9 Best Companies for Credit-Based Auto Insurance (2025)

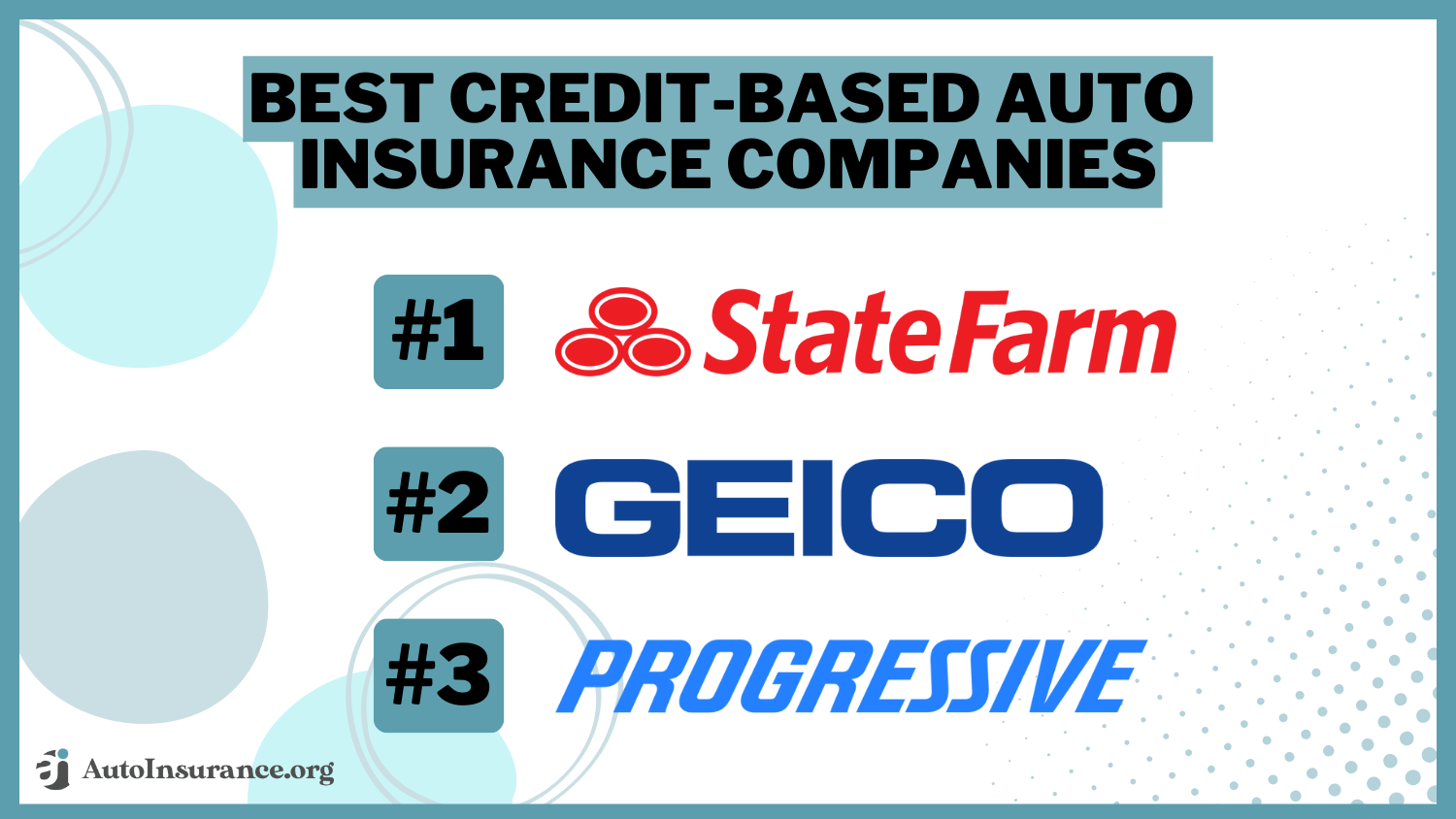

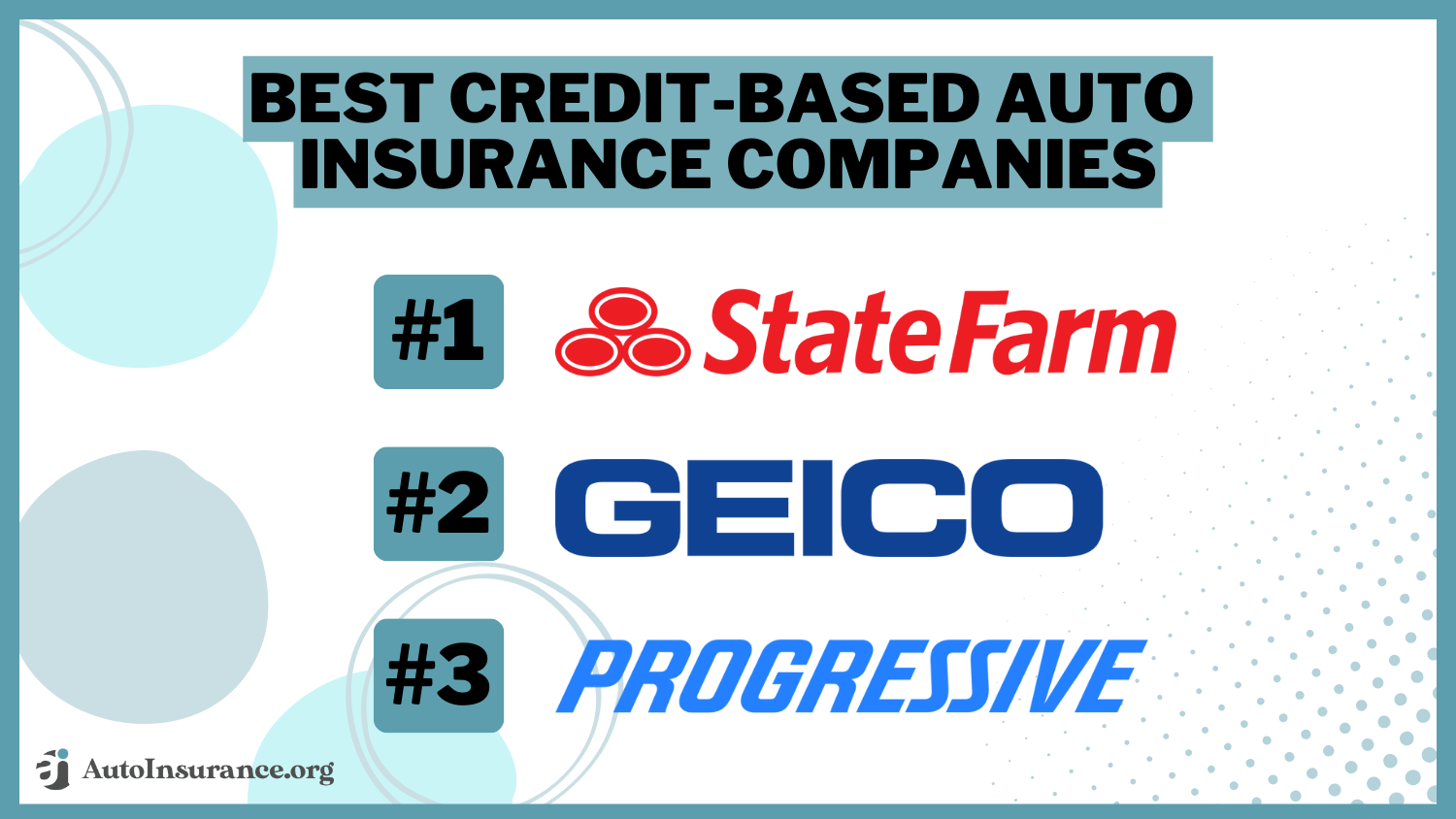

State Farm, Geico, and Progressive are the best companies for credit-based auto insurance. Car insurance rates by credit score can vary by up to 59%, with auto insurance for bad credit costing an average of $289 per month. However, you can save no matter what your score is by finding discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Avg. Monthly Rate for Credit-Based Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Avg. Monthly Rate for Credit-Based Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Avg. Monthly Rate for Credit-Based Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsWhen it comes to the best companies for credit-based auto insurance, State Farm is our top pick due to its extensive network of agents, usage-based insurance program, and discount options. Geico and Progressive also top our list because they offer multiple ways for drivers to save, regardless of their credit scores.

