Best Washington, D.C. Auto Insurance in 2025 (Check Out These 10 Companies!)

Secure the best Washington, D.C. auto insurance with rates starting at $29 per month, led by State Farm, Geico, and Progressive, renowned for their competitive pricing and comprehensive coverage options. Compare quotes from these top providers to find the most suitable D.C. car insurance policy for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe top picks for the best Washington, D.C. auto insurance are State Farm, Geico, and Progressive, offering monthly rates at $29. In this article, Washington, D.C. auto insurance guide helps you compare policies and find the most suitable coverage for your needs.

Finding cheap auto insurance in Washington, D.C. depends on your driving habits and the insurer you choose. Factors like age, driving record, credit score, and ZIP code affect rates.

Our Top 10 Company Picks: Best Washington, D.C. Auto Insurance

Company Rank Multi-Car Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Customer Service State Farm

#2 18% A++ Cheap Rates Geico

#3 12% A+ Senior Discounts Progressive

#4 20% A++ Military Members USAA

#5 14% A Add-on Coverages Liberty Mutual

#6 13% A++ Industry Experience Travelers

#7 16% A+ Multi-Policies Discount Allstate

#8 11% A+ Tailored Policies The Hartford

#9 15% A Safe-Driving Discounts Farmers

#10 10% A Claims Service American Family

Keep reading to find out how much auto insurance you need and where you can find the best Washington, D.C. car insurance rates for your policy. Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- Compare quotes from top D.C. insurers for best rates

- Factors like age, driving history matter

- State Farm is top pick for affordable coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Agent Network: State Farm boasts one of the largest networks of agents, ensuring personalized service and local expertise.

- Strong Financial Stability: Known for its financial strength, State Farm consistently receives high ratings from A.M. Best. Check out our page titled State Farm auto insurance review to learn more details.

- Comprehensive Coverage Options: Offers a wide range of policies including auto, home, and life insurance, allowing for bundling discounts.

Cons

- Higher Premiums: Compared to some competitors, State Farm’s premiums can be on the higher side, especially for young drivers.

- Limited Online Tools: While improving, State Farm’s online tools and mobile app features lag behind some of the more tech-savvy competitors.

#2 – Geico: Best for Cheap Rates

Pros

- Competitive Pricing: Geico is known for offering some of the most affordable rates in the industry.

- User-Friendly Online Experience: As mentioned in our Geico auto insurance review, they are known for excellent website and mobile app for managing policies and claims.

- Discount Opportunities: A variety of discounts available, including for good drivers, military personnel, and federal employees.

Cons

- Limited Agent Availability: Primarily operates online and via phone, which may not suit those preferring in-person interactions.

- Mixed Customer Service Reviews: While many praise Geico for affordability, customer service experiences can be inconsistent.

#3 – Progressive: Best for Coverage Options

Pros

- Name Your Price Tool: Their unique tool allows customers to customize their coverage and find a policy that fits their budget.

- Variety of Coverage Options: Progressive offers a wide range of insurance products and coverage options, including specialized policies like rideshare and pet injury coverage.

- Strong Online Tools: Progressive auto insurance review highlights the robust digital tools for policy management and claims processing.

Cons

- Mixed Customer Service Reviews: Some customers report dissatisfaction with Progressive’s customer service, citing delays in claims processing and communication issues.

- Price Competitiveness: While the Name Your Price Tool is helpful, Progressive’s premiums may not always be the cheapest option for all demographics or coverage needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Members

Pros

- Excellent Customer Service: USAA consistently receives high ratings for customer service, with personalized attention and efficient claims processing.

- Competitive Rates for Military: As outlined in USAA auto insurance review, the company offers great rates and special benefits for military members and their families.

- Exclusive Member Benefits: Members enjoy benefits such as dividend distributions, flexible payment options, and extensive coverage options tailored to military personnel.

Cons

- Membership Restrictions: USAA membership is limited to military members, veterans, and their families, which restricts eligibility for others seeking their services.

- Limited Availability: Not available to the general public, USAA operates in a limited number of states, potentially limiting options based on geographical location.

#5 – Liberty Mutual: Best for Add-On Coverages

Pros

- Customizable Policies: Offers a wide range of add-ons and customizable coverage options.

