to Nationwide auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Sioux Falls, South Dakota drivers can easily customize Liberty Mutual’s policies to fit their specific needs, including comprehensive and collision coverage options.

- 24/7 Claims Support: According to Liberty Mutual auto insurance review, drivers in Sioux Falls are getting assistance to file claims or seek assistance whenever they need it.

- Digital and Mobile App Convenience: In Sioux Falls, South Dakota, policyholders have access to Liberty Mutual’s advanced mobile app for managing policies, filing claims, and tracking services.

Cons

- Higher Premiums: Sioux Falls, South Dakota drivers with past incidents or poor credit may find Liberty Mutual’s rates higher compared to competitors.

- Higher Rates for Non-Bundle Policies: Sioux Falls, South Dakota drivers who do not bundle other policies (like home or renters) with Liberty Mutual may face higher rates than anticipated.

Auto Insurance Pricing in Sioux Falls, SD, by ZIP Code

It might be difficult to comprehend Sioux Falls, South Dakota, auto insurance rates, particularly when they differ greatly by ZIP code. Drivers’ premiums may be impacted by the particular dangers and advantages that each location may offer. Discover our comprehensive guide to “Auto Insurance Rates by Zip Code” for additional insights.

Sioux Falls, South Dakota Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $82 | $120 |

| $84 | $122 | |

| $85 | $125 |

| $87 | $130 | |

| $80 | $115 | |

| $89 | $135 |

| $86 | $128 |

| $83 | $118 | |

| $78 | $112 | |

| $79 | $115 |

In order to assist you in selecting coverage, this guide explores the specific vehicle insurance costs in Sioux Falls across a number of ZIP codes.

Auto Insurance Discounts From the Top Providers in Sioux Falls, South Dakota

| Insurance Company | Available Discounts |

|---|---|

| Bundling, Good Driver, Safety Features, Membership, Anti-Theft |

| Drivewise, Bundling, Safe Driver, Anti-Theft | |

| Safe Driver, Multi-Car, Bundling, Anti-Theft, Loyalty |

| Good Driver, Bundling, Safety Features, Defensive Driver | |

| Good Driver, Multi-Car, Safety Features, Low Mileage, Bundling | |

| RightTrack, Multi-Car, Bundling, Safe Driver, Home Ownership |

| SmartRide, Multi-Car, Bundling, Safe Driver, Anti-Theft |

| Snapshot, Multi-Car, Bundling, Safe Driver, Home Ownership | |

| Drive Safe & Save, Multi-Car, Bundling, Safety Features, Good Student | |

| Safe Driver, Bundling, Good Student, Multi-Car, Vehicle Safety Features |

It doesn’t have to be difficult to navigate Sioux Falls, South Dakota, auto insurance. You may locate the finest coverage for your needs and possibly save money by comparing rates by ZIP code.

Find more info about the monthly Sioux Falls, SD car insurance rates by ZIP Code below:

To make sure you’re getting the most out of your auto insurance policy, never forget to examine your alternatives periodically.

