Travelers IntelliDrive Review 2025 (See Real Customer Feedback Here)

Travelers IntelliDrive can save you up to 30% on auto insurance. Simply install the IntelliDrive mobile app to earn an insurance discount. Our Travelers IntelliDrive review will explain what happens with Travelers IntelliDrive after 90 days and how to save with the IntelliDrive discount.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Nov 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Travelers IntelliDrive, a usage-based auto insurance program, tracks driving habits and rewards policyholders with discounts for good driving.

The IntelliDrive mobile app monitors speed, hard braking, acceleration, phone usage, and time of day. You can get a 30% discount with Travelers if you’re a safe driver.

Learn More: Travelers Auto Insurance Review

Travelers also offers a 10% discount just for signing up. After enrolling, download the Travelers IntelliDrive app and keep your Wi-Fi and location services enabled.

Read our Travelers IntelliDrive review to learn what qualifies as high speed with Travelers IntelliDrive and what happens after the initial 90 days. Then, enter your ZIP code above to compare quotes from the top companies in your area.

- Travelers IntelliDrive can help you save on auto insurance with a 30% discount

- IntelliDrive tracks your driving behavior and rewards safe drivers

- IntelliDrive also monitors bad driving habits, which could hurt your rates

How Travelers IntelliDrive Works

IntelliDrive is an auto insurance discount that helps lower Travelers policyholders’ rates, and you can find Travelers coverage in all states. The IntelliDrive system is one of their more recent innovations in keeping drivers safe and offering competitive rates.

So, you might be wondering how much you’d pay for your car insurance with the IntelliDrive discount. Find your state below to see how much you could pay for coverage after Travelers’ UBI discount:

Auto Insurance Monthly Rates With Travelers IntelliDrive Discount by State

| State | Before Discount | After Discount |

|---|---|---|

| Alabama | $140 | $98 |

| Alaska | $145 | $105 |

| Arizona | $145 | $102 |

| Arkansas | $152 | $107 |

| California | $168 | $118 |

| Colorado | $155 | $109 |

| Connecticut | $160 | $112 |

| Delaware | $150 | $105 |

| Florida | $165 | $129 |

| Georgia | $147 | $103 |

| Hawaii | $149 | $104 |

| Idaho | $142 | $99 |

| Illinois | $149 | $104 |

| Indiana | $153 | $107 |

| Iowa | $138 | $97 |

| Kansas | $144 | $101 |

| Kentucky | $159 | $111 |

| Louisiana | $175 | $123 |

| Maine | $146 | $102 |

| Maryland | $162 | $113 |

| Massachusetts | $164 | $115 |

| Michigan | $170 | $120 |

| Minnesota | $141 | $99 |

| Mississippi | $137 | $96 |

| Missouri | $152 | $106 |

| Montana | $148 | $104 |

| Nebraska | $151 | $106 |

| Nevada | $155 | $93 |

| New Hampshire | $143 | $100 |

| New Jersey | $165 | $124 |

| New Mexico | $150 | $105 |

| New York | $167 | $117 |

| North Carolina | $156 | $110 |

| North Dakota | $144 | $101 |

| Ohio | $156 | $109 |

| Oklahoma | $139 | $97 |

| Oregon | $157 | $110 |

| Pennsylvania | $163 | $114 |

| Rhode Island | $162 | $114 |

| South Carolina | $160 | $152 |

| South Dakota | $145 | $101 |

| Tennessee | $154 | $108 |

| Texas | $149 | $104 |

| Utah | $158 | $111 |

| Vermont | $148 | $104 |

| Virginia | $160 | $112 |

| Washington | $165 | $116 |

| Washington, D.C. | $158 | $111 |

| West Virginia | $150 | $105 |

| Wisconsin | $142 | $99 |

| Wyoming | $143 | $100 |

It’s also important to compare usage-based insurance programs against other competitors to see if another offers a better deal. Check out the table below to compare the savings amount with Travelers IntelliDrive vs. other top-rated providers:

