New Car Replacement Insurance in 2025 (In-Depth Explanation)

New car replacement insurance is an add-on that covers the entire cost of a brand-new vehicle, not just the depreciated value, if yours is totaled. It starts as low as $5/mo. Company requirements vary, but you must have full coverage, and most companies require cars to be no more than a year old.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

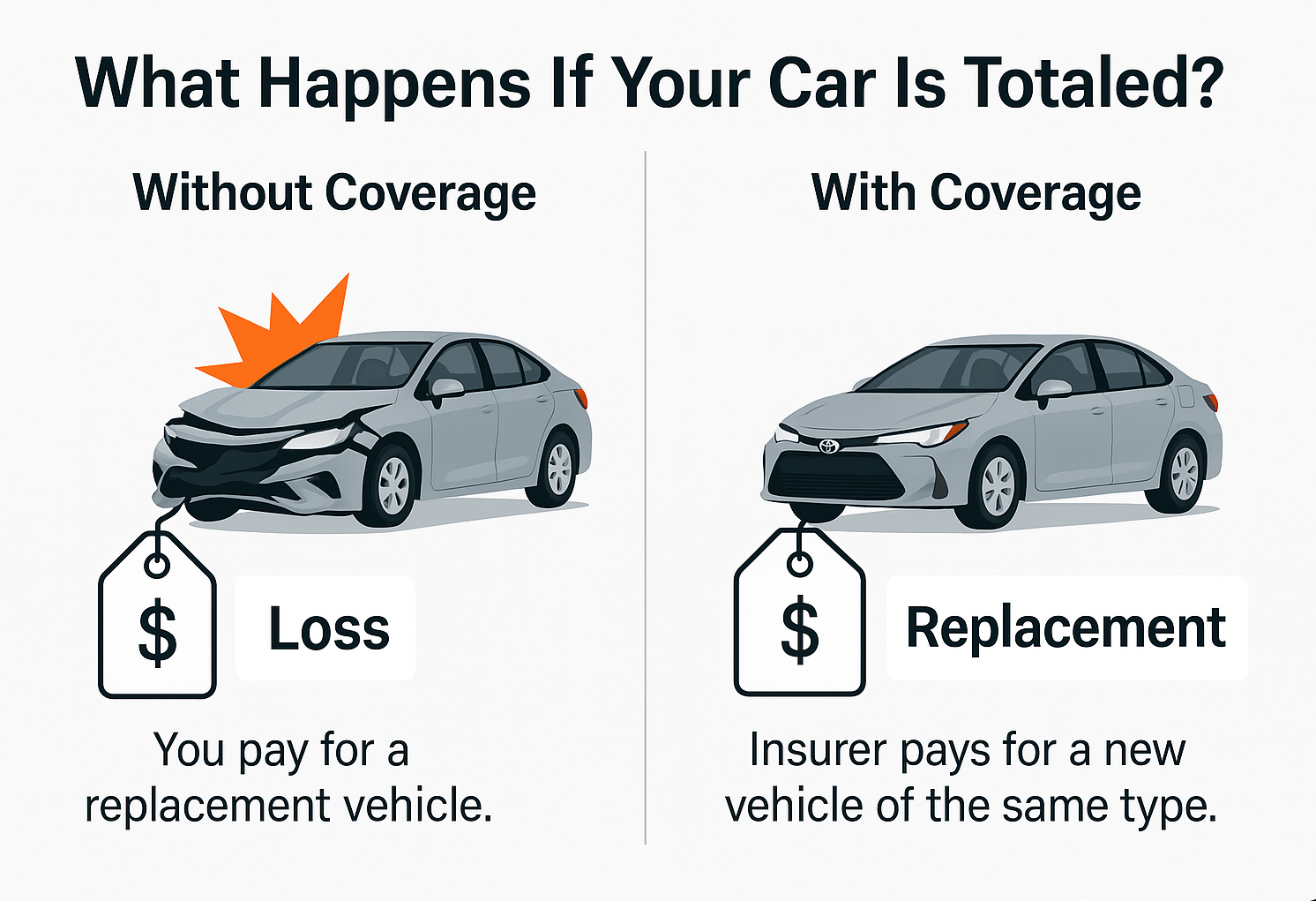

New car replacement insurance is an add-on coverage that offers drivers financial reimbursement for a brand-new vehicle of the same make and model if their car is totaled, ensuring complete value protection against depreciation.