- Accident Forgiveness: Includes accident forgiveness and new car replacement in some policies.

- Discount Opportunities: As mentioned in our Liberty Mutual auto insurance review, they offer various discounts, including multi-policy and safe driver discounts.

Cons

- Higher Premiums: Can be more expensive than other insurers for some drivers.

- Average Customer Service: Customer service ratings are average, with some reports of dissatisfaction.

#6 – Travelers: Best for Industry Experience

Pros

- Extensive Coverage Options: As outlined in our Travelers auto insurance review, Travelers offers a broad array of insurance products and customizable policies.

- Strong Financial Ratings: Well-rated for financial stability and claims-paying ability.

- Discounts and Bundling: Multiple discount opportunities, especially when bundling with other insurance products.

Cons

- Higher Rates for High-Risk Drivers: Can be costly for drivers with poor records.

- Digital Tools: Online tools and mobile app are functional but not as advanced as some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Multi-Policies Discount

Pros

- Wide Range of Coverage Options: Allstate offers a comprehensive selection of coverage options, including standard policies and additional features like roadside assistance and rental reimbursement.

- Strong Financial Stability: Allstate has a solid financial strength rating, providing reassurance of its ability to pay claims even in challenging situations.

- Variety of Discounts: Numerous discount opportunities for safe driving, bundling, and more. Learn more about the discounts available in our Allstate auto insurance review.

Cons

- Higher Premiums: Some customers may find Allstate’s premiums to be higher compared to other insurers, especially for certain demographics or higher-risk drivers.

- Mixed Customer Service Reviews: Reviews on customer service can vary, with some policyholders reporting issues with claims processing and responsiveness.

#8 – The Hartford: Best for Tailored Policies

Pros

- AARP Member Benefits: Special rates and benefits for AARP members. Learn more in our The Hartford auto insurance review.

- Strong Customer Service: High ratings for customer support and satisfaction.

- Comprehensive Coverage Options: Broad range of coverage options tailored for older drivers.

Cons

- Higher Costs for Non-AARP: Rates can be less competitive for those not eligible for AARP benefits.

- Limited Online Features: Digital tools and mobile app are not as advanced as some competitors.

#9 – Farmers: Best for Safe-Driving Discounts

Pros

- Customizable Policies: Farmers Insurance offers a variety of customizable policies with extensive coverage options tailored to individual needs.

- Discount Opportunities: Policyholders can benefit from discounts for safe driving records, bundling policies, and owning eco-friendly vehicles.

- Financial Stability: Farmers has a strong financial stability rating and a reputable history in the insurance industry.

Cons

- Higher Premiums: Can be more expensive than some other insurers. Check their rates in our Farmers auto insurance review.

- Mixed Customer Service Reviews: While some customers praise their experiences, others report inconsistent customer service, particularly with claims processing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Claims Service

Pros

- Customizable Coverage: American Family offers a wide range of customizable coverage options, allowing policyholders to tailor their insurance plans to their specific needs.

- Discount Opportunities: Discounts are available for bundling policies, safe driving, and loyalty, making it potentially more affordable for many customers.

- Strong Customer Service: Generally positive reviews for customer service, with many policyholders noting responsive agents and efficient claims handling.

Cons

- Limited Availability: Not available in all states. (Read More: American Family Auto Insurance Review).

- Varied Premiums: Premium rates can vary significantly depending on factors like location, driving history, and coverage options selected, which may lead to higher costs for some customers.

Cheapest Washington, D.C. Auto Insurance Companies

The cheapest D.C. auto insurance companies discussed below are based on average rates. You may find that your Washington, D.C. auto insurance quotes are contingent on location and car type, so use the top companies in this guide as a place to start your quote comparison.

Washington, D.C. Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $101 $241

American Family $48 $115

Farmers $58 $139

Geico $29 $69

Liberty Mutual $76 $180

Progressive $48 $114

State Farm $47 $111

The Hartford $43 $113

Travelers $43 $102

USAA $20 $48

Comparing auto insurance quotes is essential to find the best coverage and affordable rates for your needs.