Finding insurance companies that do not use credit scores to calculate rates can be difficult. However, understanding the relationship between your auto insurance and credit score can help you save.

Our Top 9 Picks: Best Companies for Credit-Based Auto Insurance

| Company | Rank | Usage-Based Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | A++ | Agency Network | State Farm | |

| #2 | 25% | A++ | Discount Options | Geico | |

| #3 | 30% | A+ | Budgeting Tools | Progressive | |

| #4 | 40% | A+ | UBI Savings | Allstate | |

| #5 | 40% | A+ | Vanishing Deductible | Nationwide |

| #6 | 30% | A | Safe-Driving Discounts | Farmers | |

| #7 | 30% | A | Add-on Coverages | Liberty Mutual |

| #8 | 30% | A++ | Military Savings | USAA | |

| #9 | 30% | A | Costco Members | American Family |

Enter your ZIP code above to get started on comparing quotes from the best auto insurance companies for credit-based coverage.

- Average car insurance rates for drivers with poor credit are 59% higher

- Drivers with bad credit are more likely to file claims, leading to higher rates

- The best credit-based auto insurance companies are State Farm and Geico

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Drive Safe and Save Program: Drivers can save up to 30% on their insurance by enrolling in State Farm’s usage-based car insurance program, Drive Safe and Safe. Learn more about Drive Safe and Save in our State Farm auto insurance review.

- Extensive agent network: With one of the largest agent networks in the country, finding help for your policy is easy. Whether you have a high or low credit score, a State Farm agent can help you pick the best coverage for your budget.

- Discount availability: State Farm offers a variety of discounts to help customers save. Even if your credit score is low, you might qualify for discounts like remaining accident-free, bundling policies, and having safety features installed in your car.

Cons

- Higher rates for drivers with low credit scores: Although it usually has low rates, State Farm drivers with low credit scores typically see higher rates.

- Add-on options are limited: State Farm is lacking a few add-on options some of its competitors provide, particularly gap insurance.

#2 – Geico: Best for Discount Options

Pros

- Excellent online tools: Whether you’re a policyholder or a new applicant, Geico offers a wealth of online tools to help you pick the right coverage and find the cheapest rates.

- Plenty of discounts: Geico is known for being one of the cheapest providers in the country, partially because it offers so many discounts. Explore your discount options in our Geico auto insurance company review.

- Tons of coverage options: Aside from standard insurance options, Geico offers a few excellent add-ons. Most notable is Geico’s mechanical breakdown insurance.

Cons

- Mixed customer reviews: While many customers report happiness with Geico, the company sometimes struggles with its claims satisfaction.

- Rates can be higher for some drivers: Geico car insurance is particularly high for drivers with a DUI.

#3 – Progressive: Best on a Budget

Pros

- Name Your Price tool: Use Progressive’s Name Your Price tool to say how much you want to spend monthly on your coverage. Progressive will list coverage options that match your budget.

- Snapshot: Snapshot is Progressive’s usage-based insurance program, which can help drivers with bad credit scores save if they practice safe habits. See if Snapshot could help you save in our Progressive auto insurance review.

- Ample discounts: Progressive offers drivers plenty of ways to save on their coverage, which can help if you have a low credit score. Discounts include safe driving, paying in full, and customer loyalty.

- Affordable rates: For most drivers, Progressive insurance is one of the cheapest options on the market, especially if you have bad credit or a DUI on your record.

Cons

- Low customer loyalty: Despite having low rates and solid coverage options, Progressive ranks low when it comes to customers’ intent to continue their policies.

- Above average rates for teens: Progressive tends to have lower than average rates, but teens and young adult drivers can usually find more affordable coverage elsewhere.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Usage-Based Insurance

Pros

- Drivewise helps safe drivers save: Another usage-based program, Drivewise helps safe drivers save on their insurance. Allstate also offers Milewise for low-mileage drivers.

- Deductible rewards for safe drivers: You can earn up to $500 off your deductible by enrolling in Allstate’s Deductible Rewards program.

- Teen driving program: Allstate has a special driving program teens can complete to save on their coverage.

Cons

- Higher than average rates: Despite offering plenty of discounts, Allstate tends to rank as one of the most expensive options for car insurance for all drivers. Learn more about Allstate’s rates in our Allstate auto insurance review.