Company requirements vary, but most require that the vehicle is no older than a year and that you carry full coverage. With rates starting at $5 per month, it shields car owners from the steep loss in value that typically happens during the first year.

Perfect for new vehicle owners worried about depreciation, this coverage helps avoid large out-of-pocket costs with recoverable depreciation.

- Not all insurance companies offer new car replacement coverage

- New car replacement insurance protects you from depreciation after a total loss

- Offers a new vehicle of the same make and model if your car is totaled

Make sure to compare policies from different insurers to secure the most competitive rate and the optimal protection for your vehicle. Get fast and cheap auto insurance coverage today with our quote comparison tool.

How New Car Replacement Insurance Works

What is new car replacement insurance? New car replacement pays to replace your brand-new vehicle if it’s totaled in a collision within the first year of ownership. Assuming you paid around $35,000 for a new SUV, new car coverage would replace it with the same SUV or a similar make and model at the same price.

Most auto insurance companies only offer new car replacement insurance to vehicles no older than a year.

Nobody wants to think that their brand-new automobile could be written off so soon after they buy it. But if it does, new car replacement coverage will provide you with a larger reimbursement. What insurance companies offer new car replacement? Take a look below to see which car insurance companies offer this add-on coverage.

New Car Replacement Insurance Terms by Provider

| Company | Coverage |

|---|---|

| First 4 years of new car ownership; includes motorcycles. | |

| Car must be 2 model years old or newer. | |

| First year or 15,000 miles; pays up to 110% MSRP if same model unavailable. | |

| Must start within 30 days of buying a car with less than 1,000 miles (current or prior model year). |

| Applies within 2 years of purchase; offered in two policy packages. | |

| Covers first 2 years; can be added anytime before a claim. | |

| Car must be under 2 years old and under 24,000 miles at time of purchase. | |

| Applies to vehicles up to 4 model years old (5 in select states). | |

| First year or 15,000 miles; standard with policy. | |

| Free with AARP auto policies; includes new car benefits. |

| Eligible if car is under 1 year old with under 15,000 miles. |

| Vehicle must be under 2 years old and fewer than 24,001 miles. | |

| Excludes coverage if car is stolen or damaged by fire. | |

| Covers original owner's first 2 years; upgrade options available. | |

| Applies to original owner; car must be under 1 year and under 15,000 miles. | |

| First year or 15,000 miles; included on all auto policies. |

| First 5 years of new car ownership; includes gap and glass benefits. |

If you don’t have insurance for new cars, you would only get the current actual cash value of the vehicle, which will be significantly less than what you paid for it. While shopping for car insurance, specifically when replacing a new car, remember that depreciation is a very important factor that usually is missed in the buying process.

Read More: Buying Auto Insurance for a New Car

To see what average rates are for new car replacement, from State Farm new car replacement insurance to Travelers replacement coverage, take a look at the table below.

New Car Replacement Insurance Cost by Provider

| Insurance Company | Monthly Rate |

|---|---|

| $9 | |

| $10 | |

| $8 | |

| $10 |

| $7 | |

| $7 | |

| $9 | |

| $7 | |

| $9 | |

| $7 |

| $12 |

| $8 | |

| $7 | |

| $8 | |

| $9 | |

| $7 |

| $11 |

These rates will be added to the cost of your full coverage insurance policy at your company. If you total your car, having new car replacement coverage means the company will pay you for the full value of your new vehicle, not the depreciated value. Each insurance company uses its own formula to calculate a totaled car value.

Still, you can compare a repair bill to average market values to get an idea of what you can expect from a payout. Read our guide to using a totaled car value calculator to get a better idea of the value of your totaled vehicle.

