Best Vermont Auto Insurance in 2025 (Compare the Top 10 Companies)

The best Vermont auto insurance companies, including Allstate, Farmers, and Liberty Mutual, offer rates as low as $47 per month. These top providers stand out for their affordable premiums. Learn the average cost of car insurance in Vermont to find the best coverage option and understand your potential savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Vermont Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Vermont Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Vermont Auto Insurance

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

Discover the best Vermont auto insurance with the industry leaders including Allstate, Farmers, and Liberty Mutual, offering rates as low as $47 per month.

Allstate excels with top-notch service and fast claims, ideal for Vermont drivers. Read on to learn more about Vermont car insurance and which companies offer the cheapest coverage in Vermont.

Vermont auto insurance is affordable due to its low population and traffic.

Our Top 10 Company Picks: Best Vermont Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 28% A+ Discount Variety Allstate

#2 25% A Personalized Service Farmers

#3 29% A Policy Flexibility Liberty Mutual

#4 22% A++ Affordable Rates Geico

#5 20% A+ Custom Plans Progressive

#6 27% A++ Local Agents State Farm

#7 19% A+ Deductible Program Nationwide

#8 17% A++ Military Benefits USAA

#9 15% A++ Broad Coverage Travelers

#10 10% A Customer Satisfaction American Family

Drivers pay less than the national average and significantly less for minimum coverage. Factors such as credit score or DUI can influence affordability.

Comparing auto insurance companies is important to get the best rates. Use our free comparison tool above to see what auto insurance quotes for Vermont look like.

- Vermont auto insurance is affordable, with rates below the national average

- Allstate provides excellent service and fast claims processing

- Factors like credit score and driving history impact costs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Excellent Service: Known for excellent customer service and quick claims processing.

- Comprehensive Coverage: Offers a wide range of comprehensive coverage options.

- Strong Financial Stability: Provides peace of mind with its strong financial stability.

Cons

- Higher Premiums: Premiums can be higher compared to some competitors. Learn more about their premiums in our Allstate auto insurance review.

- Limited Discounts: Not all policyholders may qualify for extensive discounts.

#2 – Farmers: Best for Personalized Service

Pros

- Competitive Rates: Offers competitive rates across various coverage options.

- Enhanced Coverage: Provides additional coverage enhancements for policyholders.

- Personalized Service: Dedicated agents offer personalized assistance. Check out this page Farmers auto insurance review to know more details.

Cons

- Mixed Claims Handling: Some customers report mixed experiences with claims handling.

- Limited Discounts: Not all discounts may apply universally.

#3 – Liberty Mutual: Best for Policy Flexibility

Pros

- Customizable Policies: Offers customizable policies tailored to individual needs.

- Extensive Discounts: As mentioned in our Liberty Mutual auto insurance review, they provide a wide range of discounts to policyholders.

- Robust Online Tools: User-friendly online platform for policy management.

Cons

- Higher Premiums: Premiums may be higher for certain demographics.

- Interface Issues: Some customers find the online service interface challenging.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Affordable Rates

Pros

- Low Premiums: As mentioned in our Geico auto insurance review, they are known for offering low premiums across demographics.

- User-Friendly Platform: Easy-to-use online platform for managing policies and claims.

- Strong Financial Reputation: Trusted for its strong financial stability.

Cons

- Mixed Customer Service: Some customers report mixed experiences with customer service.

- Limited Agent Support: Relies heavily on online and phone support.

#5 – Progressive: Best for Custom Plans

Pros

- Competitive Rates: Offers competitive rates and innovative tools for policy management.

- Comprehensive Coverage Options: Progressive auto insurance review highlights the wide range of coverage options to choose from.

- Strong Online Presence: User-friendly website and mobile app for policy management.

Cons

- Claims Handling Issues: Some customers experience challenges with the claims process.

- Potential Rate Increases: Rates may increase after the initial policy term

#6 – State Farm: Best for Local Agents

Pros

- Local Agent Network: Extensive network of local agents for personalized service.

- Multiple Policy Options: Offers multiple policy options and bundling discounts.

- Financial Strength: Strong financial stability and security for policyholders. Check out our page titled State Farm auto insurance review to learn more details.

Cons

- Regional Price Variability: Premiums may vary by region and demographic.

