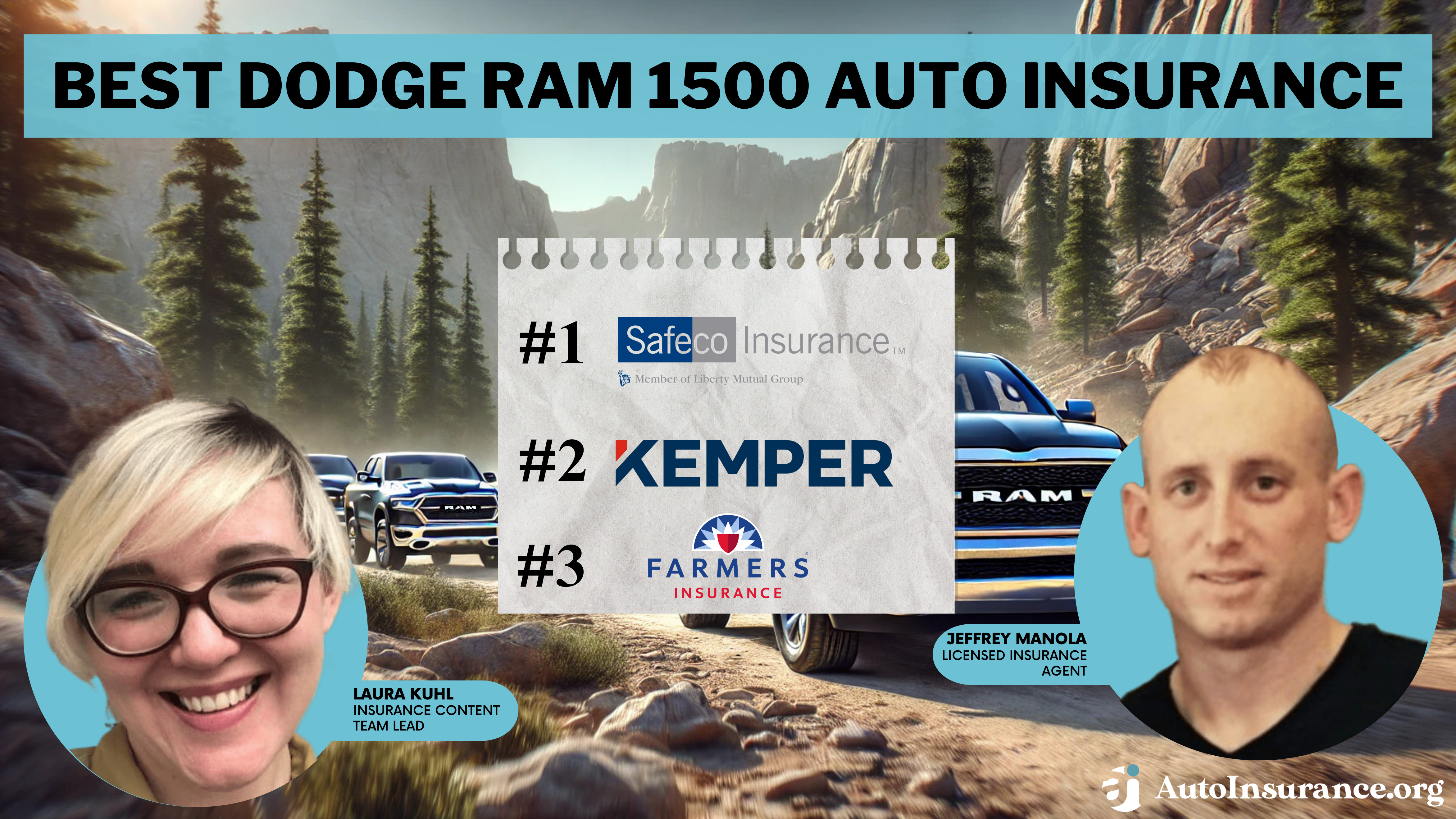

Best Dodge Ram 1500 Auto Insurance in 2025 (Top 10 Companies Ranked)

Safeco, Kemper, and Farmers are the top providers for the best Dodge Ram 1500 auto insurance, offering rates as low as $24/month. Safeco stands out overall, Kemper excels in comprehensive coverage, and Farmers offers great add-ons. These companies ensure your Dodge Ram 1500 is well-protected with excellent value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,277 reviews

1,277 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,277 reviews

1,277 reviews 210 reviews

210 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

210 reviews

210 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe top pick overall for the best Dodge Ram 1500 auto insurance are Safeco, Kemper, and Farmers, offering competitive rates starting at $24/month. Safeco stands out for its overall excellence, providing robust coverage options and discounts.

Kemper excels in comprehensive coverage, while Farmers is known for its great add-ons. These companies ensure your Dodge Ram 1500 is well-protected and affordable to insure.

Our Top 10 Company Picks: Best Dodge Ram 1500 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A | Online Tools | Safeco | |

| #2 | 15% | A++ | Comprehensive Coverage | Kemper | |

| #3 | 20% | A | Great Add-ons | Farmers | |

| #4 | 15% | A | Variety of Discounts | American National | |

| #5 | 10% | A+ | Filing Claims | Erie |

| #6 | 15% | B | Localized Service | Farm Bureau | |

| #7 | 25% | A | Occupational Discount | Liberty Mutual |

| #8 | 15% | A+ | High-Risk Insurance | Direct Auto |

| #9 | 15% | A- | Technology Integration | Clearcover | |

| #10 | 20% | A+ | Widespread Availability | Nationwide |

Do you want cheap auto insurance for your Dodge Ram 1500? You can buy good, cheap Dodge Ram 1500 auto insurance coverage under the right circumstances. The Dodge Ram 1500 is a multifunction tailgate pickup truck with a powerful engine.

Are you ready to buy Dodge Ram 1500 auto insurance? Compare your Dodge Ram 1500 auto insurance rates by entering your ZIP code in our free online tool above.

- The best Dodge Ram 1500 auto insurance options with rates starting at $24/month

- Safeco is the top pick for the best Dodge Ram 1500 auto insurance

- Comparing quotes can help find the best auto insurance rates tailored to your needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Safeco: Top Overall Pick

Pros

- Comprehensive Online Tools: Safeco excels in providing an intuitive online platform for managing Dodge Ram 1500 insurance.

- Competitive Monthly Rates: Safeco offers competitive rates at $24 per month for Dodge Ram 1500 with minimum coverage.

- Multi-Vehicle Discount: Safeco auto insurance review provides a 15% discount for insuring multiple vehicles, benefiting Dodge Ram 1500 owners with more than one vehicle.

Cons

- Limited Local Agents: Safeco’s services might be limited in areas with fewer local agents, impacting Dodge Ram 1500 owners in remote locations.

- Complex Claim Process: Some users report a more complex claims process compared to competitors, which might affect Dodge Ram 1500 owners during claims.

#2 – Kemper: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Kemper offers extensive coverage options tailored for Dodge Ram 1500.

- Affordable Monthly Premiums: Kemper auto insurance review provides affordable rates at $49 per month for Dodge Ram 1500 with minimum coverage.

