Auto Insurance Deductibles in 2025 (What it Means for Your Coverage)

Auto insurance deductibles are what you pay before coverage applies. For example, if you have a $500 deductible and repair costs are $4,500, you'll get a $4,000 payout. Consider a higher deductible to get cheaper rates. Below, we'll explain the auto insurance deductible meaning and how they work.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

What does a deductible mean for car insurance? Auto insurance deductibles are the amount you must pay before your coverage pays out a claim.

Deductibles affects rates, so consider a higher deductible for cheap auto insurance premiums if you can afford it.

Generally, drivers select their auto insurance deductible amount, but the most common deductible is $500. Picking the right deductible for your car insurance is crucial, so learn more about how to get auto insurance coverage.

Read on for a comprehensive auto insurance deductibles definition.

Then, enter your ZIP code above to find a deductible for car insurance in your area offering the best rates and coverage for you.

- Your auto insurance deductible is what you must pay before coverage pays out

- Insurers offer several options, but $500 is the average deductible for car insurance

- Many types of auto insurance have deductibles, but some don’t

Car Insurance Deductible Explained

So, what is a car insurance deductible? Your deductible is an amount you agree to pay before your insurance kicks in. Think of it as risk-sharing — you and your insurance company have a financial stake in your car repairs.

When you need to file a claim, your insurance company will verify that your policy covers the damage to your car. After your claim is approved, your car insurance company will send you a check or pay your mechanic directly, minus your deductible.Michelle Robbins Licensed Insurance Agent

Paying a deductible before your insurance takes over prevents drivers from making claims for minor events. Learn more about how to file an auto insurance claim and pay your car insurance deductible.

You might be able to adjust your deductible during your policy, but you can always change it when your insurance renews. The amount you select directly affects your car insurance rates. You might find it necessary to change your deductible when you need to save money.

So, when do you pay a car insurance deductible? Generally, your insurer will subtract your deductible amount from the settlement check before sending it to you.

Choosing a deductible is a simple task, but it’s an important decision that can have long-term effects on your insurance experience. So, knowing how a car insurance deductible works is important.

Now that you know the auto insurance deductible definition, we’ll explain how the deductible amount you choose impacts your car insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Your Auto Insurance Deductible Affects Rates

The deductible amount you choose is one of many factors that affect auto insurance rates — the lower your deductible, the higher your rates. Check out the table below to see how much you could pay for coverage based on your deductible amount:

Auto Insurance Monthly Rates by Deductible Amount & Coverage Level

| Deductible Amount | Minimum Coverage | Full Coverage |

|---|---|---|

| $0 | $183 | $272 |

| $100 | $171 | $258 |

| $250 | $158 | $238 |

| $500 | $142 | $213 |

| $1,000 | $125 | $188 |

| $2,000 | $108 | $163 |

You should carefully consider the value of choosing a high deductible. High deductible car insurance offers the cheapest premiums, but you might not save that much compared to a slightly lower deductible.

While you can justifiably select a higher deductible if you have a history of being a safe driver, it might not be worth the risk.

