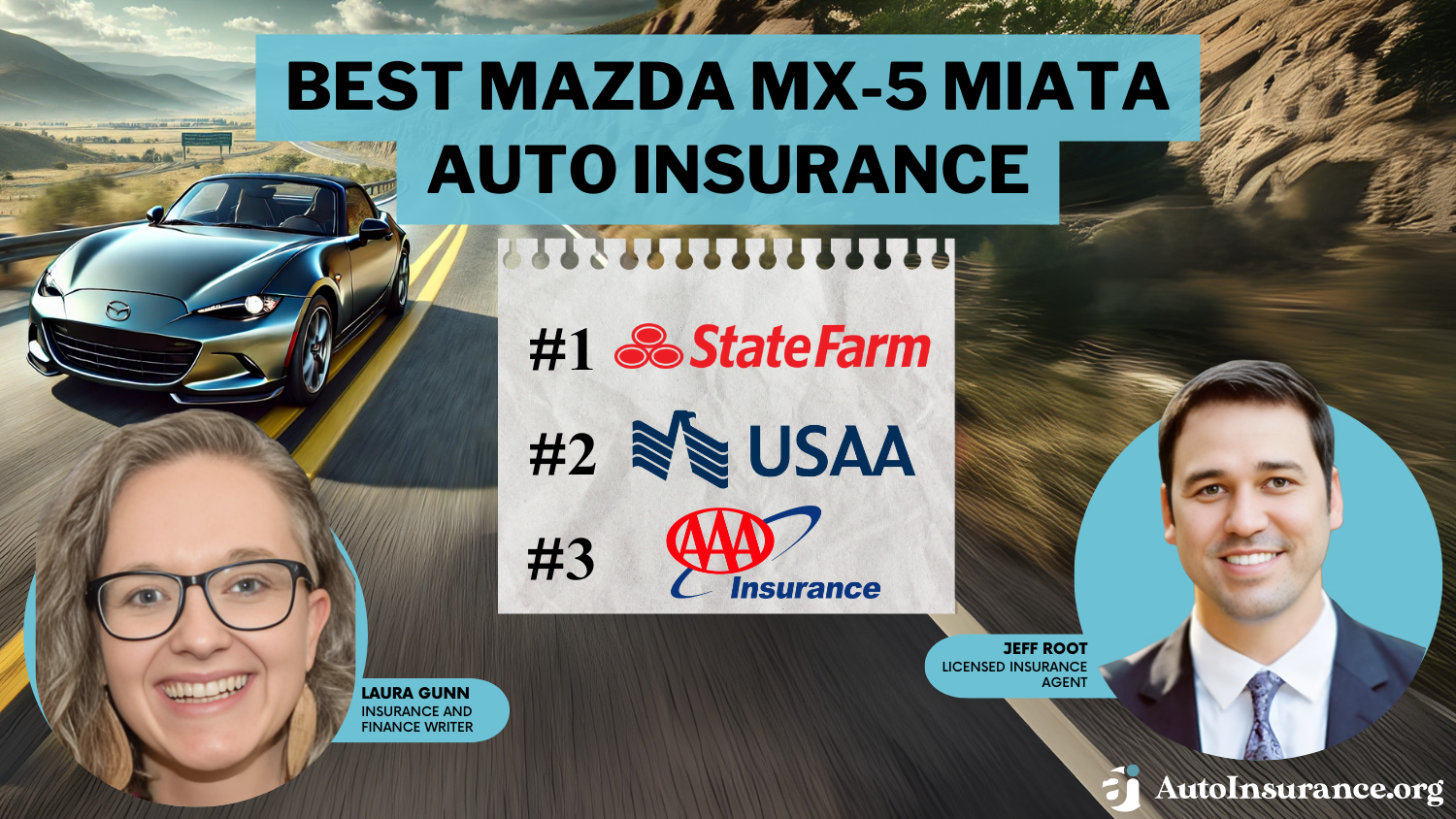

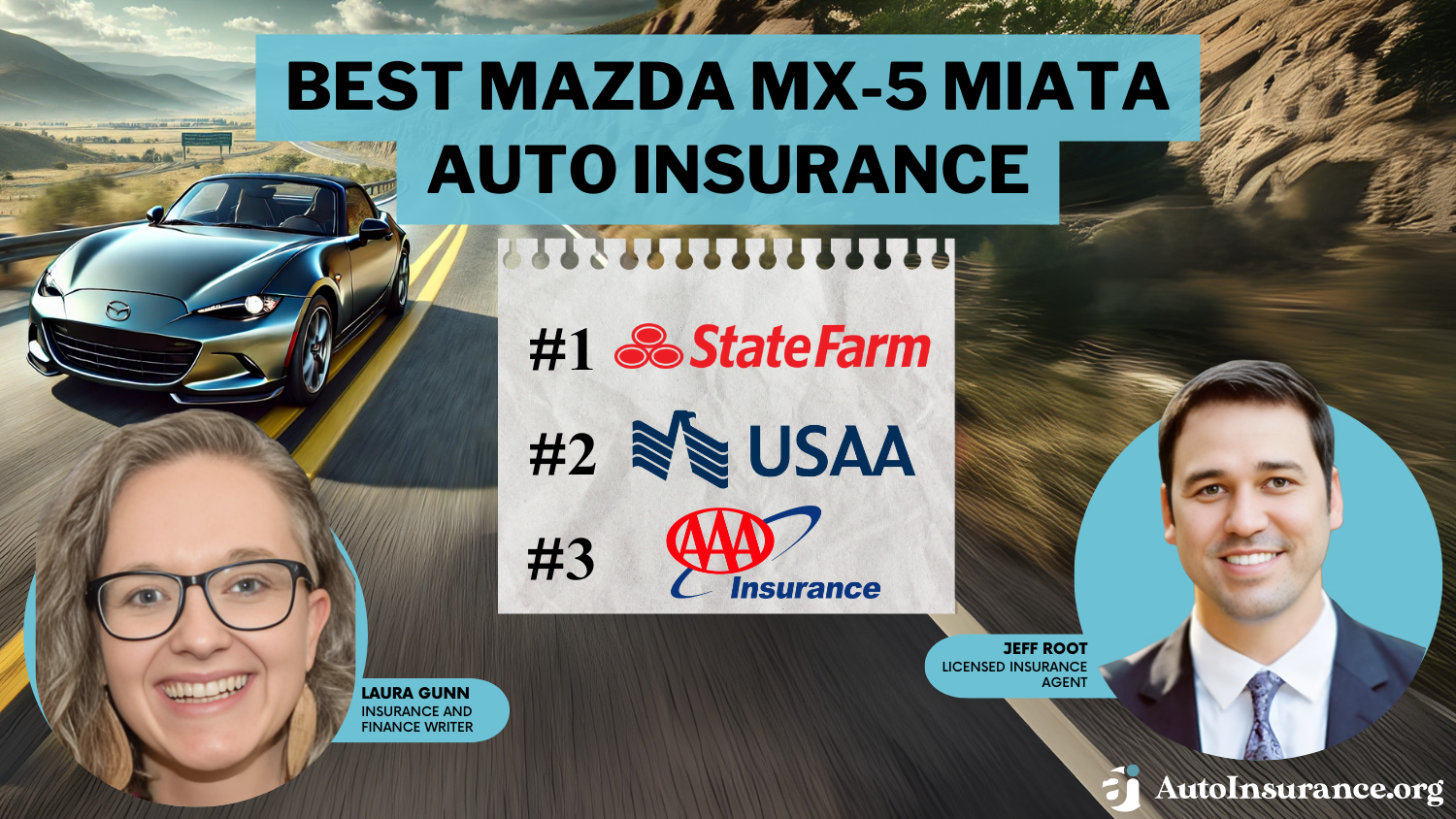

Best Mazda MX-5 Miata Auto Insurance in 2025 (Check Out the Top 10 Companies)

State Farm, USAA, and AAA are the top picks for the best Mazda MX-5 Miata auto insurance, with average monthly premiums starting at $40. These top providers deliver comprehensive coverage options and discounts that cater specifically to Mazda MX-5 Miata owners, ensuring peace of mind and protection on the road.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Mazda MX-5 Miata

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Full Coverage for Mazda MX-5 Miata

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Mazda MX-5 Miata

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews

State Farm, USAA, and AAA stand out as the top providers for the best Mazda MX-5 Miata auto insurance, offering competitive rates and tailored to Miata owners.  With average monthly premiums around $40, these companies excel in delivering value through various discounts and customer support options. See if you’re getting the best deal on car insurance by entering your ZIP code above.

With average monthly premiums around $40, these companies excel in delivering value through various discounts and customer support options. See if you’re getting the best deal on car insurance by entering your ZIP code above.

Our Top 10 Company Picks: Best Mazda MX-5 Miata Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 14% B Many Discounts State Farm

#2 10% A++ Military Savings USAA

#3 12% A Local Agents AAA

#4 15% A+ Online Convenience Progressive

#5 11% A++ Accident Forgiveness Travelers

#6 16% A++ Cheap Rates Geico

#7 13% A Customizable Polices Liberty Mutual

#8 18% A Online App Farmers

#9 17% A+ Usage Discount Nationwide

#10 19% A+ Add-on Coverages Allstate

They provide robust coverage options, making them ideal for both new and seasoned drivers. Ultimately, choosing one of these leading insurers can help you secure the best protection for your beloved Mazda MX-5 Miata without breaking the bank.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Discounts for Safety Features: State Farm offers discounts for the Mazda MX-5 Miata’s advanced safety features, such as anti-lock brakes and airbags, which can significantly reduce premiums, as highlighted in the State Farm auto insurance review.