- Limited Digital Tools: Digital tools and mobile app features may be less robust.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Deductible Program

Pros

- Financial Stability: Well-established with strong financial stability and security. For more information, read our Nationwide auto insurance review.

- Customizable Coverage: Offers customizable coverage options and bundling discounts.

- Nationwide Availability: Available in multiple states, providing widespread coverage.

Cons

- Regional Premium Variations: Premiums can be higher in certain regions compared to competitors.

- Mixed Customer Satisfaction: Mixed reviews regarding claims handling and customer service.

#8 – USAA: Best for Military Benefits

Pros

- Exceptional Service: Known for exceptional customer service and member benefits.

- Military Discounts: As outlined in USAA auto insurance review, the company offers lower premiums and exclusive benefits for military members.

- Financial Strength: Strong financial stability and security for military families.

Cons

- Limited Eligibility: Only available to military personnel, veterans, and their families.

- Accessibility Issues: Not accessible to the general public, limiting availability.

#9 – Travelers: Best for Broad Coverage

Pros

- Competitive Rates: Provides competitive rates across a range of coverage options.

- Financial Strength: As outlined in our Travelers auto insurance review, Travelers has a strong financial stability and security for policyholders.

- Reputation: Well-regarded for reliability and customer satisfaction.

Cons

- Limited Discounts: Offers fewer discounts compared to larger insurers.

- Customer Feedback: Mixed customer reviews regarding claims handling and service satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Customer Satisfaction

Pros

- Local Agents: Local agents provide personalized service and assistance.

- Bundle Discounts: Offers discounts for bundling home and auto insurance policies.

- Strong Financial Stability: High financial strength ratings provide peace of mind. (Read more: American Family Auto Insurance Review).

Cons

- Limited Availability: Available in fewer states compared to larger insurers.

- Claims Process: Some customers report delays in the claims process.

Cheapest Vermont Auto Insurance Companies

The amount you pay for your insurance depends on various factors, including your age, the make and model of your car, and your credit score.

While any quotes you receive for Vermont insurance will be unique, Geico usually offers the cheapest insurance in the Green Mountain State. Active or retired military members and their families can see even lower rates by choosing USAA. Travelers, Nationwide, and State Farm also offer affordable VT insurance coverage.

