Virginia Minimum Auto Insurance Requirements in 2025 (What VA Drivers Need to Buy)

Virginia minimum auto insurance requirements mandate liability coverage of 30/60/20, which provides protection for bodily injury per person, per accident, and property damage. Virginia car insurance rates start at $30/mo. Drivers in Virginia can meet legal obligations and protect against accident-related costs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Virginia minimum auto insurance requirements make sure drivers have liability coverage of 30/60/20. This means financial protection for property damage and bodily injury liability auto insurance in case of an accident.

These needs include uninsured motorist coverage, which protects against accidents with drivers who don’t have enough insurance. In Virginia, it is possible to drive legally without having insurance, but the driver must take full responsibility for any costs if an accident happens.

Virginia Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $30,000 per person / $60,000 per accident |

| Property Damage Liability | $20,000 per accident |

To stop getting big punishments, like losing their license or paying fines, drivers need follow these rules. If they learn the rules and look for more insurance choices, drivers can keep their things safe and make sure they are following law correctly. If you need a more affordable policy, you can view new policies with the help of our free comparison tool above.

- Virginia requires 30/60/20 liability coverage for drivers

- Uninsured motorist coverage protects against uninsured drivers

- Legal driving without insurance leaves drivers fully liable

Virginia Minimum Coverage Requirements & What They Cover

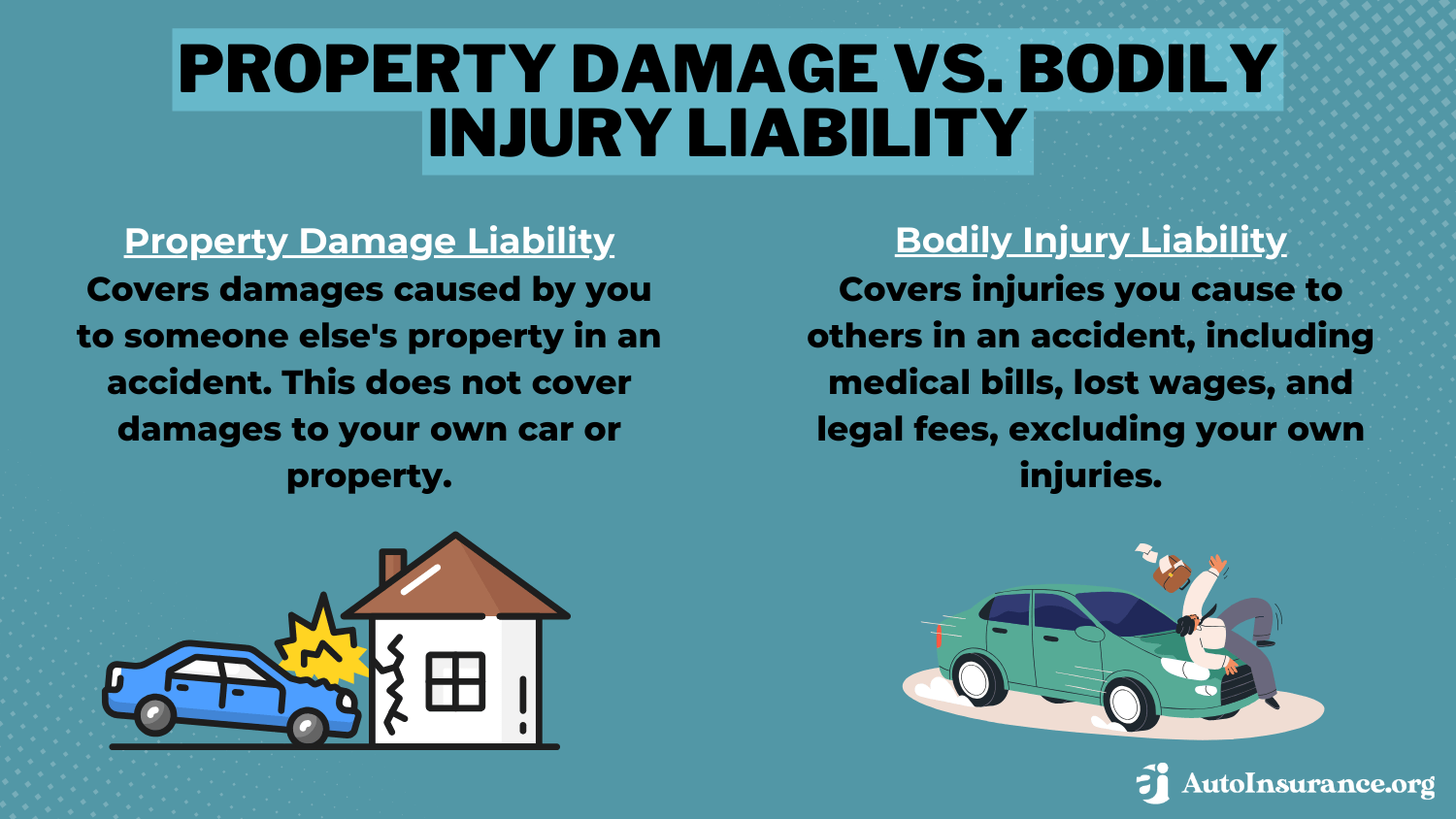

To determine if you have the right auto insurance policy for your needs, you need to understand the types of coverage available in Virginia and their definitions.

- Bodily Injury Liability: Bodily Injury Liability coverage pays for the injuries or deaths of individuals, not the policyholder. If you drive someone else’s vehicle, this coverage may apply to you and any occupants.

- Property Damage Liability: If you or someone you allow to drive your car causes property damage, this coverage pays for that damage. Property damage can include damaging someone else’s car, damaging someone else’s residential property with your vehicle, or paying to repair items such as light poles and railings.

Virginia mandates auto insurance policies that address bodily harm and property damage liability. Discover the best Property Damage Liability (PDL) auto insurance companies to protect your assets.

While bodily injury liability provides protection for others affected by your driving, property damage liability ensures that physical damage to external structures or vehicles is covered.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Virginia

