Government Assistance Programs for Low-Income Drivers in 2025 (Get Help Here!)

Government assistance programs for low-income drivers offer financial help with car insurance payments in California, New Jersey, and Hawaii. Some financial assistance programs start at $45/mo. Find cheap government auto insurance for low-income drivers and get emergency help paying car insurance below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Government assistance programs for low-income drivers can help with car insurance payments if you live in California, New Jersey, or Hawaii.

These state-sponsored insurance options offer affordable car insurance for low-income families who need to meet state minimum insurance requirements. Also, if low-income auto insurance assistance programs aren’t in your state, you can still save on government car insurance for low-income drivers and get cheap insurance rates.

Still wondering, “How do I find government auto insurance for low income near me?” Learn more about cheap auto insurance for low-income families and how to save on government auto insurance for low-income drivers here. You can also enter your ZIP code above to compare low-income auto insurance quotes.

- Government auto insurance makes coverage affordable for low-income families

- California, New Jersey, and Hawaii have car insurance assistance programs

- If you can’t get government assistance car insurance, you can still find cheap rates

Low-Income Families Can Get Help Paying for Car Insurance

Some may wonder, “How can I get low-income car insurance near me?” If you need car insurance, help paying for premiums is available. California, New Jersey, and Hawaii are the only states offering financial assistance for car insurance.

Learn More: Best Auto Insurance for Low-Income Drivers

If you’re looking to get help paying car insurance, you might wonder how much coverage costs through an emergency car payment assistance program. The table below shows the average cost of car insurance assistance for low-income drivers in the states offering it:

Government-Sponsored Auto Insurance Monthly Cost by State

| State | Rates |

|---|---|

| California | $72 |

| Hawaii | $37 |

| New Jersey | $126 |

So, while you can’t get free government auto insurance for low-income drivers, government car insurance programs cater to low-income individuals and families who can’t afford traditional auto insurance.

Government Auto Insurance for Low-Income Drivers in California

If you reside in California, you may be eligible for California’s Low Cost Auto (CLCA) program to get emergency help paying car insurance (Learn More: Best California Auto Insurance).

The CLCA program only offers liability auto insurance, so it may not be the best option for drivers who wants a more comprehensive policy, such as full coverage auto insurance.

To benefit from California’s program, you must be a resident with a clean driving record, have a valid license, and own a car with a value lower than $25,000. You must also meet certain income requirements and have had continuous liability insurance coverage for the past six months.