Vermont Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$65 $203

$39 $121

$47 $147

$17 $54

$46 $143

$35 $110

$83 $258

$40 $125

$34 $108

$19 $60

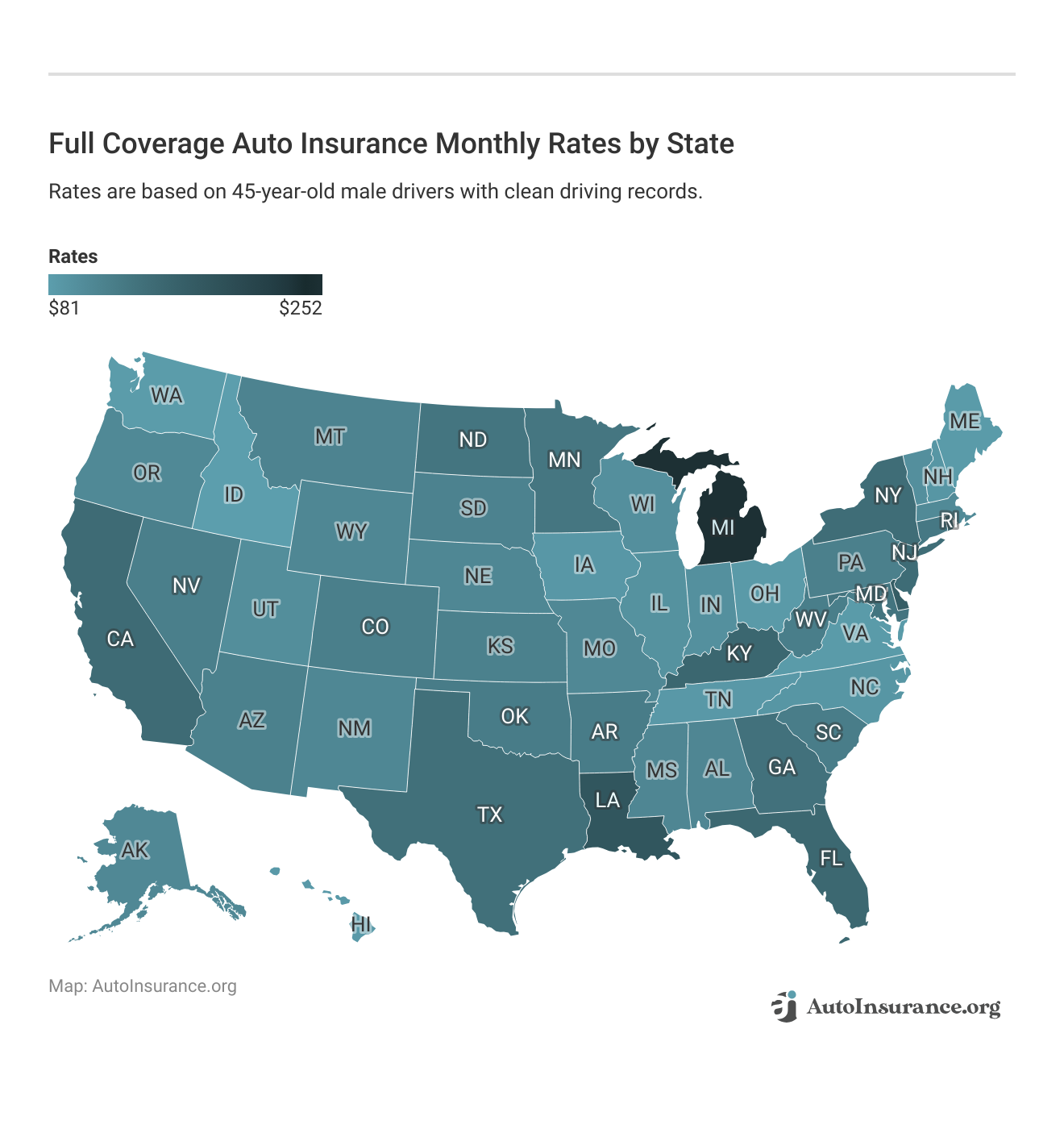

To see how Vermont’s average monthly auto insurance rates compare with the rest of the country, consult the map below:

