Best Syracuse, New York Auto Insurance in 2025 (Find the Top 10 Companies Here)

Discover the best Syracuse, New York auto insurance with State Farm, USAA, and Geico, offering monthly rates of $22. State Farm is known for its cost-effectiveness, while USAA and Geico offer robust policy options customized to your requirements, making them ideal for Syracuse drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Syracuse New York

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Syracuse New York

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Syracuse New York

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

State Farm stands out for its exceptional support and wide range of coverage plans, making it the top pick overall. USAA is favored by military members for its tailored benefits, while Geico offers reliable coverage with significant discounts. For more information, read our article titled “Best State Farm Auto Insurance Discounts.”

Our Top 10 Company Picks: Best Syracuse, New York Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% B Competitive Rates State Farm

#2 10% A++ Military Discounts USAA

#3 17% A++ Affordable Pricing Geico

#4 25% A+ Flexible Discounts Progressive

#5 5% A+ Comprehensive Coverage Allstate

#6 5% A Unique Coverages Liberty Mutual

#7 20% A++ Custom Discounts Travelers

#8 5% A+ Vanishing Deductible Nationwide

#9 13% A Local Agents Farmers

#10 5% A Safe Driving American Family

These companies provide the best combination of value and protection for Syracuse drivers. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- State Farm is the top pick for Syracuse, New York auto insurance

- Syracuse drivers benefit from coverage tailored to local needs

- Geico and USAA offer competitive rates with discounts for Syracuse residents

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Noteworthy Low-Mileage Discounts: Drive less, pay less. State Farm offers impressive discounts for those clocking fewer miles on the roads of Syracuse, New York, making it ideal for local commuters.

- Expansive Agent Presence: Need personal touch? State Farm’s widespread network of agents across Syracuse, New York, ensures you’re never far from professional advice and in-person assistance. Read more in our full review on State Farm’s auto insurance.

- Crash-Free Incentives: Keep accidents at bay and your wallet full with State Farm’s discounts for accident-free driving—an appealing offer for careful drivers in Syracuse, New York.

Cons

- Premium Tallies: Even with those enticing discounts, State Farm’s premiums can still climb higher than anticipated, particularly in Syracuse, New York, where costs might not always favor every budget.

- Subpar Multi-Policy Reductions: While merging policies sounds lucrative, State Farm’s multi-policy discount doesn’t quite hit the high notes, especially when compared to rivals in Syracuse, New York.

#2 – USAA: Best for Military Discounts

Pros

- Exclusive Military Perks: USAA offers substantial savings and specialized perks exclusively for military members and veterans in Syracuse, New York, making it the prime choice for military families.

- Superior Financial Strength: With an A++ rating from A.M. Best, USAA is highly trusted for its financial security, providing reassurance to policyholders in Syracuse, New York.

- Low Costs for Military Families: USAA is recognized for offering some of the lowest auto insurance costs, particularly for military households residing in Syracuse, New York. See how USAA’s rates compare to other insurance providers in our article titled USAA auto insurance review.

Cons

- Eligibility Limitations: USAA is accessible only to military members and their families, restricting availability for non-military residents in Syracuse, New York.

- No SR-22 Service: USAA does not offer SR-22 filing services, which could be a disadvantage for high-risk drivers in Syracuse, New York who need this specific documentation.

#3 – Geico: Best for Affordable Pricing

Pros

- Exceptional Financial Stability: With an A++ rating from A.M. Best, Geico demonstrates solid financial stability and reliability, ensuring peace of mind for policyholders in Syracuse, New York.

- User-Friendly Digital Tools: Geico’s mobile application and online tools are intuitive and convenient for managing policies and claims in Syracuse, New York. Read more here: Geico auto insurance review.

- Low Rates: Rates are so low, Geico is a great choice for drivers who want to save money on their auto insurance in Syracuse, New York.

Cons

- Customer Service Issues: Some customers in Syracuse, New York have experienced delays or issues with Geico’s customer service, particularly when handling claims.

- Limited Rental Car Coverage: Geico’s rental reimbursement coverage might be more restricted or pricier than similar options available in Syracuse, New York.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Flexible Discounts

Pros

- Bundling Discounts: Progressive offers a robust 25% discount for bundling home and auto insurance, which can lead to significant savings for residents of Syracuse, New York. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

- Snapshot Program: Progressive’s Snapshot program offers significant discounts to Syracuse, New York drivers based on their safe driving habits.

- Continuous Coverage Savings: Progressive rewards drivers in Syracuse, New York who maintain continuous insurance coverage with extra savings.

Cons

- Higher Costs for High-Risk Drivers: Progressive may charge more for high-risk drivers in Syracuse, New York, potentially making it less affordable for some.

- Complex Pricing Model: Progressive’s pricing can fluctuate widely based on various factors, making it challenging to predict costs for Syracuse, New York drivers.

#5 – Allstate: Best for Comprehensive Coverage

Pros

- Wide Range of Coverage Options: Allstate provides an extensive selection of coverage choices, making it a top pick for drivers in Syracuse, New York who need comprehensive auto insurance.

- Solid Financial Security: With an A+ rating from A.M. Best, Allstate ensures strong financial security and reliability for Syracuse, New York residents.

- Safe Driving Incentives: Allstate’s Drivewise program rewards safe drivers in Syracuse, New York with discounts, encouraging better driving habits. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Customer Service Complaints: Some Syracuse, New York customers have expressed dissatisfaction with Allstate’s customer service, especially during the claims process.

- Drivewise App Issues: The Drivewise app has received mixed reviews from users in Syracuse, New York, with concerns about its accuracy and effectiveness.

