Best Statesboro, Georgia Auto Insurance in 2025 (Check Out the Top 10 Companies)

To secure the best Statesboro, Georgia auto insurance, compare top providers like USAA, Allstate, and Geico, with rates starting at $43 per month. Considering local factors, find a policy that not only fits your budget but also provides the coverage necessary for Statesboro drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Statesboro GA

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Statesboro GA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Statesboro GA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The best Statesboro, Georgia auto insurance providers, such as USAA, Allstate, and Geico, have starting insurance rates as low as $43 per month. These insurers will help Statesboro drivers manage downtown traffic and navigate Georgia Southern University on game day, which presents unique insurance challenges.

Comparing quotes guarantees you will find coverage that protects you on every journey, from quick trips to the Farmers Market to weekend getaways to Splash in the Boro, regardless of how long you have lived in Statesboro or whether you are a student living there.

Our Top 10 Company Picks: Best Statesboro, Georgia Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A++ Military Savings USAA

#2 13% A+ Customized Policies Allstate

#3 11% A++ Competitive Rates Geico

#4 9% A Discount Availability American Family

#5 6% A++ Bundling Policies Travelers

#6 12% A+ Accident Forgiveness Nationwide

#7 11% A+ Coverage Options Progressive

#8 6% B Customer Service State Farm

#9 7% A Customizable Policies Liberty Mutual

#10 9% A+ Organization Discount The Hartford

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance in Statesboro, GA.

- Even a single incident can result in a substantial rate increase

- maintaining good credit can lead to substantial savings on your auto insurance

- Many local factors may affect your Statesboro auto insurance rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Military-Focused Discounts: USAA offers military-specific discounts, making it one of the most affordable options for military personnel and their families in Statesboro, Georgia. With premiums as low as $125, it’s an excellent choice for those who qualify.

- Comprehensive Coverage Options: USAA provides a wide range of coverage options, including comprehensive and collision coverage, tailored to meet the needs of Statesboro, Georgia drivers. This flexibility ensures that policyholders are well-protected in various scenarios.

- Superior Customer Service: Known for exceptional customer service, USAA is highly rated by its members in Statesboro, Georgia. The company is praised for its quick response times and efficient claims processing, making it a reliable choice. For an expert breakdown of Allstate’s policies, dive into our detailed USAA auto insurance review.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families. This limitation can be a significant drawback for Statesboro, Georgia residents who do not qualify for membership, forcing them to seek insurance elsewhere.

- Limited Local Branches: While USAA excels in customer service, its limited physical presence in Statesboro, Georgia can be inconvenient for those who prefer in-person interactions when handling their insurance needs.

#2 – Allstate: Best for Customized Policies

Pros

- Policy Personalization: Pioneers in policy personalization, tailoring protection to fit Statesboro’s eclectic mix of urban and rural drivers.

- Good Neighbor Initiative: Introduces the “Good Neighbor” initiative, offering premium reductions for involvement in local community service projects in Statesboro.

- Strong Digital Tools: Allstate’s mobile app and online tools make managing policies and filing claims easy for residents of Statesboro, Georgia. The user-friendly interface and 24/7 access provide convenience and efficiency. For a deep dive into Allstate’s services, see our detailed Allstate auto insurance review.

Cons

- Higher Premiums for Certain Drivers: Allstate’s premiums in Statesboro, Georgia can be higher than other providers, especially for younger drivers or those with less-than-perfect driving records. This could make it a less attractive option for some residents.

- Mixed Customer Service Reviews: While Allstate has a strong local presence, some Statesboro, Georgia customers report inconsistent customer service experiences, particularly with claims handling. This inconsistency can be a concern for those seeking reliable support.

#3 – Geico: Best for Competitive Rates

Pros

- Affordable Premiums: Geico offers some of the most competitive rates in Statesboro, Georgia, with premiums starting at $132. This affordability makes it a popular choice for budget-conscious drivers seeking reliable protection.