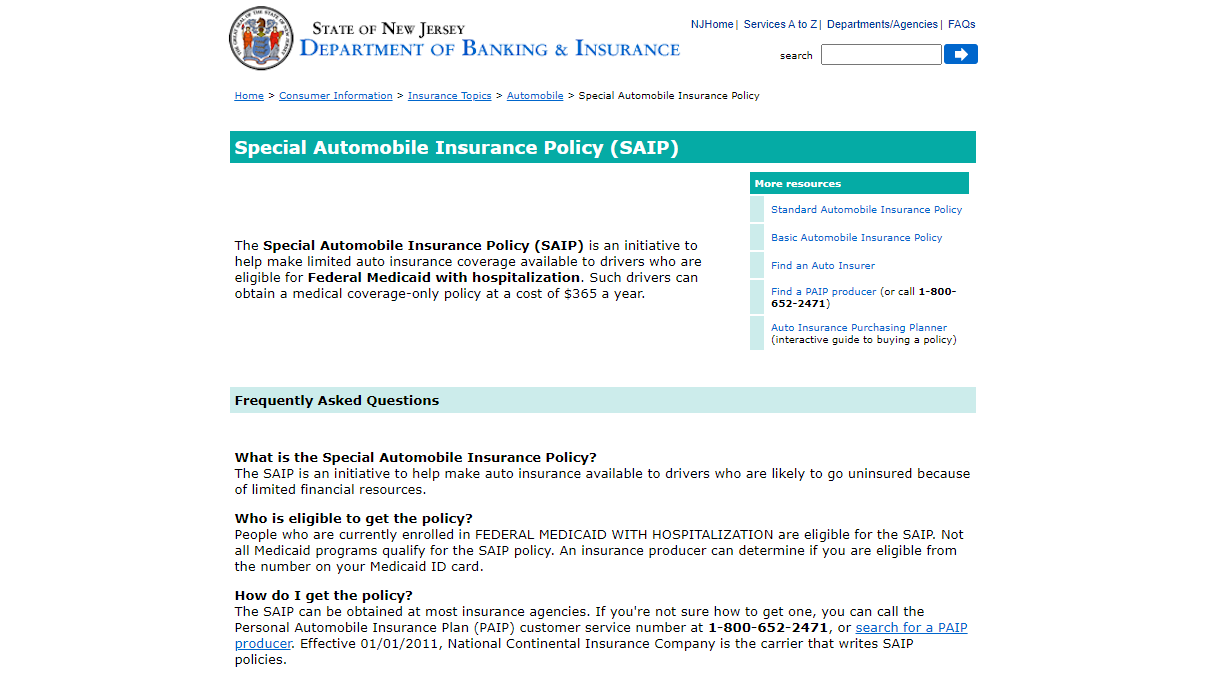

Government Car Insurance for Low-Income Drivers in New Jersey

New Jersey’s Special Automobile Insurance Policy (SAIP) program offers affordable government car insurance for low income in NJ. According to New Jersey’s Department of Banking and Insurance, you must be a New Jersey resident, be enrolled in Medicaid with hospitalization coverage, and have a valid state driver’s license or permit to qualify.

The SAIP program pays for medical expenses and accidents involving uninsured motorists. However, it does not cover damage to your vehicle or injuries to passengers in your car. This policy costs $48 monthly, offering the best New Jersey auto insurance rates for low-income drivers.

Government Car Insurance for Low-Income Drivers in Hawaii

As a low-income driver in Hawaii, you may qualify for the Aged, Blind, and Disabled (AABD) program, which offers government assistance car insurance. According to Hawaii’s Department of Human Services, to qualify, you must:

- Be a Hawaii resident

- Have a valid Hawaii driver’s license

- Be enrolled in Medicaid

- Be 65 years of age or older, blind, or disabled

- Have income below 34% of the federal poverty level

Wondering how to get free car insurance in Hawaii? In some cases, you could also get free auto insurance for low-income drivers in Hawaii. If you qualify, this low-income offers some of the best Hawaii car insurance rates, costing around $45 monthly for liability insurance (Learn More: Cheapest Liability-Only Auto Insurance).

Note that the AABD program only offers basic liability coverage to drivers seeking government assistance for car insurance rates. However, it sometimes provides coverage for vehicle damage. Read more about the best property damage liability auto insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cost of Standard Auto Insurance for Low-Income Families

If you don’t qualify for assistance with your car insurance payment, you can still find affordable coverage with a standard policy by comparing quotes and asking for car insurance discounts.