- High Financial Strength: Kemper holds an A++ rating, ensuring reliability for Dodge Ram 1500 insurance claims.

Cons

- Limited Discounts: Kemper offers fewer discounts compared to some competitors, potentially affecting Dodge Ram 1500 owners looking for savings.

- Customer Service: Some customers have reported less satisfactory customer service experiences, which could impact Dodge Ram 1500 owners needing support.

#3 – Farmers: Best for Great Add-Ons

Pros

- Comprehensive Add-Ons: Farmers offers a wide range of add-ons, enhancing coverage for Dodge Ram 1500.

- Reasonable Rates: Farmers auto insurance review provides competitive rates at $65 per month for Dodge Ram 1500 with minimum coverage.

- Multi-Policy Discounts: Farmers offers a 20% discount for bundling multiple policies, benefiting Dodge Ram 1500 owners.

Cons

- Limited Online Tools: Farmers’ online tools are not as robust as some competitors, potentially impacting Dodge Ram 1500 owners who prefer digital management.

- Premium Costs: Despite discounts, some coverage levels might still be relatively higher for Dodge Ram 1500 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American National: Best for Variety of Discounts

Pros

- Wide Range of Discounts: American National offers a variety of discounts, beneficial for Dodge Ram 1500 insurance.

- Competitive Monthly Premiums: American National autoinsurance review provides affordable rates at $48 per month for Dodge Ram 1500 with minimum coverage.

- Reliable Financial Strength: American National holds an A rating, ensuring reliability for Dodge Ram 1500 insurance claims.

Cons

- Limited Availability: American National’s services might be limited in certain areas, affecting Dodge Ram 1500 owners in those locations.

- Customer Service: Some customers report less satisfactory customer service experiences, which could impact Dodge Ram 1500 owners needing support.

#5 – Erie: Best for Filing Claims

Pros

- Efficient Claims Process: Based on Erie auto insurance review, Erie excels in providing a smooth claims process for Dodge Ram 1500 insurance.

- Affordable Monthly Rates: Erie offers competitive rates at $67 per month for Dodge Ram 1500 with minimum coverage.

- Strong Financial Rating: Erie holds an A+ rating, ensuring reliability for Dodge Ram 1500 insurance claims.

Cons

- Limited Discounts: Erie offers fewer discounts compared to some competitors, potentially affecting Dodge Ram 1500 owners looking for savings.

- Availability: Erie’s services might be limited in some regions, impacting Dodge Ram 1500 owners in those areas.

#6 – Farm Bureau: Best for Localized Service

Pros

- Personalized Service: Farm Bureau auto insurance review provides localized and personalized service for Dodge Ram 1500 insurance.

- Reasonable Rates: Farm Bureau offers competitive rates at $83 per month for Dodge Ram 1500 with minimum coverage.

- Multi-Vehicle Discount: Farm Bureau provides a 15% discount for insuring multiple vehicles, benefiting Dodge Ram 1500 owners with more than one vehicle.

Cons

- Limited Online Tools: Farm Bureau’s online tools are not as robust as some competitors, potentially impacting Dodge Ram 1500 owners who prefer digital management.

- Regional Limitations: Farm Bureau’s services might be limited to certain regions, affecting Dodge Ram 1500 owners outside those areas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Occupational Discounts

Pros

- Occupational Discounts: Liberty Mutual offers discounts for various professions, benefiting Dodge Ram 1500 owners.

- Competitive Monthly Rates: Liberty Mutual auto insurance review provides affordable rates at $85 per month for Dodge Ram 1500 with minimum coverage.

- High Multi-Vehicle Discount: Liberty Mutual offers a 25% discount for insuring multiple vehicles, advantageous for Dodge Ram 1500 owners with more than one vehicle.

Cons

- Premium Costs: Despite discounts, some coverage levels might still be relatively higher for Dodge Ram 1500 owners.

- Customer Service: Some customers report less satisfactory customer service experiences, which could impact Dodge Ram 1500 owners needing support.

#8 – Direct Auto: Best for High-Risk Insurance

Pros

- High-Risk Coverage: Direct Auto specializes in providing coverage for high-risk drivers, beneficial for some Dodge Ram 1500 owners.

- Affordable Monthly Premiums: Direct Auto offers competitive rates at $82 per month for Dodge Ram 1500 with minimum coverage.

- Multi-Vehicle Discount: Direct Auto car insurance review provides a 15% discount for insuring multiple vehicles, benefiting Dodge Ram 1500 owners with more than one vehicle.

Cons

- Limited Coverage Options: Direct Auto might offer fewer coverage options compared to some competitors, impacting Dodge Ram 1500 owners looking for comprehensive plans.

- Customer Service: Some customers have reported less satisfactory customer service experiences, which could impact Dodge Ram 1500 owners needing support.

#9 – Clearcover: Best for Technology Integration

Pros

- Advanced Technology Integration: Clearcover excels in providing a tech-forward platform for managing Dodge Ram 1500 insurance.

- Competitive Monthly Rates: Clearcover offers competitive rates at $93 per month for Dodge Ram 1500 with minimum coverage.

- Multi-Vehicle Discount: Clearcover auto insurance review provides a 15% discount for insuring multiple vehicles, benefiting Dodge Ram 1500 owners with more than one vehicle.

Cons

- Limited Local Agents: Clearcover’s services might be limited in areas with fewer local agents, impacting Dodge Ram 1500 owners in remote locations.

- Customer Service: Some customers report less satisfactory customer service experiences, which could impact Dodge Ram 1500 owners needing support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Widespread Availability

Pros

- Widespread Availability: Nationwide auto insurance review provides extensive coverage across various regions, benefiting Dodge Ram 1500 owners everywhere.

- Reasonable Monthly Premiums: Nationwide offers competitive rates at $95 per month for Dodge Ram 1500 with minimum coverage.

- Multi-Policy Discounts: Nationwide offers a 20% discount for bundling multiple policies, advantageous for Dodge Ram 1500 owners.

Cons

- Premium Costs: Despite discounts, some coverage levels might still be relatively higher for Dodge Ram 1500 owners.

- Limited Discounts: Nationwide offers fewer discounts compared to some competitors, potentially affecting Dodge Ram 1500 owners looking for savings.

Dodge Ram 1500 Auto Insurance Costs

Is Dodge auto insurance for Dodge Ram 1500s cheaper than the average truck? Costs can vary based on the trim and model year—which raises more questions than answers. Dodge Ram 1500 insurance depends on many factors.

Dodge Ram 1500 Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $48 | $95 | |

| $93 | $185 | |

| $82 | $163 |

| $67 | $134 |

| $83 | $166 |

| $65 | $135 | |

| $49 | $98 | |

| $85 | $168 |

| $95 | $190 |

| $24 | $47 |

Your rate will likely vary from the average because so many things come into play when auto insurance rates get calculated, such as age, driving record, credit history, and coverage level. The factors related to the vehicle itself include theft rates, claims history, and repair costs. We’ll break down each of these in the following sections.