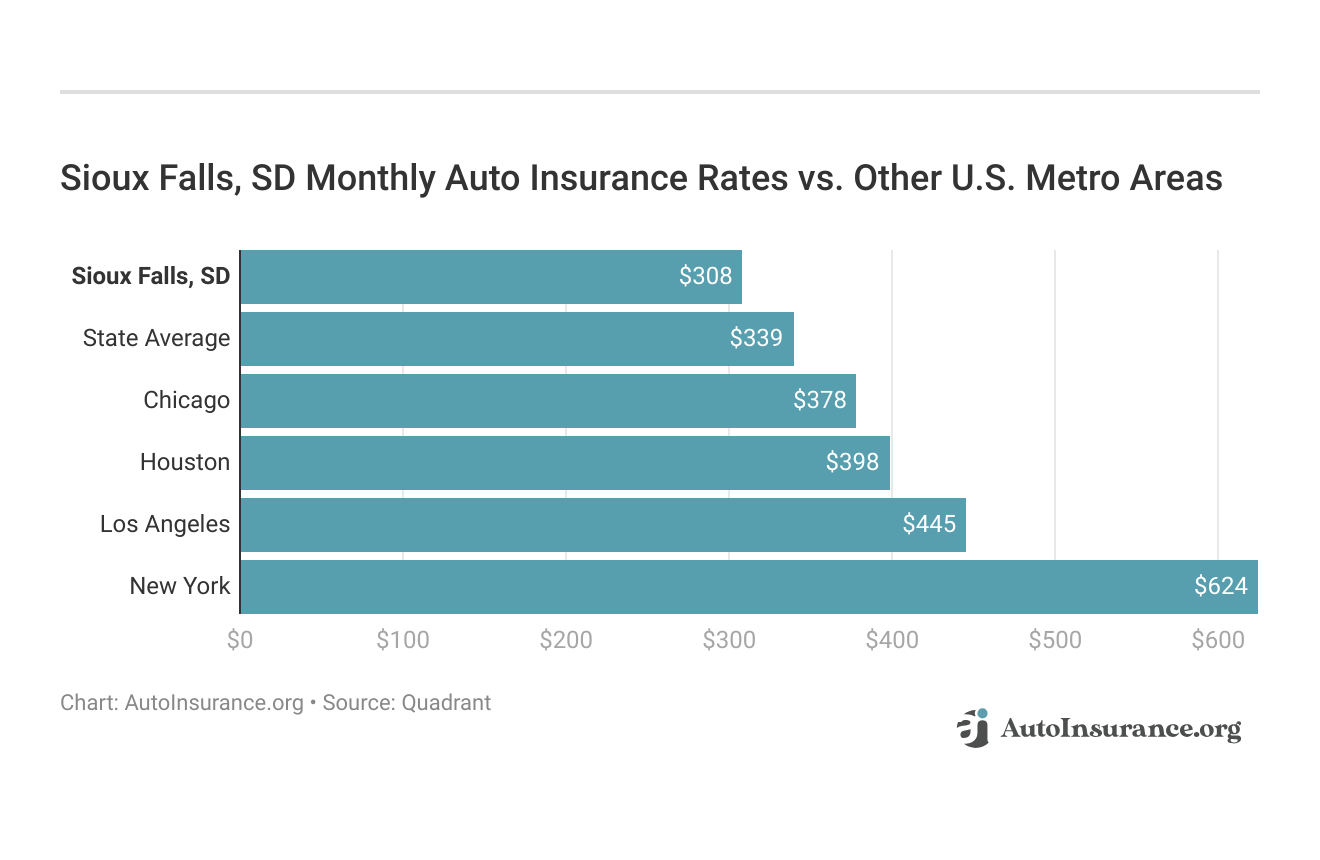

Sioux Falls Auto Insurance: A Comparison with Top US Metro Areas

Where you live significantly influences your car insurance rates. In Sioux Falls, South Dakota, it’s crucial to evaluate how your city’s rates stack up against those in other major U.S. metropolitan areas.

Knowing how location affects insurance premiums is a useful skill. It allows you to make wise choices, which could result in financial savings.

You can find possible savings and get the greatest coverage for your requirements by contrasting Sioux Falls with other prestigious places. Enter your ZIP code now to compare Sioux Falls, SD, auto insurance quotes near you for free.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Your Guide to the Cheapest Auto Insurance in Sioux Falls, SD

State Farm is the cheapest auto insurance company in Sioux Falls, SD, based on average rates. However, rates will be different for each driver. For more information about State Farm, check out our State Farm auto insurance review. For further details, check out our in-depth “Cheapest Liability-Only Auto Insurance” article.

Below, you can find the cheapest Sioux Falls, SD auto insurance company. You might then ask, “How do those rates compare against the average South Dakota auto insurance company rates?” We cover that as well.