#6 – Liberty Mutual: Best for Unique Coverages

Pros

- Flexible Coverage Options: Liberty Mutual offers distinctive and adaptable insurance plans specifically designed to meet the diverse needs of drivers in Syracuse, New York.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness feature aids Syracuse, New York motorists in avoiding rate hikes after their first mishap. You can learn more about Liberty Mutual’s insurance options in our complete guide: Liberty Mutual auto insurance review.

- New Car Replacement: Liberty Mutual provides new vehicle replacement coverage for residents of Syracuse, New York, ensuring full value compensation if a total loss occurs.

Cons

- Elevated Premiums: Liberty Mutual’s rates in Syracuse, New York tend to be higher than those of other providers, even when discounts are applied.

- Modest Bundling Discount: The bundling discount provided by Liberty Mutual in Syracuse, New York is only 5%, which falls short compared to many other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Custom Discounts

Pros

- Substantial Bundling Discount: Travelers provides a notable 20% bundling discount for Syracuse, New York residents who combine home and auto insurance policies. Read our full review of Travelers insurance for more information.

- Superior Financial Stability: Travelers boasts an A++ rating from A.M. Best, ensuring strong financial health and reliability for policyholders in Syracuse, New York.

- Eco-Friendly Vehicle Discount: Syracuse, New York drivers with environmentally-friendly or hybrid vehicles can benefit from Travelers’ green vehicle discount, supporting sustainability.

Cons

- Premium Costs: Travelers’ premiums in Syracuse, New York can be higher than those of other insurers, making it less attractive for price-sensitive drivers.

- Limited Local Representation: Travelers has fewer local agents in Syracuse, New York, which might affect the level of personalized service available to policyholders.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Nationwide’s vanishing deductible program is highly advantageous for Syracuse, New York drivers, gradually lowering their deductible with safe driving.

- Strong Financial Rating: Nationwide’s A+ rating from A.M. Best reflects its solid financial health and ability to meet claims obligations for customers in Syracuse, New York. Find out if Nationwide might have the lowest rates for you in our Nationwide auto insurance review.

- Annual Coverage Review: Nationwide provides an annual On Your Side Review for Syracuse, New York residents, ensuring they have the right coverage and are maximizing available discounts.

Cons

- Limited Bundling Savings: Nationwide’s bundling discount in Syracuse, New York is only 5%, which is lower than what many other providers offer.

- Gap Coverage Limitations: Nationwide’s gap insurance offerings in Syracuse, New York may not be as extensive as those from other insurers, potentially leaving drivers underinsured.

#9 – Farmers: Best for Local Agents

Pros

- Extensive Local Presence: Farmers has a large network of local agents in Syracuse, New York, providing tailored service and support to policyholders. Check out our online Farmers auto insurance review for more information.

- Accident Forgiveness: Farmers provides accident forgiveness in Syracuse, New York, allowing drivers to keep their rates stable after their first at-fault incident.

- Customizable Coverage Options: Farmers offers a broad array of customizable coverage options to meet the distinct needs of drivers in Syracuse, New York.

Cons

- Higher Rates: Farmers’ premiums in Syracuse, New York can be more expensive than those of other insurers, even with the available discounts.

- Fewer Discount Opportunities: Farmers offers fewer discount options in Syracuse, New York, such as a modest 13% discount for bundling, which may not be as competitive as other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Safe Driving

Pros

- Safe Driving Incentives: American Family offers significant discounts for safe drivers in Syracuse, New York, encouraging responsible driving behavior. Find out more about American Family in our guide titled American Family auto insurance review.

- Solid Financial Rating: American Family’s A rating from A.M. Best reflects strong financial stability, offering reliability for Syracuse, New York policyholders.

- Personalized Service: American Family provides tailored service through its network of local agents in Syracuse, New York, ensuring customized insurance solutions.

Cons

- Modest Bundling Discount: American Family’s bundling discount in Syracuse, New York is only 5%, which is less competitive compared to other providers.

- Limited Coverage Options: American Family may offer fewer specialized coverage options in Syracuse, New York compared to other insurers, potentially limiting customization for some drivers.

Monthly Auto Insurance Rates by Coverage in Syracuse, NY

Understanding the cost differences between minimum and full coverage is essential when selecting auto insurance in Syracuse, New York. The table below provides a clear comparison of monthly rates offered by various providers for both minimum and full coverage options.

Syracuse, New York Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $61 $160

American Family $44 $117

Farmers $22 $59

Geico $30 $80

Liberty Mutual $68 $174

Nationwide $44 $115

Progressive $39 $105

State Farm $33 $86

Travelers $37 $99

USAA $53 $139

The table highlights the significant variation in monthly rates across different insurance companies in Syracuse, New York. Farmers offers the most affordable option for both minimum and full coverage, with rates starting at $22 for minimum coverage and $59 for full coverage auto insurance.

On the higher end, Liberty Mutual charges $68 for minimum coverage and $174 for full coverage, making it the most expensive provider listed.

Other providers like Geico and State Farm offer competitive rates, with Geico’s full coverage at $80 and State Farm’s at $86, offering solid value for those seeking comprehensive protection. These variations underscore the importance of comparing coverage levels and provider rates to find the most suitable and cost-effective auto insurance in Syracuse, New York.