How Frequency of Claims Filed Affect Dodge Ram 1500 Auto Insurance Quotes

Some car models are associated with higher numbers of car insurance claims, affecting your auto insurance rates. The following information comes from the Insurance Information Institute (III).

Passenger Vehicle Collision Coverage Insurance Losses

| Vehicle Type | Claim Frequency | Claim Severity | Overall Loss |

|---|---|---|---|

| All passenger vehicles | 7.3 | $6,005 | $438 |

| Passenger cars and minivans | 8.4 | $5,949 | $501 |

| Pickups | 6.2 | $6,100 | $380 |

| SUVs | 6.5 | $6,045 | $393 |

When it comes to losses for personal injury protection, the Dodge Ram 1500 is average. Let’s examine what some of these terms mean.

- Claims Frequency: Per 100 vehicles years insured.

- Overall Loss: Represents the average loss of payment in vehicle years.

- All Passenger Vehicles: Includes claims from cargo and passenger vans.

The results will always be from the car model’s first-year sales to the beginning of the following calendar year. If you file too many claims, it will have a direct impact on your auto insurance rates. The more claims you file, the higher your car insurance will be. If you file too many claims, your auto insurance company will not likely renew your policy.

As a Dodge Ram 1500 owner, you should have the minimum auto insurance requirements for your state.

- Bodily Injury: Bodily injury coverage pays for medical bills for an accident where you were at fault.

- Property Damage: Property damage coverage pays the cost of repairs for an accident where you were at fault.

Each state will have its own minimum requirements for bodily injury liability auto insurance and property damage coverage. To go above the minimum, drivers can opt for full coverage auto insurance, usually consisting of collision, comprehensive, and liability coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Full Coverage Auto Insurance Rates for Dodge Ram 1500

You may be wondering, “Do I need full coverage insurance to finance a car?” The answer is yes, to protect the financer’s interest in the vehicle. Lenders can take out force-placed insurance to cover your vehicle if you don’t carry the required insurance.

This coverage only protects the lender and doesn’t cover you if you get in an accident. Force-placed insurance is something that you pay for, and it’s expensive.

You can save more money by purchasing full coverage auto insurance. Here’s a list of the full coverage auto insurance rates for the Dodge Ram 1500.

Dodge Ram 1500 Full Coverage Auto Insurance Rates by Model Year

| Model Year | Monthly Rates |

|---|---|

| 2024 Dodge Ram 1500 | $133 |

| 2023 Dodge Ram 1500 | $132 |

| 2022 Dodge Ram 1500 | $130 |

| 2021 Dodge Ram 1500 | $128 |

| 2020 Dodge Ram 1500 | $127 |

| 2019 Dodge Ram 1500 | $126 |

| 2018 Dodge Ram 1500 | $125 |

| 2017 Dodge Ram 1500 | $125 |

| 2016 Dodge Ram 1500 | $123 |

These insurance rates are average for the trim and model and with the assumption that the driver is a 40-year-old male with full coverage who pays a $500 deductible.

How Size and Class of the Dodge Ram 1500 Affects Liability Auto Insurance Rates

The Dodge Ram 1500 is a large pickup with a crew cab. The class of the Dodge Ram 1500 and other pickup trucks is determined by the gross vehicle weight rating created by the U.S. Department of Transportation.

Heavier vehicles provide better protection for the occupants than smaller, lighter vehicles. Large vehicles have more protection in frontal crashes and will continue to move forward in crashes with smaller vehicles or when faced with obstacles.

Lighter vehicles will be at a disadvantage in a car accident. However, car manufacturers have reduced the threats that pickups and SUVs pose to other vehicles in a crash. If you have liability coverage, you’ll have bodily injury liability. As mentioned before, this helps pay medical bills for the other parties involved in a car accident you caused.

Below are the losses for bodily injury for popular pickups, according to the Insurance Institute for Highway Safety.

Losses by Class and Size for Bodily Injury

| Vehicle | Bodily Injury Losses |

|---|---|

| Chevrolet Silverado 1500 | 36% |

| Chevrolet Silverado 1500 crew cab | 4% |

| Chevrolet Silverado 1500 crew cab 4WD | -12% |

| Chevrolet Silverado 1500 ext. cab | 31% |

| Chevrolet Silverado 1500 ext. cab 4WD | -16% |

| Ford F-150 | 11% |

| Ford F-150 4WD | -40% |

| Ford F-150 SuperCab | 9% |

| Ford F-150 SuperCab 4WD | -17% |

| Ford F-150 SuperCrew | -2% |

| Ford F-150 SuperCrew 4WD | -23% |

| GMC Sierra 1500 crew cab | -1% |

| GMC Sierra 1500 crew cab 4WD | -22% |

| GMC Sierra 1500 ext. cab 4WD | -9% |

| Nissan Titan crew cab short bed | 6% |

| Nissan Titan crew cab short bed 4WD | -7% |

| Nissan Titan XD crew cab 4WD | -5% |

| Ram 1500 crew cab LWB 4WD | -7% |

| Ram 1500 crew cab SWB | 21% |

| Ram 1500 crew cab SWB 4WD | 4% |

| Ram 1500 ext. cab | 43% |

| Ram 1500 ext. cab 4WD | 14% |

| Ram 1500 SWB | 27% |

| Toyota Tundra CrewMax | -15% |

| Toyota Tundra CrewMax 4WD | -23% |

| Toyota Tundra double cab | 16% |

| Toyota Tundra double cab 4WD | -31% |

The loss percentages represent the cost of claims for the vehicle compared to the premiums taken in by insurance companies for that vehicle. Positive numbers indicate the vehicle is worse than average (more claims filed), and negative numbers are better than average (fewer claims filed). Compared to other vehicles, the Dodge Ram 1500 is worse than average.

When you get auto insurance for your Dodge Ram 1500, you can decide to get high, medium, or low coverage. But what is the average cost of auto insurance for a Dodge Ram 1500? Let’s examine the cost of liability auto insurance for a Dodge Ram 1500.

Dodge Ram 1500 Minimum Coverage Auto Insurance Monthly Rates by Model Year

| Model Year | Minimum Coverage |

|---|---|

| 2024 Dodge Ram 1500 | $34 |

| 2023 Dodge Ram 1500 | $35 |

| 2022 Dodge Ram 1500 | $36 |

| 2021 Dodge Ram 1500 | $35 |

| 2020 Dodge Ram 1500 | $35 |

| 2019 Dodge Ram 1500 | $37 |

| 2018 Dodge Ram 1500 | $38 |

| 2017 Dodge Ram 1500 | $39 |

| 2016 Dodge Ram 1500 | $41 |

You’ll notice that older Dodge Ram 1500 vehicles have higher liability costs. Older vehicles have been through several claims, crash test ratings, and safety ratings. Those results conclude that some of the older Dodge Ram 1500s are more likely to be in a liability claim.

That could mean there are older Dodge Ram 1500s, or it could mean the new model years have done a better job of staying away from claims.

MRSP of the Dodge Ram 1500

MSRP stands for manufacturer-suggested retail price or the sticker price — this is the recommended price for new cars. Below are the fair market range and the MSRP for the Dodge Ram from the past five years.