- Mixed customer service ratings: Like many of its big competitors, Allstate’s customer service ratings are mixed. Some customers report complete satisfaction, while others are less satisfied with their Allstate experience.

#5 – Nationwide: Best Deductible Options

Pros

- Vanishing deductible program: For every year you spend accident and claim-free, Nationwide will subtract $100 from your collision and comprehensive deductible. You can earn a max savings of up to $500. Learn about other unique coverage programs in our Nationwide auto insurance review.

- SmartRide discount: Save up to 40% on your insurance by enrolling in Nationwide’s SmartRide program. Low mileage drivers can also save by enrolling in SmartMiles.

- Affordable auto insurance for bad credit: Although most drivers with bad credit see price hikes, Nationwide is one of the few companies offering affordable rates for lower scores.

Cons

- Local agents are limited: Signing up for a Nationwide policy online is easy, but finding a local agent can be more difficult if you want to speak with a person.

- Rates are higher for some drivers: Although drivers with bad credit scores typically see affordable Nationwide rates, people with a DUI can pay much more. Additionally, Nationwide usually has higher minimum coverage rates.

#6 – Farmers Insurance: Best for Safe Driving Discounts

Pros

- Solid customer service ratings: Farmers Insurance is known for its excellent customer service ratings, particularly for its claims resolution. Take a look at our Farmers insurance company review to learn more.

- Signal app can help you save: Signal is Farmers’ usage-based insurance app that helps safe drivers save and provides tips to improve driving skills.

- Additional discounts for safe driving: Earn more savings by being a safe driver and having safety features in your car, like daytime running lights and anti-lock brakes.

Cons

- Typically has higher rates: Buying car insurance from Farmers has many perks, but rates tend to be higher for most drivers.

- No new policies in Florida: As of July 2023, Farmers no longer sells new car insurance policies in Florida.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Coverage Options

Pros

- Good discount opportunities: Liberty Mutual offers a variety of discounts to help drivers with any credit score save, including being claim-free, paying in full, and being a homeowner.

- RightTrack can help if you have bad credit: Save up to 30% on your car insurance by enrolling in the RightTrack program. However, you should skip this program if you don’t regularly practice safe driving habits.

- Excellent coverage options: Liberty Mutual offers coverage options that can be hard to find elsewhere, including new car replacement, accident forgiveness, roadside assistance, gap, and original parts replacement insurance.

Cons

- Rates can be high: Although Liberty Mutual offers competitive pricing for teens and college students, it tends to have higher rates than the national average. To see monthly premiums and honest rankings, read our Liberty Mutual review.

- Claims satisfaction ratings are low: Liberty Mutual has some great policy options, but many customers report low claims satisfaction.

#8 – USAA: Best for Military Families

Pros

- Cheapest rates: USAA is almost always the cheapest option for car insurance for all drivers, regardless of age, location, and driving history.

- Military-specific discounts: As a company dedicated to serving America’s troops, USAA has several military-specific discounts to help servicemembers save. See what other discounts you might qualify for in our USAA auto insurance review.

- Excellent customer service: USAA consistently receives excellent customer service and claims satisfaction ratings.

- Comprehensive financial services: You can buy more than insurance from USAA as the company offers various financial products like banking and retirement services.

Cons

- Membership required: USAA auto insurance is only available to active and retired military members and their families.

- No gap insurance: While it doesn’t offer traditional gap insurance, you can add Car Replacement Assistance to your USAA plan.

#9 – American Family Insurance: Best for Costco Members

Pros

- Excellent customer service and claims satisfaction: American Family might not be as well-known as some competitors, but it keeps up with larger companies with superb customer service scores.

- KnowYourDrive program: Save up to 20% with American Family’s KnowYourDrive program, which tracks your driving habits. It can also help refine your driving skills by pointing out areas to improve.

- Underwrites Costco car insurance: Costco shoppers can save on more than household goods. They can also purchase auto insurance, which is underwritten by American Family.

Cons

- Limited availability: American Family only sells car insurance in 19 states. See if Am Fam sells insurance in your state in our American Family auto insurance review.