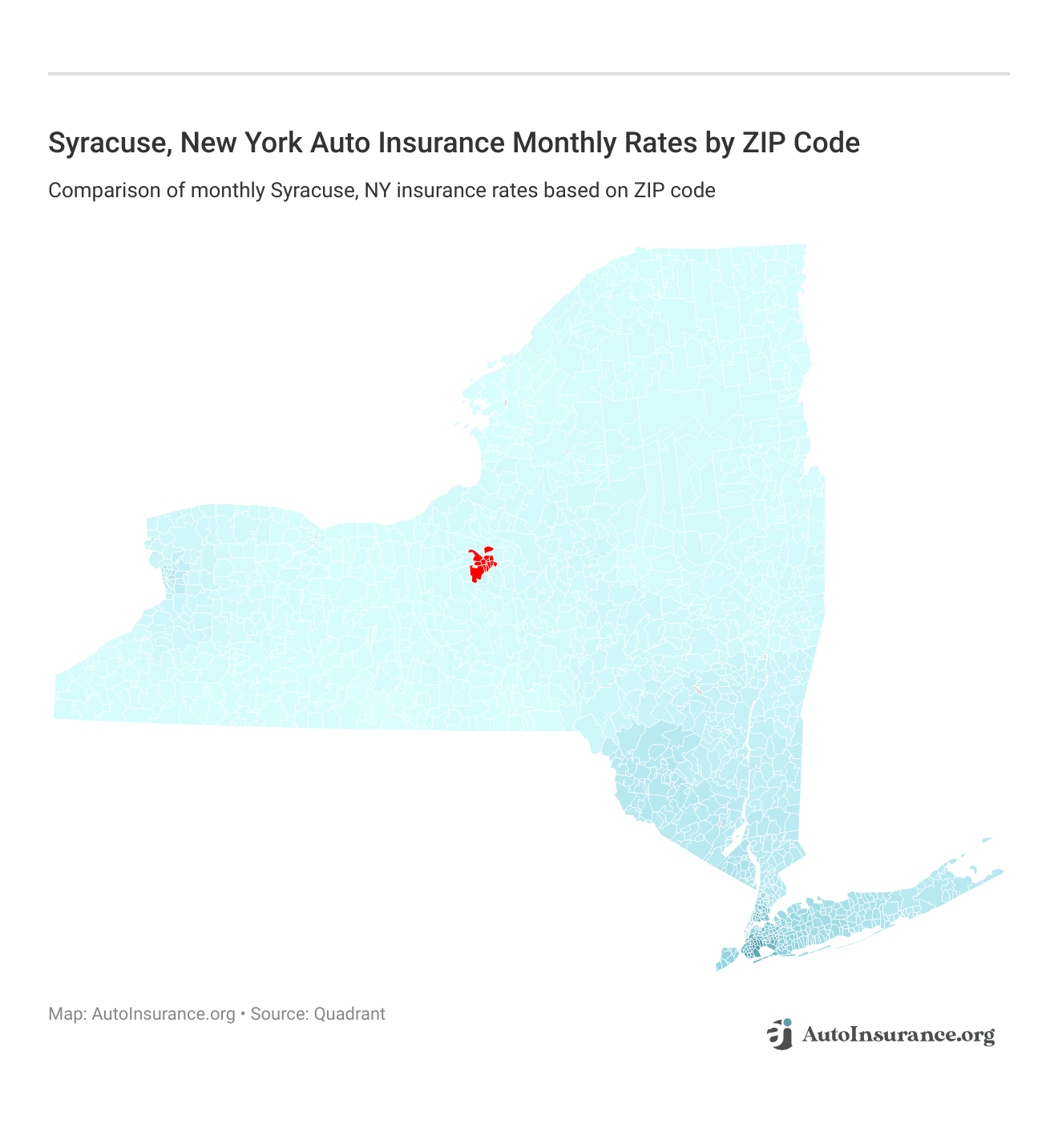

Monthly Syracuse, NY Car Insurance Rates by ZIP Code

Car insurance rates in Syracuse, NY can vary significantly based on your ZIP code. Insurers calculate premiums by considering factors like traffic density, crime rates, and local accident statistics. Higher traffic or crime areas may face increased costs, while safer, less congested areas might see lower premiums. Explore monthly Syracuse, NY auto insurance rates by ZIP code below:

Understanding these variations helps drivers in Syracuse find the most affordable insurance options based on their location. You can learn more in our guide titled “Do auto insurance companies check where you live?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