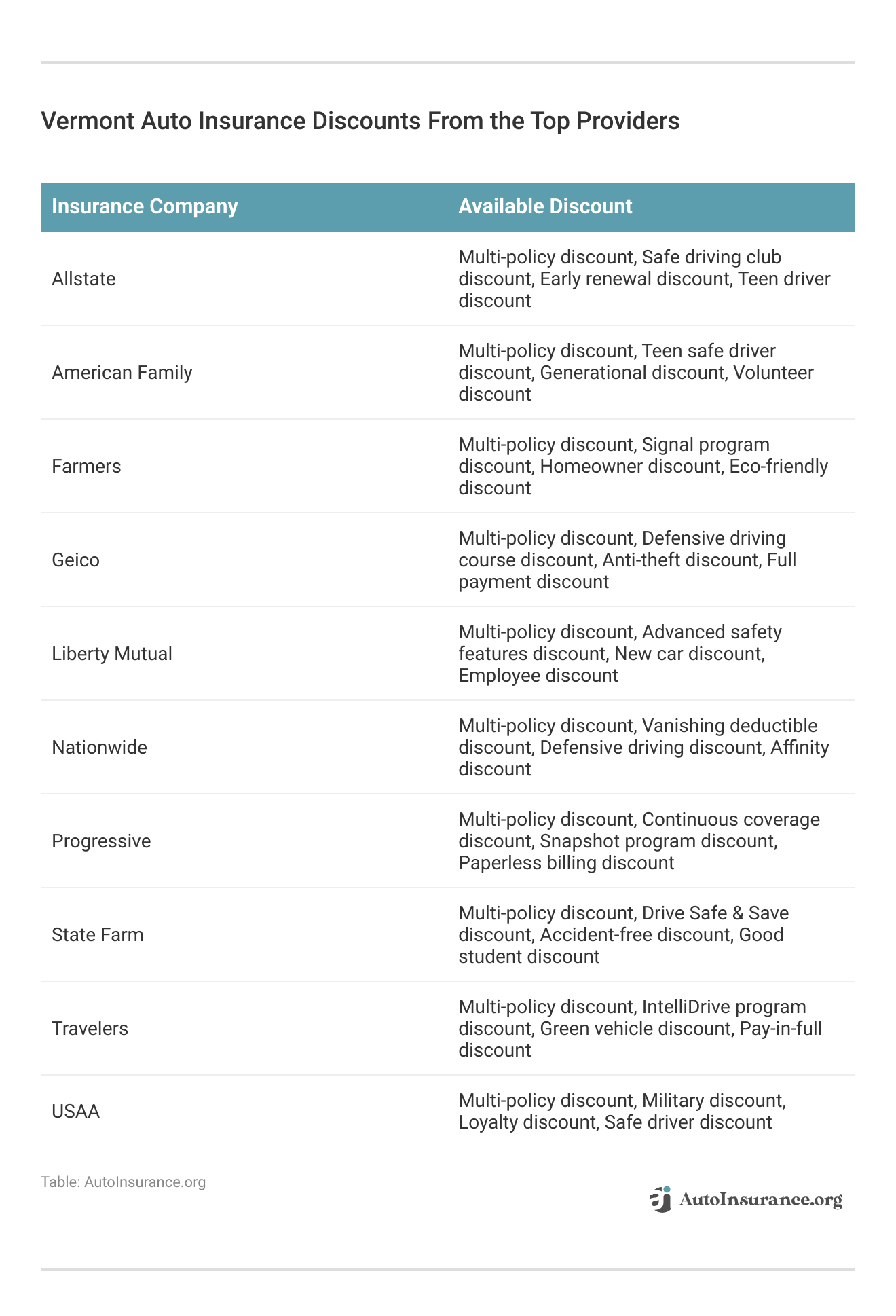

While Geico and USAA offer the lowest rates overall, you should still compare quotes with as many Vermont insurance companies as possible. You might find lower prices for your situation with other companies.