- Bundling Options: You can save money by bundling your Mazda MX-5 Miata auto insurance with other State Farm policies like home or life insurance, making it a cost-effective choice for those looking for comprehensive coverage.

- Usage-Based Plans: The Drive Safe & Save program allows you to potentially lower your premiums based on your driving habits and mileage, which can be particularly beneficial for low-mileage Mazda MX-5 Miata drivers.

Cons

- Higher Premiums: State Farm generally has higher premiums compared to some other insurance providers, which might not be ideal for budget-conscious Mazda MX-5 Miata owners.

- Limited Customization: There are fewer options for customizing your Mazda MX-5 Miata policy compared to other insurers, which might not meet the specific needs of all Mazda MX-5 Miata drivers.

#2 – USAA: Best for Military Discounts

Pros

- Military Discounts: USAA offers substantial discounts for military members and their families, making it an excellent choice for those who qualify and own a Mazda MX-5 Miata.

- Comprehensive Coverage: USAA provides a wide range of coverage options tailored to the needs of Mazda MX-5 Miata owners, ensuring complete protection, as mentioned in the USAA auto insurance review.

- Accident Forgiveness: USAA offers accident forgiveness, which prevents your rates from increasing after your first at-fault accident, providing financial peace of mind for Mazda MX-5 Miata owners.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting access for the general public who own a Mazda MX-5 Miata.

- Limited Availability: Because of its eligibility restrictions, USAA’s excellent services are not accessible to every Mazda MX-5 Miata owner.

#3 – AAA: Best for Membership Benefits

Pros

- Membership Benefits: In addition to insurance, AAA members enjoy benefits like roadside assistance, travel discounts, and other perks that add value to owning a Mazda MX-5 Miata.

- Good Driver Discounts: Discounts are available for safe driving records and completing defensive driving courses, which can help reduce premiums for Mazda MX-5 Miata owners.

- New Car Replacement: AAA offers new car replacement coverage, ensuring you can replace your Mazda MX-5 Miata with a new one if it’s totaled within the first year.

Cons

- Membership Fee: AAA requires a membership fee, which adds to the overall cost of insurance for Mazda MX-5 Miata owners, as detailed in the AAA auto insurance review.

- Variable Service Quality: The quality of service can vary depending on the regional office, potentially leading to inconsistent experiences for Mazda MX-5 Miata owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program is a usage-based insurance option that can lower premiums based on your driving habits and mileage, ideal for Mazda MX-5 Miata owners who drive less.

- Multi-Car Discount: Progressive offers discounts for insuring multiple vehicles, which can be beneficial for families with more than one car, including a Mazda MX-5 Miata, according to Progressive auto insurance review.

- Comprehensive Coverage Options: Progressive offers a wide range of coverage options, including gap insurance and custom parts and equipment coverage, tailored to meet the specific needs of Mazda MX-5 Miata owners.

Cons

- Inconsistent Customer Service: Customer service experiences can vary, with some Mazda MX-5 Miata owners reporting less satisfactory interactions.

- Higher Rates for High-Risk Drivers: Progressive tends to have higher premiums for Mazda MX-5 Miata drivers with a less-than-perfect driving record, which might not be ideal for all Mazda MX-5 Miata owners.

#5 – Travelers: Best for Range of Discounts

Pros

- Range of Discounts: Travelers offers multiple discounts, including those for hybrid vehicles, safe drivers, and bundling policies, helping Mazda MX-5 Miata owners save on premiums.

- Comprehensive Coverage Options: Travelers provides a wide array of coverage options suitable for Mazda MX-5 Miata owners, including gap insurance and accident forgiveness.

- Vanishing Deductible: Travelers’ vanishing deductible program reduces your deductible for every year of safe driving, offering additional savings for Mazda MX-5 Miata owners, as highlighted in the Travelers auto insurance review.

Cons

- Limited Local Agents: Travelers has fewer local agents compared to some other insurers, which can impact the level of personalized service for Mazda MX-5 Miata owners.

- Average Customer Service: While Travelers provides adequate customer service, it is generally rated as average and not exceptional for Mazda MX-5 Miata owners.

#6 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is known for offering some of the lowest rates in the industry, making it an attractive option for budget-conscious Mazda MX-5 Miata owners.

- Multi-Policy Discounts: Geico offers discounts for bundling Mazda MX-5 Miata auto insurance with other types of insurance, such as homeowners or renters insurance.