Cheapest Washington, D.C. Auto Insurance Companies for Liability Coverage

Minimum liability auto insurance coverage in Washington, D.C. includes uninsured motorist coverage, which can raise your rates. However, rates remain cheaper than the national average of $55 per month. Below are the most affordable liability auto insurance companies in the District:

Minimum Coverage Auto Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $87 | |

| $62 | |

| $53 | |

| $76 | |

| $43 | |

| $96 |

| $63 |

| $56 | |

| $47 | |

| $53 | |

| $32 | |

| U.S. Average | $61 |

If you choose to carry higher liability limits on your policy, expect your average quotes to be higher than these. Your car insurance quotes will also go up if you have an accident or speeding ticket, so shop around with multiple companies before you buy.

Washington, D.C. Auto Insurance Rates by Driver

Washington, D.C. car insurance companies are able to offer competitive rates to good drivers because the number of traffic fatalities in the District is so low. Safe driving habits reward all local drivers with cheap rates as long as they’re able to maintain a clean record and a good credit score.

Keep reading for side-by-side comparisons of auto insurance quotes in Washington, D.C. by driving record.

Cheap Auto Insurance in Washington, D.C. With an At-Fault Accident

Unfortunately, one accident can raise your D.C. car insurance rates by 30%.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

Geico offers the cheapest car insurance in Washington, D.C. to drivers after an accident, averaging $106 monthly. However, insurers like Allstate and Nationwide offer accident forgiveness policies that won’t raise your rates after a covered collision. You may pay slightly higher monthly rates for this perk, but you won’t see that 30% increase other at-fault drivers see after an accident.

Read More:

Compare insurance quotes from as many companies as possible to find the absolute best rates if you have one or more accidents on your record.

Cheap Auto Insurance in Washington, D.C. for Young Drivers

Due to inexperience behind the wheel, auto insurance for young adults comes with the highest rates. Car insurance companies in Washington, D.C. charge teens double the rates they charge drivers in their 30s and 40s, and most young drivers won’t see their rates go down until they turn 25.

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $468 | $540 | $141 | $147 | $125 | $122 | $122 | $119 |

| $640 | $740 | $240 | $252 | $231 | $228 | $226 | $223 | |

| $435 | $591 | $165 | $195 | $164 | $166 | $161 | $163 | |

| $520 | $600 | $200 | $210 | $190 | $185 | $180 | $175 | |

| $853 | $897 | $228 | $239 | $199 | $198 | $194 | $194 | |

| $313 | $362 | $128 | $124 | $114 | $114 | $112 | $112 | |

| $745 | $893 | $249 | $285 | $244 | $248 | $239 | $243 |

| $404 | $454 | $124 | $130 | $112 | $110 | $110 | $108 | |

| $432 | $552 | $177 | $194 | $161 | $164 | $158 | $160 |

| $843 | $944 | $187 | $194 | $159 | $150 | $156 | $147 | |

| $362 | $417 | $109 | $113 | $103 | $101 | $101 | $99 | |

| $327 | $405 | $133 | $147 | $123 | $123 | $120 | $120 | |

| $580 | $670 | $180 | $190 | $164 | $161 | $159 | $156 |

| $757 | $1,056 | $142 | $154 | $139 | $141 | $136 | $138 | |

| $257 | $289 | $106 | $113 | $84 | $84 | $82 | $82 | |

| U.S. Average | $560 | $656 | $182 | $191 | $166 | $165 | $163 | $161 |

If you’re a teen driver, cheap car insurance in D.C. is hard to come by. Auto insurance for teens in Washington, D.C. is cheaper if you can add yourself to a parent, guardian, or roommate’s policy. Their rates will go up too, but you will still pay much less than you would be buying an individual policy.

Cheap Auto Insurance in Washington, D.C. With Bad Credit

How credit scores affects auto insurance rates depends on your payment history, credit history, debt type, and whether you recently opened any new lines of credit. Drivers with poor credit usually pay double the average rates for car insurance in D.C.

Geico and Nationwide offer the best rates to drivers with bad credit but still charge more than average.

Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

You can find cheap auto insurance quotes in Washington, D.C. with bad credit by shopping around and working toward improving your score. Paying insurance bills on time and making regular payments to your existing debt will slowly but surely lower your auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Washington, D.C. Auto Insurance After a DUI

After a DUI charge, your Washington, D.C. auto insurance rates can go up to $224 monthly, an increase of over 62%.