Dodge Ram 1500 Fair Market Range and MSRP by Vehicle Trim and Model

| Dodge Ram 1500 Vehicle Trim and Model | 2024 MSRP | 2019 MSRP | 2018 MSRP | 2017 MSRP | 2016 MSRP |

|---|---|---|---|---|---|

| Crew Cab MSRP | $40,140 | $37,335 | $25,450 | $24,190 | $22,476 |

| Crew Cab Fair Market Range | $34,695 - $38,454 | $32,028 - $35,307 | $23,101 - $25,740 | $21,941 - $24,638 | $20,332 - $23,069 |

| Quad Cab MSRP | NA | $38,035 | $26,182 | $23,634 | $22,272 |

| Quad Cab Fair Market Range | NA | $32,783 - $35,974 | $23,981 - $26,724 | $21,602 - $24,265 | $20,231 - $22,962 |

| Regular Cab MSRP | NA | NA | $20,026 | $18,718 | $18,099 |

| Regular Cab Fair Market Range | NA | NA | $17,311 - $21,740 | $15,716 - $19,919 | $15,115 - $19,282 |

The data above comes from Kelley Blue Book. The fair market range is the range of prices that a person will pay for a vehicle. The difference between MSRP and fair market range is that you can negotiate an MSRP. The fair purchase price is what consumers are likely paying for the vehicle. The MSRP doesn’t directly affect auto insurance rates, but other factors do, such as your driving record, age, and location.

The age and value of your truck can affect insurance rates as well. Here’s a simplified look at the MSRP and FMR of a Dodge Ram 1500.

Dodge Ram 1500 MSRP and Fair Market Range

| Dodge Ram 1500 Model Years | Manufacturer Suggested Retail Price (MSRP) | Fair Market Range (FMR) |

|---|---|---|

| 2024 Dodge Ram 1500 | $42,500 | $36,895 - $41,254 |

| 2023 Dodge Ram 1500 | $41,800 | $36,295 - $40,654 |

| 2022 Dodge Ram 1500 | $41,200 | $35,695 - $40,054 |

| 2021 Dodge Ram 1500 | $40,700 | $35,195 - $39,554 |

| 2020 Dodge Ram 1500 | $40,140 | $34,695 - $38,454 |

| 2019 Dodge Ram 1500 | $37,335 | $32,028 - $35,307 |

| 2018 Dodge Ram 1500 | $25,450 | $23,101 - $25,740 |

| 2017 Dodge Ram 1500 | $24,190 | $21,941 - $24,638 |

| 2016 Dodge Ram 1500 | $22,476 | $20,332 - $23,069 |

The newer Dodge Ram 1500s are worth more. All vehicles lose their value once they leave the lot. Therefore, your Dodge Ram 1500 auto insurance rates will increase as the value of your truck gets higher. However, your car insurance rates can vary based on the coverage.

How MSRP of the Dodge Ram 1500 Affects Collision Auto Insurance Rates

Collision insurance pays to repair damage to your vehicle after an accident, regardless of who was at fault. Below are auto insurance rates for collision coverage for the Dodge Ram 1500 for different years.

Dodge Ram 1500 Collision Auto Insurance Rates by Model Year

| Model Year | Monthly Rates |

|---|---|

| 2024 Dodge Ram 1500 | $53 |

| 2023 Dodge Ram 1500 | $52 |

| 2022 Dodge Ram 1500 | $51 |

| 2021 Dodge Ram 1500 | $50 |

| 2020 Dodge Ram 1500 | $47 |

| 2019 Dodge Ram 1500 | $45 |

| 2018 Dodge Ram 1500 | $45 |

| 2017 Dodge Ram 1500 | $44 |

| 2016 Dodge Ram 1500 | $42 |

The rates from this table are based on a 40-year-old male driver with a $500 deductible. Depending on where you live, you may pay more or less for auto insurance. For example, your rates may increase or decrease if you move from one ZIP code to the next.

Losses For Collision By Class and Size

| Vehicle | Collision |

|---|---|

| Chevrolet Silverado 1500 | -4% |

| Chevrolet Silverado 1500 4WD | -20% |

| Chevrolet Silverado 1500 crew cab | -2% |

| Chevrolet Silverado 1500 crew cab 4WD | 0% |

| Chevrolet Silverado 1500 ext. cab | 5% |

| Chevrolet Silverado 1500 ext. cab 4WD | -10% |

| Ford F-150 | -36% |

| Ford F-150 4WD | -45% |

| Ford F-150 SuperCab | -22% |

| Ford F-150 SuperCab 4WD | -36% |

| Ford F-150 SuperCrew | -27% |

| Ford F-150 SuperCrew 4WD | -28% |

| GMC Sierra 1500 | -20% |

| GMC Sierra 1500 4WD | -25% |

| GMC Sierra 1500 crew cab | -4% |

| GMC Sierra 1500 crew cab 4WD | -7% |

| GMC Sierra 1500 ext. cab | -5% |

| GMC Sierra 1500 ext. cab 4WD | -7% |

| Nissan Titan | -42% |

| Nissan Titan crew cab short bed | 10% |

| Nissan Titan crew cab short bed 4WD | 5% |

| Nissan Titan King cab pickup 4WD | 15% |

| Nissan Titan XD crew cab | 24% |

| Nissan Titan XD crew cab 4WD | 28% |

| Ram 1500 crew cab LWB | -5% |

| Ram 1500 crew cab LWB 4WD | -8% |

| Ram 1500 crew cab SWB | 0% |

| Ram 1500 crew cab SWB 4WD | -7% |

| Ram 1500 ext. cab | -6% |

| Ram 1500 ext. cab 4WD | -11% |

| Ram 1500 LWB | -31% |

| Ram 1500 LWB 4WD | -35% |

| Ram 1500 SWB | -15% |

| Ram 1500 SWB 4WD | -27% |

| Toyota Tundra CrewMax | -13% |

| Toyota Tundra CrewMax 4WD | -11% |

| Toyota Tundra double cab | -10% |

| Toyota Tundra double cab 4WD | -18% |

| Toyota Tundra double cab LWB 4WD | -4% |

The information in the table above comes from the Insurance Institute for Highway Safety (IIHS). Looking at the loss percentages for collision insurance, the Dodge Ram 1500 was average. In addition, some models of the vehicle were better than average.

How MSRP of the Dodge Ram 1500 Affects Comprehensive Auto Insurance Rates

When you have comprehensive insurance, it covers damage to your vehicle not caused by a collision. Below are comprehensive auto insurance rates for the Dodge Ram 1500.

Dodge Ram 1500 Comprehensive Auto Insurance Rates by Model Year

| Model Year | Monthly Rates |

|---|---|

| 2024 Dodge Ram 1500 | $34 |

| 2023 Dodge Ram 1500 | $33 |

| 2022 Dodge Ram 1500 | $32 |

| 2021 Dodge Ram 1500 | $31 |

| 2020 Dodge Ram 1500 | $30 |

| 2019 Dodge Ram 1500 | $29 |

| 2018 Dodge Ram 1500 | $28 |

| 2017 Dodge Ram 1500 | $27 |

| 2016 Dodge Ram 1500 | $26 |

The information in the table above uses the same driver parameters as the previous section and also comes from the IIHS.

