USAA vs. Geico Auto Insurance in 2025 (Best Value Revealed)

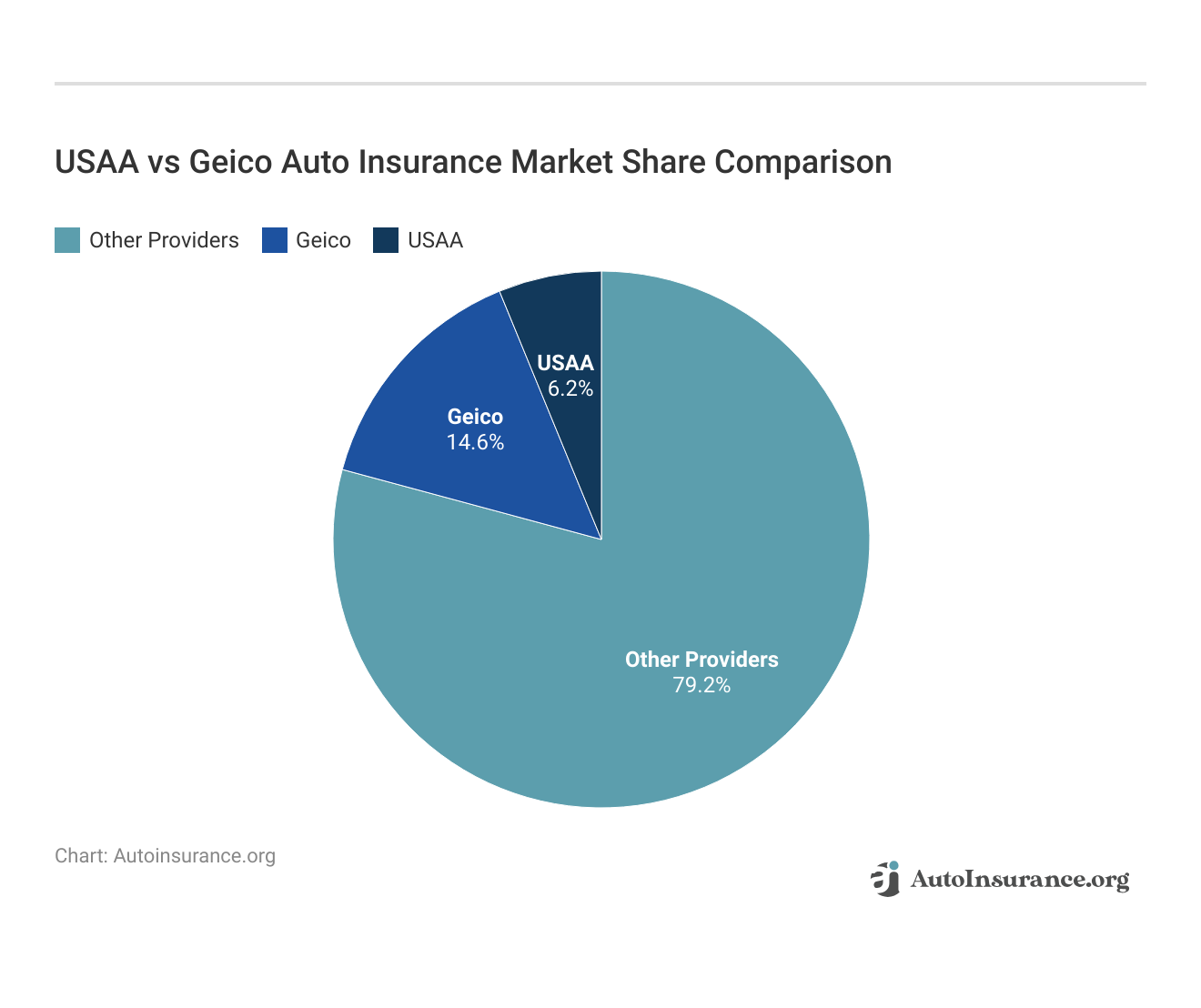

USAA vs. Geico auto insurance compares value and coverage, with USAA offering complete coverage for $22 per month and Geico for $30 per month. USAA is tailored for military families with lower rates, while Geico offers broader accessibility. For more details, explore this article.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsUSAA vs. Geico auto insurance highlights the differences in pricing, customer satisfaction, and service options. USAA offers lower premiums, but Geico provides wider accessibility and faster claims processing.