- Vehicle Equipment Discounts: Discounts are available for safety features and anti-theft devices in the Mazda MX-5 Miata, further reducing premiums.

Cons

- Limited Local Agents: Geico primarily operates online, with limited availability of local agents for personalized service for Mazda MX-5 Miata owners.

- Average Claims Experience: While generally positive, some Mazda MX-5 Miata policyholders report that the claims experience can be average, with room for improvement, as noted in the Geico auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Liberty Mutual offers a wide range of coverage options, including gap insurance and custom parts and equipment coverage, tailored to the needs of Mazda MX-5 Miata owners.

- New Car Replacement: Liberty Mutual offers new car replacement if your Mazda MX-5 Miata is totaled within the first year, ensuring you can replace your vehicle with a new one.

- Flexible Payment Options: Various payment plans are available to fit different budgets, providing financial flexibility for Mazda MX-5 Miata owners, according to Liberty Mutual auto insurance review.

Cons

- Higher Rates: Liberty Mutual’s premiums can be higher than average, especially without discounts, which might not be ideal for budget-conscious Mazda MX-5 Miata owners.

- Mixed Customer Reviews: Customer reviews are mixed, with some Mazda MX-5 Miata policyholders reporting less satisfactory experiences with customer service and claims handling.

#8 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Farmers offers highly customizable insurance policies to fit the specific needs of Mazda MX-5 Miata owners, as detailed in the Farmers Auto Insurance Discounts.

- Accident Forgiveness: Provides accident forgiveness to prevent rate increases after your first at-fault accident, offering financial stability for Mazda MX-5 Miata owners.

- Comprehensive Coverage: Farmers offers a wide range of coverage options, including gap insurance and custom parts and equipment coverage, tailored to the needs of Mazda MX-5 Miata owners.

Cons

- Higher Premiums: Farmers generally has higher premiums compared to some competitors, which might not be ideal for budget-conscious Mazda MX-5 Miata owners.

- Inconsistent Customer Service: Customer service experiences can vary, with some Mazda MX-5 Miata policyholders reporting less satisfactory interactions.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible program reduces your deductible for every year of safe driving, offering additional savings for Mazda MX-5 Miata owners.

- Bundling Discounts: Significant savings are available when bundling Mazda MX-5 Miata auto insurance with other policies like home or renters insurance.

- Accident Forgiveness: Nationwide offers accident forgiveness to keep your rates stable after your first at-fault accident, providing financial security for Mazda MX-5 Miata owners.

Cons

- Limited Discounts: Nationwide offers fewer discounts compared to other insurers, which might limit savings opportunities for Mazda MX-5 Miata owners, as noted in the Nationwide auto insurance review.

- Average Customer Service: Customer service is rated as average, with room for improvement in responsiveness and satisfaction for Mazda MX-5 Miata owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Multiple Discounts

Pros

- Multiple Discounts: Various discounts are available, including those for safe drivers, bundling policies, and installing anti-theft devices, helping reduce premiums for Mazda MX-5 Miata owners.

- Drivewise Program: Allstate’s usage-based insurance program can lower premiums for good driving habits, making it a cost-effective option for Mazda MX-5 Miata owners.

- New Car Replacement: Allstate offers new car replacement coverage if your Mazda MX-5 Miata is totaled, ensuring you can replace it with a new one, as highlighted in the Allstate auto insurance review.

Cons

- Higher Rates: Allstate’s premiums tend to be higher than some competitors, which might not be ideal for budget-conscious Mazda MX-5 Miata owners.

- Mixed Customer Reviews: Customer reviews are mixed, with some Mazda MX-5 Miata policyholders reporting less satisfactory experiences with customer service and claims handling.

Mazda MX-5 Miata Insurance Cost

The Mazda MX-5 Miata is renowned for its sporty performance, stylish design, and affordable price tag. However, owning this iconic roadster comes with the responsibility of securing the right insurance coverage. Understanding the costs associated with insuring a Mazda MX-5 Miata can help you budget more effectively and ensure you have the protection you need on the road.

Mazda MX-5 Miata Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $72 $216

Allstate $56 $171

Farmers $95 $300

Geico $59 $176

Liberty Mutual $62 $192

Nationwide $72 $218

Progressive $40 $127

State Farm $50 $146

Travelers $70 $198

USAA $57 $179

In this article, we will explore the factors that influence insurance rates for the Mazda MX-5 Miata, average costs, and tips for finding the best insurance deals.

The average Mazda MX-5 Miata auto insurance rates are $1,174 a year or $98 a month. Discover our comprehensive guide to “What is the average auto insurance cost per month?” for additional insights.