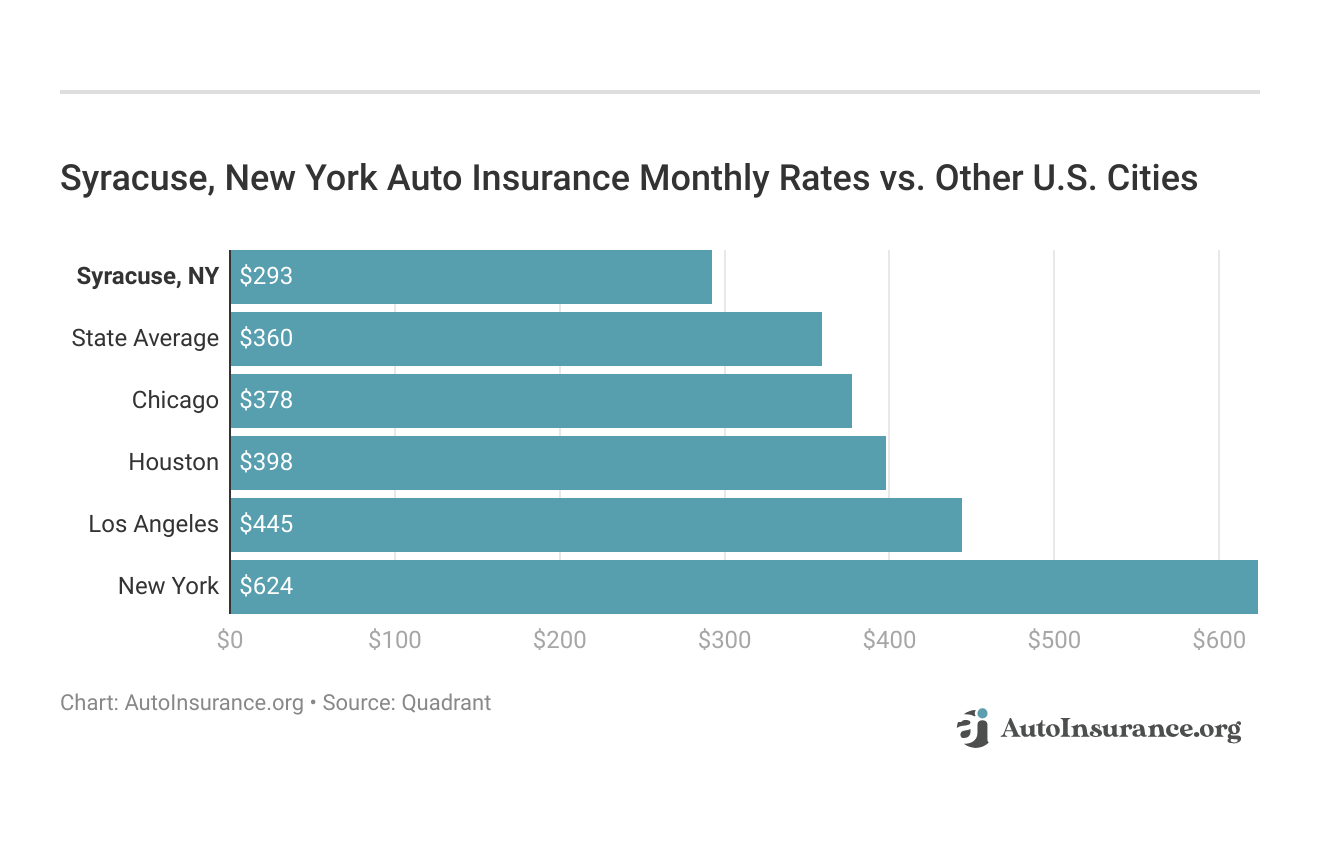

Syracuse, NY Car Insurance Rates vs. Top Us Metro Car Insurance Rates

The city you live in plays a significant role in determining your car insurance rates, which is why it’s crucial to compare Syracuse, NY, with other major US metro areas. Explore more discount options in our article titled “Factors That Affect Auto Insurance Rates.”

Understanding how Syracuse’s insurance costs stack up against these areas can help you make informed decisions and find the best rates for your coverage needs. Compare Syracuse, NY auto insurance quotes for free by entering your ZIP code into our rate tool above.

Finding Budget-Friendly Car Insurance in Syracuse, New York

The cheapest Syracuse, NY auto insurance company is Geico. However, your rates depend on your age, driving record, and coverage needs.

Therefore, to truly secure cheap auto insurance, compare rates from multiple providers before picking a policy.