For disabled veterans, USAA delivers personalized rates for military families, while Geico offers broader access. For those searching for the best auto insurance for disabled veterans, USAA offers customized rates to military families, whereas Geico ensures more comprehensive access.

USAA vs. Geico Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.8 | 4.5 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 5.0 | 4.8 |

| Company Reputation | 5.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.7 | 4.4 |

| Customer Satisfaction | 4.7 | 4.5 |

| Digital Experience | 5.0 | 5.0 |

| Discounts Available | 5.0 | 4.7 |

| Insurance Cost | 4.6 | 4.4 |

| Plan Personalization | 5.0 | 4.5 |

| Policy Options | 4.7 | 4.1 |

| Savings Potential | 4.7 | 4.5 |

| USAA Review | Geico Review |

Regardless of preference, always compare multiple insurance quotes to find the best deal for your needs. Enter your ZIP code above to see which companies provide the most affordable options, such as in the USAA vs. Geico auto insurance comparison.

- USAA vs. Geico auto insurance shows USAA offers a 15% military discount

- Geico provides up to 25% off for safe drivers, enhancing affordability

- USAA’s rates start at $22 monthly, while Geico averages $30 for coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Coverage Cost in USAA vs. Geico Auto Insurance

USAA vs. Geico car insurance rates depend on several factors. While driving history, age, gender, and location impact the rates. Generally, USAA has the lower average monthly rates, averaging around $22 for full coverage.

USA vs Geico Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $245 | $298 |

| Age: 16 Male | $249 | $312 |

| Age: 30 Female | $74 | $90 |

| Age: 30 Male | $79 | $87 |

| Age: 45 Female | $59 | $80 |

| Age: 45 Male | $59 | $80 |

| Age: 60 Female | $53 | $73 |

| Age: 60 Male | $53 | $74 |

Geico’s rates average at $30. A 22-year-old male would pay as much as $250 with Geico, while the same driver might pay only about $180 with USAA. A clean driving record will also save you a good amount of money.

The USAA vs. Geico auto insurance comparison, USAA stands out for military families with lower coverage costs, starting at just $22 per month.Tracey L. Wells Licensed Insurance Agent & Agency Owner

You can get USAA as low as $20 a month if you’re accident-free for recent times, versus Geico at $28. Read how to reduce auto insurance rates, benefitting those contemplating insurance by the mile.

Geico vs. USAA is about what anyone needs and when, so it would be preferred to check out their coverages & benefits for getting into. On a nationwide level, USAA continues to reign supreme with a 4.6 mean score and is (barely) followed closely by Geico at 4.4.

Coverage Options in USAA vs. Geico Auto Insurance

Let’s start comparing USAA vs. Geico by talking about their coverage options. Of course, both companies maintain whole coverage policies and cover essential items such as liability and collision auto insurance. USAA allows for customized plans, especially if you are a military family. Geico takes pride in its competitive pricing.

USAA vs. Geico Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $59 | $80 |

| Not-At-Fault Accident | $78 | $132 |

| Speeding Ticket | $67 | $106 |

| DUI/DWI | $108 | $216 |

USAA provides state-specific minimum coverage levels and gap insurance when financed, whereas Geico charges a slightly higher basic premium, and the gap is only available as an add-on. Both can support higher-risk drivers by having ready SR-22 filings; however, the companies have different fee structures.

What are your thoughts on Liberty Mutual vs. Geico or State Farm vs. Geico? Ultimately, in evaluating such choices, one compares types of coverage and other benefits. USAA and Geico excel in this category, each receiving a perfect score of 5.0.

Available Discounts in USAA vs. Geico Auto Insurance

The competition between USAA vs. Allstate and Geico vs. Liberty Mutual demonstrates the range of discounts policyholders can take advantage of regarding auto insurance. USAA also provides discounts, up to 25%, for being a safe driver (Geico offers as much as 22% under similar criteria).