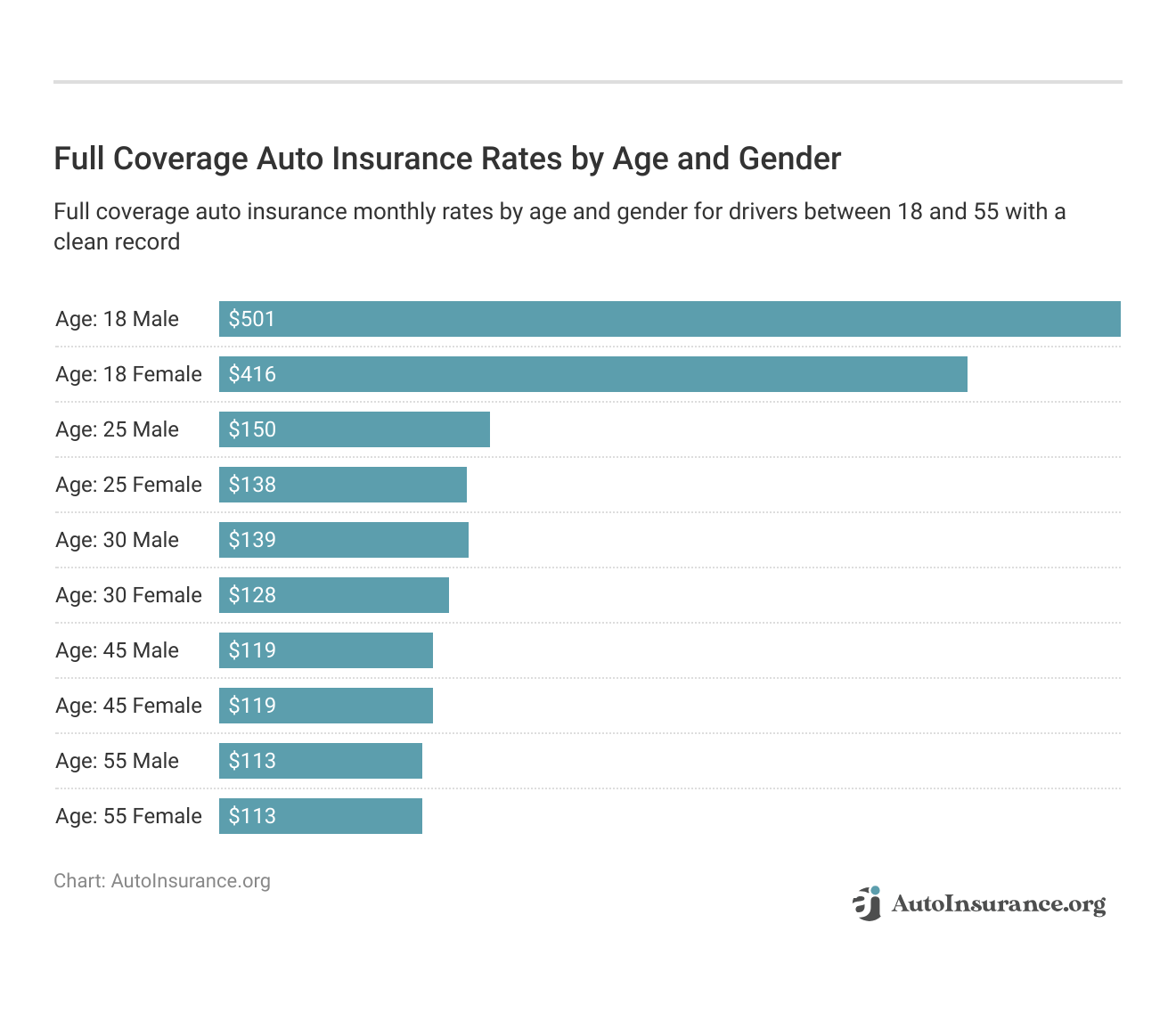

There are various factors that affect auto insurance rates greatly, such as driving record, car type, driver’s age, gender, location, and coverage types. Check out the table below to compare insurance rates by age and gender:

It’s important to note that these averages are just estimates, and the amount you pay for government-assisted car insurance rates may vary. To get a quote, enter your ZIP code into our free comparison tool below to find the best deal for you.

Other Opportunities for Low-Income Drivers to Save on Auto Insurance

If you don’t qualify for government assistance programs or can’t find an affordable policy, there are still some options to get cheap car insurance for low-income drivers. Here are some potential options for saving on car insurance:

Shop Around

As anyone who has ever shopped for auto insurance knows, there can be a wide range of prices from the best auto insurance companies.

However, remember that the lowest price is not always the best deal. Several factors go into setting rates, so getting quotes from several companies is imperative. For example, one company may offer a lower rate for a particular driver, while another may offer a better overall value.Michelle Robbins Licensed Insurance Agent

Always read the fine print and ensure the policy covers what you need. Check out our comprehensive guide titled, “What does an auto insurance policy look like?” for more details.

Consider Buying Usage-Based Auto Insurance

Pay-per-mile insurance is usage-based auto insurance that charges drivers based on the number of miles driven. This type of auto insurance can be a good option for infrequent or occasional drivers, who may find that traditional auto insurance policies are too expensive.

For example, a driver who only drives a few hundred miles per year may find that pay-per-mile insurance is cheaper than a standard policy. However, if you travel frequently or commute a long distance to work, it may not be right for you.

Apply for Common Car Insurance Discounts

As a low-income driver, inquire about any potential auto insurance discounts that may be available. Check out the table below for a full list of common car insurance discounts you’ll find from the best car insurance companies:

Common Auto Insurance Discounts

| Vehicle Discounts | Driver/Customer Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Other common auto insurance discounts are good student, anti-theft, new car, defensive driver, paperless, senior driver, and occupational. As you can see, shopping for eligible discounts is a great way to get cheap car insurance for low income. Read more about how to get an electronic automatic billing auto insurance discount.