When You Will and Won’t Pay a Car Insurance Deductible

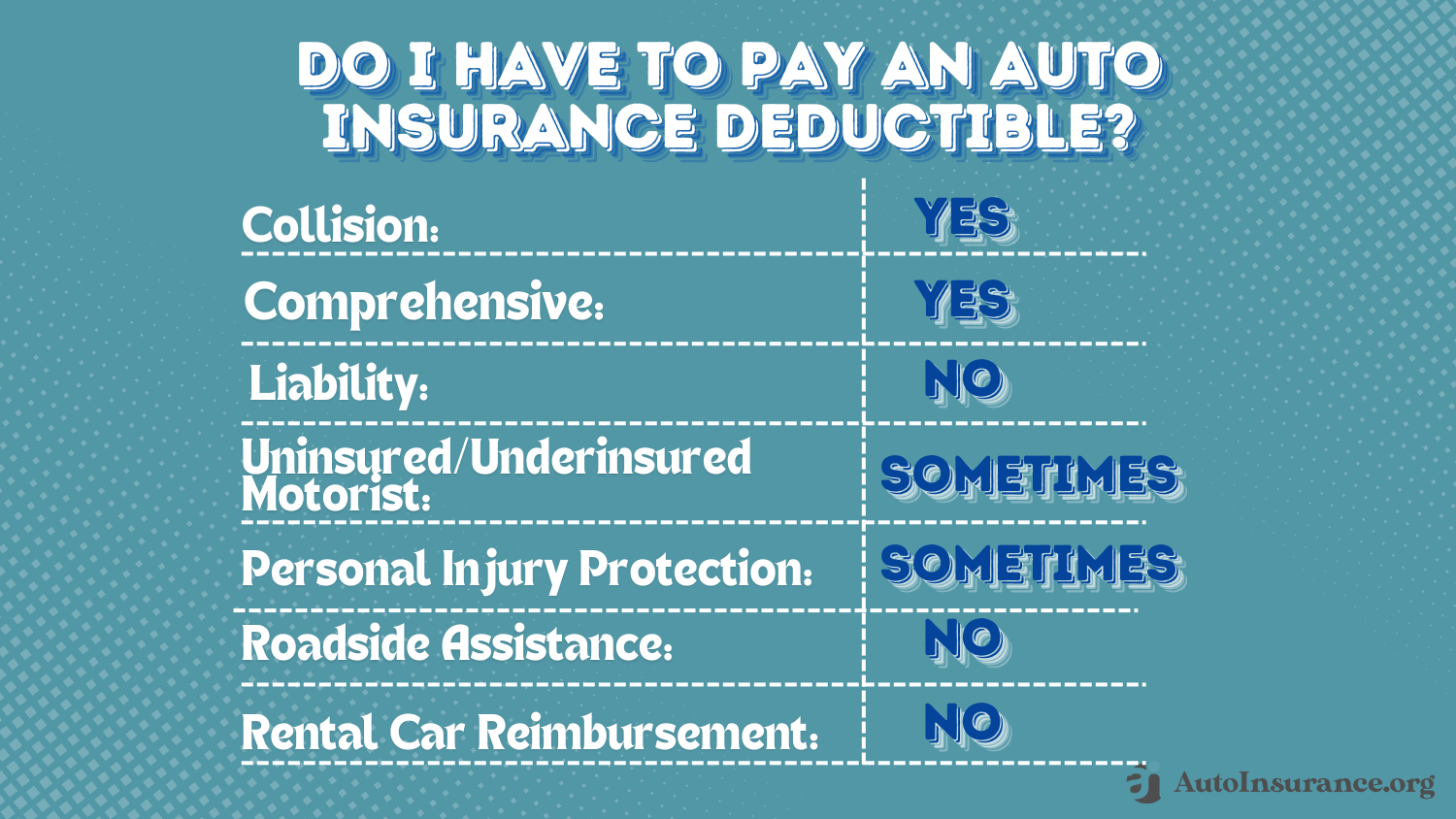

When do you have to pay a deductible? You must pay a deductible for collision and comprehensive coverages, while coverages such as liability, roadside assistance, and rental car reimbursement generally don’t have deductibles.

On the other hand, you may need to pay a deductible for uninsured/underinsured motorist coverage or personal injury protection.

Most insurance companies don’t require you to physically pay your deductible. Instead, they subtract your deductible from the cost of your repairs. For example, if your car sustains $8,000 worth of damage, your company subtracts your comprehensive auto insurance deductible from the repair cost.

So, if you have a $2,000 car insurance deductible, your insurance company pays for $6,000 worth of repairs, making the remainder your responsibility.

Your deductible works the same, no matter what type of claim you need to make. Whether it’s liability, personal injury protection, custom parts and equipment, or any other type of coverage, deductibles will always work the same.

If you’re unsure how much your deductible should be, an insurance representative can help you choose the right amount.

Average Car Insurance Deductible Amount

How much deductible for car insurance can you get? You generally have options from your insurer for the amount your deductible will cost. Options vary by company and insurance type but usually fit most budgets.

Learn More: How to Pay Your Auto Insurance Deductible

Most insurance companies offer deductibles in amounts of $250, $500, $1,000, and $2,000.

So, what is the average car insurance deductible? Since deductibles are the part drivers must cover, the average deductible most people choose for car insurance is $500. A $500 deductible is an affordable amount to pay for car repairs and usually keeps your insurance rates relatively low.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Choose Your Auto Insurance Deductible

A top question readers ask is, “What deductible should I choose for car insurance?” The most important factor to consider when selecting a deductible is how much you can pay after an accident.