- Efficient Claims Process: Geico is known for its efficient claims process, which is highly rated by Statesboro, Georgia policyholders. The company’s streamlined procedures ensure quick resolutions, helping drivers get back on the road faster.

- Comprehensive Online Tools: Geico’s website and mobile app provide extensive online tools for policy management, quotes, and claims in Statesboro, Georgia. The ease of use and accessibility make it a convenient option for tech-savvy drivers. Explore the full range of benefits and options in our Geico auto insurance review.

Cons

- Limited Local Agents: Geico’s strong emphasis on online services means it has fewer local agents in Statesboro, Georgia. For residents who prefer in-person assistance, this can be a disadvantage.

- Less Personalized Service: Due to its size and online focus, Geico may offer less personalized service to Statesboro, Georgia customers compared to providers with a stronger local presence. This could be a drawback for those seeking tailored advice.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Discount Availability

Pros

- Farm-to-Table Coverage Option: Unveils the “Farm-to-Table” coverage option, protecting vehicles in Statesboro used in local agricultural operations and farmers’ markets.

- Student Success Discount: Launches a first-of-its-kind “Student Success” discount, linking academic achievement at Georgia Southern which include Statesboro, to insurance savings.

- Rideshare Driver Coverage Add-Ons: Introduces coverage add-ons for rideshare drivers, accommodating the increasing demand around Statesboro’s expanding nightlife scene. Delve into the details of American Family’s plans with our thorough American Family auto insurance review.

Cons

- Higher Premiums for Some Policies: While American Family offers competitive rates, some policies in Statesboro, Georgia may come with higher premiums compared to other providers, particularly for drivers with specific risk factors.

- Limited Availability in Some Areas: American Family’s coverage may not be as widespread in certain parts of Statesboro, Georgia, potentially limiting options for residents living in more rural areas. This could be a disadvantage for those needing broader coverage.

#5 – Travelers: Best for Bundling Policies

Pros

Cons

- Less Personal Interaction: Limited opportunity for personal interaction with local agents in Statesboro, which may affect service quality.

- Higher Rates for Certain Demographics: Rates can be higher for Statesboro younger drivers and those with poor driving records.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Vanishing Deductible Program: Nationwide offers a unique vanishing deductible program for Statesboro, Georgia drivers, where the deductible decreases for each year of safe driving. This feature can lead to significant savings over time.

- Agribusiness Automobile Policy: Develops a unique “Agribusiness Automobile” policy, supporting Bulloch County’s farming community with specialized vehicle protection for Statesboro policyholders.

- Blue and White Spirit Discounts: Offers “Blue and White Spirit” discounts for Georgia Southern University alumni, fostering continued community engagement. For a detailed exploration of Nationwide’s auto insurance, check out our Nationwide auto insurance review.

Cons

- Higher Premiums for Younger Drivers: Nationwide’s premiums in Statesboro, Georgia can be higher for younger drivers, making it a less attractive option for those in this demographic. This could be a significant factor for families with teen drivers.

- Complex Policies: Policies can be complex, making it difficult for customers in Statesboro to fully understand their coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Coverage Options

Pros

- Snapshot Program for Safe Drivers: Progressive’s Snapshot program allows Statesboro, Georgia drivers to earn discounts based on their driving habits. This telematics option can lead to significant savings for those who practice safe driving.

- Campus Innovation Discounts: Develops “Campus Innovation” discounts, encouraging Statesboro student-led projects in automotive technology and traffic management.

- Strong Online Tools and Resources: Progressive’s robust online tools and resources make managing policies easy for Statesboro, Georgia residents. The user-friendly interface and comprehensive options are ideal for tech-savvy customers. For a clear and detailed breakdown, read our Progressive auto insurance review.

Cons

- Higher Rates for High-Risk Drivers: Progressive’s premiums can be higher for high-risk drivers in Statesboro, Georgia, making it a less affordable option for those with poor driving records or other risk factors.

- Claims Processing Delays: Some customers experience delays in the claims process, which can be frustrating for Statesboro drivers.