DUI Full Coverage Auto Insurance Monthly Rates vs. Clean Record by Provider

| Insurance Company | Clean Record | One DUI |

|---|---|---|

| $122 | $211 |

| $228 | $385 | |

| $166 | $276 | |

| $138 | $237 | |

| $198 | $275 | |

| $114 | $309 | |

| $248 | $447 |

| $142 | $338 |

| $150 | $200 | |

| $123 | $160 | |

| $161 | $239 |

| $141 | $294 | |

| U.S. Average | $165 | $295 |

Even the cheapest car insurance companies in the District still raise your rates after a DUI. You may even lose coverage if this is your second or third offense, so compare rates from multiple companies to get the most affordable coverage.

Washington, D.C. DUI Laws

On top of increased insurance rates, you also face fines and penalties. The table below goes into the details of Washington, D.C. DUI laws and penalties.

Washington, D.C. DUI Laws & Penalties

| Offense | Penalty |

|---|---|

| 1st Offense | Six-month license revocation, $1,000 fine and/or 180 days in jail, mandatory 10-20 day sentence |

| 2nd Offense | One-year license revocation, $2,500-$5,000 fine and/or one year in jail, mandatory 10-35 day sentence |

| 3rd Offense | Two-year license revocation, $2,500-$10,000 fine and/or one year in jail, mandatory 12-45 day sentence |

| 4th & Subsequent Offenses | Two-year license revocation, $2,500-$10,000 fine and/or one year in jail, mandatory 45-75 day sentence (plus 30 days for each subsequent offense) |

You will lose your driver’s license after your first offense, and multiple offenses can cost you up to $10,000. In addition, drivers under 21 caught with alcohol face additional mandatory minimums and fines of up to $1,000 for having false or altered IDs.

Washington, D.C. SR-22 Auto Insurance

Washington, D.C. may require you to file SR-22 auto insurance if you lose your license after a DUI or reckless driving accident. SR-22 forms do not provide any insurance coverage but act as proof that you carry minimum coverage.

District of Columbia insurance law requires high-risk drivers to carry SR-22 for three years. Your insurance rates will go up when you file, and you have to pay a fee of $15-$25 to have your insurance company file the SR-22 form on your behalf.

How to get SR-22 Auto Insurance in Washington, D.C.

Filing SR-22 insurance in Washington, D.C. is easy — call your insurance company and ask them to file the form with your local DMV.

If your current insurer cannot file for you or cancels your policy for increased risk, you can shop for SR-22 insurance quotes online. Just choose “yes” when asked if you need an SR-22.

Make sure you have your license and vehicle information ready when you shop online for auto insurance quotes. Each insurance company charges different rates for these offenses, and you will find the most affordable Washington, D.C. auto insurance by comparing at least three different insurers.

Washington, D.C. Auto Insurance Laws

The District of Columbia follows no-fault auto insurance laws, meaning you typically carry higher insurance limits because you cannot sue other drivers for damages except for very specific exceptions. However, unlike other no-fault states, drivers are allowed to choose between no-fault and liability policies when they buy coverage.

In Washington D.C., car insurance laws mandate liability and uninsured motorist coverage. If opting for no-fault insurance, you have 60 days post-accident to switch and pursue claims against the at-fault party. Failure to surrender tags and registration upon policy cancellation incurs fines up to $2,500. Driving uninsured hikes rates and may hinder finding new coverage, so maintaining liability coverage is crucial for affordable auto insurance.