Usage-Based Auto Insurance Discounts by Provider & Savings Amount

| Insurance Company | Program Name | Device Type | Sign-up Discount | Savings Potential |

|---|---|---|---|---|

| AAADrive | Mobile App | 15% | 30% |

| Drivewise | Mobile App | 10% | 40% | |

| KnowYourDrive | Mobile App or Plug-in | 10% | 20% | |

| DriveEasy | Mobile App | 20% | 25% | |

| RightTrack | Mobile App or Plug-in | 5% | 30% |

| Mile Auto | Neither | 20% | 40% | |

| SmartRide | Mobile App or Plug-in | 10% | 40% |

| Snapshot | Mobile App or Plug-in | $25 | 20% | |

| Drive Safe & Save | Mobile App or Plug-in | 5% | 50% | |

| TrueLane | Plug-in | 5% | 25% |

| IntelliDrive | Mobile App | 10% | 30% | |

| SafePilot | Mobile App | 5% | 20% |

As you can see, Travelers IntelliDrive can save participants up to 30% if they drive safely. In addition, other top providers, such as Nationwide and Allstate, offer savings of 40%. Find the right provider for you by reading our guide titled, “Allstate vs. Travelers Auto Insurance.”

To use IntelliDrive, you must be a Travelers customer and enroll in the IntelliDrive program by downloading the application and keeping your location services and Wi-Fi enabled.Eric Stauffer Licensed Insurance Agent

Once you enroll, the application tracks your driving habits for 90 days. Travelers’ usage-based program is unlike other programs, such as State Farm Drive Safe and Save, where your driving habits get tracked continually (Learn More: State Farm Drive Safe & Save Review).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What the IntelliDrive Mobile App Tracks

IntelliDrive tracks high speed, time of day, braking habits, hand-held phone usage, and accelerate for 90 days. Once the 90 days end, the IntelliDrive system stops tracking your habits, and the good driver auto insurance discount automatically renews annually.

The telemetrics tracked by Travelers IntelliDrive includes the following:

- Speed: High speed with Travelers IntelliDrive harms your score, so frequent speeders should avoid the program. However, safe drivers could benefit from the IntelliDrive discount.

- Acceleration: The Travelers IntelliDrive mobile app also dings you for accelerating quickly. However, you could see cheaper Travelers insurance rates if you accelerate gently.

- Hard Braking: Continuous hard braking is a sign of someone who drives unsafely. If you find yourself frequently slamming on the brakes, you likely won’t get a discount with IntelliDrive.

- Night Driving: Night-time driving is more dangerous. Though often unavoidable, those that do it frequently may want to reconsider installing IntelliDrive.