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Age & Gender | ||

|---|---|---|

| Age: 17 Female | $245 | $298 |

| Age: 17 Male | $249 | $312 |

| Age: 25 Female | $74 | $90 |

| Age: 25 Male | $79 | $87 |

| Age: 35 Female | $59 | $80 |

| Age: 35 Male | $59 | $80 |

| Age: 60 Female | $53 | $73 |

| Age: 60 Male | $53 | $74 |

Recognizing good students with low rates from both insurers makes them close to the top of our list for best student auto insurance discounts. Meanwhile, the

Auto Insurance Monthly Rates by Driving Record & Provider

| Driving Record | ||

|---|---|---|

| Clean Record | $59 | $80 |

| One Accident | $78 | $106 |

| One DUI | $108 | $216 |

| One Ticket | $67 | $132 |

Understanding these savings strategies can reduce your total insurance charges considerably. USAA leads with a score of 5.0, while Geico follows closely at 4.7.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customer Reviews of USAA vs. Geico Auto Insurance

Customer reviews are exceptionally compared to USAA auto insurance vs. Geico in terms of their relative strengths and weaknesses. Since USAA is suited explicitly to military families, USAA has been rated at 4.7 since many policyholders state that it is effortless and personalized for claims submission.

In contrast, Geico gets an excellent score of 4.5 points, where customers like the simplicity of navigating its website and its smooth claims handling. However, a few more customers of their poor customer support community did not, or even worse, so be sure to uprising; this tends to happen on both.

People on other platforms like Reddit and Quora have turned over information that exposes USAA as the go-to organization for anything military. At the same time, Geico has received accolades for being easy to work with and full of novel technology.

If you’re contemplating other alternatives, like comparing Nationwide vs. Geico or USAA vs. AAA, understanding things such as how long after a car accident you can file a claim will make all the difference between making the right insurance choice and missing out.

Business Reviews of USAA vs. Geico Auto Insurance

While testing USAA vs. Geico auto insurance, you may need to cross-reference business ratings from 3rd-party sources to determine whether or not the service is dependable and worthy of praise. J.D. Power rates USAA 882 out of 1,000, putting it in the above-average category for satisfaction levels.

Insurance Business Ratings & Consumer Reviews: USAA vs. Geico

| Agency | ||

|---|---|---|

| Score: 882 / 1,000 Above Avg. Satisfaction | Score: 857 / 1,000 Above Avg. Satisfaction |

|

| Score: A++ Excellent Business Practices | Score: A+ Great Business Practices |

|

| Score: 96/100 High Customer Satisfaction | Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.74 More Complaints Than Avg. | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength | Score: A++ Superior Financial Strength |

Geico scored similarly at 857, a rating above average in that regard. Both USAA and Geico have a business practices score of A++. Consumer Reports show that USAA has 96 out of 100, which indicates that consumers are delighted.

A.M. Best rates the two companies as A++, which is an excellent financial strength. The business rating score for both Geico and USAA stands at 4.5. Compare options by checking on USAA vs. Infinity. Ultimately, knowing how to research auto insurance companies will help one decide what suits them best.

Pros and Cons of USAA Auto Insurance

This USAA auto insurance review will weigh the company’s pros and cons. A niche in providing for military families, cheap quotes, and a complete line of protection characterize this carrier.

In comparing USAA vs. Geico auto insurance, the pros of USAA with benefits tailored for military families outweigh the cons because the former is generally the better option for most cases.Heidi Mertlich Licensed Insurance Agent

This company has certain drawbacks, including strict eligibility requirements and making its services available to some. Please review them in detail to see whether USAA will be a good solution when choosing other insurance companies.

Pros

- Low Cost: USAA offers cheap premiums, specially made for active-duty military members, veterans, and their families, making it pretty affordable.

- Superb Service: USAA has excellent customer service. They always provide a pleasing and prompt response to their client’s issues.

- Different Policies: USAA offers extensive coverage through several standards that cover a wide range of options, such as replacing rental vehicles or providing extra roadside assistance.

Cons

- Eligible Person: USAA policies can only be acquired if the military, a veteran, or a member of their families- limited coverage to a smaller number of people

- Availability: USAA is absent in many states, so persons with addresses in unavailable places cannot benefit from it.