According to Consumer Reports, raising your deductibles from $500 to $1,000 can cut 11% off your premium on average. While a high car insurance deductible will save you money on your monthly bill, not everyone is able to pay $2,000 after an accident.

However, your monthly rates also need to be considered. After all, what’s the point of having insurance if it’s too expensive?

There are many factors to consider when choosing a deductible, but here are a few to keep in mind:

- How much you can spend out of pocket on an emergency car repair

- The value of your car

- How much you can save by increasing your deductible

- Whether your loan or lease specifies how much your deductible should be

Another consideration is how much your deductible should be for different types of car insurance. For example, a deductible for collision auto insurance might be best kept low since accidents are fairly common and repairs can be expensive.

On the other hand, you might be safer choosing a higher deductible for coverages like personal injury protection (PIP) auto insurance or medical payments.

How to Avoid Paying Car Insurance Deductible

In most scenarios, it’s difficult to avoid paying an auto insurance deductible since they come with most policies. However, you may be able to forgo a deductible payment if you:

- Have a Zero-Deductible Policy: Many of the best car insurance companies offer a $0 deductible, meaning you won’t pay anything at all before getting your payout. However, rates are much higher for a $0 deductible.

- Have Waiver of Deductible: With a waiver of deductible, you won’t pay your car insurance deductible if you get hit by an uninsured or hit-and-run driver.

- Have Vanishing Deductible: Some providers have a vanishing deductible, where your deductible amount decreases for each year you go claims free, which could eventually get to $0 over time. (Learn More: How do vanishing or disappearing deductibles work?)

- Ask Your Mechanic: You could also receive a discount from your repair shop to help with the deductible, or they can work with your insurance company to cover the deductible cost.

- Don’t File a Claim: If your repair costs are less than or near your deductible amount, you could skip the claim altogether to avoid paying a deductible and higher rates.

Remember, with a vanishing deductible or waiver of deductible, you’ll likely pay higher rates for these services. You’ll also see higher rates if you opt for a $0 deductible.

However, considering these situations could help you avoid unnecessary out-of-pocket expenses after a car accident. Speak with your insurance company to figure out the best approach for your situation if you’re still unsure what to do.

Auto Insurance Deductible: Situations Where You Will and Won’t Need to Pay it

You may wonder, “How does an auto insurance deductible work in certain scenarios?” Whether you pay a deductible after an incident depends on the type of insurance you need to make a claim with.

Here are some examples on when you will and won’t have to pay a deductible:

- You won’t pay a deductible if you cause an accident but don’t damage your vehicle. The other driver will be making a claim on your liability insurance. However, your insurance rates will increase.

- If your car is damaged in an accident you cause, and you want to file a collision claim, you’ll have to pay the deductible.

- If another driver strikes you, you won’t have to pay a deductible to file a claim against the other driver’s liability insurance.

Things get a little more complicated if you’re the victim of a hit-and-run accident. Uninsured motorist (UM) coverage will help pay for damage to your car if you have it, sometimes without the need for paying a deductible.

Found yourself in an auto accident?💥It's important to ensure the other driver is insured! But how can you check?🤔 At https://t.co/27f1xf131D, we're here to help you after your collision! Learn more about checking if another driver has coverage here👉: https://t.co/2MFv9Fxlge pic.twitter.com/S8uibATnf4

— AutoInsurance.org (@AutoInsurance) May 26, 2023

However, if you don’t have uninsured motorist insurance, you’ll have to rely on your collision auto insurance, which requires a deductible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find the Best Auto Insurance Policy With the Right Deductible Today

So, what is the car insurance deductible meaning? Your deductible is the amount you must pay before insurance pays out a claim. The average deductible for auto insurance is $500.

Your deductible amount is one of the most significant factors that affect auto insurance rates. However, while it can be tempting to choose the highest option to keep your rates down, ensure you can afford the car insurance deductible if you need to file a claim.

With our Deductible Fund, you pay less out of pocket following an accident. Learn more: https://t.co/xWNMaRF01j pic.twitter.com/3c1G0bSbxN

— Liberty Mutual (@LibertyMutual) September 8, 2016

When you need to save money, comparing quotes the best auto insurance companies might find you lower rates than raising your deductible. An insurance representative can help you determine how much you should choose for your deductible when you look at new companies.

