State Farm vs. Allstate Auto Insurance in 2025 (Who Has Better Deals?)

To compare State Farm vs. Allstate auto insurance, you’ll need to look at several factors. State Farm auto insurance rates tend to be lower, with prices starting at $33/mo. Allstate starts higher at $61/mo, but you get more coverage options. However, reviews tend to be positive for both companies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsTrying to decide between State Farm vs. Allstate auto insurance policies? State Farm is usually cheaper, while Allstate offers more robust coverage.

Since State Farm and Allstate are similar companies, deciding between the two comes down to your personal needs.

Allstate auto quotes tend to be better for full coverage policies, while State Farm is easier on budgets, especially if you have teen drivers in your coverage.

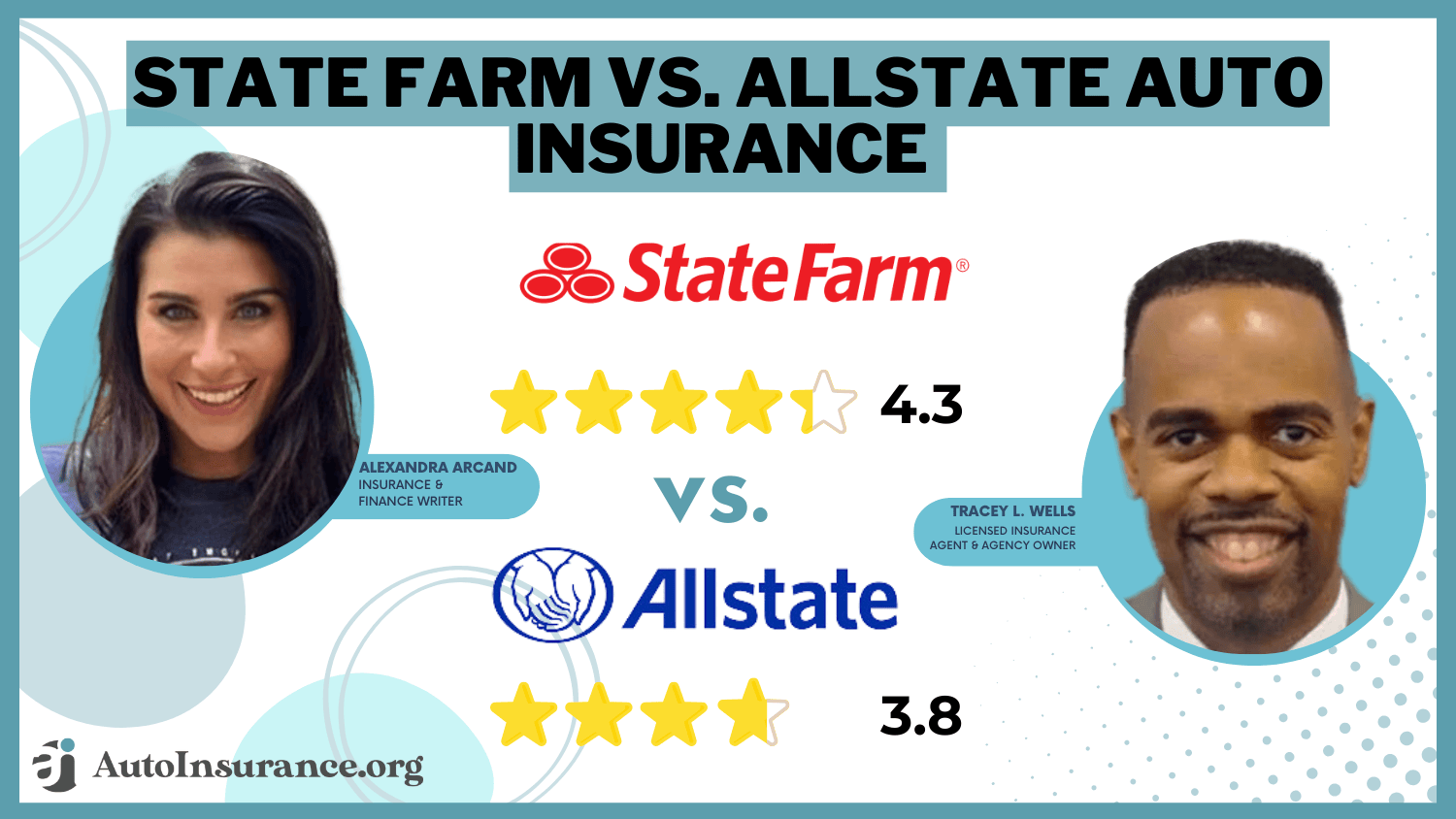

State Farm vs. Allstate Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 3.8 |

| Business Reviews | 5.0 | 4.0 |

| Claim Processing | 4.3 | 3.0 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 3.4 |

| Customer Satisfaction | 4.1 | 4.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.9 | 3.2 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.8 | 3.4 |

| Savings Potential | 4.3 | 3.8 |

| Nationwide Review | Allstate Review |

Before you decide between Allstate vs. State Farm insurance, it’s crucial that you learn how to evaluate auto insurance quotes. Read on to compare Allstate vs. State Farm auto insurance. Then, enter your ZIP code to see if Allstate or State Farm is your cheapest option.

- State Farm is usually a cheaper car insurance option than Allstate

- Allstate tends to offer better coverage options compared to State Farm

- Both companies are highly rated, trustworthy insurance providers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comparing Costs: State Farm Insurance vs. Allstate Insurance

When comparing Allstate vs. State Farm car insurance policies, one of the most important things to consider is pricing. If finding the cheapest auto insurance companies is your primary goal, State Farm is probably your best bet.

However, there are many factors that affect car insurance rates, including your age and gender. Check below to see how much you might pay for insurance from both companies.

State Farm vs. Allstate Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $311 | $608 |