- Higher rates for bad credit: Car insurance for bad credit almost always costs more, but American Family is particularly pricy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Why Auto Insurance Companies Check Credit Scores

When it comes to auto insurance and credit scores, there are two primary reasons companies look at your rating. The first has to do with claims numbers — the lower your credit score, the more likely you are statistically to file a claim and cost the company money. Secondly, insurance companies assume people with higher credit scores are more likely to pay their bills on time.

While most states allow car insurance companies to look at your credit score when determining your rates, four do not. You don't need to worry about increased rates from a low credit score in Michigan, Massachusetts, Hawaii, or California.Heidi Mertlich Licensed Insurance Agent

Studies show drivers with poor credit typically have more traffic violations and a higher likelihood of getting in an accident, costing their insurance company more money. So naturally, drivers with lower credit scores pay higher overall car insurance rates.

Insurance companies consider various factors when setting rates, including credit score. For example, driving history, claims history, and other criteria may impact your final policy rates. Credit scores range from 300 to 850 and often have numerous layers.

Insurers examine five criteria — all connected to your borrowing history and present circumstances — to set your credit score, also known as a FICO score:

- Payment background: 35%

- Payment due: 30%

- Credit history duration: 15%

- Credit diversity: 10%

- New credit: 10%

Most car insurance companies check your credit score when setting your rates. So, if you have bad credit, your rates could be expensive, or you could save a lot if you have outstanding credit.

On average, auto insurance rates for drivers with poor credit increased by 59% compared to drivers with average credit. On the other hand, drivers with excellent credit can save more than 20% annually. In extreme circumstances, your credit score might double your spending or reduce your cost by almost a fifth.

We discovered that auto insurance costs might vary by more than $160 per month or $2,000 annually based on the insurer and credit score. Poor and extremely good credit indicate more than a $550 difference in premiums for each company considered.

Average Insurance Costs by State and Credit Score

The consequences of credit ratings vary significantly between insurance companies and states. Not all states allow companies to base insurance rates on your credit score, but most do.

Full Coverage Auto Insurance Rates by State

| State | Monthly Rates |

|---|---|

| Alaska | $200 |

| Alabama | $180 |

| Arkansas | $170 |

| Arizona | $220 |

| California | $250 |

| Colorado | $230 |

| Connecticut | $260 |

| District of Columbia | $270 |

| Delaware | $220 |

| Florida | $280 |

| Georgia | $230 |

| Hawaii | $180 |

| Iowa | $200 |

| Idaho | $180 |

| Illinois | $220 |

| Indiana | $200 |

| Kansas | $180 |

| Kentucky | $200 |

| Louisiana | $240 |

| Massachusetts | $250 |

| Maryland | $230 |

| Maine | $180 |

| Michigan | $240 |

| Minnesota | $220 |

| Missouri | $200 |

| Mississippi | $180 |

| Montana | $200 |

| North Carolina | $200 |

| North Dakota | $180 |

| Nebraska | $180 |

| New Hampshire | $180 |

| New Jersey | $240 |

| New Mexico | $200 |

| Nevada | $230 |

| New York | $240 |

| Ohio | $200 |

| Oklahoma | $180 |

| Oregon | $220 |

| Pennsylvania | $230 |

| Rhode Island | $240 |

| South Carolina | $200 |

| South Dakota | $180 |

| Tennessee | $200 |

| Texas | $230 |

| Utah | $220 |

| Virginia | $220 |

| Vermont | $180 |

| Washington | $230 |

| Wisconsin | $200 |

| West Virginia | $180 |

| Wyoming | $180 |

California, Hawaii, Massachusetts, and Michigan are the only states to outlaw utilizing credit scores to set auto insurance prices.

Using credit as a rating factor is also restricted in Maryland, Oregon, and Utah. In these states, regulations restrict when insurers can use credit in rating and underwriting decisions.

Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Average Credit | Good Credit |

|---|---|---|---|

| Allstate | $240 | $180 | $120 |

| American Family | $220 | $170 | $120 |

| Farmers | $250 | $190 | $130 |

| Geico | $220 | $160 | $90 |

| Liberty Mutual | $260 | $200 | $140 |

| Nationwide | $230 | $170 | $110 |

| Progressive | $230 | $170 | $110 |

| State Farm | $200 | $150 | $100 |

| USAA | $180 | $130 | $80 |

Since physical location also matters, your state of residence and ZIP code will impact your rates.