Each state sets its car insurance requirements. When you view car insurance requirements for Virginia, you’ll see that they require bodily injury and/or death of a single person, bodily injury and/or death of more than one person, and property damage.

After those listings, you will see an amount in thousands of dollars. This amount represents the minimum amount of coverage you need to drive legally. For example, if you see $25,000 listed after the bodily injury and/or death of a single person, this means that your car insurance policy must have at least $25,000 of coverage for that category.

You are not legally allowed to drive if the policy lists a lesser amount. The details below show the top three companies that give the cheapest car insurance in Virginia, according to users’ reviews and ratings. Each company is very good at offering low prices while also having strong trust from customers for being reliable.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsUSAA is the most affordable choice, offering great value for military members and their families. Progressive comes next with policies that can be tailored to individual needs and good prices throughout Virginia. State Farm is in third place, well-known because it has many agents and good customer service scores.

The ratings are between 4.3 to 4.8, showing that customers are usually happy with them. This highlights the company’s promise to provide quality and affordable services. Drivers can compare these providers to find a plan tailored to their specific needs.

Virginia Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Alexandria | $82 |

| Arlington | $80 |

| Blacksburg | $64 |

| Chesapeake | $72 |

| Danville | $65 |

| Hampton | $74 |

| Lynchburg | $67 |

| Newport News | $73 |

| Norfolk | $85 |

| Richmond | $78 |

| Roanoke | $68 |

| Virginia Beach | $70 |

The table shows the average monthly cost for minimum auto insurance in different cities of Virginia. These prices change by place because of how many people live there, the traffic, and local dangers.

Read more: Minimum Auto Insurance Requirements by State

Penalties for Driving Without Insurance in Virginia

If the driver of a vehicle does not purchase insurance or pay the $500 fee to operate their vehicle without insurance, he or she can face heavy fines and other penalties.

- Driver’s License and Registration Suspension

- Must Pay a $500 Statutory Fee

- Purchase and Maintain SR-22 Insurance for Three Years

- Pay a Fee for Reinstatement

Driving uninsured in Virginia can lead to severe repercussions that extend beyond immediate fines. Non-compliance with the state’s auto insurance laws exposes drivers to financial penalties, legal obligations, and prolonged administrative hurdles.

