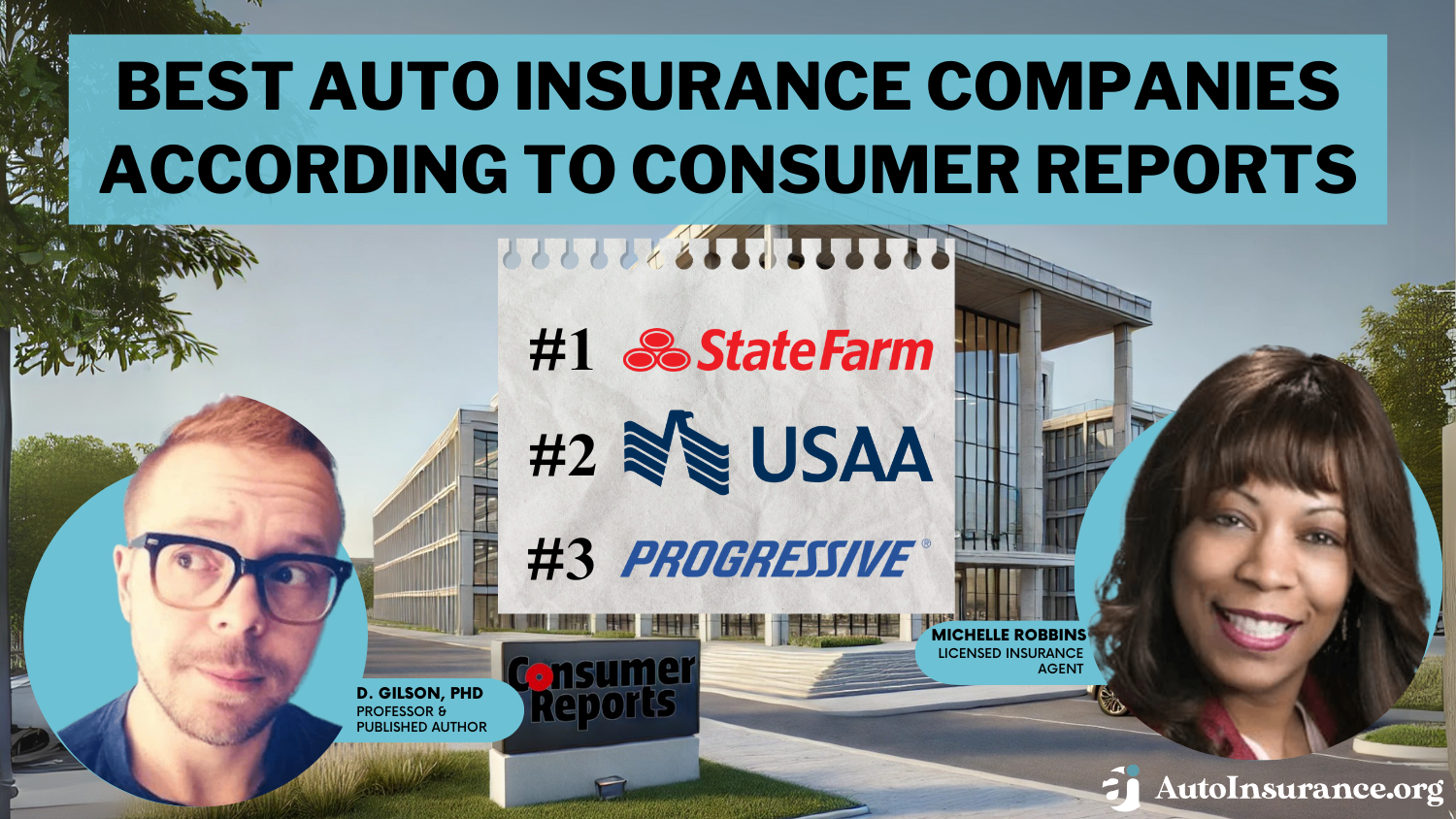

8 Best Auto Insurance Companies According to Consumer Reports in 2026

State Farm, USAA, and Progressive are the best auto insurance companies, according to Consumer Reports. At State Farm, minimum coverage is an average of $47/mo, though rates vary by driver. Each of the best companies rated by Consumer Reports has great customer service and financial ratings.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated February 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage

A.M. Best

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsState Farm, USAA, and Progressive are the best auto insurance companies, according to Consumer Reports.