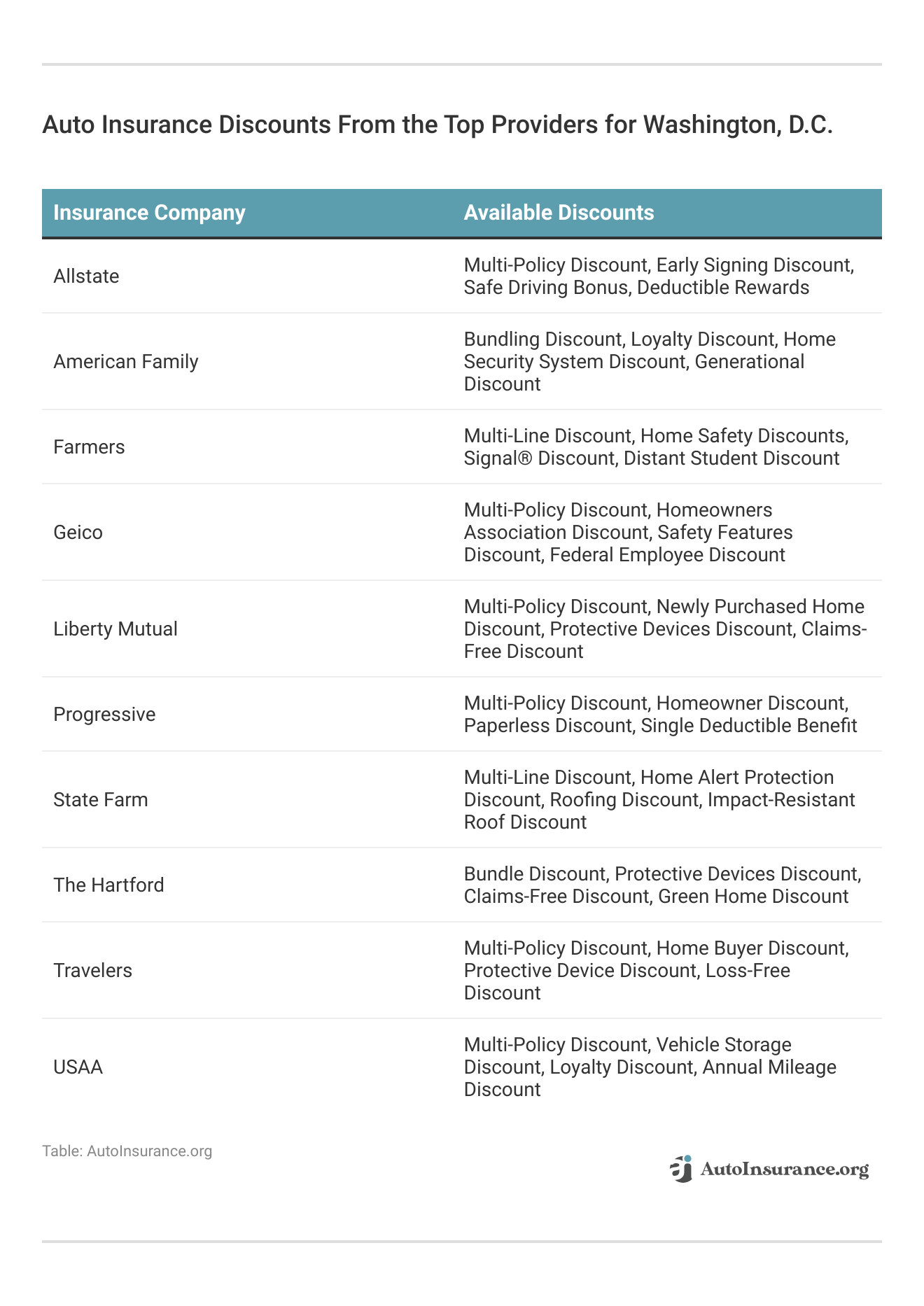

Explore the various auto insurance discounts offered by top providers in Washington, D.C.

These discounts can help you save money on premiums while ensuring you get the coverage you need.

Washington, D.C. Auto Insurance Requirements

Washington, D.C.’s minimum coverage operates in the amounts of 25/50/10 to cover any damage you cause to other drivers in an accident. You must also carry 25/50/5 in uninsured motorist (UM) coverage, which you can use to pay for hit-and-runs or collisions with uninsured or underinsured drivers.

Take a look at the table below to see D.C. car insurance requirements:

Washington, D.C. Auto Insurance Minimum Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $10,000 minimum |

| Uninsured Motorist Bodily Injury | $20,000 per person $50,000 per accident |

| Uninsured Motorist Property Damage | $5,000 per accident w/ $200 deductible |

You must maintain this level of coverage to legally drive in Washington, D.C., but we recommend buying more coverage. Liability auto insurance in D.C. won’t pay for your injuries or property damage, and the unisured coverage required in the District is very low.

Optional Auto Insurance Coverage in Washington, D.C.