#8 – State Farm: Best for Customer Service

Pros

- Competitive Rates for Bundling: State Farm offers competitive rates for Statesboro, Georgia residents who bundle their auto insurance with other policies like homeowners or renters insurance. This can lead to significant savings for those with multiple insurance needs.

- Plantation Trail Protection: Introduces “Plantation Trail” protection, offering specialized coverage for vehicles touring Statesboro’s historic sites.

- First Responder Appreciation Rates: Creates “First Responder Appreciation” rates, honoring Statesboro’s emergency service personnel with preferential pricing. Get an all-inclusive look at State Farm’s policies in our extensive State Farm auto insurance review.

Cons

- Higher Premiums for Certain Demographics: State Farm’s premiums in Statesboro, Georgia can be higher for younger or high-risk drivers, making it a less attractive option for these demographics. This could be a concern for families with teen drivers.

- Limited Discount Availability: While State Farm offers various discounts, some Statesboro, Georgia residents may find that the discounts available to them are limited compared to other providers, potentially reducing overall savings.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Artisan Auto Coverage: Unveils “Artisan Auto” coverage, protecting vehicles of local craftspeople showcasing at Statesboro’s Main Street Market.

- Local Agent Support: Liberty Mutual has a network of car insurance agents in Statesboro, GA, providing personalized service and face-to-face consultations. This local presence helps residents receive customized insurance solutions, making it a convenient choice.

- Home and Auto Bundling Discounts: Liberty Mutual provides attractive discounts for bundling home and auto insurance, which can lead to significant savings for Statesboro, Georgia residents. With premiums starting at $148, this option is particularly beneficial for homeowners. Check our full Liberty Mutual auto insurance review to explore their comprehensive offerings.

Cons

- Online Interface: Online tools and resources may not be as user-friendly or advanced as those of competitors in Statesboro.

- Customer Service Variability: Mixed reviews on customer service quality, with some Statesboro customers reporting dissatisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Organization Discount

Pros

- AARP Member Benefits: The Hartford is known for offering exclusive benefits and discounts to AARP members in Statesboro, Georgia. This makes it an excellent choice for senior drivers looking for affordable and comprehensive coverage, with premiums starting at $155.

- Golden Opportunity Policies: Crafts “Golden Opportunity” policies, catering to Statesboro’s active retiree community with age-appreciated benefits.

- Encore Career Options: Develops “Encore Career” options, supporting Statesboro’s seniors engaged in part-time or volunteer driving roles. This ensures that residents are well-protected in various situations. For in-depth coverage analysis, read our The Hartford auto insurance review.

Cons

- Higher Premiums for Non-AARP Members: The Hartford’s premiums can be higher for non-AARP members in Statesboro, Georgia, making it a less attractive option for younger drivers or those who do not qualify for AARP discounts.

- Limited Availability of Discounts: While The Hartford offers several coverage options, the availability of discounts is more limited compared to other providers in Statesboro, Georgia. This could reduce potential savings for some residents.

Statesboro, Georgia Coverage Laws

As you cruise through Statesboro’s streets, from the bustling Fair Road to the serene paths of Mill Creek Regional Park, having the right auto insurance gives you peace of mind.

Statesboro, Georgia Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $49 $130

American Family $48 $135

Geico $47 $132

Liberty Mutual $55 $148

Nationwide $50 $140

Progressive $46 $143

State Farm $52 $145

The Hartford $57 $155

Travelers $48 $136

USAA $43 $125

Statesboro abides by the laws of the state of Georgia regarding the minimum amount of coverage required for auto insurance. This is the information that you need to be aware of:

- Bodily Injury Liability Coverage: $25,000 per person and $50,000 per accident

- Property Damage Liability Coverage: $25,000 minimum

Remember, while these are the minimum requirements, many drivers opt for higher coverage limits to ensure better protection.

Find a policy that not only fits your budget but also provides the coverage necessary.Jeff Root Licensed Insurance Agent

You will be prepared for anything that the road that lies ahead may bring about as a result of having the appropriate coverage if you have it.