Reduce the Number of Cars You Own

The number of cars and drivers on a policy often dictates the auto insurance rates. Owning and insuring multiple cars can significantly increase the cost (Learn More: Best Auto Insurance Companies for Multiple Vehicles).

One option for reducing insurance costs may be to sell or get rid of a second car and become a single-car household. Moreover, this can help reduce transportation expenses, like gas and maintenance.

For instance, if you need affordable car insurance for low-income single mothers, getting rid of one car is a possibility to achieve lower rates if you don’t need it. Find cheap auto insurance for single moms here.

Reduce Your Coverage

Another potential option for reducing auto insurance costs is to reduce your coverage. However, carefully consider the risks and ensure that you are not compromising your financial security.

For instance, while dropping collision auto insurance coverage on an older car with a low value may save on insurance costs, it may not be worth it if you’re at risk of being unable to cover the cost of repairs in the event of an accident.

To determine if you no longer need collision coverage, compare the cost of your car’s value to your auto insurance premiums, and evaluate your financial ability to pay for repairs out of pocket after an accident.

Generally, you can drop full coverage, which includes collision, when your annual auto insurance premiums exceed 10% of your vehicle’s market value. Speak with your insurance agent to discuss your options.

Avoid Letting Your Insurance Lapse

Maintaining continuous auto insurance coverage is vital for several reasons. For one, driving without auto insurance is illegal in most states. However, beyond that, letting your insurance lapse can lead to much higher rates when you restart your policy.

Check out the table below to see the penalties for driving without insurance coverage in your state:

Penalties for Driving Without Auto Insurance by State

| States | Penalties |

|---|---|

| Alabama | Fine: Up to $500; registration suspension, $200 reinstatement fee |

| Alaska | License suspension for 90 days |

| Arizona | Fine: $500+; license/registration suspension for 3 months |

| Arkansas | Fine: $50-$250; suspended registration; $20 reinstatement fee; possible impoundment |

| California | Fine: $100-$200; possible impoundment |

| Colorado | Fine: $500+; 4 points; license suspension until proof of insurance |

| Connecticut | Fine: $100-$1000; suspended registration/license for 1 month; $175 reinstatement fee |

| Delaware | Fine: $1500+; license suspension for 6 months |

| Florida | Suspension of license/registration; $150 reinstatement fee |

| Georgia | Suspended registration; $25 lapse fee; $60 reinstatement fee |

| Hawaii | Fine: $500 or community service; 3-month license suspension or 6-month insurance policy |

| Idaho | Fine: $75; license suspension until proof of insurance |

| Illinois | Fine: $500+; license plate suspension until $100 reinstatement fee |

| Indiana | License/registration suspension for 90 days to 1 year |

| Iowa | Fine: $250-$500; possible community service; possible impoundment |

| Kansas | Fine: $300-$1000; possible jail for 6 months; license/registration suspension; $100 reinstatement fee |

| Kentucky | Fine: $500-$1000; possible jail for 90 days; plates/registration revoked for 1 year |

| Louisiana | Fine: $500-$1000; if in accident, registration revoked, driving privileges suspended for 180 days |

| Maine | Fine: $100-$500; license/registration suspension until proof of insurance |

| Maryland | Loss of plates/registration; uninsured motorist penalty fees; $25 restoration fee |

| Massachusetts | Fine: $500-$5000; possible imprisonment for 1 year or less |

| Michigan | Fine: $200-$500; possible imprisonment for 1 year; license suspension for 30 days; $25 service fee |

| Minnesota | Fine: $200-$1000; possible community service; possible imprisonment for 90 days; license/registration revoked for 12 months |

| Mississippi | Fine: $1000; driving privileges suspended for 1 year |

| Missouri | Four points; suspended until proof of insurance; $20 reinstatement fee |

| Montana | Fine: $250-$500; possible imprisonment for 10 days |

| Nebraska | License/registration suspension; $50 reinstatement fee for each |

| Nevada | Fine: $250-$1000; registration suspension; $250 reinstatement fee |

| New Hampshire | Not mandatory, but SR-22 may be required post-conviction or accident |

| New Jersey | Fine: $300-$1000; license suspension for 1 year; $250/year surcharge for 3 years |

| New Mexico | Fine: $300; possible imprisonment for 90 days; license suspension |