| Age: 16 Male | $349 | $638 |

| Age: 30 Female | $94 | $168 |

| Age: 30 Male | $103 | $176 |

| Age: 45 Female | $86 | $162 |

| Age: 45 Male | $86 | $160 |

| Age: 60 Female | $76 | $150 |

| Age: 60 Male | $76 | $154 |

While there are plenty of other factors providers look at to determine your rates, one of the most important is your driving history. Drivers with clean scores pay far less for insurance than people with multiple speeding tickets, accidents, or DUIs.

Check below to compare Allstate and State Farm auto insurance rates based on your driving record.

State Farm vs. Allstate Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $86 | $160 |

| At-Fault Accident | $102 | $225 |

| Speeding Ticket | $96 | $188 |

| DUI/DWI | $112 | $270 |

Regardless of what your record looks like, State Farm is almost always the cheapest option for coverage. However, that doesn’t mean you shouldn’t compare quotes. Getting a personalized quote is easy – simply visit State Farm or Allstate’s website and fill out the quote request form.

If you don’t want to spend the time collecting multiple rates from individual websites, you can always use an online quote-generating tool. These free tools will allow you to compare State Farm vs. Allstate car insurance rates with other providers.

Auto Insurance Options From Allstate and State Farm

State Farm and Allstate offer plenty of auto insurance options to meet any need. That includes policies that only meet the minimum auto insurance requirements in your state and full coverage plans.

Both companies also offer a variety of policy add-ons so you can customize your coverage. However, there are more Allstate car insurance add-ons than what State Farm offers. Take a look below to see your customization options at each company.

State Farm vs. Allstate Auto Insurance Add-On Options

| Add-On | ||

|---|---|---|

| Accident Forgiveness | X | 7% |

| Deductible Savings | X | 3% |

| Extended Vehicle Care | X | 13% |

| Gap | X | 3% |

| New Car Replacement | X | 4% |

| Rental Car Reimbursement | 2% | 2% |

| Rideshare | 1% | 1% |

| Roadside Assistance | 2% | 2% |

| Sound System Coverage | X | 1% |

| Travel Expense | 3% | X |

As you can see, Allstate offers almost all State Farm car insurance options except for travel expense coverage. If you’re interested in a policy with diverse coverage, Allstate is your best option.