Statesboro, Georgia Demographics: Auto Insurance Rates

Statesboro drivers, take note: your personal details significantly impact your auto insurance premiums. This table breaks down how age, and gender affect rates across top providers. Let’s dive into the numbers to help you navigate your options effectively.

Statesboro, Georgia Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $564 | $726 | $273 | $298 | $244 | $244 | $233 | $233 |

| Geico | $394 | $471 | $172 | $192 | $135 | $133 | $130 | $130 |

| Liberty Mutual | $1,768 | $1,974 | $452 | $482 | $426 | $464 | $349 | $396 |

| Nationwide | $1,081 | $1,393 | $421 | $457 | $344 | $356 | $340 | $374 |

| Progressive | $663 | $735 | $249 | $262 | $215 | $199 | $185 | $193 |

| State Farm | $459 | $604 | $191 | $206 | $175 | $175 | $156 | $156 |

| USAA | $530 | $628 | $185 | $205 | $148 | $148 | $137 | $138 |

Your unique profile could lead to substantial savings or unexpected costs. Remember, while this data provides a general overview, your actual rates may differ. Always request personalized quotes to ensure you’re getting the best deal for your specific circumstances.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Your Driving Profile Factors in Statesboro, Georgia

This table illustrates how different incidents on your record can impact premiums across major providers. From clean records to DUIs, let’s examine how your driving behavior influences your insurance costs.

Statesboro, Georgia Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $291 | $448 | $306 | $364 |

| Geico | $148 | $185 | $165 | $381 |

| Liberty Mutual | $599 | $818 | $798 | $940 |

| Nationwide | $458 | $538 | $556 | $831 |

| Progressive | $266 | $464 | $309 | $312 |

| State Farm | $242 | $289 | $265 | $265 |

| USAA | $203 | $256 | $226 | $375 |

Even a single incident can result in a substantial rate increase. If you’ve had any recent driving infractions, it’s especially crucial to compare car insurance quotes in Statesboro, GA from multiple providers to find the most competitive rate.

Remember that if you make changes to the way you drive, you might find that your insurance premiums go down in the long run.

Statesboro, Georgia Auto Insurance: Credit History

Credit history also matters, this table demonstrates how rates vary across major insurers based on credit history. Let’s find out how your financial standing could affect your insurance costs.

Statesboro, Georgia Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $456 | $317 | $283 |

| Geico | $276 | $194 | $189 |

| Liberty Mutual | $1,132 | $692 | $543 |

| Nationwide | $710 | $575 | $502 |

| Progressive | $382 | $328 | $303 |

| State Farm | $376 | $234 | $186 |

| USAA | $346 | $243 | $207 |

The data clearly shows that maintaining good credit can lead to substantial savings on your auto insurance in Statesboro. If your credit score isn’t ideal, don’t despair – some insurers weigh credit less heavily than others.

Statesboro, Georgia Auto Insurance Rates By ZIP Code

Where you live and how you drive matter when it comes to your auto insurance rates in Statesboro. The tables that follow show how your Statesboro, GA ZIP code and the distance you travel each day can influence your premiums. Let’s look at how these elements shape your insurance costs with various providers.

Statesboro, Georgia Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 30458 | $382 |

| 30460 | $383 |

| 30461 | $404 |

Just as the paramount rule of risk management suggests, always remember that finding the best compromise between coverage and costs demands probing for numerous solutions.

Commuting in Statesboro, Georgia

Of course, longer and more important commutes, along with some ZIP codes, can also result in higher premiums, and not all insurers compensate for these factors in the same manner.

Statesboro, Georgia Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $344 | $360 |

| Geico | $216 | $224 |

| Liberty Mutual | $789 | $789 |

| Nationwide | $596 | $596 |

| Progressive | $338 | $338 |

| State Farm | $265 | $265 |

| USAA | $253 | $277 |

Remember, finding the right balance between coverage and cost for auto insurance in Statesboro, Georgia often requires exploring multiple options.