Impact of Auto Insurance Quotes on Credit Scores

Requesting auto insurance quotes shouldn’t impact your credit score. The “soft pull” credit-check procedure used to obtain your quotes is referred to as such because it doesn’t use as much personal data. In contrast, a “hard pull” credit check affects your overall score:

- Soft pull: Confirms a few pieces of fundamental data that don’t affect your credit score.

- Hard pull: Reveals your entire credit history but temporarily decreases your credit score. A buildup of hard pulls can reduce your score if you apply to numerous lenders quickly.

In virtually every scenario, you won’t get final pricing before the insurance company reviews your credit rating. Learn more about why getting auto insurance quotes doesn’t affect your credit.

Understanding Whether Insurers Run a Credit Check

Insurers will almost always run a credit check when you apply for auto insurance. Studies show a driver’s credit rating offers a valuable prediction of how many claims you’d submit, allowing insurers to pair high-risk drivers with higher rates. However, you don’t need to know your credit score to get quotes. Most insurance companies will automatically check your credit score when you get enter some basic information.

When insurance companies request your Social Security number to offer a quote, your credit gets checked. Some companies offer rates without requesting your SSN but will do so before providing a final cost.

Insurance companies can’t utilize credit scores to set auto insurance premiums in several areas, including California, Hawaii, Massachusetts, and Michigan. Here you can find auto insurance companies that don’t check credit.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Company Rate Increases Due to Poor Credit

We found various auto insurance quotes for drivers with bad credit after examining rates from leading companies. Geico had the lowest average annual rates ($1,750), while Auto-Owners had the highest prices ($3,970).

A higher credit score = LOWER INSURANCE RATES😲. With inflation high⬆️, finding ways to cut costs💸has become more important than ever. 👉Price compare rates here: https://t.co/TSq0vDEjME

Learn other ways to lower your auto insurance rates🚗: https://t.co/pHF47vG6hP pic.twitter.com/ddqUMtUpCo— AutoInsurance.org (@AutoInsurance) February 18, 2023

Nationwide had the lowest percentage increase for drivers with poor credit among the companies we looked at (35%). Still, Geico beat Nationwide by $155 in terms of offering the lowest overall car insurance rates to drivers with bad credit. Read more about the best auto insurance companies for drivers with bad credit.

This wide discrepancy in insurance costs highlights the significance of comparison shopping for auto insurance. So, it’s critical to consider the whole premium when comparing prices rather than simply the possible savings from reductions or the amount that rates increase for particular problems.

Other Factors Insurers Consider When Setting Rates

Insurers consider numerous factors to establish eligibility and rates, regardless of whether credit-based insurance scores get considered. Some factors that affect auto insurance rates include:

- Age

- Gender

- Marital status

- Education

- ZIP code

Your desired insurance types, coverage level, and deductible amount also impact how much you pay for auto insurance.

Individual insurance companies may also look at other factors. For example, a few insurers provide pay-per-mile plans that link costs to usage.

Some companies offer an app or telematics device to monitor your driving behavior, like the one listed in this State Farm auto insurance review. If you have good driving habits, this information could lower rates for drivers with poor credit.

Understanding if Car Insurance Payments Help Build Credit

Generally, paying your auto insurance doesn’t improve your credit history. There’s no direct correlation between auto insurance and your credit, though paying your bill late or never may result in debt collection reports. Learn more about how not paying your auto insurance affects credit.

However, using a credit card to make timely car insurance payments can improve your score, but only if you pay off your credit card billing statement every month. Future lenders can view the debt collection reports on your credit report, often for up to 10 years.

Failure to pay your auto insurance may result in your payments going to a collection agency, negatively impacting your ability to obtain loans, credit cards, or mortgages. So if you’re looking for a new car, remember that it could also affect your future auto loan.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Reducing Auto Insurance Rates Despite Bad Credit

Use these tips to get cheaper auto insurance rates with poor credit:

- Ask for reductions. Find out if you qualify for any auto insurance discounts you aren’t already receiving. It may be as simple as going paperless, making a complete payment, or bundling your auto and home insurance.