State Farm vs. Allstate Auto Insurance Discounts

The best auto insurance discounts can help you save a significant amount on your policy. Both Allstate and State Farm offer a variety of discounts to lower costs. See which you might qualify for below.

Allstate vs. State Farm Auto Insurance Discounts

| Discount Name | ||

|---|---|---|

| Drive Safe Program | 40% | 30% |

| New Car Discount | 30% | 40% |

| Good Student | 20% | 25% |

| Paperless Billing | 20% | 5% |

| Bundling | 17% | 10% |

| Safe Driver | 15% | 45% |

| Claim-Free | 15% | 35% |

| Anti-Theft Device | 10% | 15% |

| Early Signing | 10% | 5% |

| Defensive Driving | 5% | 10% |

State Farm offers a few more discounts, but that doesn’t mean you can’t save with Allstate. Most discounts apply automatically to your account, but you can always check with a representative from either company to ensure you get everything you qualify for.

Drive Safe & Save vs. Drivewise

Most insurance companies offer a usage-based insurance (UBI) program to help safe drivers lower their rates. State Farm and Allstate are no exceptions.

State Farm’s UBI program is called Drive Safe and Save. Policyholders can access this service by signing in to the Drive Safe and Save Mobile App using their State Farm online account information.

Allstate, however, offers two UBI programs: Drivewise and Milewise. Drivewise is Allstate’s UBI discount program, offering a whopping 40% off to the safest drivers.

This program allows policyholders to earn discounts when they drive at safe speeds, limit late-night commutes, and limit hard-braking events. Allstate uses this information in their best driver’s report, which you may have seen in our city insurance guides.

If you’re a low-mileage driver, Allstate’s Milewise program might be the better option. Milewise is a pay-per-mile insurance option that can cost far less than a traditional policy.

Drivers who put fewer than 10,000 miles on their car annually usually find low rates with Milewise. Milewise calculates your rates by combining a flat monthly price and a small per-mile fee.Michelle Robbins Licensed Insurance Agent

Milewise is a great option for low-mileage drivers, but you should probably skip it if your annual mileage is closer to the average American’s. If Milewise won’t work for you, Drivewise is a great alternative to save.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

State Farm vs. Allstate Auto Insurance Customer Reviews

Looking at customer reviews is a great way to decide if a car insurance company is the right choice for you, especially if you’re learning how to switch auto insurance companies. Both State Farm and Allstate generally get positive reviews, though State Farm seems to do a bit better.

Customers love State Farm’s affordable rates. That’s particularly true for families with young drivers, who often struggle to find affordable coverage.

When your child goes away to college, there are options to lower your insurance premiums. Here’s how: https://t.co/RaefBSO3Ty#carinsurance pic.twitter.com/9M1Zk15gbP

— State Farm (@StateFarm) October 8, 2024

Allstate receives the most positive reviews regarding its coverage options. Customers often state their appreciation for the number of add-on options Allstate offers.

However, many customers say there isn’t much of a difference between either company. For example, this Reddit user was told both State Farm and Allstate offer excellent policies — the only real difference is price.

Allstate vs State Farm – Is one really better or just price for decision?

byu/stuman1974 inInsurance

As many responded on this Reddit thread, one of the most important distinctions between Allstate and State Farm is how much you’ll pay. Many users also pointed out that your overall experience has more to do with the agent you work with.