Mazda MX-5 Miata Auto Insurance Monthly Rates by Coverage Type

Category Rates

Average Rate $98

Discount Rate $58

High Deductibles $84

High Risk Driver $208

Low Deductibles $123

Teen Driver $358

Insuring your Mazda MX-5 Miata doesn’t have to be a daunting task. By understanding the factors that impact insurance costs and taking advantage of discounts and competitive rates, you can find affordable coverage that meets your needs.

Whether you’re a new owner or a long-time enthusiast, ensuring your Miata is well-protected will allow you to enjoy the open road with peace of mind. Consider comparing quotes from different providers and explore various coverage options to make an informed decision that keeps you and your beloved Miata safe.

Cost of Insuring a Mazda MX-5 Miata

The chart below details how Mazda MX-5 Miata insurance rates compare to other sports cars like the Audi RS 7, Chevrolet Camaro, and Ford Mustang.

Mazda MX-5 Miata Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

Vehicle Comprehensive Collision Liability Full Coverage

Mazda MX-5 Miata $44 $92 $33 $183

Chevrolet Camaro $29 $50 $31 $123

Ford Mustang $29 $60 $35 $139

Audi TTS $33 $60 $28 $132

Porsche 718 Boxster $37 $79 $28 $156

Porsche 718 Cayman $38 $84 $33 $169

However, there are a few things you can do to find the cheapest Mazda insurance rates online. For further details, check out our in-depth “How Insurance Providers Determine Rates” article.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting the Cost of Mazda MX-5 Miata Insurance

The Mazda MX-5 Miata trim and model you choose will affect the total price you will pay for Mazda MX-5 Miata insurance coverage. Explore our detailed analysis on “Factors That Affect Auto Insurance Rates” for additional information.

Age of the Vehicle

The average auto insurance rates for the Mazda MX-5 Miata are generally higher for newer models. For instance, insuring a 2017 Mazda MX-5 Miata costs about $98 per month, while the insurance for a 2010 Mazda MX-5 Miata is approximately $82 per month.

Mazda MX-5 Miata Auto Insurance Monthly Rates by Model Year and Coverage Type

Vehicle Comprehensive Collision Minimum Coverage Full Coverage

2023 Mazda MX-5 Miata $21 $36 $30 $98

2022 Mazda MX-5 Miata $20 $35 $30 $97

2021 Mazda MX-5 Miata $19 $34 $31 $95

2020 Mazda MX-5 Miata $18 $31 $32 $93

2019 Mazda MX-5 Miata $17 $29 $32 $90

2018 Mazda MX-5 Miata $17 $26 $33 $87

2017 Mazda MX-5 Miata $16 $24 $33 $84

2016 Mazda MX-5 Miata $15 $23 $33 $82

This results in a difference of $4 per month, reflecting how newer models typically incur higher premiums due to their increased value, repair costs, and advanced features, which insurers consider when calculating rates.

Driver Age

Mazda MX-5 Miata Auto Insurance Monthly Rates by Age

Age Rates

Age: 16 $540

Age: 18 $478

Age: 20 $395

Age: 30 $218

Age: 40 $192

Age: 45 $183

Age: 50 $176

Age: 60 $171

This discrepancy arises because younger drivers are often considered higher risk due to factors like inexperience and higher accident rates, leading to higher premiums for them.

Driver Location

Where you live can significantly affect Mazda MX-5 Miata insurance rates. For instance, drivers in Jacksonville might pay about $704 more per year for their insurance compared to drivers in Indianapolis.

Mazda MX-5 Miata Auto Insurance Monthly Rates by City

City Rates

Chicago, IL $133

Columbus, OH $84

Houston, TX $158

Indianapolis, IN $86

Jacksonville, FL $146

Los Angeles, CA $173

New York, NY $160

Philadelphia, PA $135

Phoenix, AZ $117

Seattle, WA $98

This variation is due to factors such as local traffic conditions, crime rates, and repair costs, which influence how insurers set premiums based on regional risks and costs.

Your Driving Record

Mazda MX-5 Miata Auto Insurance Monthly Rates by Age & Driving Record

Age Clean Record One Accident One DUI One Ticket

Age: 16 $540 $789 $985 $645

Age: 18 $478 $697 870 570

Age: 20 $395 $581 725 475

Age: 30 $218 $327 408 267

Age: 40 $192 $288 360 234

Age: 45 $183 $275 343 223

Age: 50 $176 $264 330 215

Age: 60 $171 $256 320 209

This age group is perceived as higher risk due to factors like inexperience and a greater likelihood of accidents, leading to more substantial rate hikes with any driving infractions.