Losses by Class and Size for Comprehensive

| Vehicle | Comprehensive |

|---|---|

| Chevrolet Silverado 1500 | 8% |

| Chevrolet Silverado 1500 4WD | -2% |

| Chevrolet Silverado 1500 crew cab | 26% |

| Chevrolet Silverado 1500 crew cab 4WD | 36% |

| Chevrolet Silverado 1500 ext. cab | 2% |

| Chevrolet Silverado 1500 ext. cab 4WD | 4% |

| Ford F-150 | -41% |

| Ford F-150 4WD | -35% |

| Ford F-150 SuperCab | -18% |

| Ford F-150 SuperCab 4WD | -21% |

| Ford F-150 SuperCrew | -6% |

| Ford F-150 SuperCrew 4WD | 2% |

| GMC Sierra 1500 | 18% |

| GMC Sierra 1500 4WD | -18% |

| GMC Sierra 1500 crew cab | 35% |

| GMC Sierra 1500 crew cab 4WD | 33% |

| GMC Sierra 1500 ext. cab | 4% |

| GMC Sierra 1500 ext. cab 4WD | -4% |

| Nissan Titan crew cab short bed | 15% |

| Nissan Titan crew cab short bed 4WD | 21% |

| Nissan Titan XD crew cab | 138% |

| Nissan Titan XD crew cab 4WD | 88% |

| Ram 1500 crew cab LWB | -25% |

| Ram 1500 crew cab LWB 4WD | 3% |

| Ram 1500 crew cab SWB | -2% |

| Ram 1500 crew cab SWB 4WD | -8% |

| Ram 1500 ext. cab | -13% |

| Ram 1500 ext. cab 4WD | -13% |

| Ram 1500 LWB | -44% |

| Ram 1500 LWB 4WD | -23% |

| Ram 1500 SWB | -20% |

| Ram 1500 SWB 4WD | -38% |

| Toyota Tundra CrewMax | -8% |

| Toyota Tundra CrewMax 4WD | 2% |

| Toyota Tundra double cab | -12% |

| Toyota Tundra double cab 4WD | -1% |

| Toyota Tundra double cab LWB 4WD | -27% |

The Dodge Ram 1500 was average for comprehensive insurance compared to other vehicles. Some models of the Dodge Ram 1500 were better than average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dodge Ram 1500 Theft Rates

In addition to the vehicle’s overall value, insurance companies gauge how likely a vehicle will get stolen. It costs an insurer a lot to replace a vehicle under comprehensive coverage. So the car insurance company will offset the risk with a higher premium.

You can help reduce the likelihood of theft by installing car alarms, tracking systems, and other devices to help prevent theft and ensure you recover your vehicle. The National Insurance Crime Bureau (NICB) annually compiles a top 10 list of the most frequently stolen vehicles.

A full-size Dodge Ram 1500 pickup is one of the most frequently stolen cars, ranked at number nine on the list. There were 1,155 Ram trucks stolen in 2001.

How Auto Insurance Quotes for the Dodge Ram 1500 Compare to Other Trucks

If a powerful pickup truck suits your driving needs best, then you’re probably well aware of the Dodge Ram 1500. However, while you’re reviewing each truck’s price tag and capabilities, you should also consider Dodge Ram 1500 insurance costs before making your decision.

We’ve mentioned other vehicles in the previous sections but didn’t show how the Dodge Ram 1500 compares against other trucks. Let’s compare the Dodge Ram 1500 car insurance rates to the most popular trucks in the United States.

Dodge Ram 1500 Auto Insurance Monthly Rates vs. Other Pickup Trucks

| Make & Model | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| Ford Ranger | $21 | $39 | $31 | $105 |

| Ford F-150 | $27 | $39 | $31 | $110 |

| Dodge Ram 3500 | $22 | $33 | $48 | $121 |

| GMC Sierra 1500 | $28 | $50 | $31 | $122 |

| Toyota Tundra | $28 | $44 | $35 | $122 |

| Chevrolet Silverado 1500 | $27 | $47 | $35 | $124 |

| Dodge Ram 1500 | $30 | $47 | $35 | $127 |

| Ford F-Series Super Duty | $27 | $51 | $39 | $132 |

| Chevrolet Silverado 2500HD | $30 | $57 | $35 | $138 |

The Dodge Ram 1500 has one of the most expensive monthly car insurance rates compared to other vehicles. Depending on the company and other factors that determine auto insurance, you could pay less under the right circumstances. Continue reading to learn how you can save money on a Dodge Ram 1500.

How to Save on Dodge Ram 1500 Auto Insurance

Before you compare the insurance rates of the Dodge Ram 1500, it’s important to consider your circumstances. In other words, what you might pay to insure your Dodge Ram 1500 could be very different from what someone with the same truck might pay.

The more likely someone is to get into an accident and file an auto insurance claim, the more a company will charge them to insure their car. If you have a great driving record, there’s a good chance your insurance rates will be lower than those of someone who has caused several accidents. Alternatively, if you’ve received several speeding tickets, you’ll probably pay more for Dodge Ram insurance rates than someone who hasn’t.

If you live in the city and drive your Dodge Ram 1500 daily, your insurance will likely be more expensive than someone who drives their truck occasionally on a farm. Even if you’re a great driver, the more your truck is on the road and in heavy traffic, the more likely an accident is.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Required Auto Insurance Coverages for the Dodge Ram 1500

How much insurance coverage a driver decides to buy will also affect their rates. For example, if one Dodge Ram 1500 owner buys plenty of coverage for their truck, but another driver purchases a minimum amount, the first driver will pay more.

Car accidents have serious and costly effects. However, having good coverage could save you from financial ruin. Liability insurance pays for damages you cause to a person or property in an accident. Nearly every state requires drivers to have liability insurance for their vehicles. The minimum amount you’re required to have varies from state to state.

You can check with your state’s regulating body to determine the requirements. For example, the Oregon Department of Motor Vehicles oversees the state’s insurance regulations.

In addition to liability car insurance, many drivers purchase other policies like collision and comprehensive for their vehicles. Collision insurance pays for the repairs your car needs in an accident you cause. Comprehensive insurance covers damages that don’t happen in a car accident. For example, if your Dodge Ram 1500 is broken into or vandalized, comprehensive insurance would cover the repairs.

Other Dodge Ram 1500 Auto Insurance Coverages

In this section, we’re going to cover how safety ratings affect personal injury protection and medical payment insurance. We’ve included more data from the IIHS to show you how claims affect these coverages.

A number of the top factors that affect auto insurance rates are based on you, the driver. Others are based on the insurance company you choose. Two different companies can have drastically different rates for the same types of coverage, as you may see while searching for rates.

Personal injury protection auto insurance covers medical expenses and lost wages. This type of coverage protects you, and it doesn’t matter if you were at fault for the accident.