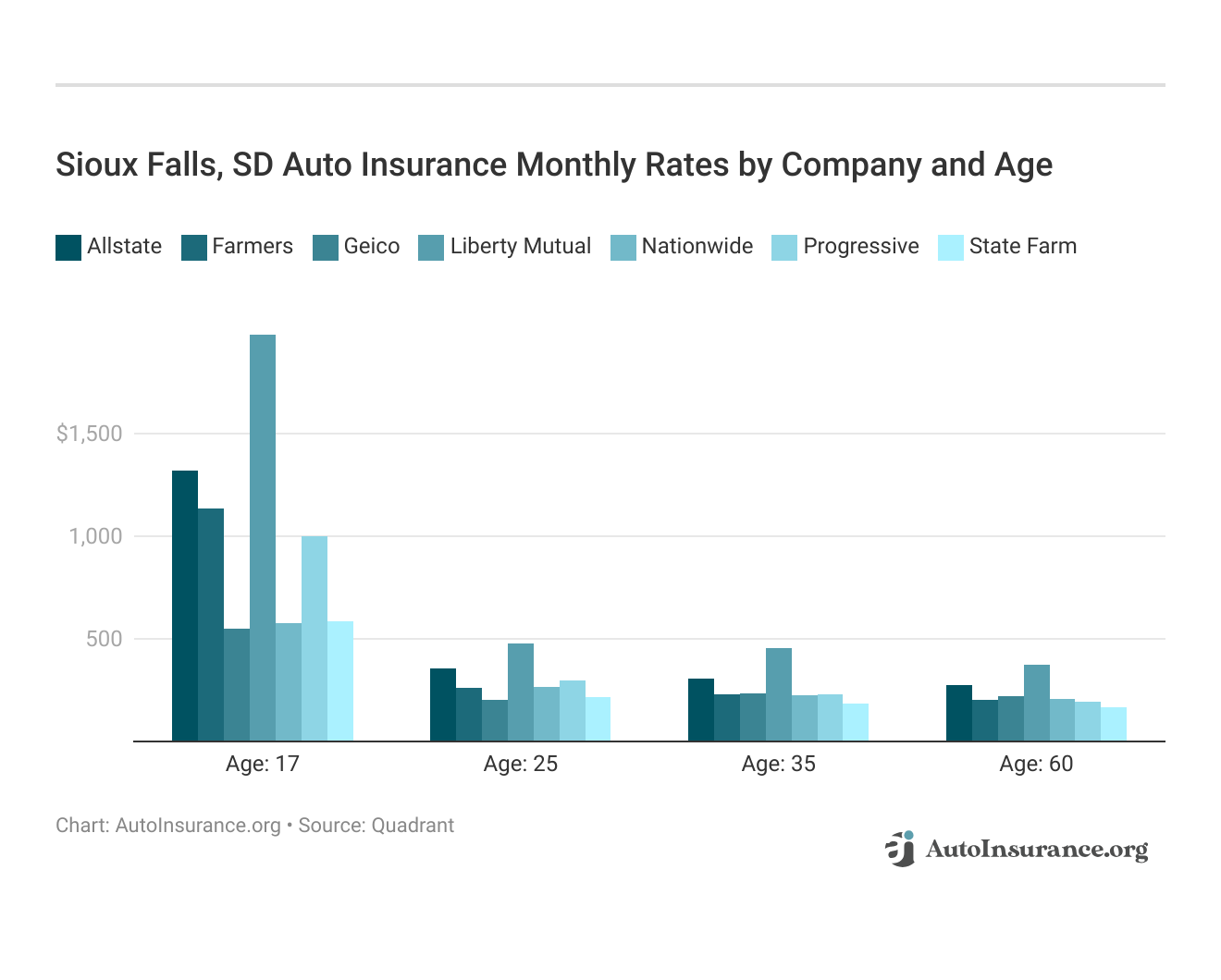

Many factors affect auto insurance rates, such as age, driving record, and ZIP code. Young drivers, drivers with many tickets and accidents, and drivers who live in high-crime areas will pay more for auto insurance.