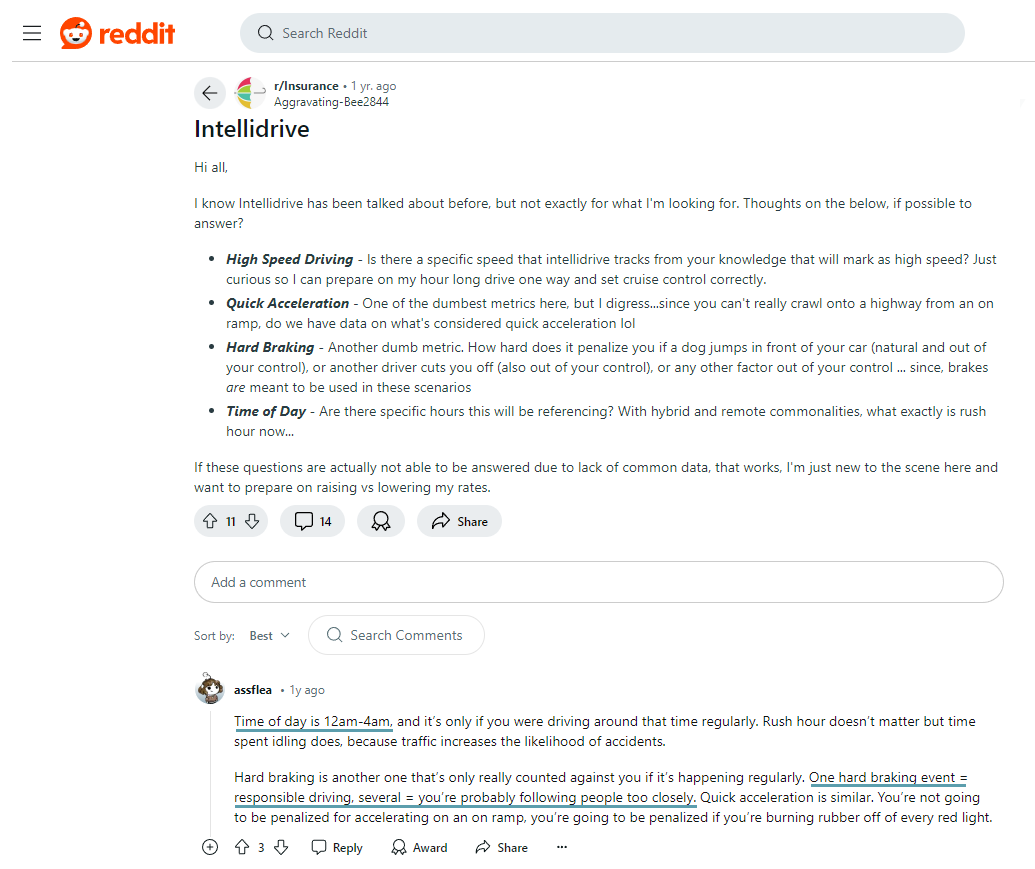

According to reviews of Travelers IntelliDrive from Reddit users, you’ll get dinged for an IntelliDrive time of day event for late driving betweeen 12 a.m. and 4 a.m., as statistics show driving during these hours is associated with fatigue and impaired driving.

In addition, if you get one acceleration event with IntelliDrive, that Reddit user also explains that it won’t count against you heavily. However, a pattern of hard braking could impact your Travelers IntelliDrive score.

Travelers also tracks your phone or handheld device while driving. However, this is limited to certain states. For example, Idaho, Maryland, and New Jersey drivers can’t have phone usage tracked.

Read More About Coverage in These States:

In all other states, this is tracked, but usage that is not hand-held, such as streaming music, doesn’t count against you.

How to Earn an Auto Insurance Discount With IntelliDrive

You can get 10% off your auto insurance just for enrolling, but the discounts grow from there. If you continue to drive safely, you can earn up to 30% off your auto insurance rates. By combining multiple discounts with IntelliDrive, such as an anti-theft auto insurance discount, you could save more than 30% on your monthly insurance bill.

The discount available with IntelliDrive changes by state. For example, the maximum discount is capped at 20% in Idaho, Maryland, and New Jersey. The discount caps at 22% in Florida and 40% in Nevada. The following states don’t participate at all:

- Maryland

- Montana

- Virginia

- Washington, D.C.

Read More: Auto Insurance Rates by State

In addition, if you have several people on your insurance policy, you’ll only get the full discount if all insured drivers enroll. If only some do, the discount percentage decreases. Read more about how to get a multi-vehicle auto insurance discount.

What to Know About the Advantages vs. Disadvantages of IntelliDrive

The Travelers IntelliDrive insurance discount has the ability to save you money, but it does come with some negatives. Unlike other usage-based programs, Travelers actually raises auto insurance rates if you don’t drive safe. Understand more in our guide titled, “Factors That Affect Auto Insurance Rates.”

Travelers tracks certain events that other providers don’t, such as hand-held device usage and time of day. So, if you work nights or early mornings, IntelliDrive may not be for you, as you’ll lose out on savings by driving during high-risk hours.

The biggest benefit of the IntelliDrive system is that it offers a massive discount of up to 30% or more in most states, which is far higher than many other companies. The system also must only be installed for 90 days versus having it at all times. This could be attractive to anyone who is a safe driver but not necessarily open to being tracked at all times.