Other Coverage Options to Consider in Virginia

The table shows extra coverages—Personal Injury Protection (PIP), Collision, Comprehensive, and Uninsured/Underinsured Motorist—and what benefits they give. Each choice adds to the required liability coverage, providing specific financial safety for different needs.

- Personal Injury Protection (PIP) / Medical Payments: PIP insurance covers the medical payments for treating the policyholder’s injuries after a car accident and funeral costs if someone dies. Extremely generous PIP coverage may also cover lost wages and other financial losses due to the accident.

- Collision: Collision insurance pays for the damage to your vehicle if you are involved in a car accident deemed your fault. This type of coverage usually has a deductible that you must pay.

- Comprehensive: Comprehensive insurance coverage pays for damage to your vehicle that does not result from hitting another car or object. Items covered under this policy may include fire, theft, vandalism, and certain weather-related damages.

- Uninsured and Underinsured Motorist Coverage: The uninsured and underinsured motorist portion of your car insurance policy helps pay for your accident-related expenses if you are hit by a driver who does not have any insurance or has an insurance policy that does not cover all of your accident-related expenses.

Drivers who buy these policies ensure they are protected from medical costs, sudden damages, and liability issues caused by underinsured people or natural disasters. Find out how Personal Injury Protection (PIP) auto insurance ensures comprehensive accident coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Car Insurance Policy Requirements in Virginia

Insurance policy requirements are often listed as a set of numbers. If you have the minimum insurance for Virginia, your policy would list 30/60/20. These numbers should be multiplied by 1,000 to get the dollar amounts of the specific coverages.

- First Number (Bodily Injury One Person): The first number indicates the maximum amount of money your car insurance provider will pay out for the injuries or death of one of the occupants of the other vehicle, assuming you were determined to have caused the accident.

- Second Number (Bodily Injury Multiple People): The second number indicates the maximum amount of money your insurance provider will pay for the injuries and/or deaths of multiple occupants of the other vehicle.

- Third Number (Property Damage): The third number indicates the maximum amount available to pay for any property damage.

Virginia’s 30/60/20 insurance coverage offers essential liability protection but leaves gaps for high-cost scenarios. Understand how to compare rates for the cheapest liability-only auto insurance in your area.

Virginia’s 30/60/20 coverage provides a solid foundation for legal driving and basic financial protection.Brandon Frady Licensed Insurance Producer

While legal, the minimum coverage can be insufficient for modern vehicle prices or severe accidents, underscoring the importance of customized policies.

Minimum Requirements vs. Recommended Coverage in Virginia

The state of Virginia does allow drivers to operate their vehicles without car insurance. These drivers must pay the BMV $500, which is an uninsured motor vehicle fee. The minimum insurance requirements in Virginia only ensure that you are legal to drive. They may not actually cover all of your accident-related expenses, and if more money is required to cover the remaining expenses, you could be held personally responsible for paying the rest of that money to the other driver.

Wondering🤔 how your state’s minimum car 🚗insurance requirements compare to other states? We have the low down right here👉: https://t.co/fuNJF9boUN pic.twitter.com/7cdb8jo22t

— AutoInsurance.org (@AutoInsurance) November 18, 2024

This fee does not provide any car insurance. If the driver gets into an at-fault accident, he or she would be responsible for paying the accident-related expenses from their own personal finances.

For example, Virginia only requires $20,000 in property damage. The average cost of a new car is $32,086, which means if you hit a new car, you could be responsible for paying thousands of dollars, even after your insurance company pays a settlement. If the accident results in someone’s death, it could result in an economic cost of more than one million dollars and a major disabling injury could cost nearly $80,000.

To ensure that you are properly covered in the event of an accident, you should purchase a car insurance policy that pays for the average expenses incurred in a car accident instead of the state minimums. This may mean making sure you have $40,000 in personal property coverage instead of $20,000 and making sure your bodily injury and death coverage is at least $80,000.

Discover more by reading our guide: What are the recommended auto insurance coverage levels?

How to Get Car Insurance in Virginia

To get the right amount of coverage for the state of Virginia for a price you can afford, you should use the services of a car insurance comparison tool.