Mazda MX-5 Miata Safety Ratings

Your Mazda MX-5 Miata auto insurance rates are influenced by the safety ratings of the Mazda MX-5 Miata. See the breakdown below:

Mazda MX-5 Miata Safety Ratings

Type Rating

Small overlap front: driver-side Marginal

Small overlap front: passenger-side Good

Moderate overlap front Good

Side Good

Roof strength Good

Head restraints and seats Good

Compare RatesStart Now →

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Marginal |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

Understanding these ratings helps gauge how well the MX-5 Miata performs in terms of safety and informs potential buyers about the vehicle’s reliability and protection standards.

Mazda MX-5 Miata Crash Test Ratings

Mazda MX-5 Miata crash test ratings offer valuable information on how the vehicle performs in collision scenarios, assessing its ability to protect occupants during accidents. Evaluated by organizations such as the NHTSA and IIHS, these ratings consider factors like crashworthiness, impact protection, and overall safety performance.

If the Mazda MX-5 Miata crash test ratings are good, you could have lower Mazda MX-5 Miata auto insurance rates. See Mazda MX-5 Miata crash test results below:

Mazda MX-5 Miata Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2023 Mazda MX-5 Miata | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Mazda MX-5 Miata | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Mazda MX-5 Miata | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Mazda MX-5 Miata | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Mazda MX-5 Miata | 4 stars | 4 stars | 5 stars | 4 stars |

By reviewing these ratings, potential buyers can better understand the Miata’s safety capabilities and how it measures up in real-world crash situations.

Mazda MX-5 Miata Safety Features

The Mazda MX-5 Miata is equipped with a range of safety features designed to enhance driver and passenger protection. These include advanced technologies such as adaptive cruise control, automatic emergency braking, and blind-spot monitoring.

The numerous safety features of the Mazda MX-5 Miata help contribute to lower insurance rates. The 2020 Mazda MX-5 Miata has the following safety features:

- Electronic Stability Control (ESC)

- ABS And Driveline Traction Control

- Side Impact Beams

- Dual Stage Driver And Passenger Seat-Mounted Side Airbags

- Low Tire Pressure Warning

Additionally, the Miata features robust structural design elements and multiple airbags to help safeguard occupants during collisions. By incorporating these safety features, the MX-5 Miata aims to provide a secure driving experience while maintaining its sporty performance.

Mazda MX-5 Miata Insurance Loss Probability

The insurance loss probability for the Mazda MX-5 Miata differs based on the type of coverage, affecting overall insurance rates. Lower percentages indicate a reduced likelihood of insurance losses, which generally leads to lower auto insurance rates for the Miata.

Mazda MX-5 Miata Auto Insurance Loss Probability by Coverage Type

Coverage Probability

Collision -24%

Property Damage -39%

Comprehensive -26%

Personal Injury -28%

Conversely, higher percentages suggest a greater risk, resulting in higher insurance premiums. This variability highlights how different forms of coverage impact the cost of insuring a Mazda MX-5 Miata.

Mazda MX-5 Miata Finance and Insurance Cost

If you are financing a Mazda MX-5 Miata, most lenders will require your carry higher Mazda MX-5 Miata coverage options including comprehensive coverage, so be sure to shop around and compare Mazda MX-5 Miata auto insurance quotes from the best companies using our FREE tool below. Get more insights by reading our expert “Calculating Auto Insurance Costs” advice.

Understanding the finance and insurance costs of the Mazda MX-5 Miata is essential for making an informed decision. By considering factors like coverage options, personal circumstances, and available discounts, you can find the best insurance rates and financing terms for your needs.

Whether you’re a first-time buyer or an experienced owner, a thorough comparison of options will help ensure you’re getting the best value and protection for your Mazda MX-5 Miata.