Tired of paying 💵for auto insurance when your car is in the garage and don’t even drive 🚘every day? Usage-based insurance might be right for you. https://t.co/27f1xf1ARb has put together an easy-to-understand guide, and you can check it out here👉: https://t.co/Giu8rLur0c pic.twitter.com/cFXkwvuS32

— AutoInsurance.org (@AutoInsurance) October 10, 2023

If you have auto insurance for teens, IntelliDrive allows you to track their driving habits, which can be great for new drivers who still need to learn good habits. Read more about auto insurance for new drivers.

However, the discount you achieve with IntelliDrive will be applied to a renewal policy, so it’s not instantaneous. So, if you try it for 90 days when you become a Travelers customer, you won’t see a discount until your next renewal cycle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Summing up the Travelers IntelliDrive Program

Travelers IntelliDrive is a system that tracks your habits and offers savings for good driving behaviors of up to 30% in most states. The IntelliDrive mobile app tracks braking, speed, acceleration, hand-held device usage, and the time of day you operate your vehicle.

Unlike other usage-based systems from insurance companies, IntelliDrive will also raise your rates if you drive poorly. If you want to compare discounts from other companies, insert your ZIP code into our comparison tool below to find affordable auto insurers in your area.

Learn More: How to Lower Your Auto Insurance Rates

Frequently Asked Questions

What happens to IntelliDrive after 90 days?

A top question readers ask is, “Can I delete IntelliDrive after 90 days?” Yes, you only have to use IntelliDrive for 90 days, and then you can remove the application. After that, any car insurance discount earned is applied to your next renewal.

How many miles do you need to drive with IntelliDrive?

Travelers’ website says 500 miles or more offers sufficient driving behavior data within the 90-day monitoring period.

Can IntelliDrive raise your rates?

IntelliDrive can make your rate go up, unlike many other similar systems. If the application tracks your driving habits and reads them as high-risk, you can expect to see your auto insurance rates go up at renewal.

Enter your ZIP code into our free quote tool below to instantly compare costs from the best auto insurance companies for high-risk drivers in your area.

What does the IntelliDrive app do?

The Travelers IntelliDrive mobile app monitors driving behavior and offers feedback after each trip ends. Find out more about the best auto insurance apps here.

What does an event mean on IntelliDrive?

The IntelliDrive events detected meaning is that certain behaviors, such as a time of day event with IntelliDrive, have been detected and marked against you. However, if you believe the IntelliDrive app is not working properly, the Travelers IntelliDrive phone number for customer service is 1-888-505-1217.

What is Travelers IntelliDrive?

Travelers IntelliDrive is a type of usage-based insurance offered by Travelers Insurance. It is a system that tracks your driving habits using a mobile app and provides potential discounts on auto insurance for safe driving behavior. Check out our guide titled “Cheap Usage-Based Auto Insurance” for more details.

How much is the Travelers IntelliDrive discount?

The IntelliDrive discount does vary by state. On average, it’s 30%, with the lowest being 20% and the highest being 50%. In a select few states, you can’t get the IntelliDrive, including Montana, Maryland, Virginia, and Washington D.C.

How does IntelliDrive know if I’m driving?

You may wonder, “How does IntelliDrive know I’m driving?” IntelliDrive uses location services to track where you are and how you are moving to establish you are driving and your speed of travel.

How does Travelers IntelliDrive work?

So, how does IntelliDrive work? To use IntelliDrive, you need to be a Travelers customer and enroll in the IntelliDrive program. You download the IntelliDrive mobile app, keep it running on your phone with location services and Wi-Fi enabled, and it tracks your driving habits for 90 days.

After the initial tracking period, the good driver car insurance discount automatically renews each year.

Should I enroll in IntelliDrive?

You might be asking, “Is IntelliDrive worth it?” Good drivers can save a significant amount on car insurance premiums with IntelliDrive. So, you should enroll in Travelers IntelliDrive if you regularly practice safe driving habits. Check out Travelers IntelliDrive reviews online from sites such as Reddit to see what others say about the program.

What does IntelliDrive consider high speed?

Does IntelliDrive know the speed limit? Yes, and most usage-based programs, including IntelliDrive, have a database of speed limits for all roadways, which they compare against your location and speed (Read More: The Consequences and Dangers of Speeding).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.