Reasons for High Rates in Statesboro, Georgia

There are a lot of reasons why auto insurance rates in Statesboro, Georgia, are higher or lower than in other cities.

These include traffic and the number of vehicle thefts in Statesboro, Georgia. Many local factors may affect your Statesboro auto insurance rates.

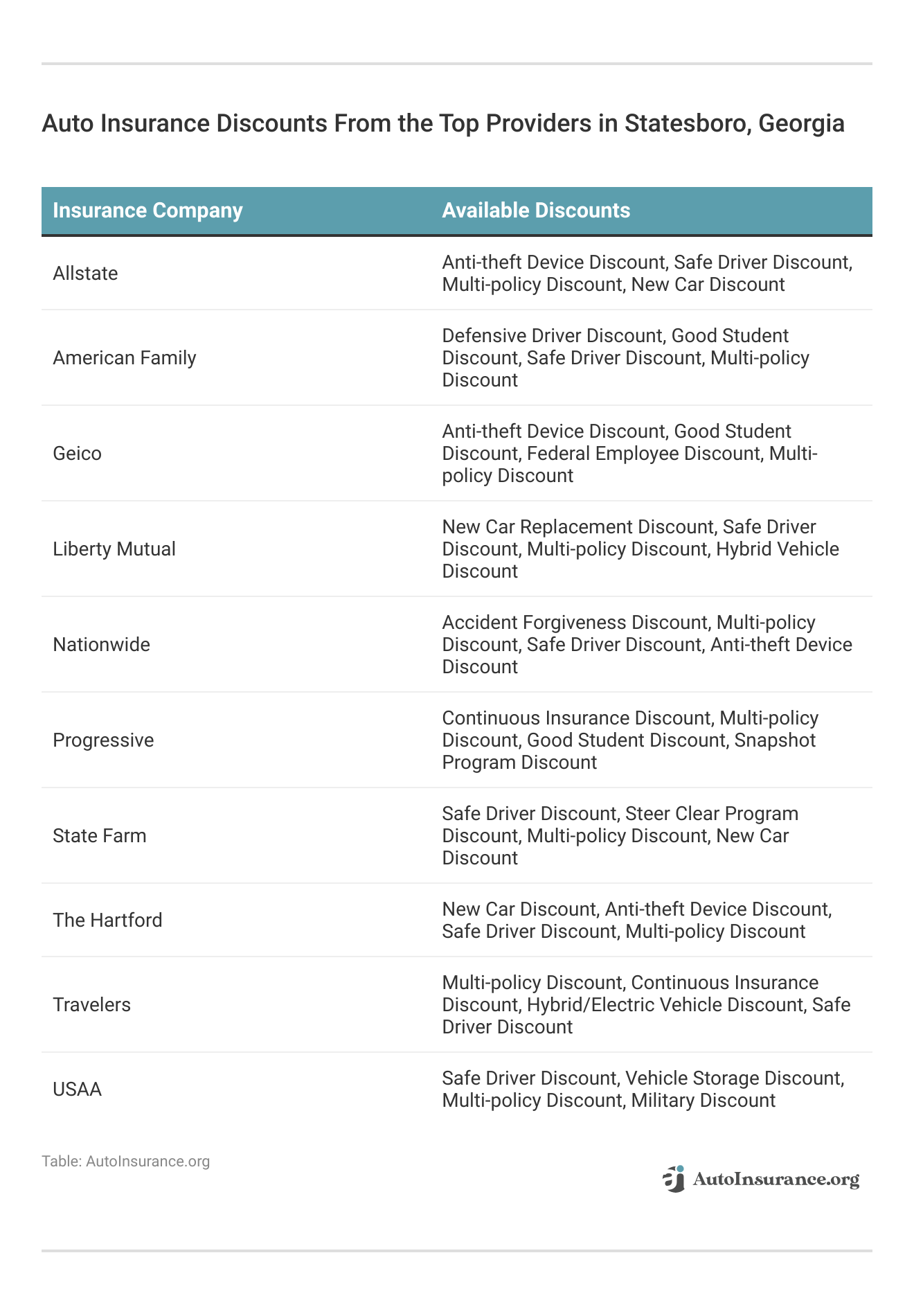

Try to get discounts if you are eligible, as seen in our chart above which shows the discounts from top providers in Statesboro, Georgia.