Losses For Personal Injury By Class and Size

| Vehicle | Personal Injury Losses |

|---|---|

| Chevrolet Silverado 1500 | -25% |

| Chevrolet Silverado 1500 4WD | -63% |

| Chevrolet Silverado 1500 crew cab | -20% |

| Chevrolet Silverado 1500 crew cab 4WD | -37% |

| Chevrolet Silverado 1500 ext. cab | -9% |

| Chevrolet Silverado 1500 ext. cab 4WD | -38% |

| Ford F-150 | -31% |

| Ford F-150 4WD | -58% |

| Ford F-150 SuperCab | -26% |

| Ford F-150 SuperCab 4WD | -45% |

| Ford F-150 SuperCrew | -25% |

| Ford F-150 SuperCrew 4WD | -45% |

| GMC Sierra 1500 crew cab | -21% |

| GMC Sierra 1500 crew cab 4WD | -44% |

| GMC Sierra 1500 ext. cab | -31% |

| GMC Sierra 1500 ext. cab 4WD | -43% |

| Nissan Titan crew cab short bed | -6% |

| Nissan Titan crew cab short bed 4WD | -32% |

| Nissan Titan XD crew cab 4WD | -30% |

| Ram 1500 crew cab LWB 4WD | -40% |

| Ram 1500 crew cab SWB | -11% |

| Ram 1500 crew cab SWB 4WD | -29% |

| Ram 1500 ext. cab | 1% |

| Ram 1500 ext. cab 4WD | -29% |

| Ram 1500 SWB | -21% |

| Toyota Tundra CrewMax | -24% |

| Toyota Tundra CrewMax 4WD | -33% |

| Toyota Tundra double cab | -12% |

| Toyota Tundra double cab 4WD | -41% |

The Dodge Ram 1500 was better than average when it came to the losses for personal injury protection. While, Medical payments auto insurance covers medical expenses for all passengers involved in the accident.

Losses By Medical Payment by Class and Size

| Vehicle | Medical Payment Losses |

|---|---|

| Chevrolet Silverado 1500 | -26% |

| Chevrolet Silverado 1500 4WD | -37% |

| Chevrolet Silverado 1500 crew cab | -14% |

| Chevrolet Silverado 1500 crew cab 4WD | -36% |

| Chevrolet Silverado 1500 ext. cab | 0% |

| Chevrolet Silverado 1500 ext. cab 4WD | -35% |

| Ford F-150 | -35% |

| Ford F-150 4WD | -44% |

| Ford F-150 SuperCab | -30% |

| Ford F-150 SuperCab 4WD | -46% |

| Ford F-150 SuperCrew | -22% |

| Ford F-150 SuperCrew 4WD | -46% |

| GMC Sierra 1500 crew cab | -22% |

| GMC Sierra 1500 crew cab 4WD | -45% |

| GMC Sierra 1500 ext. cab 4WD | -33% |

| Nissan Titan crew cab short bed 4WD | -22% |

| Nissan Titan XD crew cab 4WD | -37% |

| Ram 1500 crew cab LWB 4WD | -39% |

| Ram 1500 crew cab SWB | -2% |

| Ram 1500 crew cab SWB 4WD | -32% |

| Ram 1500 ext. cab | -4% |

| Ram 1500 ext. cab 4WD | -24% |

| Toyota Tundra CrewMax | -19% |

| Toyota Tundra CrewMax 4WD | -45% |

| Toyota Tundra double cab | -10% |

| Toyota Tundra double cab 4WD | -47% |

For the Dodge Ram 1500, the losses for medical payments coverage are better than average. This means that the vehicle is statistically less likely to result in high medical expenses for occupants in the event of an accident.

How Dodge Ram 1500 Safety Features Can Help Me Save on Auto Insurance

As a driver, you’ll likely appreciate the safety features of the Ram 1500. The truck uses the latest technology to help drivers prevent accidents and to protect them during a collision. All Ram 1500s have blindspot monitoring, Rear Cross Path, and Trailer Detection. These features scan areas you can’t see while driving and ensure your trailer is safe while maneuvering.

Here’s a complete list of the Dodge Ram 1500 safety features: driver air bag, passenger air bag, front head air bag, rear head air bag, front side air bag, 4-wheel ABS, 4-wheel disc brakes, brake assist, electronic stability control, daytime running lights, child safety locks, integrated turn signal mirrors, traction control, blind spot monitor, lane departure warning, lane keeping assist, and cross-traffic alert.

The truck is equipped with 14.9-inch standard brakes to enhance stopping power. Additionally, it includes six airbags in the front and sides of the truck. In the event of an accident, the front airbags feature adaptive venting technology that opens a vent within the airbag cushion, allowing the airbag to adapt to the occupant’s size in the front seat and the severity of the crash.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dodge Ram 1500 Safety

In 2019, the Dodge Ram 1500 got an update that enhanced the truck’s safety features and improved its safety ratings as well. Due to the 2019 updates, the Insurance Institute for Highway Safety (IIHS) named this vehicle a Top Safety Pick, affecting the 2019 Dodge Ram 1500’s auto insurance rates positively.

2020 Dodge Ram 1500 IIHS Ratings

| IIHS Dodge Ram 1500 Rating Overview | IIHS Ratings |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints & seats | Good |

| Headlights (varies by trim/ option) | Good |

| Front crash prevention: vehicle-to-vehicle | Good |

| Child Seat Anchors | Good |

For the overall evaluation, the Dodge Ram 1500 received a G for “good.” For the structure and safety cage, it also received a rating of G. For driver injury measures, the truck rated all Gs.

However, the Dodge Ram 1500 scored an “M” (marginal) for lower foot/leg. After the crash tests, the dummy’s position in the truck indicated that the driver’s survival space held up well after the crash. Redesigned models built after July 2018 have the cab mounts to the vehicle frame at the C-pillars strengthened to improve passenger protection in frontal crashes.

The front and side air bags helped keep the driver’s head from hitting the steering wheel. However, the lower left leg area showed some risk for injury for both crash tests done on the Dodge Ram 1500.

Crash test ratings reveal how a car handles damage from a crash and how well it protects the driver and other passengers. The National Highway Traffic Safety Administration (NHTSA) also performs crash tests to determine the vehicle’s safety.

Dodge Ram 1500 Safety Ratings Compared to Other Vehicles

The Dodge Ram 1500 was tested along with other popular trucks. So let’s compare the Dodge Ram 1500 NHTSA crash test ratings to other popular truck models.

Dodge Ram 1500 NHTSA Crash Test Ratings Compared to Popular Trucks

| NHTSA Rating Overview | Overall Rating | Frontal Crash | Side Crash | Rollover |

|---|---|---|---|---|

| 2024 Dodge Ram 1500 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Dodge Ram 1500 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Dodge Ram 1500 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Toyota Tundra | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Dodge Ram 1500 | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford F-150 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Chevrolet Silverado 1500 | 4 stars | 4 stars | 5 stars | 4 stars |

Compared to other trucks, the Dodge Ram 1500 is a tough competitor for other trucks. The Ford F-150 has slightly better crash ratings, but all trucks in the data are considered the best in the United States.