We’ve listed other top-ranked auto insurance companies below.

Our Top 8 Picks: Best Auto Insurance Companies According to Consumer Reports

| Company | Rank | Multi-Vehicle Discount | A.M. Best Rating | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Customer Service | State Farm | |

| #2 | 10% | A++ | Military Focus | USAA | |

| #3 | 12% | A+ | Competitive Rates | Progressive | |

| #4 | 25% | A++ | Extensive Coverage | Geico | |

| #5 | 25% | A+ | Wide Range | Allstate | |

| #6 | 15% | A+ | Strong Reputation | Amica | |

| #7 | 30% | A+ | Personalized Service | Erie |

| #8 | 20% | A++ | Localized Support | Auto-Owners |

To see different coverage options at great prices, enter your ZIP code into our FREE auto insurance quote finder.

- State Farm ranks as number one according to Consumer Reports

- USAA and Progressive also ranked well on Consumer Reports

- High ratings from Consumer Reports indicate high customer satisfaction

#1 – State Farm: Top Pick Overall

Pros

- Customer Service: One of the reasons for State Farm’s high ranking on Consumer Reports is the company’s great customer service.

- Financial Strength: State Farm is well-established financially, which you can read about in our State Farm review.

- Multi-Policy Discount: Customers can save by bundling policies at State Farm.

Cons

- Safe Driver Discount Availability: State Farm’s UBI discount is only available in select states.

- No Online Purchases: You can get quotes online but can’t purchase a policy unless you go through an agent.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Focus

Pros

- Military Focus: USAA’s focus on military members and veterans allows it to provide great customer service and low rates.

- Competitive Rates: USAA’s low rates and multiple discounts help its rates stay competitive. Learn about its rates in our review of USAA.

- Coverage Options: USAA offers plenty of add-on coverage options to personalize policies.

Cons

- Few Local Branches: USAA doesn’t have as wide a base of in-person locations and agents.

- Eligibility is Limited: Only veterans, military, and their families can purchase USAA insurance.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive has competitive rates for high-risk drivers. Learn more in our Progressive auto insurance review.

- User-Friendly: Progressive’s website and app are easily navigated.

- Coverage Options: Progressive has gap insurance, roadside assistance, and more.

Cons

- UBI Rate Increases: Progressive may raise rates for drivers who score poorly in its UBI program.

- Varying Customer Service: Some customers have poor ratings for Progressive’s customer service.

#4 – Geico: Best for Extensive Coverage

Pros

- Extensive Coverage: Geico offers extensive coverage options for cars. We cover Geico’s coverage options in our Geico review.

- User-Friendly: Geico’s website and app are easily navigable.

- Multiple Discounts: Geico has bundling discounts, good driver discounts, and more.

Cons

- Few Local Agents: Geico doesn’t have an extensive network of local agents.

- UBI Availability: Not all states have Geico’s UBI discount program.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Wide Range

Pros

- Wide Range: Allstate is available across the U.S. Read more about the company in our review of Allstate.

- Coverage Options: Allstate has roadside assistance and more.

- Multiple Discounts: Allstate has good driver discounts, bundling discounts, and many more.

Cons

- UBI Availability: A few states don’t have Allstate’s UBI discount.

- Higher Rates for Some: Allstate has less competitive rates for drivers with high-risk records or younger drivers.

#6 – Amica: Best for Strong Reputation

Pros

- Strong Reputation: Amica has strong ratings for its financial strength and business practices.