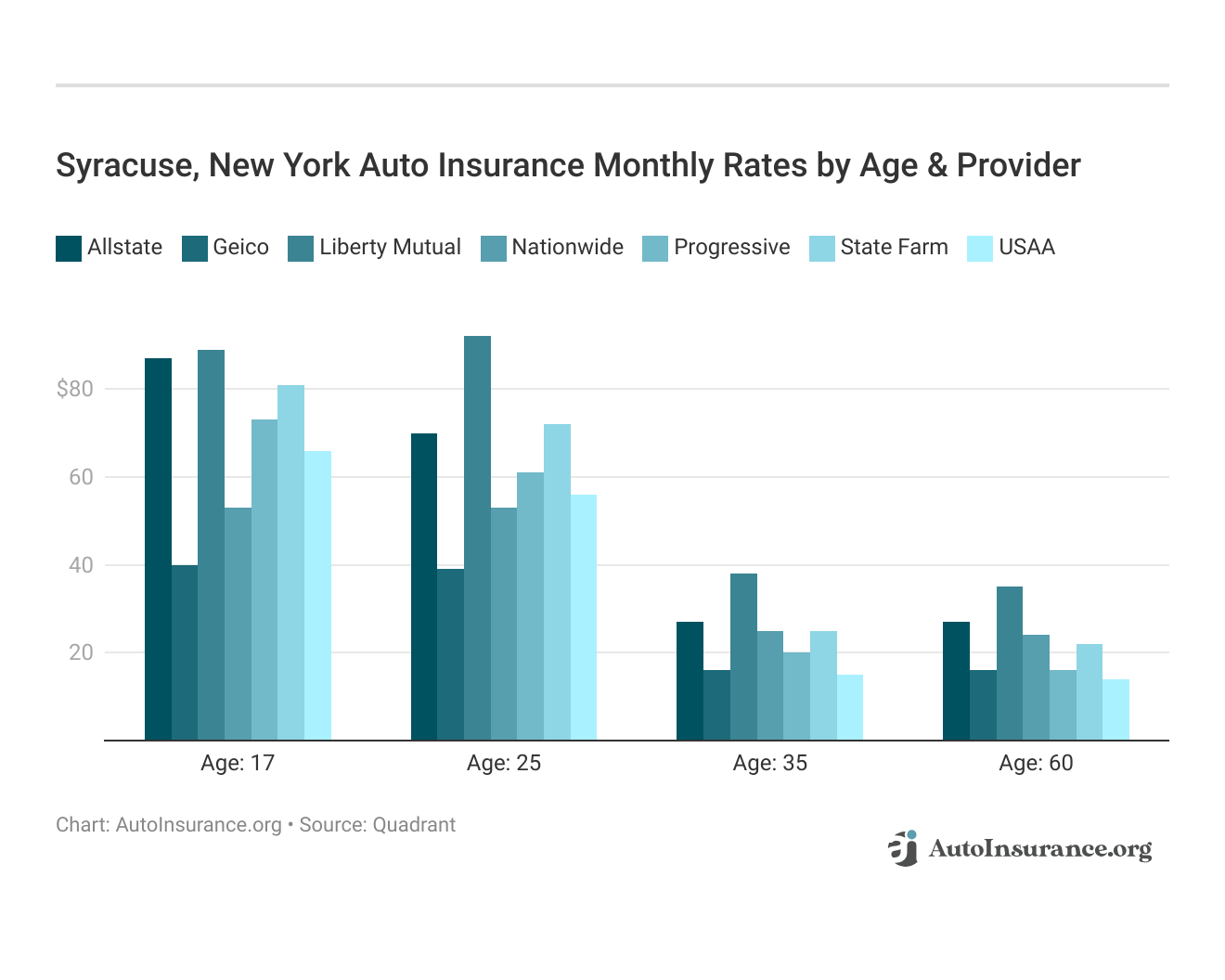

Syracuse, New York car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

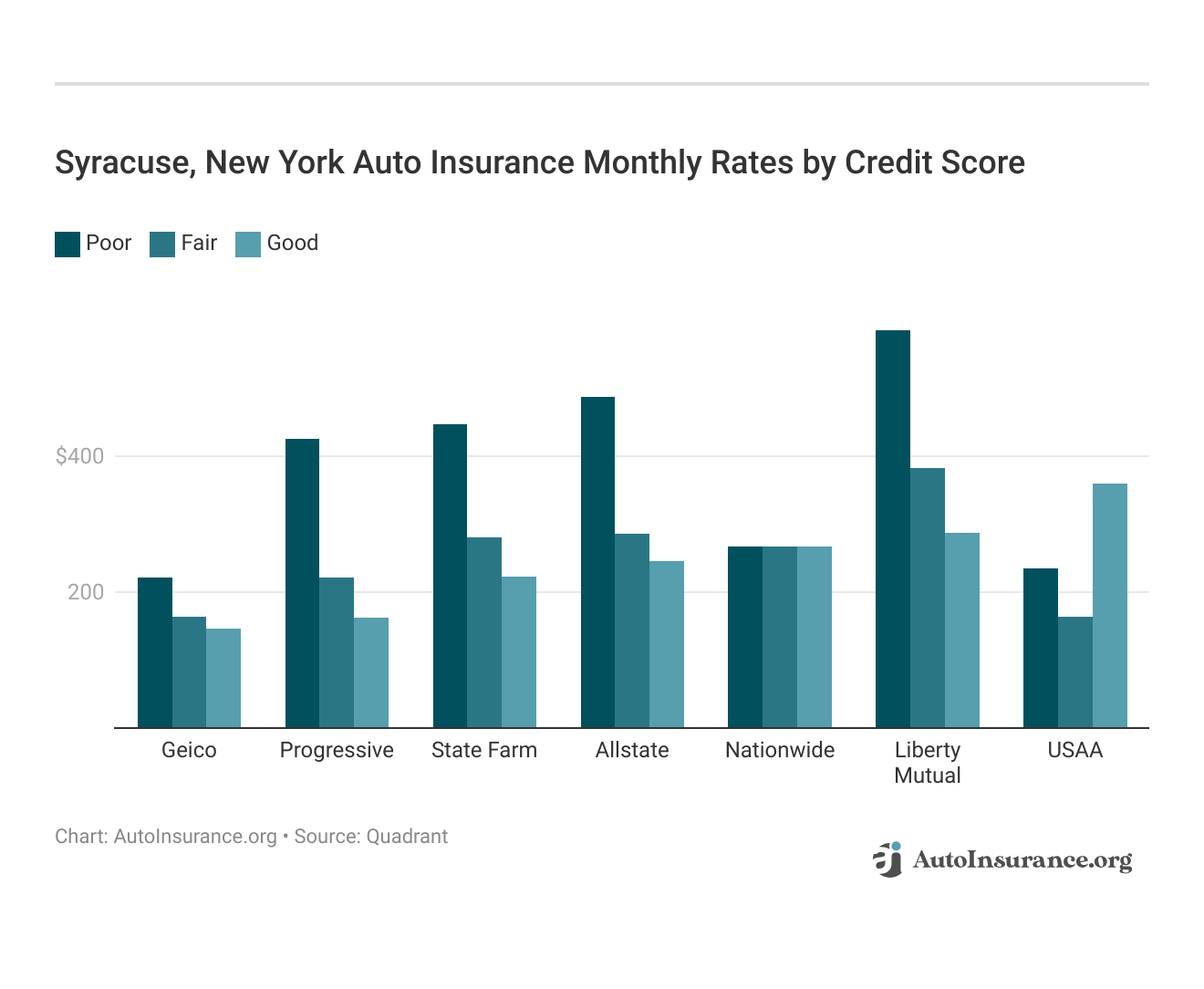

Your credit score will play a major role in your Syracuse, NY car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Syracuse, New York car insurance costs by credit score below.