| New York | Fine: $1500; $750 civil penalty; license/registration suspension; $8-$12 daily penalties for lapse |

| North Carolina | Fine: $50; registration suspension until proof of insurance; $50 restoration fee |

| North Dakota | Fine: $1500; possible 30-day imprisonment; 14 points; proof required for 1 year; $50 fee |

| Ohio | License/plates/registration suspension; $100 reinstatement fee; high-risk coverage for 3-5 years |

| Oklahoma | Fine: $250; possible 30-day imprisonment; license suspension; $275 reinstatement fee |

| Oregon | Fine: $130-$1000; possible 1-year license suspension; proof required for 3 years |

| Pennsylvania | Registration suspended for 3 months; $88 restoration fee or $500 civil penalty |

| Rhode Island | Fine: $100-$500; license/registration suspension for 3 months; $30-$50 reinstatement fee |

| South Carolina | Fine: $100-$200; possible 30-day imprisonment; $200 reinstatement fee |

| South Dakota | Fine: $100; possible 30-day imprisonment; 30-day to 1-year license suspension; SR-22 required for 3 years |

| Tennessee | $25 coverage failure fee; additional $100 fee if unpaid; possible registration suspension |

| Texas | Fine: $175-$350; $250 surcharge for 3 years |

| Utah | Fine: $400; license suspension; $100 reinstatement fee; proof required for 3 years |

| Vermont | Fine: $500; license suspension until proof of insurance |

| Virginia | $500 uninsured motorist fee; suspension if unpaid |

| Washington | Fine: $250+ |

| West Virginia | Fine: $200-$5000; 30-day license suspension; $200 penalty fee |

| Wisconsin | Fine: $500 |

| Wyoming | Fine: $750; possible 6-month imprisonment |

Insurance companies view lapsed coverage as a risk since you were willing to drive without insurance at one point. As a result, you’ll likely pay a significantly higher rate than someone who has maintained continuous coverage. You may also require high-risk auto insurance.

If you’ve let your previous insurance policy lapse, you may have difficulty obtaining proof of prior insurance when you reapply. So if you don’t want to see your rates skyrocket, it’s best to avoid letting your car insurance lapse.

Own a Car That’s Inexpensive to Insure

The most impactful way to save on car insurance for low-income individuals is to drive an inexpensive car. For instance, you could save if you purchase an older vehicle with a lower value. Examples of cheap cars to insure are:

- Older Cars: A car’s value depreciates over time, meaning that older cars are generally less expensive to insure.

- Smaller Cars: Smaller cars typically have a lower replacement value and, therefore, a lower insurance cost.

- Cars With Good Safety Ratings: Cars with a history of fewer accidents or theft claims are less expensive to insure.

- Cars With a Low Theft Rate: Cars that have fewer thefts have lower insurance rates.

Always ask your car insurance provider about any anti-theft or safety insurance discounts you could qualify for because of the car you own. Check out our guide titled “Auto Insurance for Older Cars” to see how an old vehicle could lower your premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

More About Government Auto Insurance Assistance Programs for Low-Income Drivers

Need help paying car insurance? Government car insurance for low-income families may be the best and most affordable option if need car insurance payment assistance. State-sponsored assistance programs offer cheap auto insurance to those who qualify based on their income.

We could all use a little extra money💰. If you’re low-income, you may be wondering how to pay as little as possible for auto insurance. https://t.co/27f1xf131D is the place to go if you want to save🤑. For more info on lowest-cost insurance, check out 👉https://t.co/NLue1K9wHs pic.twitter.com/eKacFrzTiD

— AutoInsurance.org (@AutoInsurance) June 20, 2023

Also, avoid letting your insurance lapse, as this will result in much higher rates when you reinstate your policy. Read more about the best auto insurance companies that don’t penalize for a lapse in coverage.

You can also find other ways to get low-income car insurance by shopping around, considering pay-per-mile policies, applying for discounts, and reducing your coverage.

While there isn’t a government car insurance company, you can shop around and look for discounts from other providers if you can’t get government auto insurance. Enter your ZIP code into our free quote comparison tool below to get started on finding cheaper rates.

Frequently Asked Questions

How do I find emergency help paying car insurance near me?

The application process varies depending on where you live and the car insurance assistance program in your state.