Here are a few insurance providers who provide insurance for the purchase of new cars if your automobile is totaled within the first 15 months or 15,000 miles:

- Allstate:If the new automobile is less than two model years old, Allstate’s new car replacement insurance will replace it.

- Erie: Erie’s New Auto Security program will replace vehicles older than two years with the most recent model. Learn more in our Erie auto insurance review.

- Liberty Mutual: Liberty Mutual pays for a brand-new vehicle if your totaled car is under a year old and has fewer than 15,000 miles on it.

- Nationwide: Nationwide new car replacement pays to replace an automobile as long as it is less than three years old.

- Travelers: New car replacement insurance with Travelers will pay to replace your car with a brand-new vehicle of the same make and model if it’s totaled within the first five years of ownership.

Not all insurance companies provide new automobile replacement insurance. For example, Geico does not offer Geico new car replacement insurance. Companies that do offer it may not offer it in all states.

That’s why it’s imperative to shop around with multiple companies to find one with the coverage options you’re looking for.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Drivers Who Benefit From New Car Replacement Insurance

Do you need car replacement insurance? Although new car replacement insurance is more expensive, drivers concerned about depreciation may need auto replacement protection to be covered in the event their new vehicle is totaled.

Is new car replacement insurance worth it? If you own your car, you should consider buying a new car replacement if your car is new.

Learn More: How Vehicle Year Affects Auto Insurance Rates

What is considered a new car for insurance? A vehicle must meet the following requirements at most companies:

- Is less than one year old

- Has fewer than 15,000 miles

- Was purchased new (not pre-owned)

Not everyone will need car insurance with new car replacement, but it’s worth considering if one of the above situations applies to you. If you drive fewer than 10,000 miles annually, you may also want to consider pay-per-mile insurance. Let’s go over a few general guidelines on insurance for new cars before you buy new car replacement coverage.

Regulations for New Car Replacement Insurance

Replacement car insurance for new vehicles is only available to drivers who own their vehicles and carry full coverage auto insurance. You may also have a deadline for buying new car replacement coverage from a particular insurance company.

For instance, Nationwide mandates that drivers get insurance with new car replacement within six months after purchasing a new car, while Erie allows drivers to add coverage at any time as long as it’s before an accident.

Remember that the insurance company determines the period and mileage for new car replacement coverage. It’s also possible that you can’t purchase both gap insurance and new automobile replacement coverage simultaneously.

Advantages of Buying New Car Insurance Replacement Insurance

Essentially, for the monthly cost of the replacement value car insurance, you receive peace of mind knowing that if something happens to your new car, your insurance company will pay to replace it with the same or similar make and model (Learn More: Auto Insurance Rates by Vehicle Make and Model).

Looking to save on auto insurance without compromising on coverage? Check out our latest article. We’ve compared coverage options, discounts, and customer service quality to help you make the best choice! #AutoInsurance #SaveMoney 💰🚗👉https://t.co/8fs37EXvYH pic.twitter.com/h3WDG3a1ZU

— AutoInsurance.org (@AutoInsurance) June 18, 2024

Other advantages that come with new vehicle replacement insurance include the following:

- Your vehicle is protected throughout the first year of ownership.

- You won’t have to worry about replacing your totaled vehicle with an older, less expensive model.

- You can avoid the financial loss brought on by owing more on your car than it is worth.

While better car replacement doesn’t cover an auto loan, it can get you back behind the wheel of your new car without you paying out of pocket for another vehicle.

New Car Replacement Insurance vs. Gap Insurance

Unlike new car replacement, gap insurance pays the difference left on your auto loan or lease if your car is totaled in a collision or unrecoverable after a theft.

Gap coverage won’t pay to replace the vehicle, but it does cover any outstanding loan payments you have left on a vehicle you no longer have.Dani Best Licensed Insurance Producer

Keep these differences between new vehicle replacement vs. gap insurance in mind as you shop for a policy:

- Be sure you are aware of the terms and restrictions before purchasing gap insurance or a new car replacement policy.