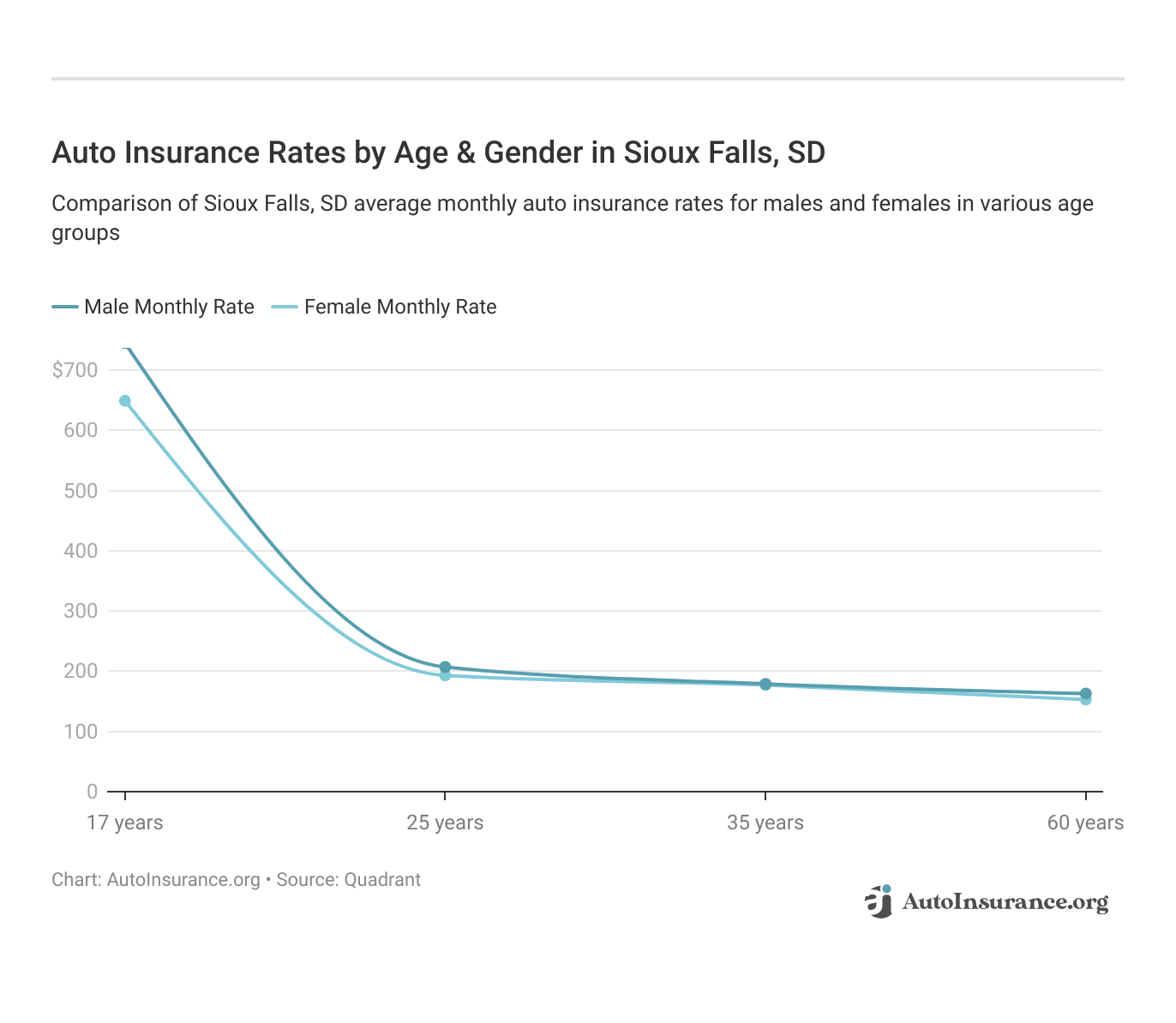

When it comes to Sioux Falls, South Dakota, auto insurance rates, the power of comparison is in your hands. The top auto insurance company for one age group may not be the best company for another age group. Remember, auto insurance for teens and young drivers is usually the most expensive, but with the right comparison, you can find the best deal.