The District requires drivers to carry minimum liability and uninsured motorist coverage, but you can choose to have more for better protection on the road. For example, you may want to add collision and comprehensive insurance, known as full coverage auto insurance, onto your D.C. car insurance policy.

Comprehensive is often called “other than collision” insurance, and it’s what you need if you’re worried that a hurricane could damage your car🚘. It also covers vandalism🔨 and theft. https://t.co/27f1xf1ARb has a guide you can check out here👉: https://t.co/ii0sdamKtX pic.twitter.com/IAYBLUdO8B

— AutoInsurance.org (@AutoInsurance) September 20, 2023

The optional coverage available for car insurance in Washington, D.C. includes:

- Collision Insurance: Collision auto insurance pays for your property and vehicle damage in an accident or collision.

- Comprehensive Coverage: Comprehensive coverage pays for claims unrelated to collisions, including weather damage, theft, and fire.

- Gap Insurance: Gap insurance pays the difference you owe on an auto loan if your vehicle is totaled after a claim,

- Medical Payments (MedPay): MedPay coverage pays for your medical bills after an accident, regardless of who is at fault.

Insurance companies can also offer unique coverages for different situations, including roadside assistance coverage and rental car reimbursement.

Understanding these optional coverages ensures you're well-protected and can tailor your policy to meet specific needs.Eric Stauffer LICENSED INSURANCE AGENT

Coverage availability varies from company to company. Compare policies and prices from at least three different D.C. auto insurance companies to guarantee you’re getting the best rates. Comparing auto insurance rates in Washington, D.C. for minimum liability and full coverage is the best way to find a policy that fits your budget.

How to Find Cheap Auto Insurance in Washington, D.C.

The cheapest auto insurance rates can vary based on where you live in Washington, D.C. and the kind of car you drive. Your daily commute may also raise your D.C. car insurance rates if you drive at night or more than 11,000 miles per year. You could also get affordable high-risk auto insurance in D.C. by comparing quotes from various companies if you have a DUI or speeding ticket on your record.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Does Washington, D.C. require car insurance?

Yes, drivers must show proof of insurance to register and legally drive a vehicle in Washington, D.C. Driving without auto insurance can result in fines, jail time, or loss of license.

Is car insurance expensive in Washington, D.C.?

Washington, D.C. auto insurance costs around $138 monthly, 16% higher than the national average. D.C. car insurance rates are expensive due to the District’s high population density and traffic.

How much is car insurance in Washington, D.C.?

Washington, D.C., auto insurance costs around $58 per month for liability-only and $138 for full coverage. Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

What is the minimum car insurance in Washington, D.C.?

Washington, D.C. car insurance requirements include 25/50/10 in minimum liability and 25/50/5 in uninsured/underinsured motorist coverage.

What optional coverages should I consider for auto insurance in Washington, D.C.?

Consider adding collision insurance for accident-related damages, comprehensive coverage for non-collision incidents like theft or weather damage, and Guaranteed Auto Protection (Gap) insurance to cover any remaining loan balance after a total loss.

Is car insurance cheaper in D.C. or Baltimore, Maryland?

Baltimore is a much larger city with higher traffic and auto theft rates, so average Washington, D.C. auto insurance rates are considerably less. Drivers in Baltimore pay over $200 per month for full coverage compared to drivers in the district, who pay around $100 monthly.

Is Washington, D.C. a no-fault state for auto accidents?

Yes, D.C. is a no-fault auto insurance state, meaning you must file with your own policy first after an accident. Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

How does my credit score affect auto insurance rates in Washington, D.C.?

Your credit score can significantly impact your auto insurance rates in D.C. Insurers may offer higher premiums to those with lower credit scores, emphasizing the importance of maintaining good credit for lower rates.

What factors determine the best auto insurance in Washington, D.C.?

The best auto insurance in D.C. depends on various factors that affect auto insurance rates such as your driving record, age, credit score, and the type of coverage you need. Companies like State Farm, Geico, and Progressive offer competitive rates based on these factors.

How are auto insurance premiums determined in Washington, D.C.?

Auto insurance premiums in Washington, D.C. are determined by various factors, including the driver’s age, driving record, type of vehicle, coverage limits, and deductibles. Insurance companies also consider factors like the driver’s credit history and the area where the vehicle is primarily kept.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.