- If you have an auto loan, gap coverage may be offered longer than new car replacement coverage, depending on the insurer.

- If you choose to forego gap or new car replacement coverage, be sure to have enough money saved up to pay back a lender or use it as a down payment on a replacement vehicle if your new car is totaled.

- If you decide to purchase new car replacement insurance, make sure to terminate it as soon as your vehicle reaches the maximum age or miles allowed by your insurer.

Before buying a new car, consider replacement or gap insurance.

Taking the time to shop around can help you find the most competitive rates and comprehensive coverage. Be sure to review policy details carefully to ensure it fits your specific needs.

New Car vs. Better Car Replacement Coverage

Replacement coverage might not be available to you if your automobile is older. However, some companies provide “better car replacement” or “newer-car replacement” plans, including:

- Erie

- Hanover

- Liberty Mutual

For example, Liberty Mutual offers better car replacement coverage as an optional add-on, which pays for a car that’s one model year newer and has 15,000 fewer miles. Any car, regardless of age, can use it. Read our Liberty Mutual auto insurance review to learn more.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors That Influence the Cost of New Car Replacement Insurance

Auto insurance rates by state, driver, and vehicle vary. Newer vehicles also cost more to insure because they are more expensive to repair. On average, you can expect your car insurance rates to go up around 5% with new car replacement.

Some insurers, such as Concord Group and Shelter, offer new car replacement as part of standard coverage, but it is typically an add-on with most larger insurance companies. Comparing quotes from insurance companies is the only way to determine your exact new car replacement insurance rates.

Here are a few things to think about when deciding if new vehicle automobile replacement insurance is right for you:

- Budget: You might want only to carry your state’s minimum insurance to keep your auto rates as low as possible, but bear in mind that you run the danger of having your car totaled in an accident.

- Possibility of an Accident: If you work from home or do not drive very often, you are less likely to be in a collision that would total your car. Therefore, new car replacement might not be worth it.

- Vehicle Make and Model: New automobile replacement coverage is smart if your vehicle depreciates quickly. Sports cars, for example, lose value more quickly than other vehicles.

If your car wasn’t totaled, you still have options. Shop around for the best deals and the best coverage that fits your needs and budget. Make sure to consider all options before locking in a policy. For example, if you’re shopping for car insurance, new car owners may qualify for special discounts like safety feature discounts (Read More: Best Auto Insurance Discounts for a New Car).

How New Car Replacement Coverage Helps You Avoid Big Losses

Consider new car replacement insurance if you recently purchased a new car. It can depreciate dramatically once you drive it off the lot, but this policy could be a cost-effective approach to retain the worth of your automobile if you have an accident and total it. Find out more in our guide, “At-Fault Accident Defined.”

Drivers should secure new car replacement coverage early to protect their investment against rapid value loss.Michelle Robbins Licensed Insurance Agent

In general, it’s a good idea to add this coverage if your insurer offers it and you can afford higher new automobile replacement insurance rates. New car replacement insurance will reimburse you for the cost of a brand-new vehicle of the same make and model if your vehicle is totaled.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

Frequently Asked Questions

How much is new car replacement insurance?

Rates for new car replacement insurance start at $5 per month. However, as prices vary from person to person, speak with your insurance agent to learn how much new car replacement insurance costs.

Can I get new car replacement coverage on a used car?

Typically, no. Most insurance companies demand that you obtain this coverage as the first owner of a new vehicle. If you drive a used car or lease a vehicle, your best option would be to look into gap insurance to cover your loan or lease if the vehicle is totaled.

Should I buy new vehicle replacement insurance when I purchase my car, or may I wait?

Some businesses let you buy it whenever you want during the first year or another time frame. For instance, Nationwide will include it in your policy as long as it happens before an accident and within the first six months of you owning the vehicle.

Delve deeper into our detailed Nationwide auto insurance review.

Upon totaling my car, do I receive a new one?