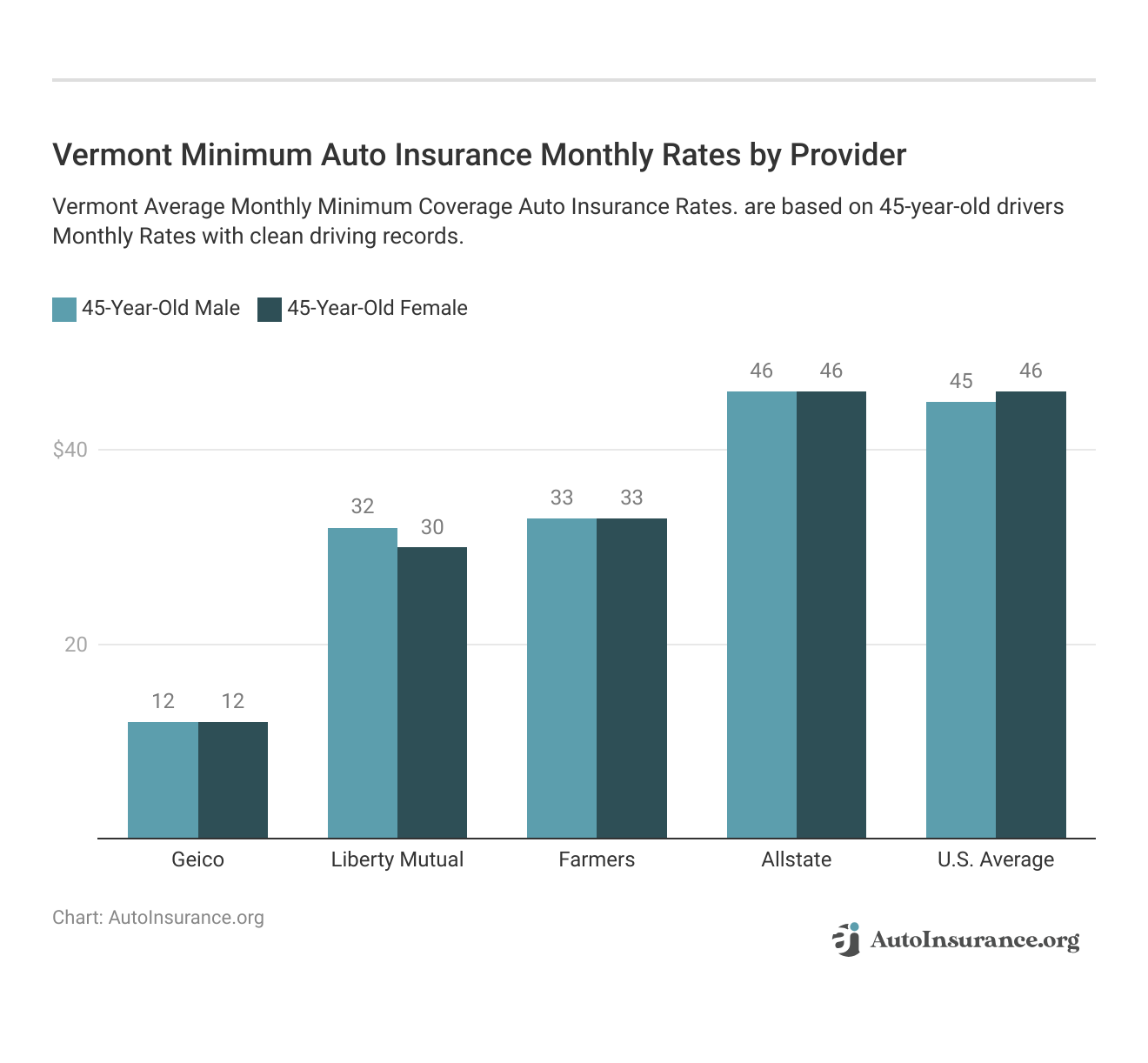

Minimum Auto Insurance Rates in Vermont

You must meet state minimum auto insurance requirements to drive legally, and Vermont is no exception. Vermonters must have the following car insurance policies to drive or register a car:

- Bodily Injury: $25,000 per person

- Bodily Injury: $50,000 per accident

- Property Damage: $10,000 per accident

- Uninsured/Underinsured Motorist Bodily Injury: $50,000 per person

- Uninsured/Underinsured Motorist Bodily Injury: $100,000 per accident

- Uninsured/Underinsured Motorist Property Damage: $10,000 per accident

Buying Vermont’s minimum car insurance is your cheapest option for coverage, with the average driver paying about $19 monthly. You can check the average prices for Vermont car insurance companies below:

Although the average minimum insurance costs under $400 per year, Vermont drivers can save a lot by choosing Geico, USAA, or Travelers.

While minimum insurance is your cheapest car insurance option in Vermont, it comes with a financial risk. If you get into an accident, you’ll have to pay for repairs to your car by yourself. Additionally, you’ll be legally responsible for any damage you cause that exceeds your policy’s limits.

Full Coverage Auto Insurance Rates in Vermont

While Vermont doesn’t require it, many drivers need full coverage. Most car loans require that you have full coverage to finance a car, but having more insurance on your car is never a bad idea. You can get an idea of how much full coverage might cost you in Vermont below.

Once again, Geico, USAA, and Travelers offer the lowest rates in Vermont.

Full coverage insurance includes liability, comprehensive, collision, uninsured/underinsured motorist, and either personal injury protection (PIP) auto insurance or medical payments. However, you can add additional coverages to your policy to increase the protection of your car. Popular options for Vermonters include the following:

- Gap insurance

- Rental car reimbursement coverage

- Roadside assistance coverage

- Custom parts and equipment

While adding more coverage to your policy offers better protection for your car, it also increases your rates. Adding as much coverage as possible to your policy can be tempting, but you should only purchase what you need to help keep costs down.

Vermont Auto Insurance Rates by age

Of all the factors affecting your insurance rates, age is one of the most important. Young drivers pay some of the highest rates for car insurance because they are more likely to cause accidents or drive recklessly.

Although finding cheap auto insurance for teens can be difficult, you won’t be stuck with high prices forever. If you keep your driving record clean, your rates will start to drop around age 25.

Once again, Geico offers the cheapest car insurance in Vermont for teen drivers. So, you should always compare VT auto insurance rates — your unique circumstances might make one company more affordable than another.

Vermont Auto Insurance Rates by Credit Score

Most states allow car insurance companies to look at your credit score to determine your rates, including Vermont. Drivers with low credit scores can pay up to 50% more for insurance than drivers with high scores:

Vermont Full Coverage Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

USAA offers the cheapest car insurance in Vermont for bad credit, averaging $125 monthly.

Vermont Auto Insurance Rates After an Accident

When an insurance company crafts your rates, it’s trying to determine how risky you are to insure. Insurance companies want to minimize their risk of paying expensive claims, so the greater the likelihood that you will cost the company money, the more you’ll pay for insurance.