- Multiple Coverages: Amica has gap insurance, rental reimbursement insurance, and more.

- Accident Forgiveness: Amica’s accident forgiveness can be a huge plus for safe drivers.

Cons

- Not Sold in Hawaii: Amica is sold in 49/50 states. Learn more about the company’s insurance in these states in our review of Amica.

- Higher Rates for Some: Amica’s rates may not be as competitive for high-risk drivers.

#7 – Erie: Best for Personalized Service

Pros

- Personalized Service: Erie’s agents help provide personalized service. Read more about Erie’s service in our review of Erie auto insurance.

- Rate Lock: Erie’s rate lock means the company won’t raise rates unless your policy changes.

- Coverage Options: Erie’s selection of add-on coverages includes rental reimbursement and gap insurance.

Cons

- Availability: Erie doesn’t offer auto insurance in many states.

- UBI Rewards: Unlike other companies, Erie doesn’t offer a discount on auto insurance through its UBI program. Instead, it offers gift cards.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Localized Support

Pros

- Localized Support: Auto-Owners’ local agents provide support to customers. Read more in our Auto-Owners review.

- Financial Stability: Auto-Owners has high ratings for financial strength.

- Coverage Options: Auto-Owners has multiple add-on coverages.

Cons

- Availability: Auto-Owners is not sold in every state.

- Higher Rates for Some: High-risk drivers may not find competitive rates at Auto-Owners.

Auto Insurance Company Consumer Satisfaction Ratings

Consumer satisfaction rankings are one of the most valued methods to evaluate auto insurance company quotes and whether or not an auto insurance company is highly preferred.

Consumer satisfaction encompasses customer happiness with customer service, claims processing, premium rates, and overall perceptions of an insurance company.

Consumer Reports frequently evaluates auto insurance company options and publishes Consumer Report car insurance findings on its website and in its subscription magazine.

The auto insurance consumer reviews from Consumer Reports are based on in-depth evaluations of car insurance company performance, including accessibility to customer service, ease of filing claims, claims processing, products and services offered, and benefits provided to policyholders. It also evaluates complaints against the companies.

Read more: How to File a Complaint Against Your Auto Insurance Company

JD Powers and Associates also conducts an annual review of auto insurance companies and publishes its report on its website. JD Powers evaluates consumer satisfaction with auto insurance companies’ customer service, claims processing, and ease of access. Additionally, the auto insurance companies ranked are based on overall perceptions of car insurance companies and premium rates.

Auto Insurance Company Financial Health

Financial health and stability are also extremely important qualities to evaluate when looking for highly preferred auto insurance companies. Financial health ratings are based on strong financial reserves, excellent financial business practices and, good credit ratings. Additionally, ratings take into consideration how long an insurance company has been in business.

Learn more: How to Research Auto Insurance Companies

Companies with strong financial rankings are able to tolerate large numbers of claims that occur during disasters. For example, during the spring of 2011, numerous tornadoes hit the southeastern United States, resulting in billions of dollars in damage.

Companies with low financial health ranking were unable to pay claims and many have folded as a result.

AM Best, Fitch and Standard and Poor’s are independent financial evaluation organizations that monitor the financial health of insurance companies. They publish their findings on their websites. Rankings are based on letter grades and the highest grade issued is “A++,” which indicates superior financial stability.

Grades in the “A” range indicate excellent financial stability. Grades in the “B” range indicate good financial standing. Grades of “C” and below indicate an insurance company is financially unhealthy.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Company Consumer Complaints

When you are looking for a preferred auto insurance company, you want to avoid companies that have high numbers of consumer complaints.

All insurance companies have at least a few complaints filed against them due to denied claims and rate increases, but companies with a high number of complaints should be avoided.Dani Best Licensed Insurance Producer

Also, consumer complaints tend to increase significantly when a catastrophic event occurs, claims are delayed, or a large number of claims are filed.