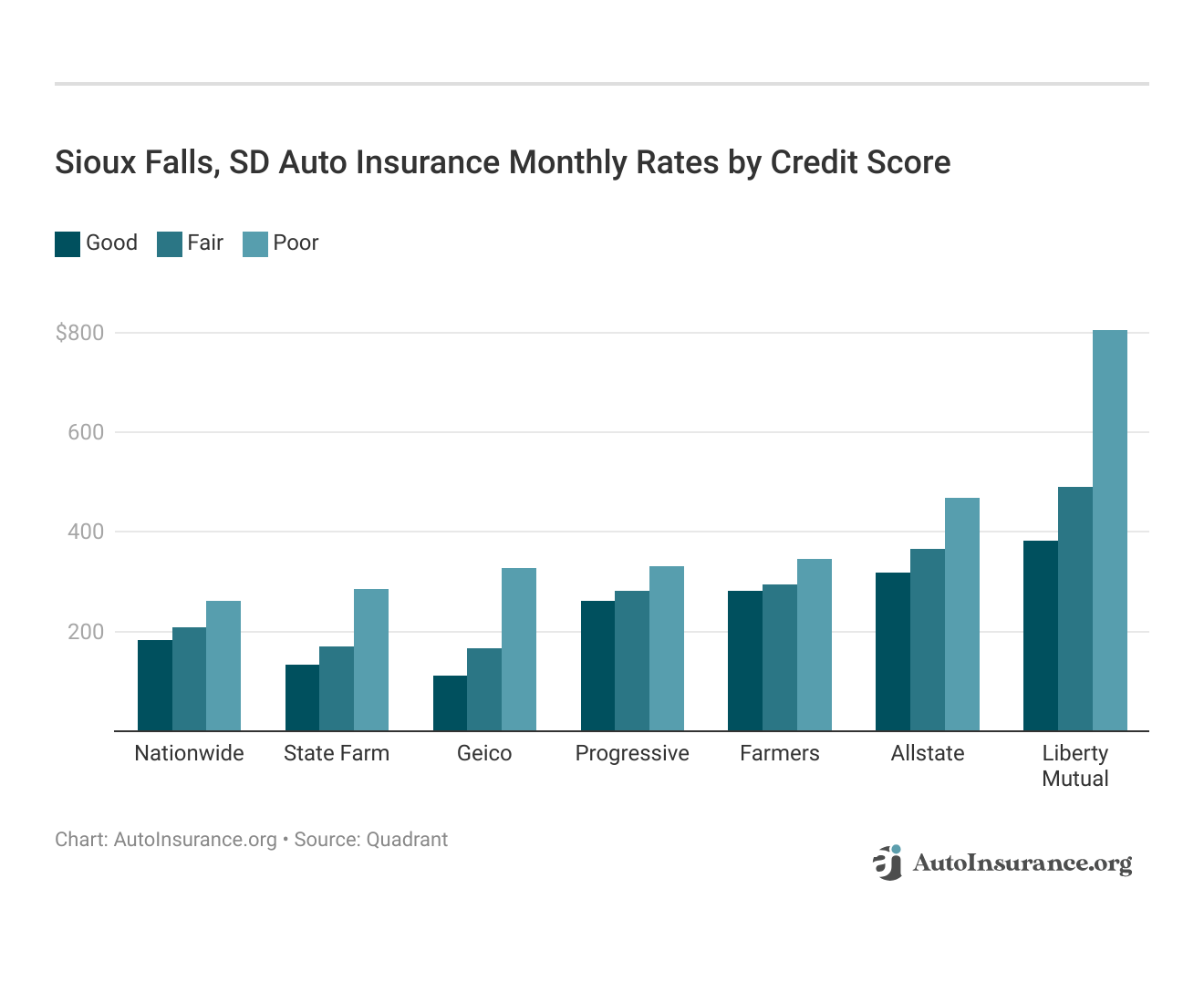

Your credit score will play a major role in your Sioux Falls, SD, auto insurance rates since auto insurance companies use credit scores to determine rates. Find the cheapest Sioux Falls, South Dakota auto insurance rates by credit score below.