- Prove you’re a safe driver. Consider a usage-based auto insurance program if you want your driving record to have a greater impact on your insurance rates. The insurance company will monitor your driving habits and can provide up to 40% off your rates for safe driving.

- Examine your insurance contract. Check your auto insurance policy again because your needs may have changed since you first purchased it. For example, you can remove collision and comprehensive coverage from an older vehicle to save money.

- Compare auto insurance quotes online. Each insurer analyzes rating elements, such as credit, differently. If you don’t compare prices from at least three different companies, you won’t find the best deal on auto insurance. To guarantee you get the best deal, check around at least once a year.

Poor credit doesn’t define you. It’s just one factor auto insurance companies consider, and there are several other ways to lower your rates.

How to Improve Your Credit Rating

Missed loan payments, past-due invoices, and more can negatively affect your credit score. However, your credit isn’t permanent. There are several strategies to raise your credit rating:

- Run a credit report check. Each year, you are entitled to one free credit report. You can identify possible problems or downturns before they become a problem by checking your credit score.

- Pay bills on time. Your credit report will only get worse if you make late payments. Establishing a long-term trend of on-time payments could help your finances.

- Improve your credit usage ratio. Your credit score may suffer if you have several credit cards with high balances. Paying outstanding debt to lower your debt-to-income ratio below 30% may be advantageous.

- Stop opening new accounts. Lenders frequently make queries when you apply for a new loan or credit card, which might lower your credit score. Instead, stick to your existing accounts and reduce those balances to lower your debt-to-income ratio.

One of the simplest ways to keep an eye on your credit score and make sure you're not being unfairly penalized is to use a credit monitoring service. There are several free options to choose from, and monitoring your score can help ensure you're not overpaying for your car insurance.Laura D. Adams Insurance & Finance Analyst

Most American drivers’ credit scores influence their auto insurance rates. Therefore, improving your credit score could positively impact efforts to reduce auto insurance costs.

Understanding Auto Insurance and Your Credit Score

Having bad credit could quadruple your auto insurance costs. Drivers with poor credit pay 59% more on average for coverage, while those with good credit qualify for premium reductions of up to 24%.

Almost all insurers run a credit check, but California, Hawaii, Michigan, and Massachusetts companies can’t use credit scores when determining rates.

The good news is that getting auto insurance quotes online won’t impact your credit score. Enter your ZIP code below to compare multiple quotes and find an insurance company that doesn’t use credit checks or offers affordable usage-based options you can take advantage of while you work to improve your rating.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Why do auto insurance companies look at credit scores?

Companies determine car insurance rates by credit scores for two reasons:

- Drivers with higher scores are more likely to pay their premiums on time

- Drivers with lower scores are statistically more likely to file a claim

Do auto insurance rates impact credit scores?

Policy details and buying auto insurance shouldn’t impact your credit. However, the insurance company may notify credit bureaus if you don’t make your payments on time.

Will changing your auto insurance impact your credit score?

No. Your credit score won’t be affected by switching insurers.

Does getting a car insurance quote affect your credit?

No, getting auto insurance quotes online does not impact your credit score. You can freely compare quotes from different insurers without worrying about it affecting your credit.

How does credit score affect auto insurance costs?

Having bad credit can significantly increase auto insurance costs, with drivers paying an average of 59% more for coverage. On the other hand, drivers with good credit may qualify for premium reductions of up to 24%.

How can I improve my credit rating?

Improving your credit rating involves checking your credit report annually, paying bills on time, improving your credit usage ratio by reducing debt, and avoiding opening new accounts that could result in credit inquiries.

Which auto insurance companies run a credit check?

Before providing a legally binding estimate, every significant auto insurance company runs a credit check, including Liberty Mutual, Geico, State Farm, USAA, and Progressive. Few insurance companies don’t run a credit check.

Can paying car insurance help build credit?

Unfortunately, paying your car insurance does not help build your credit. However, late payments can negatively impact your credit score, particularly if the company sends your account to collections.

Are there car insurance discounts for good credit?

While there isn’t a specific car insurance discount for good credit, you’ll still see savings. Companies tend to offer much lower rates to drivers with higher credit scores.

Are car insurance quotes a hard inquiry on your credit report?

For the most part, car insurance companies do a soft pull when they look at your credit score. That means the company can access your score but doesn’t impact your rating.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.