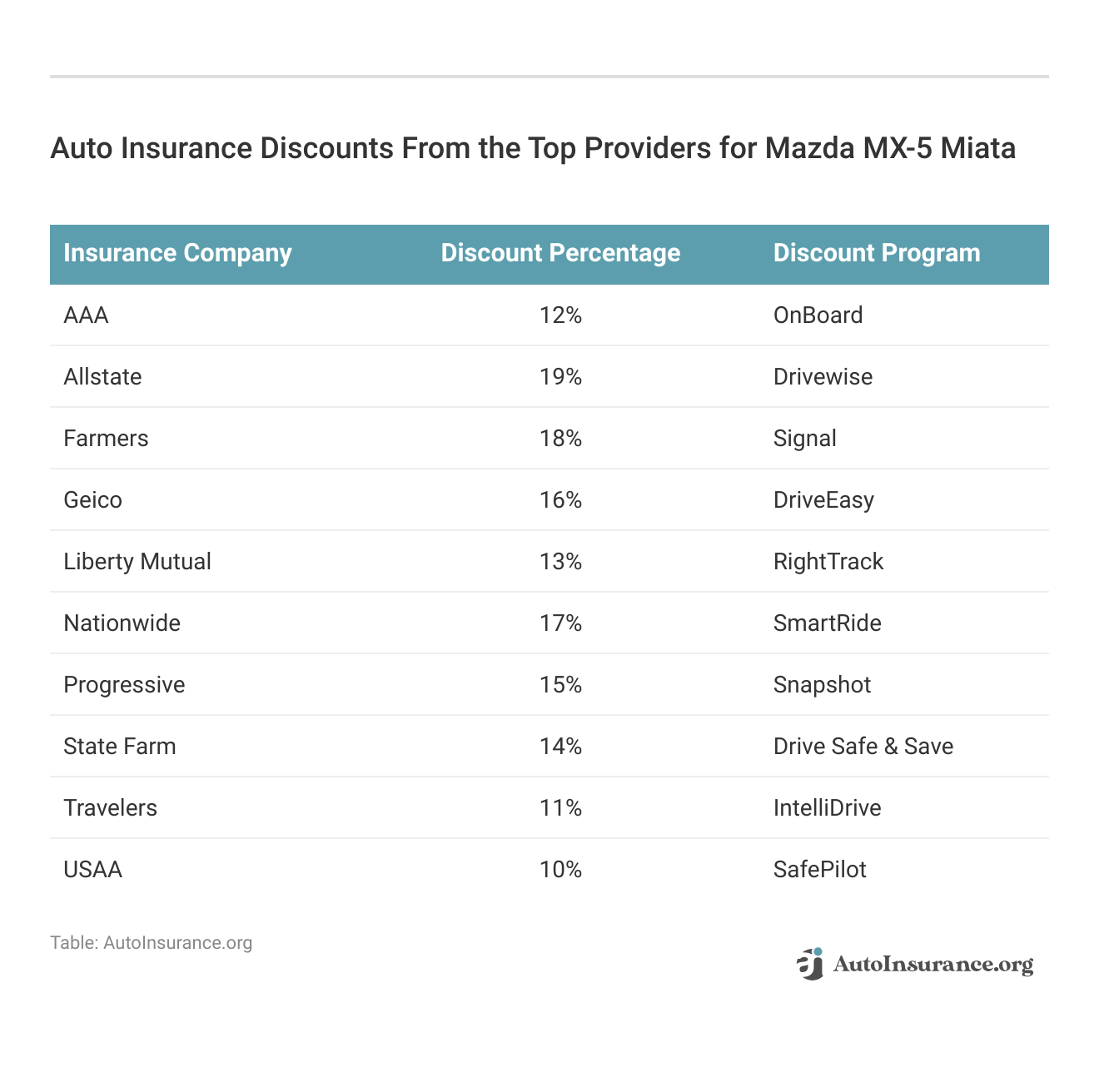

5 Ways to Save on Mazda MX-5 Miata Insurance

Owning a Mazda MX-5 Miata is a thrill, but the cost of insurance can add up quickly. Finding ways to save on your insurance without compromising on coverage is essential for enjoying your sporty roadster to the fullest. For more information, explore our informative “Auto Insurance Discounts” page.

In this guide, we will explore five practical strategies to reduce your Mazda MX-5 Miata insurance costs, helping you keep more money in your pocket while staying protected on the road.

If you want to reduce the cost of your Mazda MX-5 Miata insurance rates, follow these tips below:

- Choose automatic payments or eft for your Mazda MX-5 Miata auto insurance policy.

- Pay your bills on time — especially Mazda MX-5 Miata payments and insurance.

- Choose a Mazda MX-5 Miata with cheaper repair costs.

- Park your Mazda MX-5 Miata somewhere safe – like a garage or private driveway.

- Get married and ask for a discount.

Saving on your Mazda MX-5 Miata insurance is not only possible but also straightforward with the right approach. By following these five tips, you can lower your premiums and still maintain comprehensive coverage.

With temperatures predicted to climb into the triple digits Friday through the weekend, it is important to make sure your vehicle is ready for extreme heat. Here are 5 tips: pic.twitter.com/50OUoWLB2C

— AAA Colorado (@AAAColorado) July 10, 2024

Whether it’s shopping around for the best rates, taking advantage of discounts, or improving your driving habits, these strategies will help you enjoy your Miata with peace of mind and financial ease. Start implementing these tips today and watch your savings grow.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Mazda MX-5 Miata Insurance Companies

When it comes to insuring your Mazda MX-5 Miata, choosing the right provider can significantly impact your coverage and costs. We’ve analyzed the top insurance companies to find the best options for Miata owners, focusing on key factors like premiums, coverage, and customer service. Discover which insurers offer the best protection and value for your iconic roadster.