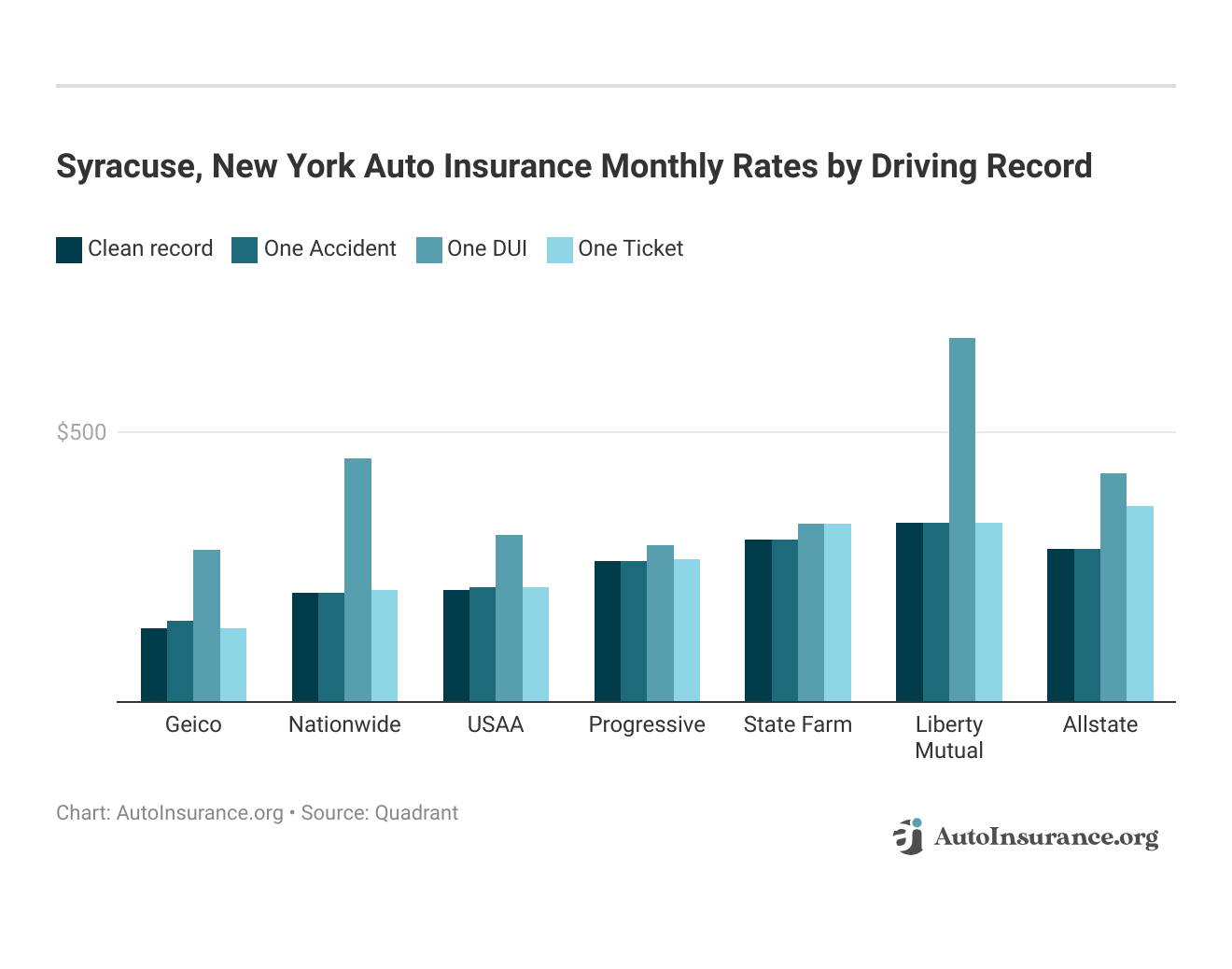

Your driving record will affect your Syracuse, NY car insurance costs. For example, a Syracuse, New York DUI may increase your car insurance costs 40% to 50%. Find the cheapest Syracuse, New York car insurance costs by driving record.

Controlling these risk factors will ensure you have the cheapest Syracuse, New York car insurance. Factors affecting car insurance rates in Syracuse, NY may include your commute, coverage level, tickets, DUIs, and credit.