One of the easiest ways for a company to determine your riskiness is to look at your driving history. Incidents like at-fault accidents, speeding tickets, and other traffic violations can increase your insurance significantly.

Take a look below to get an idea of how an at-fault accident affects your VT car insurance:

Vermont Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $267 | $203 | |

| $183 | $121 | |

| $209 | $147 | |

| $85 | $54 | |

| $176 | $143 |

| $161 | $110 |

| $443 | $258 | |

| $148 | $125 | |

| $151 | $108 | |

| U.S. Average | $203 | $133 |

Geico might be your best choice for affordable car insurance quotes in Vermont if you have an at-fault accident on your record. While your rates will be higher after an accident, they’ll fall after about three years if you keep your driving record clean.

Vermont Auto Insurance Rates After a DUI

According to Vermont State Highway Safety Office, Vermont defines drunk driving by a driver’s blood alcohol content (BAC), ranging from 0.08 for drivers over 21 to 0.02 for bus drivers or minors. To combat drunk driving, Vermont imposes strict consequences:

- First convictions face up to two years in prison, a 90-day license suspension, and a $750 fine.

- Second-time offenders see up to two years in prison, an 18-month suspension, and a $1,500 fine.

- A third conviction earns up to five years in prison, a fine of $2,500, and a permanent suspension of their license.

Getting a DUI will drastically increase your rates, and you might have to find insurance for high-risk drivers if your current provider will no longer cover you. To get an idea of how much your rates might increase after a DUI, check below:

Vermont Full Coverage Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $203 | $267 | $276 | $233 | |

| $121 | $183 | $202 | $142 | |

| $147 | $209 | $204 | $183 | |

| $54 | $85 | $132 | $54 | |

| $143 | $176 | $184 | $158 |

| $110 | $161 | $217 | $126 |

| $258 | $443 | $305 | $323 | |

| $125 | $148 | $136 | $136 | |

| $108 | $151 | $224 | $146 | |

| U.S. Average | $133 | $203 | $209 | $167 |

Once again, Geico has the cheapest average Vermont car insurance rates for DUI drivers, but other factors might make another company more appealing. Read more about the best auto insurance companies for drivers with a DUI.

You can lower your rates by avoiding additional violations, but DUIs take longer to fall off your record than at-fault accidents. A DUI will affect your rates for about seven years.

Auto Insurance Costs in Vermont Cities

This table presents a snapshot of auto insurance costs across key cities in Vermont, including Burlington, South Burlington, and St. Albans. By offering a concise comparison, residents can quickly assess potential expenses associated with insurance coverage in their area, facilitating informed decision-making regarding their insurance needs.

Vermont Auto Insurance Cost by City

Cheapest Cities for Vermont Auto Insurance

One of the key ways insurance companies decide how much to charge you is by looking at where you live. Auto insurance in Vermont is generally cheaper than the national average, but are some cities more expensive than others?

Some states see a great deal of variation between cities, but Vermonters pay about the same no matter where they live. Whether Burlington, VT auto insurance or Rutland, VT, auto insurance, insurance between Vermont cities is usually affordable.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Vermont Auto Insurance Laws

Aside from requiring a minimum amount of insurance, Vermont has several other auto insurance laws drivers should be aware of.

Drivers must carry proof of insurance whenever they get behind the wheel of their car and must show law enforcement whenever asked. If you’re caught without car insurance, you’ll face a fine of up to $600, suspension of your license until you can prove coverage, and you’ll need to get financial responsibility insurance for three years.

Additionally, you’ll face harsher punishments for any traffic violations you commit if you don’t have insurance.

If you don’t have insurance because companies refuse to sell to you or it’s too expensive, you can apply for coverage from the Vermont Automobile Insurance Plan. This program ensures that all drivers can get the minimum insurance Vermont requires.

Vermont SR-22 Auto Insurance

Vermont requires drivers to file financial responsibility insurance after a DUI, a reckless driving charge, driving without auto insurance, or driving with a suspended license. Drivers can prove financial responsibility by having an insurance company file an SR-22 form.

An SR-22 form proves that a driver has at least the minimum amount of insurance required by Vermont. If you’re ordered to establish financial responsibility, you’ll have to file an SR-22 form for at least three years.

If you allow your financial responsibility insurance to lapse, your driving privileges will be suspended until you can refile an SR-22 form with the DMV.