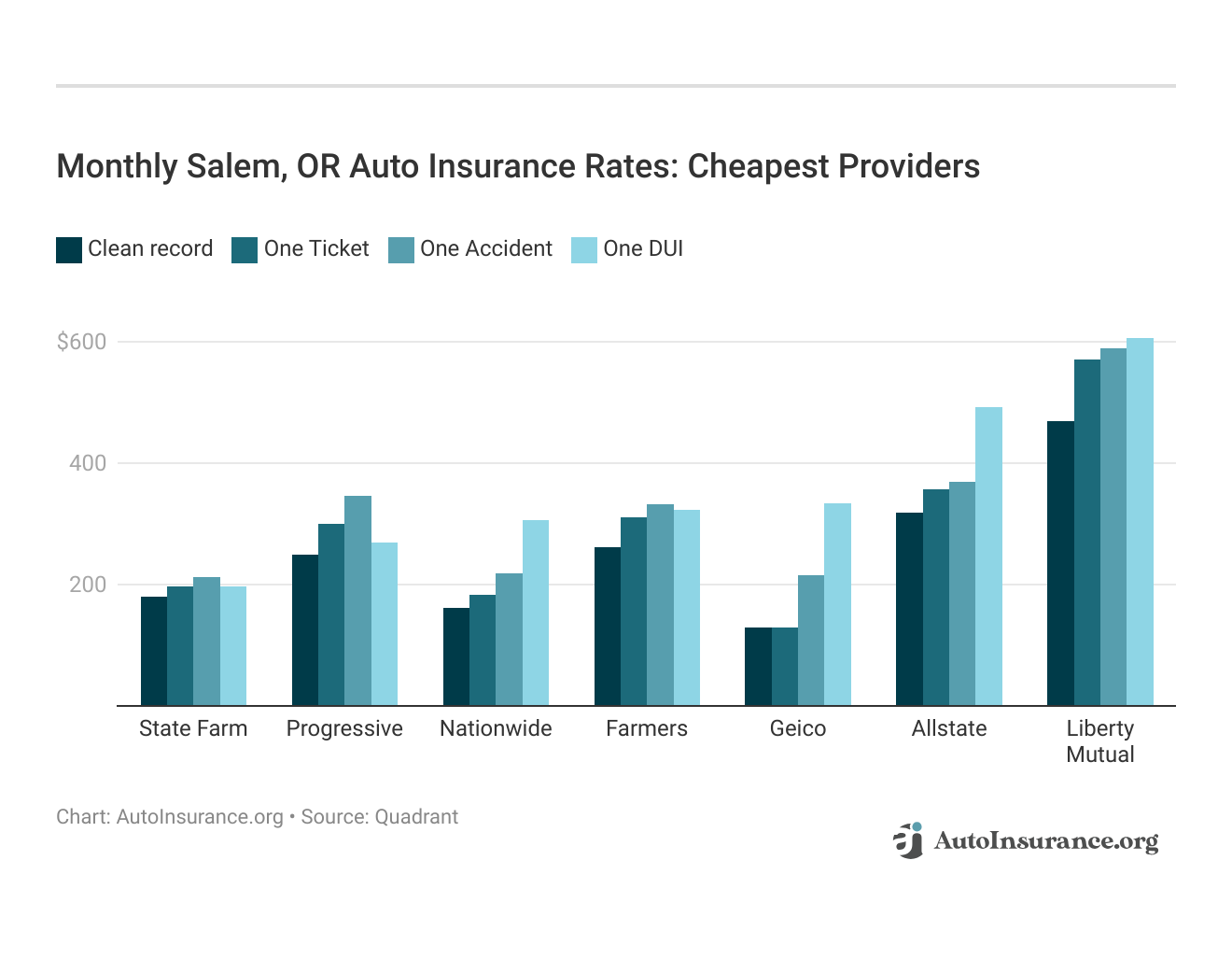

Your driving record will affect your Sioux Falls auto insurance rates. For example, a Sioux Falls, South Dakota DUI may increase your auto insurance rates by 40 to 50 percent. Cheap auto insurance for drivers with a DUI is not easy to find. Find the cheapest Sioux Falls, South Dakota auto insurance rates by driving record.