Mazda MX-5 Miata Auto Insurance Providers by Market Share

Rank Insurance Company Premiums Written Market Share

#1 State Farm $65.6 million 9%

#2 Geico $46.1 million 6%

#3 Progressive $39.2 million 6%

#4 Allstate $35.6 million 5%

#5 Liberty Mutual $35 million 5%

#6 Travelers $28 million 4%

#7 USAA $23.5 million 3%

#8 Chubb $23.4 million 3%

#9 Farmers $20.6 million 3%

#10 Nationwide $18.4 million 3%

Several top auto insurance companies offer competitive rates for the Mazda MX-5 Miata insurance rates based on factors like discounts for safety features. Expand your understanding with our thorough “Best Auto Insurance Companies” overview.

Compare Free Mazda Mx-5 Miata Insurance Quotes Online

Comparing insurance quotes online can help you find the best rates for your Mazda MX-5 Miata without any hassle. For further details, check out our in-depth “Where to Compare Auto Insurance Rates” article.

By using free quote tools, you can easily evaluate coverage options and premiums from multiple providers, ensuring you get the most value for your money. Start comparing quotes today to find the perfect insurance policy for your sporty roadster.

State Farm's extensive safety discounts and bundling opportunities provide Mazda MX-5 Miata owners with substantial savings and high-quality coverage.Jeff Root Licensed Insurance Agent

You can start comparing quotes for Mazda MX-5 Miata auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Getting the right insurance for your Mazda MX-5 Miata doesn’t have to be a complicated process. By leveraging free online quote comparisons, you can quickly identify the best deals and coverage options available. Begin your search now to secure an insurance policy that meets your needs and budget, and enjoy the road with peace of mind.

Frequently Asked Questions

How much does auto insurance for a Mazda MX-5 Miata typically cost?

It varies based on factors like location, driving history, age, coverage, and insurer. Get quotes for an accurate estimate.

What factors can affect the insurance premium for a Mazda MX-5 Miata?

Premiums depend on your driving record, location, age, gender, coverage, vehicle features, and deductible.

Are Mazda MX-5 Miata’s generally expensive to insure compared to other vehicles?

Insurance costs vary; while MX-5 Miata’s have good safety ratings, factors like performance and theft rates affect premiums.

Discover our comprehensive guide to “Compare Auto Insurance Rates by Vehicle Make and Model” for additional insights.

Can I transfer my current auto insurance to my new Mazda MX-5 Miata?

Yes, contact your insurer to update your policy, and consider comparing quotes to ensure the best rates.

Is Mazda MX-5 Miata expensive to insure?

The cost of insuring a Mazda MX-5 Miata can vary based on factors like driver age, location, and driving history. Generally, sports cars can be more expensive to insure.

Is Mazda MX-5 Miata cheap to insure?

While the Mazda MX-5 Miata is a sports car, it often has lower insurance costs compared to other high-performance vehicles, depending on the coverage and insurer.

For further details, check out our in-depth “Cheapest Auto Insurance Companies” article.

What is the average insurance for Mazda MX-5 Miata?

The average insurance for Mazda MX-5 Miata typically falls within a specific range, influenced by various personal and vehicle factors.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Can I get discounts on insurance for my Mazda MX-5 Miata?

Yes, discounts may be available for safety features, anti-theft devices, multi-policy, and good driving records.

What type of insurance coverage is recommended for a Mazda MX-5 Miata?

Recommended coverage includes liability, collision, comprehensive, and uninsured/underinsured motorist insurance.

Learn more by visiting our detailed “Types of Auto Insurance” section.

What is the average Mazda MX-5 Miata insurance cost?

The average Mazda MX-5 Miata insurance cost varies by provider, driver profile, and coverage level, but it generally provides a balance between affordability and protection.

Is Mazda MX-5 Miata a sports car for insurance purposes?

Yes, the Mazda MX-5 Miata is considered a sports car for insurance purposes, which can impact insurance rates.

How much does it cost to insure a Mazda MX-5 Miata?

The cost to insure a Mazda MX-5 Miata depends on factors such as driver age, driving record, and the chosen insurance coverage.

Read our extensive guide on “Does the price of a car affect auto insurance rates?” for more knowledge.

Are there options for low insurance Mazda MX-5 Miata sports cars?

Yes, there are options for low insurance Mazda MX-5 Miata sports cars, particularly with careful selection of coverage and providers.

How is Mazda MX-5 Miata insurance for a 17-year-old?

Mazda MX-5 Miata insurance for 17-year-old drivers can be more expensive due to their limited driving experience and higher risk profile.

What about Mazda MX-5 Miata insurance for a 20-year-old?

Mazda MX-5 Miata insurance for 20-year-old drivers is typically less expensive than for younger teens but still higher than for older, more experienced drivers.

Continue reading our full “How to Get a New Car Auto Insurance Discount” guide for extra tips.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.