Frequently Asked Questions

What is a car insurance deductible?

You may be wondering, “What does deductible mean in car insurance?” Auto insurance deductibles are the predetermined amount an auto insurance policyholder must pay to their company out of pocket before receiving a payout.

Is a $1,000 deductible good for car insurance?

A $1,000 auto insurance deductible is good if you can afford the out-of-pocket expense after an accident. You should never raise your deductible beyond an amount you can’t pay.

Learn More: What is a good deductible for auto insurance?

Is it better to have a $500 deductible for car insurance or $1,000?

It’s better to have a $1,000 deductible if you can afford the higher out-of-pocket expenses if you get in an accident. So, for example, if you enough in an emergency fund to cover a $1,000 deductible, you should consider it.

Enter your ZIP code into our free quote tool below to instantly compare thousands of quotes from the top providers by your desired deductible amount.

How does a car insurance deductible work?

After your insurer approves your claim, you’ll receive a payout minus your deductible for car insurance.

Is there a way to not pay a deductible?

If you’re wondering how to avoid paying a car insurance deductible, some companies, such as Progressive, offer a deductible waiver that waives your deductible for car insurance after a claim. Check out our Progressive insurance review to learn more about the company’s deductible waiver program.

What is the difference between a deductible and a premium?

The amount you pay for your insurance is your premium. Premiums are usually paid in monthly installments, but you can also pay for your policy in full. Your deductible is the amount you cover after a claim, usually between $500 and $2,000. After your deductible is met, your insurance will cover the rest.

Do all car insurance policies have a deductible?

Most types of coverage have a deductible, but liability insurance does not. Optional coverages like roadside assistance or rental car reimbursement usually skip deductibles as well.

What happens if your deductible is more than the cost to repair your car?

Your insurance won’t pay for car repairs until your deductible is met. If your deductible is $1,000 and repairs will only cost $750, your insurance won’t pay for anything. In this case, there’s no need for you to file a car insurance claim.

How much are car insurance deductibles?

Generally, you’ll find auto insurance deductibles in the amount of $0, $250, $500, $1,000, $1,500, and $2,000.

When do you pay the deductible for car insurance?

You might be wondering, “When do you pay a car insurance deductible?” When filing a claim, you must pay your auto insurance deductible before your company pays out. So, your insurer will remove your deductible amount from your payout.

For example, if you get in an accident with $5,000 worth of expenses and have a $2,000 deductible for car insurance, your insurer will send a check for $3,000.

Are auto insurance deductibles applicable to all types of claims?

Auto insurance deductibles generally apply to physical damage claims, such as accidents, theft, vandalism, or weather-related damage. However, deductibles may not apply to certain coverages, such as liability insurance , which covers damages you cause to others. It’s essential to review your policy documents or consult with your insurance provider to understand how deductibles apply to specific claims.

Do auto insurance deductibles reset after every claim?

Auto insurance deductibles typically don’t reset after every claim. Once you’ve paid your deductible for a claim, it usually remains the same until you choose to adjust it. However, it’s important to confirm this with your insurance company, as policies may vary. Multiple claims within a short period may lead to increased premiums, but the deductible itself usually does not reset.

Do I pay my deductible before or after my car is fixed?

You’ll usually pay your insurance deductible to the car repair shop when you pick up your car after repairs.

What is the meaning of a $500 deductible for car insurance?

A $500 auto insurance deductible means that the auto insurance policyholder must pay the first $500 for car repairs or replacement before your insurance company pays out.

What does a $1,000 deductible mean for car insurance?

If you have to file a claim, you must pay $1,000 before your insurance covers the cost to repair or replace your vehicle.

Is a 2k deductible for car insurance good?

While you’ll pay much lower rates, you may also pay much more out of pocket with a $2,000 deductible for car insurance, meaning a more significant loss after an accident.

Do you have to pay your deductible if you’re not at fault?

If you get in an accident that wasn’t your fault and the at-fault driver has insurance, you won’t pay a deductible. However, if you’re involved in a hit-and-run accident, you may need to pay a deductible to cover repairs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.