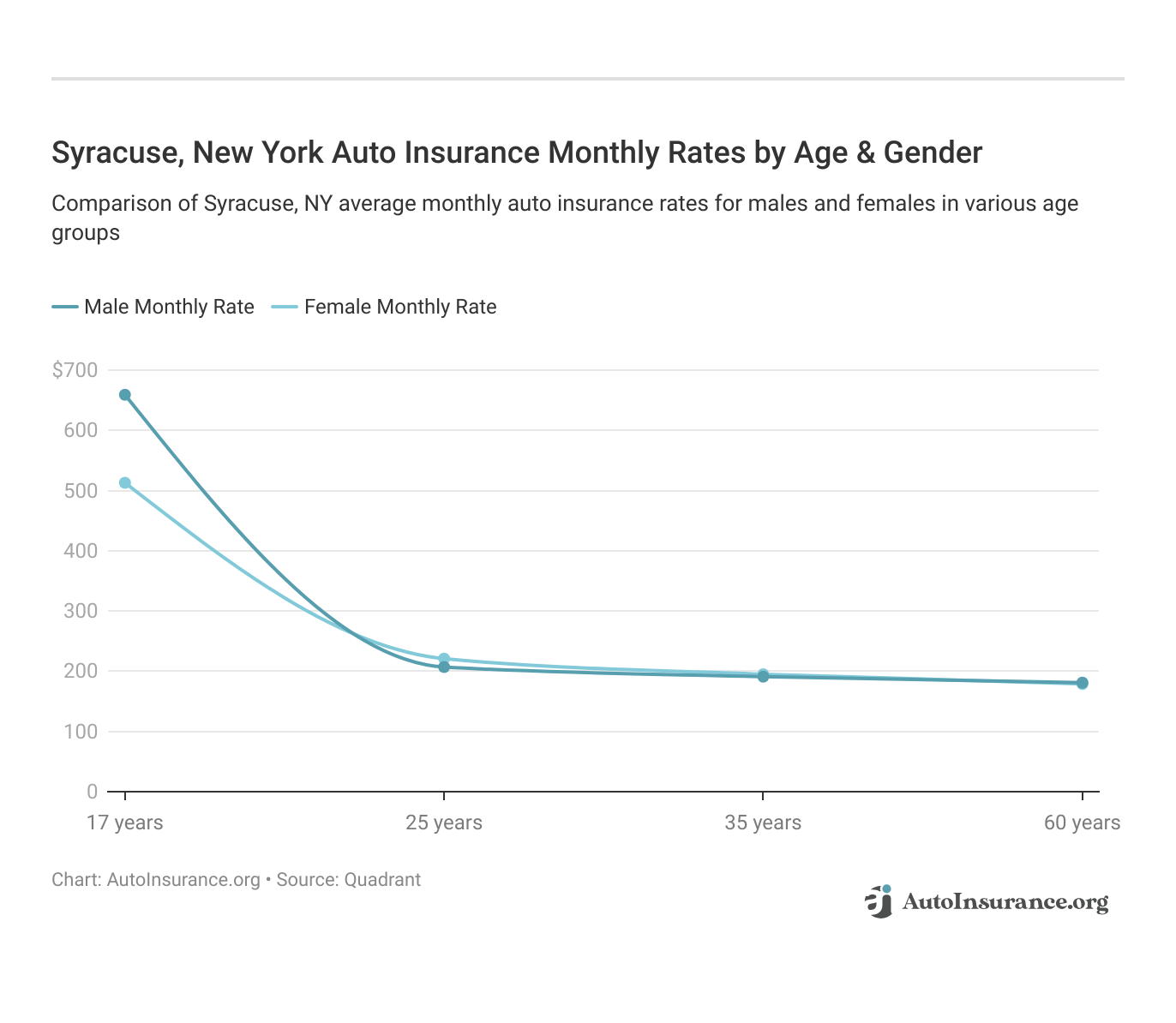

Age is a significant factor for Syracuse, NY car insurance rates. Young drivers are often considered high-risk. This Syracuse, New York does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Syracuse, NY.

To find the most affordable auto insurance in Syracuse, NY, start by comparing quotes from multiple providers like Geico, USAA, and Nationwide, as rates vary widely based on factors such as age, driving record, and coverage needs.

State Farm’s strong local presence in Syracuse, NY ensures personalized service through a network of dedicated agents.Kristen Gryglik Licensed Insurance Agent

By understanding how these elements impact your insurance costs, you can choose the best policy that fits your budget and personal circumstances.

Essential Auto Insurance Requirements in Syracuse, NY

Auto insurance laws vary from state to state. All Syracuse residents must carry the New York minimum level of auto insurance to drive on the roads legally.

You must also register your vehicle in the state of New York and not out-of-state. Currently, New Yorkers must purchase at least:

- $25,000 per person and $50,000 per incident in bodily injury liability insurance

- $10,000 in property damage liability coverage

- $50,000 in personal injury protection (PIP)

New York operates under a no-fault system, meaning your PIP coverage will cover medical expenses and lost wages from an accident, no matter who is at fault.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Influencing Auto Insurance Rates in Syracuse, NY

Despite an increase and auto theft rates, the mild Syracuse traffic congestion helps keep insurance costs down in your city.

INRIX ranks Syracuse as the 224th most congested city in America.

Commuter times in your city are also much lower than the national average of 26 minutes.

According to City-Data, the average commute length for Syracuse residents is only 17.4 minutes.

While the Federal Bureau of Investigation (FBI) recorded only 371 vehicle thefts in your town in 2017, that number has steadily increased ever since.

In 2019, there were 395.3 stolen vehicles per every 100,000 Syracuse residents, much higher than the state average. Explore more ways to save in our guide titled “Why does auto insurance vary from state to state?”

Comprehensive Coverage Options in Syracuse, NY

Overall, Syracuse auto insurance costs less than other major cities in the state.

For example, auto insurance in New York City, NY costs $624 per month compared to only $293 per month in Syracuse.

Quickly secure your best rates by comparing quotes from multiple providers online and asking about auto insurance discounts.

Find affordable Syracuse, NY auto insurance by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What is the average cost of auto insurance in Syracuse, NY?

The average cost of auto insurance in Syracuse, NY is $293 per month.

Which company offers the cheapest auto insurance in Syracuse, NY?

Geico is the cheapest auto insurance company in Syracuse, NY. However, rates may vary based on age, driving record, and coverage choices.

Learn more by reading our guide titled “Best Geico Auto Insurance Discounts.”

What is the minimum required auto insurance coverage in Syracuse, NY?

In Syracuse, NY, drivers must carry at least 25/50/10 in liability coverage and $50,000 worth of personal injury protection (PIP) to drive legally.

How does Syracuse, NY auto insurance rates compare to other major cities in New York?

Syracuse, NY auto insurance rates are lower compared to major cities like New York City. Auto insurance in Syracuse costs $293 per month, while in New York City, it’s $624 per month.

What factors can affect auto insurance rates in Syracuse, NY?

Several factors can impact auto insurance rates in Syracuse, NY, including age, driving record, credit score, coverage level, and risk factors such as commute distance, tickets, and DUIs.

To find out more, explore our guide titled “Cheap Auto Insurance After a DUI.”

How can I find reliable a insurance in Syracuse?

To find reliable a insurance in Syracuse, compare quotes from top providers and read customer reviews for the best options.

What are the top auto insurance companies in Syracuse, NY?

Top auto insurance companies in Syracuse, NY, include State Farm, Geico, Progressive, and Allstate, offering competitive rates and coverage.

How do I get auto insurance quotes in Syracuse?