Statesboro Commute Time

As for the average commute time in Statesboro, Georgia, it is 17 minutes according to City Data. Enter your ZIP code below to shop for cheap car insurance in Columbus, GA from top providers near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors can affect my auto insurance premiums in Statesboro, GA?

Several factors can impact your auto insurance premiums in Statesboro, GA, including your age, driving record, vehicle type, credit history, and even your Statesboro ZIP code. Insurers assess these factors to determine the level of risk you present and adjust your premium accordingly.

What should I do after a car accident in Statesboro, GA?

If you’re involved in a car accident in Statesboro, GA, it is crucial to ensure everyone’s safety first and call emergency services if necessary. You should also exchange information with the other party, document the scene with photos, and report the incident to your insurance provider as soon as possible to begin the claims process.

Read our article titled “If someone hits my car, do I call my insurance or theirs?” if you want to know who you should call first.

Are there any additional coverages recommended beyond the minimum requirements?

Beyond the state-mandated minimum liability coverage, it is often advisable to consider additional coverages such as comprehensive, collision, uninsured/underinsured motorist protection, and personal injury protection (PIP). These coverages provide more extensive protection and can help cover damages and medical expenses that exceed the minimum coverage limits.

Find your cheapest auto insurance quotes in Statesboro, GA by entering your ZIP code below into our free comparison tool.

Is auto insurance mandatory in Statesboro, GA?

Yes, carrying auto insurance is mandatory in Statesboro, GA. The state requires all drivers to have at least the minimum liability coverage to ensure financial protection for both themselves and others in the event of an accident. Failure to maintain the required insurance can result in fines, license suspension, and other legal consequences.

Read More: When did auto insurance become mandatory?

How can I lower my auto insurance premiums in Statesboro, GA?

There are several strategies to lower your car insurance in Statesboro, GA, including maintaining a clean driving record, bundling your auto insurance with other policies, improving your credit score, and taking advantage of available discounts such as good driver, good student, or multi-car discounts.

What are the minimum auto insurance requirements in Statesboro, GA?

In Statesboro, GA, drivers are required to have at least $25,000 in bodily injury liability per person, $50,000 per accident, and $25,000 in property damage liability. These minimum requirements ensure that drivers can cover costs associated with injuries or damages they may cause in an accident.

Does my credit score affect my auto insurance rates in Statesboro, GA?

Yes, your credit score can influence your auto insurance rates. Car insurance companies in Statesboro, GA often consider a driver’s credit history when calculating premiums, viewing it as a factor that may indicate the likelihood of filing claims. Maintaining a good credit score can help secure lower rates.

Can my auto insurance policy be canceled or non-renewed?

Your auto insurance policy can be canceled or not renewed by your insurer for several reasons, including non-payment of premiums, a history of frequent claims, or changes in your driving status. To avoid this, ensure timely payments and maintain a good driving record.

How does my driving behavior affect my insurance premiums in Statesboro, GA?

Your driving behavior, including any history of accidents, traffic violations, or DUIs, can significantly impact your insurance premiums in Statesboro, GA. Safe drivers typically receive lower rates, while those with infractions may see increased costs. Improving your driving habits can lead to lower premiums over time.

Read More: Has the pandemic ruined our safe driving practices?

Are there specific discounts available for Statesboro drivers?

Many insurance providers offer specific discounts to Statesboro drivers, such as safe driver discounts, good student discounts, multi-policy discounts, and discounts for vehicles equipped with safety features. It is beneficial to inquire with your insurance company about available discounts to reduce your premiums.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.