Read more: How to File an Auto Insurance Claim

The National Association of Insurance Commissioners (NAIC) and the Center for Insurance Policy and Research is a regulatory association for the insurance industry. They set standards and regulations for the insurance industry. They publish complaints against insurance companies that can be viewed and researched by consumers. They also publish trends in consumer complaints, including information on the most common consumer complaints and the most common resolutions of consumer complaints.

The Better Business Bureau is another national organization dedicated to providing consumer information about companies in the United States. It also publishes information about consumer complaints on its website. They also assist consumers with problems by mediating resolutions. The Better Business Bureau also publishes positive company reviews on its website.

Auto Insurance Company Premium Rates

When looking for preferred auto insurance companies, premium rates are another important quality to consider. However, low premium rates do not automatically mean that an insurance company will provide you with good service and pay your claims quickly and efficiently.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $88 | $228 | |

| $65 | $215 | |

| $47 | $124 | |

| $32 | $83 |

| $43 | $114 | |

| $56 | $150 | |

| $47 | $123 | |

| $32 | $84 |

Insurance comparison websites allow you to review premium rate quotes from multiple companies at the same time.

Insurance comparison websites often will recommend highly-rated insurance companies. Additionally, they often have articles on relevant topics of concern and interest to people looking for auto insurance. You can also get quotes directly from companies like State Farm.

Independent insurance brokers can also provide you with premium rate quotes from multiple companies (learn more: Auto Insurance Broker Defined). Independent brokers usually represent several insurance companies and can make recommendations about the type of insurance you need and ways to lower your premium rates.

The Final Word on the Best Consumer Reports Companies

When you are looking for auto insurance, you should consider more than premium rates when making your purchasing decision. Although it is important to know how to lower your auto insurance rates, you should also consider auto insurance consumer ratings from companies like Consumer Reports, J.D. Power, and more.

In addition to reading Consumer Reports’ automobile insurance reviews, shop around for rate comparisons. Our FREE car insurance comparison tool can compare coverage options and premium prices from several companies when you enter your ZIP code.

Frequently Asked Questions

Should I choose an auto insurance company solely based on premium rates?

No, consider factors like customer service, types of auto insurance offered, and claims processing when looking at the best auto insurance Consumer Reports companies.

How can I compare coverage options and premium prices from different auto insurance companies?

Yes, you can compare multiple companies’ rates for different car insurance brands easily with a comparison website. Compare quotes with our free tool to find affordable insurance near you.

Where can I find information about consumer complaints against auto insurance companies?

The National Association of Insurance Commissioners (NAIC) and the Better Business Bureau track insurance company consumer ratings.

How can I assess the financial health of an auto insurance company?

Check ratings from AM Best, Fitch, and Standard and Poor’s.

Where can I find consumer satisfaction ratings for auto insurance companies?

You can find consumer car insurance ratings from Consumer Reports and JD Powers and Associates.

What should I consider when looking for a preferred auto insurance company?

Consumer satisfaction ratings, financial health, consumer complaints, and premium rates. If you aren’t sure how to find the best price, check out our guide on how to evaluate auto insurance quotes.

Who has the most reasonable car insurance rates?

USAA and State Farm are popular auto insurance companies that have the most reasonable auto insurance rates on average. They also have great Consumer Reports insurance reviews.

What insurance company is most reliable?

The Consumer Reports’ best auto insurance companies on our list are all reliable, as they are based on Consumer Reports insurance company reviews that look at customer satisfaction, reliability, and more.

What is the best auto insurance to have?

The best auto insurance is generally full coverage from our list of preferred insurance companies. Learn about the benefits of cheap full coverage auto insurance.

Who is cheaper Geico or Progressive?

It depends on your driving profile. Geico is usually cheaper for low-risk drivers, but Progressive sometimes has cheaper rates for high-risk drivers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.