Dodge Ram 1500 Safety Ratings Compared to Other Vehicles of the Same Size and Class

In 2018, there were 34 deaths for pickup drivers per million registered vehicles compared to only 23 deaths per million registered vehicles for SUVs. For all occupants, pickups had 42 deaths, compared to 32 deaths for SUVs. Below are the deaths per million registered vehicles for pickups of various sizes provided by the IIHS.

Pickup Deaths Per Million Registered Vehicles

| Type of Pickup | Registered Vehicles | Deaths | Rate Per Million |

|---|---|---|---|

| Small | 1,276,485 | 33 | 26 |

| Large | 4,425,365 | 150 | 34 |

| Very Large | 1,797,517 | 54 | 30 |

| All Pickups | 7,499,367 | 256 | 34 |

The Dodge Ram 1500 is categorized as a large pickup. As you can see in the table above, large pickups had the highest number of deaths per million vehicles. The table below shows deaths by impact point and vehicle type for single vehicles.

Vehicle Occupant Deaths by Impact Point and Vehicle Type for One-Vehicle Accident

| Vehicle Occupants | Frontal | Side | Rear | Other (mostly rollover) | All |

|---|---|---|---|---|---|

| Car Occupants Number | 7,433 | 3,568 | 834 | 1,303 | 13,138 |

| Car Occupants Percent | 57 | 27 | 6 | 10 | 100 |

| Pickup Occupants Number | 2,493 | 807 | 173 | 896 | 4,369 |

| Pickup Occupants Percent | 57 | 18 | 4 | 21 | 100 |

| SUV Occupants Number | 2,784 | 930 | 286 | 1,035 | 5,035 |

| SUV Occupants Percent | 55 | 18 | 6 | 21 | 100 |

| All Occupants Number | 12,932 | 5,350 | 1,310 | 3,299 | 22,891 |

| All Occupants Percent | 56 | 23 | 6 | 14 | 100 |

Compared to SUVs and cars, pickup trucks had the fewest deaths by impact point. The table below shows deaths by impact point and vehicle type for multiple vehicle crashes.

Vehicle Occupant Deaths by Impact Point and Vehicle Type for Multiple Vehicles

| Vehicle Occupants | Frontal | Side | Rear | Other (mostly rollover) | All |

|---|---|---|---|---|---|

| Car Occupants Number | 4,577 | 2,616 | 738 | 118 | 8,049 |

| Car Occupants Percent | 57% | 33% | 9% | 1% | 100% |

| Pickup Occupant Number | 1,223 | 503 | 136 | 47 | 1,909 |

| Pickup Occupant Percent | 64% | 26% | 7% | 2% | 100% |

| SUV Occupants Number | 1,475 | 632 | 252 | 63 | 2,422 |

| SUV Occupants Percent | 61% | 26% | 10% | 3% | 100% |

| All Occupants Number | 7,426 | 3,784 | 1,143 | 236 | 12,589 |

| All Occupants Percent | 59% | 30% | 9% | 2% | 100 |

The data on vehicle occupant deaths by impact point reveals that pickup trucks have the fewest deaths compared to SUVs and cars in multiple vehicle crashes.

How Much it Costs to Repair a Dodge Ram 1500

Explore the average cost of repairs for a Dodge Ram 1500 including routine maintenance like oil changes. Over a five-year period, maintenance costs vary by mileage, with expenses typically increasing as the vehicle ages and accrues more miles.

Dodge Ram 1500 Maintenance Costs by Annual Mileage

| Year | 10,000 Miles | 15,000 Miles | 20,000 Miles |

|---|---|---|---|

| 1 Year | $191 | $272 | $544 |

| 2 Year | $353 | $612 | $612 |

| 3 Year | $339 | $1,645 | $2,205 |

| 4 Year | $272 | $833 | $1,286 |

| 5 Year | $1,563 | $272 | $2,413 |

Regular upkeep is crucial to avoid higher repair costs down the line, ensuring the vehicle remains in good working condition. Below are costs for repairs to certain vehicle parts of a Dodge Ram 1500.

Dodge Ram 1500 Maintenance Costs by Body Part

| Maintenance | Front Bumper | Front Door | Rear Door | Fender | Roof | Hood | Quarter Panel |

|---|---|---|---|---|---|---|---|

| Body Labor | $122 | $137 | $388 | $76 | $76 | $76 | $76 |

| Paint Labor | $137 | $94 | $448 | $144 | $205 | $175 | $175 |

| Paint Supplies | $94 | $19 | $307 | $99 | $140 | $120 | $120 |

| Color Tint | $19 | $10 | $19 | $19 | $19 | $19 | $19 |

| Haz Waste Disposal | $5 | $5 | $5 | $5 | $5 | $5 | $5 |

| Color Sand and Buff | $19 | $19 | $19 | $19 | $19 | $19 | $19 |

| Cover Car | NA | NA | $10 | $10 | $10 | $10 | $10 |

| Total | $395 | $409 | $1,253 | $372 | $475 | $423 | $423 |

Getting repairs for certain parts of a truck will cost more than others. When you get repairs, you’re not just paying for the part to be fixed but to have your car look new again. This includes paying for body labor, paint supplies, color tint, hazardous waste disposal, and sand buff.

How Cost of Repairs Affect Collision and Comprehensive Auto Insurance Rates

Comprehensive insurance covers you when you have damage to your car from things other than a car accident. Let’s say that a tree falls on your truck after a really bad thunderstorm. Your comprehensive insurance will pay for this damage. However, this coverage only applies to damage from incidents that aren’t car accidents.

Collision insurance covers you when you get into a car accident, and the other person’s liability won’t pay for the damages. Usually, this would be a situation where you were at fault or a hit-and-run. Learn more about collision vs. comprehensive auto insurance.

With this coverage, you can repair or replace your car. If you rear-end another driver and damage your vehicle, you would use collision insurance. The cost to repair a vehicle affects the insurance rates for both coverage options. A car that is older and not worth much will have much lower collision and comprehensive rates than a brand-new vehicle.

Case Studies: Finding the Best Dodge Ram 1500 Auto Insurance

When insuring your Dodge Ram 1500, finding the best coverage at an affordable rate is essential. Below are three case studies that highlight how different providers meet the unique needs of Dodge Ram 1500 owners.

- Case Study #1 – Competitive Rate: John, a Dodge Ram 1500 owner, chose Safeco for its excellent coverage options and competitive rate of $24/month. Safeco’s multiple vehicle auto insurance discounts and superior customer service ensured his vehicle was well-protected and affordable.

- Case Study #2 – Comprehensive Coverage: Emily needed extensive coverage for her Dodge Ram 1500 due to a high theft rate in her area. Kemper’s comprehensive coverage addressed her concerns, providing protection against theft and vandalism at reasonable rates.

- Case Study #3 – Best for Add-Ons: Mike required an insurance provider offering valuable add-ons for his Dodge Ram 1500 used for personal and work purposes. Farmers provided rental vehicle reimbursement and gap coverage, giving him the flexibility and coverage he needed at a competitive rate.

Whether you need comprehensive coverage, protection against theft, or valuable add-ons, these providers offer solutions that ensure your vehicle is well-protected and affordable to insure.