State Farm vs. Allstate Auto Insurance Mobile App Reviews

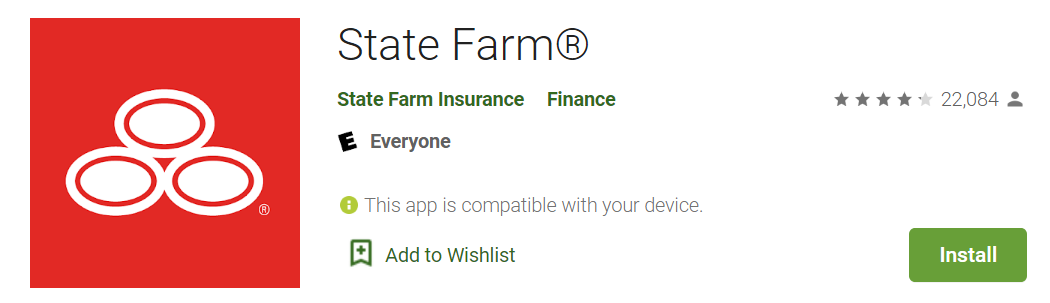

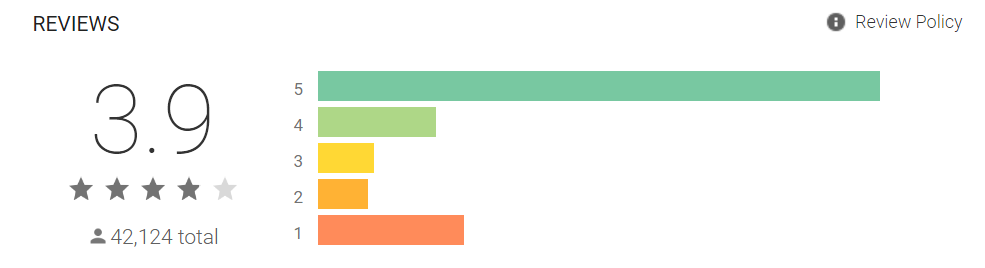

Car insurance providers have created innovative ways to get information to their policyholders. How do customers feel about their insurance provider? Let’s examine the total reviews and ratings of mobile apps.

Over 22,000 people reviewed State Farm through the Google Play Store. The State Farm app is classified as a finance mobile app, which further indicates how policyholders can use the app.

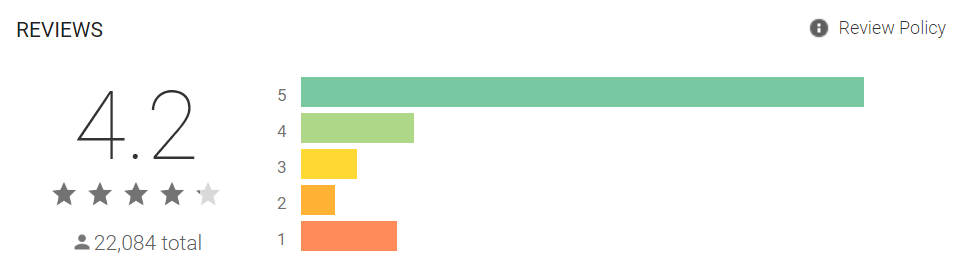

This is a more detailed look at how customers rated State Farm’s mobile app. The majority of State Farm® Mobile App users gave State Farm a five-star rating.

Let’s see Allstate’s customer review in the Google Play Store.

Google Play members gave the Allstate® Mobile App a four-star rating based on 42,124 reviews.

State Farm is rated at 4.2 stars while Allstate is rated 3.9 stars. However, more policyholders have reviewed Allstate’s mobile app service than State Farm’s mobile app service.

Although State Farm has a higher rating, many customers complain about how the mobile app works. If you plan to use an app to manage your policy and store your proof of insurance, you may want a more modernized company like Progressive.Scott W. Johnson Licensed Insurance Agent

Ratings could be associated with usability, the ease of making a claim, and simple payment arrangements. Also, ratings are subject to change depending on the rating from the customer and the number of customers that respond.

State Farm vs. Allstate Auto Insurance Pros and Cons

While an in-depth review of each company is the best way to find the right fit, sometimes you need quick answers. Check out the pros and cons of each company below for a quick idea of which company is best for you.

Starting with State Farm, you’ll enjoy the following benefits:

- Affordable Rates: State Farm is usually an affordable option for insurance, especially if you have teen drivers in your household.

- Extensive Network of Agents: State Farm maintains one of the largest networks of local agents, making it easy to get help from a real person when you need it.