Military applications and more excellent service from USAA would favor that company when comparing USAA vs. Mercury. It may be best to explore other options based on your eligibility or state of residence.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Geico Auto Insurance

Although there are a few drawbacks to comparing USAA with Progressive or other top companies, Geico has its share of advantages.

Pros

- Broad National Availability: Geico is operating in all 50 states. Therefore, it is capable of reaching most of the drivers.

- User-Friendly Tools: The website and the mobile application are easy to access. Therefore, users can easily find their respective policy management, claims, and payments.

- Effective Discounts: Geico offers discounts that lessen the premium amounts in many ways.

Cons

- Higher Rates for Some: Of course, some people, being younger drivers, may need to pay higher rates even compared to other insurance companies, including USAA vs. Progressive.

- Support Service: Customer support could be inconsistent. Some are complaining of delays or irrelevant responses.

Geico offers broad coverage and discounts but not always the lowest rates or the best customer service. If you evaluate USAA vs. Progressive or read a Geico auto insurance review, some pros and cons may help you choose your needs.

Comparing USAA and Geico Auto Insurance

USAA focuses on providing affordable auto insurance to military families, with rates starting at $22 per month. Geico serves a broader audience, offering nationwide coverage across the U.S.

Compared to USAA and Geico auto insurance, USAA is the best option for military families because of its specialized benefits and lower rates.

The starting price is at $30. It performs well in customer service. The military benefits offered by USAA make it the best auto insurance for military families and veterans, with benefits targeted toward those who serve.

Geico offers accessible policies and discounts, and both companies are good choices. Avoid high auto insurance costs by entering your ZIP code below to find the best rates in the USAA vs. Geico auto insurance battle.

Frequently Asked Questions

Is USAA car insurance cheaper than Geico?

Yes, USAA car insurance is usually cheaper than Geico for most motorists, as the average monthly rate of this service is about $22. Geico offers full coverage for $30, but factors like driving history, age, and location can affect the rate, leading to why auto insurance varies from state to state.

Quote comparisons from different service providers can help you choose alternatives that suit your needs. USAA tends to be less expensive than other service providers, especially if you are a military family.

Who qualifies for USAA car insurance?

Eligibility for USAA car insurance is available to active-duty service members, veterans, and their family members. The eligibility requirements for USAA car insurance are essential when comparing Geico vs. USAA auto insurance, as USAA offers exclusive coverage options for individuals with military connections.

How does USAA stack up in terms of customer service versus Geico?

When comparing car insurance through USAA vs. Geico, USAA scores higher in customer service, especially among military members and their families. In contrast, Geico is known for its advanced digital tools and robust online support, appealing to customers who prefer a tech-driven experience.

Does USAA have a discount for military personnel?

Geico and USAA home insurance offer several discounts for military members, such as safe driver discounts, bundling policies, and discounts for deployed personnel.

What kind of coverage does Geico offer?

These options include liability, collision, full coverage, and extras like roadside assistance, rental car reimbursement, and much more. This variety is so important to know, speaking to Geico’s position as one of the best comprehensive auto insurance companies when meeting a myriad of needs drivers might require.

Can I request a quote from USAA even if I’m not eligible for membership?

As USAA only sells insurance products to eligible members, you must first qualify under their rules to get a quote. Use our free comparison tool below to see what auto insurance quotes look like in your area.

How do I save money on my Geico car insurance policy?

There are multiple ways to save on Geico insurance:

- Discounts for safe driving

- Good grades (for students)

- Bundling other types of insurance with an existing policy

Does coverage from USAA have certain restrictions?

When comparing USAA car insurance vs. Geico, USAA offers similar coverage to other insurers, but state regulations and policies may introduce specific restrictions.

How would you compare claims handling between USAA and Geico?

When considering Geico or USAA, USAA stands out for its efficient claims handling and high levels of customer satisfaction. In contrast, USAA car insurance vs. Geico reveals that while Geico offers a smooth claims process, customer reviews are more mixed, often depending on the situation.

Checking your auto insurance claims history can help you find out the performance of each company in handling claims so that you can make a better and more informed choice.

Is it easy to change from Geico to USAA?

Of course, you can change from Geico to USAA, but you must coordinate coverage dates to avoid any lapse in insurance coverage. Check the terms and conditions of the new policy before you make the change.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.