These fast, free tools allow you to input your information and car insurance needs and get results for all of the available car insurance policies in your local area.

Once you have your results, you can quickly view the prices, auto insurance policy inclusions, and exclusions to determine which policy would best benefit you. Don’t miss out on our free quote tool below. Just enter your ZIP code to start comparing rates for free now.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are Virginia auto insurance requirements?

Virginia auto insurance requirements mandate liability coverage of $30,000 per person, $60,000 per accident, and $20,000 for property damage, with rates starting at approximately $18/month. Discover the unique benefits of collision vs. comprehensive auto insurance and what each covers.

What are Virginia liability insurance requirements?

Virginia liability insurance requirements ensure drivers carry 30/60/20 coverage, which protects against bodily injury and property damage caused to others. Virginia minimum car insurance requirements include $30,000 for bodily injury per person, $60,000 per accident, and $20,000 for property damage per accident.

What are Virginia car insurance laws?

Virginia car insurance laws allow drivers to purchase the minimum liability coverage or pay a $500 uninsured motor vehicle fee, though the latter offers no financial protection in accidents. To lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

What are Virginia SR-22 insurance requirements?

Virginia SR-22 auto insurance requirements involve filing proof of financial responsibility with the state, typically requiring minimum liability coverage of 30/60/20.

What is the state minimum auto insurance in Virginia?

Virginia’s state minimum auto insurance includes 30/60/20 liability coverage, ensuring legal compliance, with rates starting around $18/month.

What is included in a Virginia auto insurance guide?

A Virginia auto insurance guide highlights the 30/60/20 minimum requirements, uninsured motorist coverage, optional policies like comprehensive or collision, and tips for cost savings.

Is Direct Auto insurance available in Petersburg, VA?

Yes, Direct Auto insurance is available in Petersburg, VA, offering affordable options that meet state requirements and customizable add-ons.

Is temporary car insurance available in Virginia?

Yes, temporary car insurance in Virginia is available for short-term needs, typically offering coverage for periods as brief as one day to several weeks. Explore step-by-step tips on how to insure a car for one-month hassle-free.

What are Virginia’s bodily injury limits?

Virginia bodily injury limits are set at $30,000 per person and $60,000 per accident for liability coverage under state minimum requirements.

Can you have Virginia tags with no insurance?

Yes, in Virginia, you can have tags with no insurance by paying a $500 uninsured motor vehicle fee, but this does not provide any financial protection in the event of an accident.

What are Virginia trailer insurance requirements?

Virginia requires liability coverage for trailers if they are towed by a vehicle on public roads. Coverage must meet 30/60/20 liability standards.

What is the Virginia uninsured motor vehicle fee?

The Virginia uninsured motor vehicle fee is a $500 payment allowing you to drive legally without insurance, though it offers no protection against accident-related costs. Explore the legal requirements and dangers of driving without auto insurance in your state.

What is full coverage auto insurance in Virginia?

Full coverage auto insurance in Virginia includes liability coverage, comprehensive, and collision insurance to protect against both at-fault accidents and non-collision events like theft or natural disasters.

What type of insurance satisfies the financial responsibility law in Virginia?

In Virginia, the financial responsibility law is satisfied by carrying 30/60/20 liability coverage or paying the uninsured motor vehicle fee.

Which type of insurance coverage is required in Virginia?

Virginia requires liability insurance, with minimum limits of $30,000 per person, $60,000 per accident, and $20,000 for property damage.

Do you need insurance to register a car in Virginia?

Yes, to register a car in Virginia, you must either provide proof of insurance or pay the $500 uninsured motor vehicle fee. Discover how to get instant proof of your auto insurance policy online in just a few steps.

Is collision insurance required in Virginia?

No, collision insurance is not required in Virginia but is recommended to cover damages to your vehicle after an at-fault accident.

What is the minimum bodily injury coverage in Virginia?

The minimum bodily injury coverage in Virginia is $30,000 per person and $60,000 per accident, as part of the state’s liability insurance requirements.

Does Virginia require car owners to carry automobile liability insurance?

Yes, Virginia requires car owners to carry 30/60/20 automobile liability insurance, or alternatively, pay the $500 uninsured motor vehicle fee to drive legally. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.