Does insurance pay for a replacement vehicle? If your car is totaled, you won’t receive insurance money for a new model of the same car unless you also bought new car replacement insurance. Without it, you only receive compensation for what the car was worth at the time of the accident and will have to pay the price difference if you purchase a brand-new vehicle.

How much does insurance for a new car cost?

Auto insurance rates for new cars vary depending on factors such as your location, driving history, and the specific vehicle. How does insurance change when you get a new car? On average, you can expect your insurance for your new car purchase to increase by around 5% with new car replacement coverage (Learn More: How to Estimate the Auto Insurance Costs for a New Car).

It’s important to compare quotes from different insurance companies to get an accurate estimate for your situation. Avoid expensive auto insurance premiums by entering your ZIP code below to see the cheapest rates for you.

What is the difference between new car replacement vs. gap insurance?

New car replacement insurance, also known as new for old replacement car insurance, pays for the replacement of your vehicle with a brand-new one of the same make and model if it’s totaled.

On the other hand, gap insurance covers the difference between the amount you owe on your auto loan or lease and the actual cash value of your car if it’s totaled or stolen. Gap insurance doesn’t provide a new car replacement but helps with outstanding loan payments. Find out more by reading our article, “Should I get gap insurance for a used car?”

What is auto replacement protection?

Auto replacement protection is the same as replacement car insurance. New for old car insurance covers the cost of replacing a totaled vehicle with a brand-new car of the same make and model. It protects you from losing value due to depreciation.

Is new car replacement insurance worth it?

Yes, new car replacement insurance protects you from depreciation and covers the cost of a brand-new vehicle if your car is totaled. Replacement value car insurance covers the cost of replacing your vehicle with a new one, rather than paying its depreciated value.

Car replacing refers to the process of getting a new vehicle when your existing one is totaled or beyond repair. Find out how insurance companies determine car value.

What is better car replacement insurance?

Better car replacement insurance provides a newer model with fewer miles if your car is totaled, ensuring upgraded coverage. Find the best low-mileage auto insurance discounts.

What is car replacement assistance?

Car replacement assistance provides support in finding and funding a new vehicle if your current one is deemed a total loss, often through financial and logistical support from the insurer.

Does State Farm offer new car replacement insurance?

State Farm does not offer new car replacement insurance but provides other comprehensive coverage options and perks like accident forgiveness plans.

What is a new car insurance policy?

New car insurance coverage includes protections like new car replacement, gap coverage, and full collision and comprehensive insurance.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

What insurance companies offer new car replacement?

Companies like Allstate, Liberty Mutual, and Nationwide offer new car replacement insurance options.

Who can get new car replacement coverage?

Owners of new cars can get new car replacement coverage if they meet their company’s requirements. Typically, cars must have less than 15,000 miles on them and be no older than a year.

What is replacement rule insurance?

Replacement rule insurance dictates how and when an insurer must replace your totaled vehicle under a specific policy. Learn if you can view your auto insurance policy online.

What is auto replacement protection coverage?

Auto replacement protection coverage ensures your totaled vehicle is replaced with a new one, usually within the first year of ownership and based on its actual cash value.

Get further insights with our article, “Replacement Cost vs. Actual Cash Value.”

Is insurance for a new car more expensive?

Yes, insurance for a new car is often more expensive due to the higher value and cost of repairing or replacing newer vehicles.

What is car insurance replacement value?

Car insurance replacement value refers to the amount an insurer will pay to replace your car, typically based on the cost of a new, similar vehicle.

Does Progressive offer new car replacement?

No, you can not get new car replacement insurance with Progressive, but it does offer gap insurance. Learn more about Progressive in our Progressive auto insurance review.

What does auto replacement protection mean?

Auto replacement protection is another word for new car replacement. It means your insurance will cover the cost of a new vehicle if yours is totaled, protecting you from depreciation. What is auto replacement?

Auto replacement refers to the process of getting a new car to replace one that has been totaled in an accident. Enter your ZIP code below to explore which companies have the cheapest auto insurance rates for you.

How long does new car replacement coverage last?

It depends on the company, but generally, new car replacement coverage will last for at least 12 months.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.