You can get auto insurance quotes in Syracuse by using online comparison tools or contacting local agents directly for personalized quotes.

For additional details, explore our comprehensive resource titled “How to Find Auto Insurance Agents in Your Area.”

How do I secure the best car insurance rates in Syracuse?

To secure the best car insurance rates in Syracuse, maintain a clean driving record, bundle policies, and compare multiple providers.

How can I find the best cheap car insurance in Syracuse?

Find the best cheap car insurance in Syracuse by comparing quotes from multiple providers and taking advantage of available discounts.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

What is the best car insurance in Syracuse?

The best car insurance in Syracuse is typically offered by State Farm, known for competitive rates and excellent customer service.

Break down premiums and policy options in our State Farm vs. Travelers auto insurance review.

Where can I find car insurance agents in Syracuse?

Car insurance agents in Syracuse can be found through local directories or by visiting the websites of major insurance companies like State Farm and Geico.

Which car insurance companies in Syracuse, NY, are the most reliable?

Reliable car insurance companies in Syracuse, NY, include State Farm, Geico, and Progressive, known for strong customer service and competitive pricing.

How do I get cheap auto insurance in Syracuse, NY?

To get cheap auto insurance in Syracuse, NY, compare quotes, consider higher deductibles, and ask about discounts for safe driving or bundling.

Access comprehensive insights into our guide titled “What an Auto Insurance Specialist Says About Bundling Rates.”

How do insurance companies in Syracuse, NY determine coverage rates?

Insurance companies in Syracuse, NY determine coverage rates based on factors like your driving history, credit score, location, and the level of coverage selected.

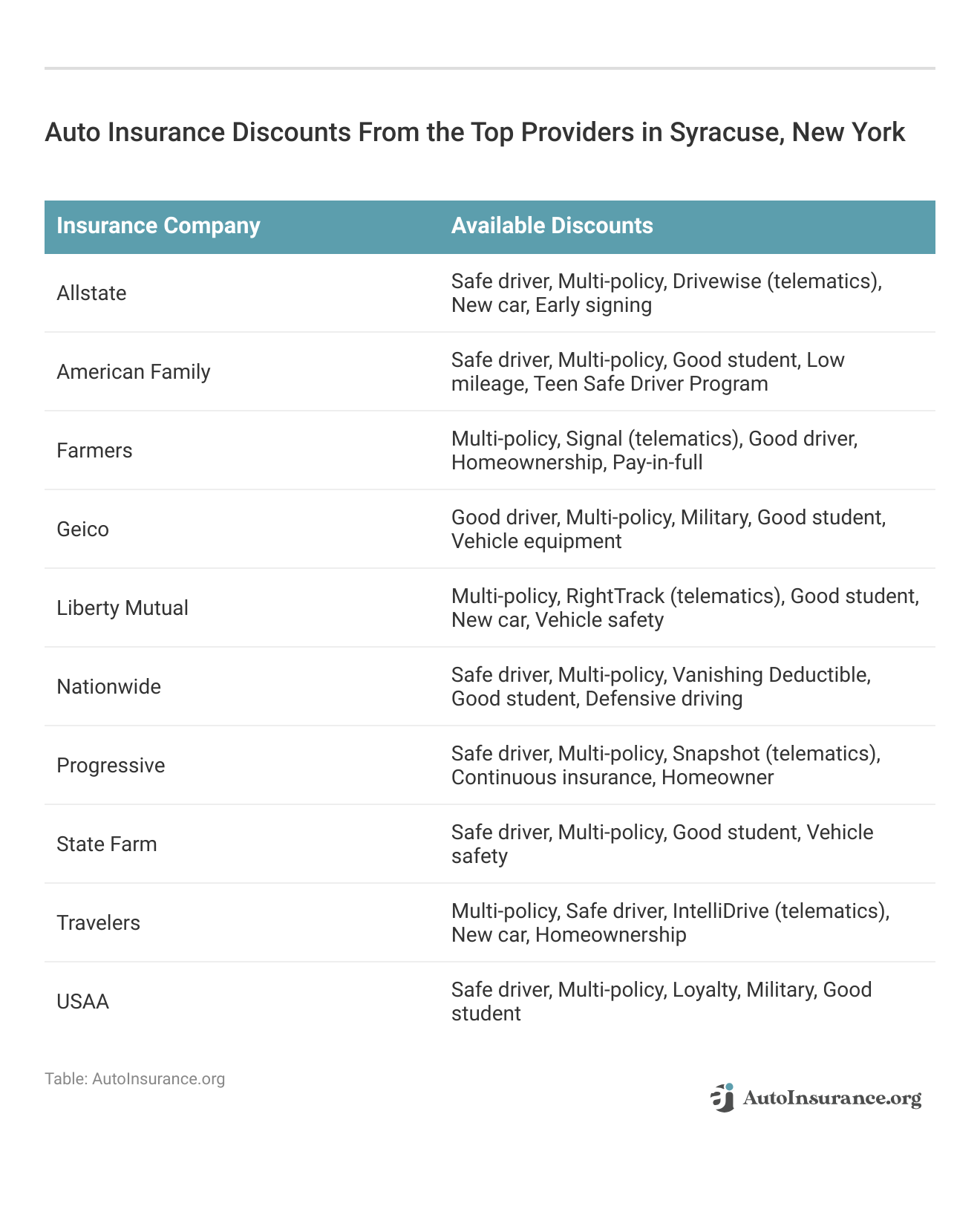

Are there discounts available from insurance companies in Syracuse, NY?

Yes, insurance companies in Syracuse, NY offer various discounts such as multi-policy bundling, good student discounts, and safe driving rewards.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.