- Generous Discounts: You’ll get more discount opportunities at State Farm than you would with Allstate.

Like all insurance companies, State Farm isn’t without its flaws. Look out for the following drawbacks when you shop at State Farm:

- Limited Digital Tools: While it has an app and website, many customers report feeling underwhelmed by the company’s digital offerings.

- Lacking Coverage Options: State Farm lacks popular insurance add-ons like accident forgiveness and gap insurance.

Despite a few disadvantages, State Farm is an excellent car insurance choice for most drivers, especially those on a budget.

Allstate Pros and Cons

Allstate is often associated with State Farm because their names sound similar, but Allstate has much different pros and cons. Buying an Allstate policy comes with the following pros:

- UBI Discounts: Allstate offers one of the best UBI discounts on the market, with safe drivers saving up to 40%.

- Comprehensive Coverage: There are plenty of add-ons to choose from when you buy an Allstate policy.

- Pay-Per-Mile Option: Low-mileage drivers can save with Drivewise.

Before you sign up for an Allstate policy, make sure you’re at ease with the following disadvantages:

- Higher Rates: No matter what type of driver you are, Allstate is usually one of the pricier options for car insurance.

- Slow Claims Reports: Some customers report that the Allstate claims process is unexpectedly slow.

While both companies are excellent options for coverage, they are not the best choice for every driver. For example, State Farm is one of the best auto insurance companies for teens, while Allstate can be prohibitively expensive for young drivers.

State Farm vs. Allstate Auto Insurance: Find the Right Policy Today

Learning how to get multiple auto insurance quotes is the most important step in figuring out if Allstate or State Farm is best for you. You can also compare these two companies with other major providers, like Progressive and Geico.

Now that you’ve compared State Farm vs. Allstate auto insurance, your next step is to compare personalized quotes. Enter your ZIP code into our free comparison tool to see what State Farm and Allstate rates look like for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is State Farm better than Allstate?

State Farm and Allstate generally perform at similar levels. Allstate is a great option for drivers looking for customizable full coverage policies, while State Farm is usually cheaper. Learn more about how State Farm keeps its rates so low in our State Farm auto insurance review.

Is Allstate cheaper than State Farm?

State Farm is cheaper than Allstate for nearly every demographic, including teens, high-risk drivers, and people with low credit scores.

Why is Allstate expensive?

Allstate tends to be more expensive because it offers a wide range of coverage options, personalized services, and features like accident forgiveness and safe driving rewards, which increase overall costs. If you’re worried about costs, make sure to enter your ZIP code into our free comparison tool to see the lowest rates in your area.

Does State Farm offer gap insurance?

Unfortunately, State Farm gap insurance is not available as an add-on. State Farm does offer a loan/lease program, but only if you finance your vehicle through State Farm.

Does Allstate have accident forgiveness?

Yes, Allstate offers accident forgiveness coverage. To qualify, you’ll need to be accident-free for at least three years.

Is Allstate or State Farm better for teen car insurance?

Allstate offers more coverage options for teens, but State Farm has lower average rates.

Do Allstate and State Farm have UBI programs?

Both companies offer a UBI program to help drivers save. You can save up to 25% with State Farm’s Drive Safe & Save, while Allstate offers a maximum discount of 40% with Drivewise. Allstate is also one of the best pay-as-you-go auto insurance companies, thanks to Milewise.

Do Allstate and State Farm sell other types of insurance?

Both companies offer a variety of other insurance types, including renters, life, homeowners, and business plans. If you’re interested in bundling your policies for a discount, you should also compare Allstate vs. State Farm home insurance.

How much does insurance cost at State Farm?

State Farm auto insurance rates start much lower than Allstate. At just $33 per month, it’s not hard to find affordable coverage through State Farm.

How much does Allstate insurance cost?

Minimum insurance at Allstate starts at just $61 per month. However, you’ll likely see a much different price based on your vehicle, where you live, and your driving record. To see how much you might pay for coverage, check out our Allstate auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.