Factors affecting auto insurance rates in Sioux Falls, SD, may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Sioux Falls, South Dakota auto insurance.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania.

However, age is still a big factor because young drivers are considered high-risk drivers in Sioux Falls. South Dakota does use gender, so check out the average monthly auto insurance rates by age and gender in Sioux Falls, SD. Car insurance rates are higher for males on average.

Key Auto Insurance Coverage Laws for Sioux Falls, SD Residents

When it comes to driving in Sioux Falls, SD, understanding auto insurance coverage laws is essential for all residents. The state has specific requirements designed to protect drivers, passengers, and the community at large. Learn more by visiting our detailed “What Are the Recommended Auto Insurance Coverage Levels?” section.

South Dakota requires drivers to carry at least the state minimum for auto insurance. The minimum car insurance requirements for South Dakota drivers are:

$25,000 per person and $50,000 per incident for bodily injury liability

$25,000 per incident for property damage

It’s crucial to note that these minimums are significantly low. In the event of a serious accident, these limits may not fully cover you, potentially leaving you with a substantial out-of-pocket expense for anything not covered. This underscores the importance of considering higher limits and additional coverages.

Consider adding collision and comprehensive coverages. Collision insurance helps pay for damages from an accident. Comprehensive insurance covers damages not resulting from an accident, such as damages from the icy Sioux Falls, SD weather.

Breaking Down Auto Insurance Rate Influences in Sioux Falls, SD

Traffic can also cause an increase in your car insurance rates. More cars on the road equal a greater chance of being in an accident. Although INRIX doesn’t have data for Sioux Falls, the closest city with data listed is Minneapolis, MN. Minneapolis is listed as the 77th most congested city in the U.S.

Sioux Falls, South Dakota Report Card: Auto Insurance Premiums

Category Grade Explanation

Traffic Density A Low traffic density reduces accidents

Vehicle Theft Rate B+ Lower-than-average vehicle theft

Uninsured Drivers Rate B Few uninsured drivers, but some remain

Weather-Related Risks B Moderate risks from hail and snow

Average Claim Size C Average claims from minor accidents and weather

City-Data reports that most drivers in Sioux Falls, SD, have a commute time of only about 20 minutes. Theft can also raise your auto insurance rates. According to the FBI, there were 469 motor vehicle thefts in Sioux Falls in one year. Explore our detailed analysis of “Factors That Affect Auto Insurance Rates” for additional information.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Realities of Auto Insurance in Sioux Falls, SD

Navigating the world of auto insurance can be complex, especially in a unique market like Sioux Falls, SD. Understanding local regulations, coverage options, and pricing trends is crucial for residents.

Sioux Falls, South Dakota Auto Accident & Insurance Claim Statistics

Factor Value

Total Accidents Per Year 9,396

Total Claims Per Year 10,800

Average Claim Size $1,997

Percentage of Uninsured Drivers 7%

Vehicle Theft Rate (per year) 1,300 thefts/year

Traffic Density Medium

Weather-Related Incidents High

This overview explores the realities of auto insurance in Sioux Falls, shedding light on what drivers can expect when selecting a policy that fits their needs.

Geico consistently offers discounts for bundling policies, safe driving, and vehicle safety features, making it an attractive choice for budget-conscious drivers.Jeff Root Licensed Insurance Agent

In conclusion, drivers are better able to select the coverage that best suits their needs and budget when they are informed about Sioux Falls auto insurance. Continue reading our full “What is Auto Insurance?” guide for extra tips.

By comprehending the local factors at work, such as market dynamics and regulatory requirements, locals may successfully navigate the insurance sector.

Knowing these facts will help you choose your auto insurance coverage more intelligently, regardless of how long you’ve lived in the area or how recently you moved here. Enter your ZIP code now to compare Sioux Falls, SD, auto insurance rates from multiple companies near you.

Frequently Asked Questions

What are the top insurance companies in Sioux Falls, SD?

Competitive auto insurance coverage is offered by several insurance providers in Sioux Falls, South Dakota. State Farm, Progressive, and Allstate are a few of the most prominent; they all provide different coverage options to meet the needs of different drivers.