Safeco is the top choice for Dodge Ram 1500 insurance, offering comprehensive coverage and affordable rates.Michelle Robbins Licensed Insurance Agent

By comparing quotes and understanding your unique requirements, you can find the best Dodge Ram 1500 auto insurance tailored to your needs. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What coverages should I purchase for my Dodge Ram 1500?

The bare minimum auto insurance required varies state by state. However, most require some type of liability coverage. Liability car insurance pays for damages to other parties when you were at fault for an accident. Bodily injury liability covers injuries, and property damage covers damage to the other party’s vehicle, home, or anything else you may have damaged.

Do you need additional insurance coverage for a pickup truck like the Dodge Ram 1500?

Car insurance companies generally offer a host of optional coverage types that go far beyond the basics. While they may give you many benefits and peace of mind, they will also increase your rates. These coverage types include things like towing, rental vehicle reimbursement, and gap coverage for leased vehicles.

Is auto insurance more expensive for diesel trucks?

Insurance for diesel trucks, including Dodge Ram 1500 and other models, can often be 10-15% more expensive than gas cars but still less expensive to insure than electric or hybrid cars. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

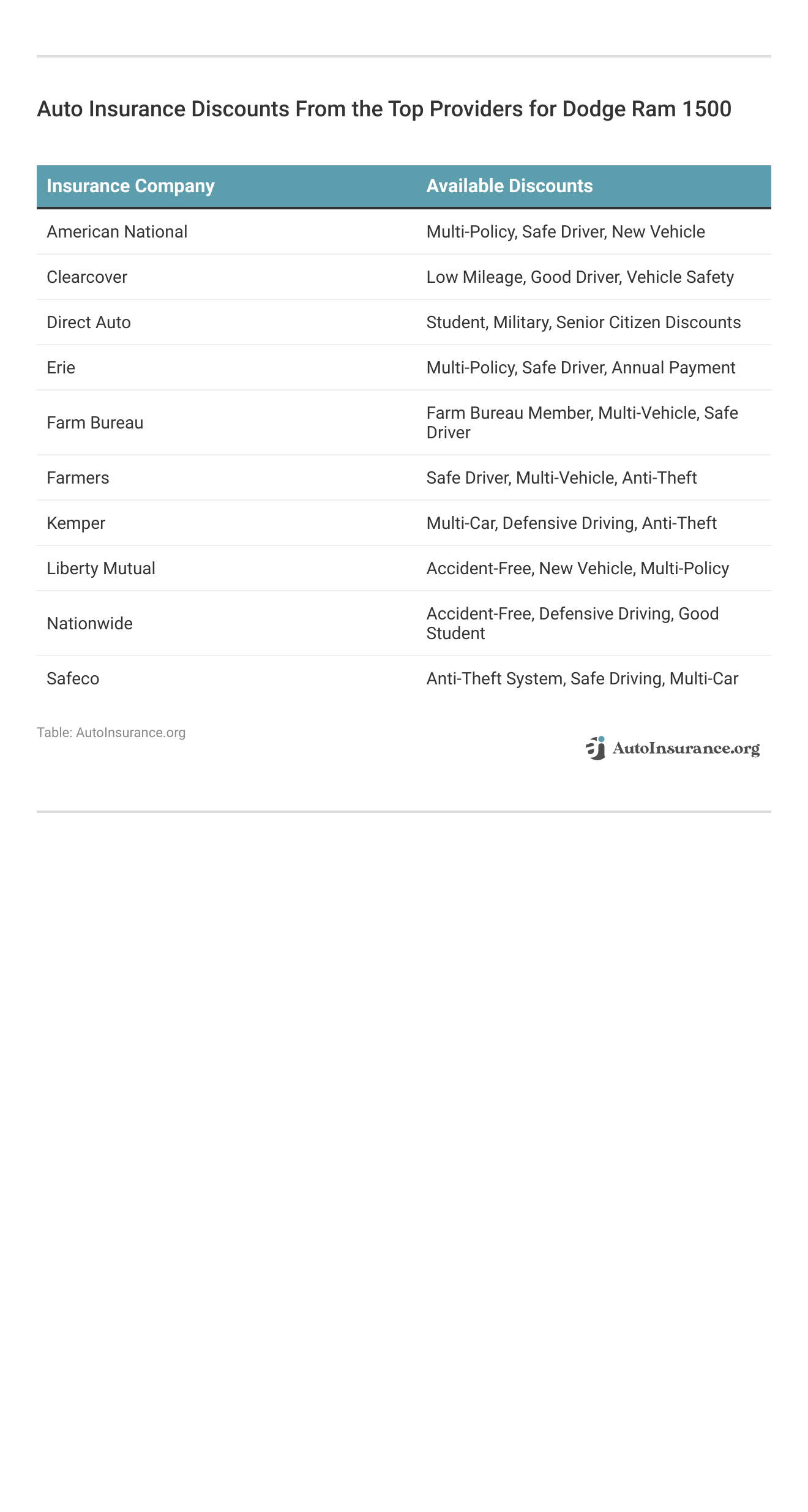

How can you get a discount on Dodge Ram 1500 auto insurance?

Auto insurance companies often offer several auto insurance discounts, and you and your Dodge Ram 1500 may be eligible for any number of them. Discount possibilities noted by the Illinois Department of Insurance include those for safety features and anti-theft devices.

How much does your driving record impact your Dodge Ram 1500 auto insurance rates?

Your overall driving record, years of driving experience, and your annual mileage are three major factors in determining your insurance rates. Drivers with a history of violations, crashes, and claims will face higher rates than those with clean driving records. Experienced drivers typically have lower premiums than less experienced drivers.

Is the Dodge Ram 1500 a good truck?

The Ram 1500 is generally considered to be a good truck. The seats are comfortable, and there is plenty of legroom. It has a nice interior design. If you get the 2020 model, you have the option to have a diesel truck.

How much is Dodge Ram 1500 auto insurance in Canada?

Canada’s auto insurance laws vary from province to province. Some use an open market, private insurance system, while others have a public insurance system. That means rates vary a lot. If you’re traveling to Canada in your Ram, there’s no need to worry. Your U.S. truck insurance will cover you while you’re up north.

What factors affect the cost of Dodge Ram 1500 auto insurance?

Several factors influence the cost of insuring a Dodge Ram 1500, including the driver’s age, driving record, location, vehicle’s age, and the level of coverage chosen. Theft rates and repair costs also play a role.

How do safety features impact Dodge Ram 1500 auto insurance rates?

Safety features like anti-lock brakes, airbags, and advanced driver assistance systems can reduce auto insurance rates for the Dodge Ram 1500. These features lower the risk of accidents and injuries, leading to potential discounts from insurers. Delve into our guide “At-Fault Accident.”

What is the average monthly cost to insure a Dodge Ram 1500?

The average monthly cost to insure a Dodge Ram 1500 is around $152, but this can vary based on factors like the model year, location, and driver history. For example, insuring a 2015 Ram 1500 typically costs less compared to newer models due to depreciation.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.