Generally, you’ll proof of income and a valid driver’s license. You may also need to provide the make and model of your vehicle. Read more about what the difference is between car make and car model.

Is there government assistance for car insurance in all states?

You might be wondering how to get help with car insurance near you. Unfortunately, not all states offer a auto insurance assistance program for low-income individuals. These government programs are only available in California, New Jersey, and Hawaii.

Is there free car insurance for low-income drivers?

Yes, some drivers in Hawaii may qualify for free government car insurance.

Is there low-income car insurance in Georgia?

Georgia doesn’t offer a publicly financed auto insurance program. However, if you need low-income car insurance in GA, some companies may offer car insurance help.

Companies, such as Geico, offer low-income discounts to those who meet specific requirements. Learn if Geico’s discount options and rates cater to your needs in our review of Geico car insurance.

Another option for Georgia’s low-income earners is joining a group auto insurance program offering lower rates. Some examples include groups for teachers, nurses, military members, and government employees.

Read More: Best Georgia Auto Insurance

Does DHS help with car insurance?

Need help paying auto insurance? The Hawaii Department of Human Services (DHS) offers free government car insurance to certain drivers. Unfortunately, no other DHS offers help with paying car insurance.

However, car insurance for EBT holders could be cheaper since they may qualify for government-funded car insurance.

How do I get cheap car insurance for SNAP recipients?

While there is no EBT car insurance program, some states offer government assistance to low-income drivers struggling to pay premiums. So, if you’re looking for SNAP EBT car insurance, enter your ZIP code into our free quote tool below to instantly compare rates from the top providers for low-income individuals.

Is there an EBT car insurance discount?

Unfortunately, there isn’t an auto insurance discount specific to drivers enrolled in the SNAP EBT program, but there are various car insurance discounts to help lower your premiums.

Are there charities that help pay car insurance premiums?

A top question readeras ask is, “Are there any charities that help pay car insurance near me?” Yes, there are some charity programs that help with car insurance. You can learn more about certain charities and non-profit organizations that help with bills here.

Can you get low-income car insurance in AZ?

While Arizona doesn’t have government-sponsored help paying auto insurance for low-income families, you can shop around for coverage from the best Arizona auto insurance for affordable policies.

Can you get low-income car insurance in Texas?

There’s no program offering government assistance paying car insurance in Texas, but you can compare quotes from various companies to find the best Texas auto insurance.

If you need car insurance and help paying for it, enter your ZIP code into our free quote tool below to find the cheapest car insurance companies near you.

Can you get low-income car insurance in MN?

There’s no low-income or welfare car insurance programs in Minnesota, but shopping around with top providers is how you’ll find the cheapest and best Minnesota auto insurance rates.

Does Oregon low-income car insurance exist?

Oregon doesn’t have a government program to help you pay for auto insurance, but you can find cheap rates by shopping around.

Read More: Best Oregon Auto Insurance

Can I get low-income car insurance in Nevada?

There isn’t a Nevada government assistance program for car insurance, but compare rates from the best Nevada auto insurance companies for cheap coverage.

Is there low-income car insurance in Washington state?

Though you can’t get the best Washington auto insurance through the government, comparing quotes from the best companies will help you find cheap premiums.

Can I get low-income car insurance in Florida?

You may be wondering, “Can I get government car insurance for low income near me in Florida?” Florida doesn’t have a government auto insurance program.

Read More: Cheapest Auto Insurance Companies in Florida

Can I get low-income car insurance in Oklahoma?

No, Oklahoma doesn’t have a car insurance program for low-income drivers. However, you can compare rates from the best Oklahoma auto insurance companies here.

Can I get low-income car insurance in NY?

While New York doesn’t have a car insurance program for low-income drivers, you can get the best New York auto insurance rates by comparing quotes, locating discounts, and only getting liability coverage if possible.

Can I get low-income car insurance in Colorado?

If you’re wondering, “I need help paying my car insurance in Colorado. Are there any programs that can help?” No, you can’t participate in a low-income insurance program in Colorado. However, if you’d like to find the best car insurance in Colorado, simply insert your ZIP code below to instantly compare quotes from top CO providers.

Can I get DMV low-income car insurance?

Some states, such as Hawaii, New Jersey, and California, offer a government-sponsored car insurance program, but it’s not through the DMV. Speak with the agency in your state that operates the program if you’re wondering how to get help paying for car insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.