How to get Vermont SR-22 Auto Insurance

Getting SR-22 auto insurance in Vermont is easy, especially if you already have insurance. You can simply contact a representative from your insurance company and ask them to file an SR-22 form.

Most companies charge a flat fee between $50 and $115 to file an SR-22 form for you, and your insurance rates will likely increase. However, you may still be able to find cheap SR-22 insurance with certain insurance companies.

If you need a new insurance policy, make sure to include that you need SR-22 insurance when you request a quote. Some companies will deny you coverage, but most will work with you.

Some drivers need SR-22 insurance to reinstate their licenses but don’t have a car. If you find yourself in this situation, the easiest way to get SR-22 insurance is to buy a non-owners policy. A non-owners policy covers you when you occasionally drive someone else’s car and allows you to file an SR-22 form.

Find the Best Vermont Auto Insurance Today

Finding cheap car insurance in Vermont doesn’t have to be a chore, especially if you look at Geico or USAA. However, you can only qualify for USAA insurance in Vermont if you’re a military member or veteran.

USAA is one excellent option for veterans 🪖and their families, but many other national companies are worth comparing. https://t.co/27f1xf1ARb has compiled a guide 📑to help veterans find the best auto🚘 insurance. Check it out here👉: https://t.co/tiseEVnfEj pic.twitter.com/dVkDa3OKPl

— AutoInsurance.org (@AutoInsurance) September 1, 2023

While factors like at-fault accidents, low credit scores, or DUIs will increase how much you’ll pay, the Green Mountain State usually has cheap auto insurance.

While Vermont’s average car insurance rate is below the national average, the rates you see will be unique to your circumstances. To find the best car insurance in Vermont, compare quotes with as many Vermont insurance companies as possible.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is car insurance in Vermont?

The average Vermont driver pays about $99 monthly for full coverage auto insurance, and $32/mo for liability. Of course, auto insurance rates in Vermont vary based on your unique situation.

Does Vermont require car insurance?

Yes, all Vermont drivers must carry a minimum amount of liability and uninsured/underinsured motorist insurance. Penalties for driving without insurance include fines, license suspension, and having to file SR-22 insurance.

Is auto insurance mandatory in Vermont?

Auto insurance is mandatory in Vermont. All drivers must have liability insurance coverage to legally operate a vehicle in the state.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

What car insurance is required in Vermont?

In Vermont, drivers must carry certain minimum auto insurance coverage. This includes $25,000 for bodily injury liability per person involved in an accident, $50,000 for bodily injury liability per accident to cover injuries to multiple individuals, and $10,000 for property damage liability per accident, which covers damage to another person’s property.

Is Vermont a no-fault state?

A no-fault auto insurance state means drivers use their own insurance after an accident, no matter who is at fault. Vermont is not a no-fault state — drivers must cover damage and injuries they cause in an accident with their liability insurance.

What other types of auto insurance coverage are available in Vermont?

Vermont drivers can opt for additional coverage types such as collision (for vehicle repairs regardless of fault), comprehensive (for damage from theft, vandalism, or natural disasters), medical payments (for accident-related medical expenses), and uninsured/underinsured motorist coverage (protecting against insufficiently insured drivers).

Do I need to purchase collision and comprehensive coverage?

Collision and comprehensive coverage are optional for Vermont car insurance requirements. However, if you have a financed or leased vehicle, your lender or leasing company may require you to carry these coverages until the loan is paid off.

Is car insurance cheaper in Vermont?

Vermont is one of the cheapest states for liability car insurance due to its lack of big cities and uninsured drivers.

What factors influence auto insurance rates in Vermont?

Auto insurance rates in Vermont can be influenced by several factors, including your age, driving history, the make and model of your vehicle, credit score, and even your ZIP code. Each insurance company evaluates these factors differently, so it’s essential to compare quotes to find the best rate tailored to your specific circumstances.

What should I do if I can’t find affordable auto insurance in Vermont?

If you’re having difficulty finding affordable auto insurance in Vermont, consider reaching out to the Vermont Automobile Insurance Plan (VAIP). VAIP helps ensure that all drivers can obtain the minimum required auto insurance coverage, even if they have been denied Vermont auto coverage or face high premiums due to various factors such as a poor driving record or financial issues.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance in Vermont.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.