What is the average cost of car insurance in South Dakota?

The average cost of auto insurance in Sioux Falls, South Dakota ranges between $40 and $100 monthly, depending on factors like driving history, coverage level, and vehicle type.

How can I get auto insurance quotes in Sioux Falls?

You may get estimates for auto insurance in Sioux Falls online, over the phone, or in person from nearby insurance brokers. Additionally, comparison websites offer several quotations, which facilitates locating the finest prices.

Expand your understanding with our thorough “How to Find Auto Insurance Quotes Fast” overview.

What does auto insurance coverage in Sioux Falls, SD include?

In Sioux Falls, South Dakota, the most common forms of auto insurance coverage are liability, collision, comprehensive, and uninsured/underinsured motorist protection. The level of protection offered by each category varies depending on the insurance.

Who offers the cheapest car insurance in Sioux Falls?

The cheapest car insurance in Sioux Falls is available through companies like Geico, Progressive, and State Farm. Rates depend on your driving record, coverage choices, and other personal factors.

Is State Farm car insurance in Sioux Falls affordable?

State Farm car insurance in Sioux Falls, SD, is known for its affordable rates, Especially for drivers that have good driving record and have multiple policies. This company also offers discounts that can lower the premium.

For more information, explore our informative “How to Compare Auto Insurance Quotes” page.

What coverage does Progressive Insurance in Sioux Falls, SD, offer?

Progressive insurance in Sioux Falls, SD, offers various coverage options, including liability, comprehensive, collision, and roadside assistance. They also provide discounts for safe drivers and multi-policy bundling.

Who is the most trusted insurance company in Sioux Falls?

Because of their established reputations for dependable coverage and excellent customer service, State Farm and Progressive are frequently ranked as some of Sioux Falls’ most reputable insurance providers.

What car insurance is required in South Dakota?

Required car insurance in South Dakota includes liability coverage for bodily injury and property damage. The state mandates minimum coverage of $25,000 per person, $50,000 per accident for bodily injury, and $25,000 for property damage.

Continue reading our full “Full Coverage Auto Insurance” guide for extra tips.

How does Allstate vs. Geico in Sioux Falls, SD, compare?

When comparing Allstate vs. Geico in Sioux Falls, SD, Geico often provides cheaper premiums, but Allstate may offer better customer service and more comprehensive coverage options. Both companies provide a range of discounts to help lower rates.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Is it illegal to not have car insurance in South Dakota?

Yes, it is illegal not to have car insurance in South Dakota. The state requires all drivers to carry at least the minimum liability coverage, and failure to do so can result in fines, license suspension, and other penalties.

What is the most important auto insurance coverage in Sioux Falls, SD?

The most important auto insurance coverage in Sioux Falls, SD, typically includes liability coverage, which is required by law, and comprehensive or collision coverage to protect your vehicle in the event of damage or theft.

Read our extensive guide on “Comprehensive Auto Insurance Defined ” for more knowledge.

Which is the best insurance company in Sioux Falls, SD?

The best insurance company in Sioux Falls, SD, depends on your needs. State Farm is popular for its reliable service, while Geico is known for its affordability. Progressive offers comprehensive coverage options.

What is the most common auto insurance coverage in Sioux Falls, SD?

The most common auto insurance coverage in Sioux Falls, SD, includes liability, comprehensive, and collision coverage. Many drivers also opt for uninsured/underinsured motorist coverage for added protection.

Who is the cheapest car insurance provider in Sioux Falls, SD?

The cheapest car insurance provider in Sioux Falls, SD, is often Geico, although Progressive and State Farm also offer competitive rates. Your final premium depends on your driving history and coverage needs.

Learn more by visiting our detailed “How Do I Compare Auto Insurance Quotes?” section

What are the top 5 insurance rating agencies in Sioux Falls, SD?

The top 5 insurance rating agencies in Sioux Falls, SD, are J.D. Power, AM Best, Moody’s, Standard & Poor’s, and Fitch Ratings. These agencies evaluate insurance companies based on financial strength and customer satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.