The Three-Tire Rule Defined (2025)

The three-tire insurance rule says auto insurance won't cover replacement if you only slash three tires. However, that is false. Comprehensive coverage, averaging $12/mo, pays out even if only three tires were slashed. We'll overview why slashing three tires, not four, doesn't negate your coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Oct 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Why slash three tires and not all four? Will insurance cover three slashed tires? The three-tire insurance rule is a common misconception that claims auto insurance won’t pay for damages if you slash three tires not four — this simply is not true.

Does auto insurance cover slashed tires? Yes, and even if all four tires are slashed, insurance does cover it. However, you’ll need comprehensive coverage added to your policy to handle vandalism.

Learn the answer to, “Why slash three tires and not four?” in our guide on comprehensive coverage and the three-tire rule. Instantly compare free quotes from auto insurance companies offering comprehensive coverage by entering your ZIP code above.

- Even if only three tires were slashed, comprehensive insurance covers it

- Slashing three tires vs. four won’t make a difference to insurers

- Park in well-lit areas to avoid vandalism to your vehicles

Three-Tire Insurance Rule

If you want to vandalize a car, why slash only three tires? Why does insurance not cover three slashed tires?

The three-tire insurance rule is a common myth suggesting that auto insurance only covers damages if three or more tires are slashed. This is not true. Comprehensive auto insurance typically covers slashed tires caused by vandalism, regardless of the number of tires affected.

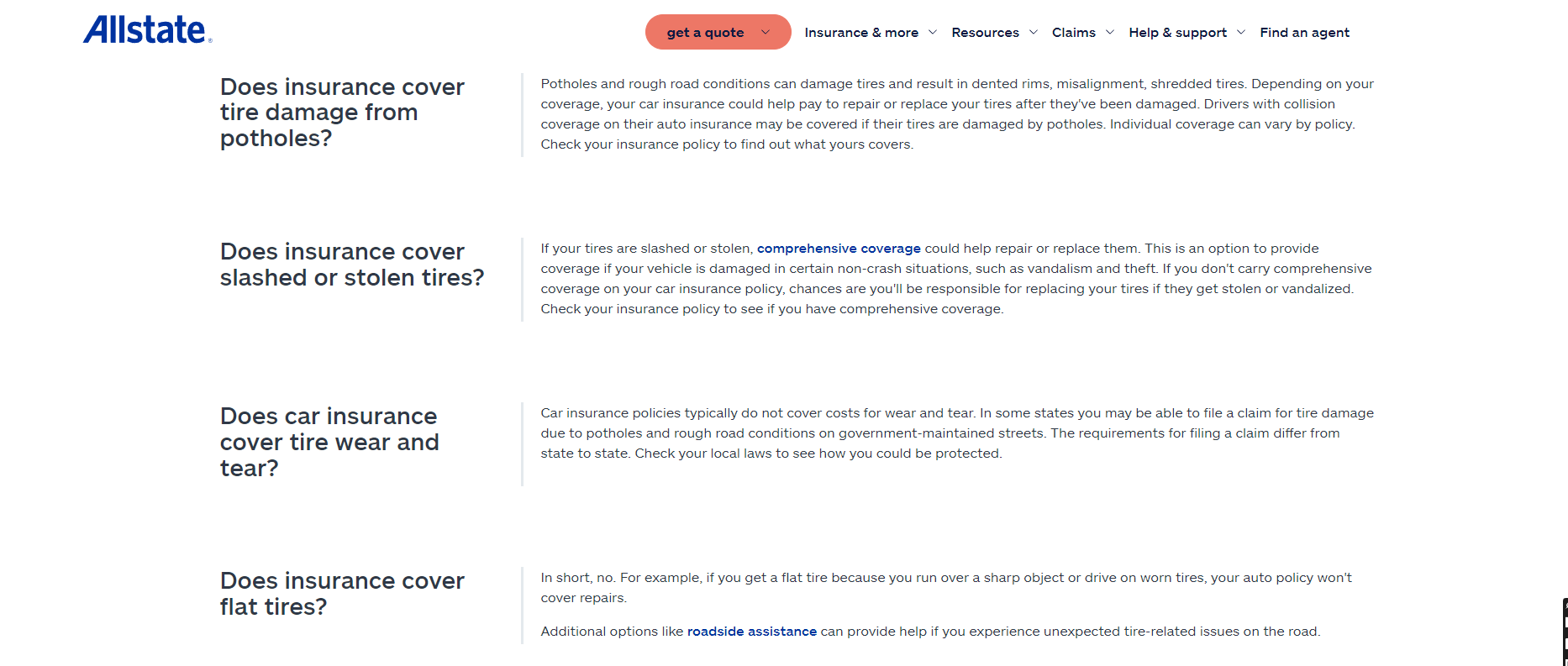

Does insurance cover tire slashing? Comprehensive coverage protects against non-collision incidents, including theft, vandalism, and natural disasters. Check out our expert guide if you’re also wondering, “Does auto insurance cover tire theft?”

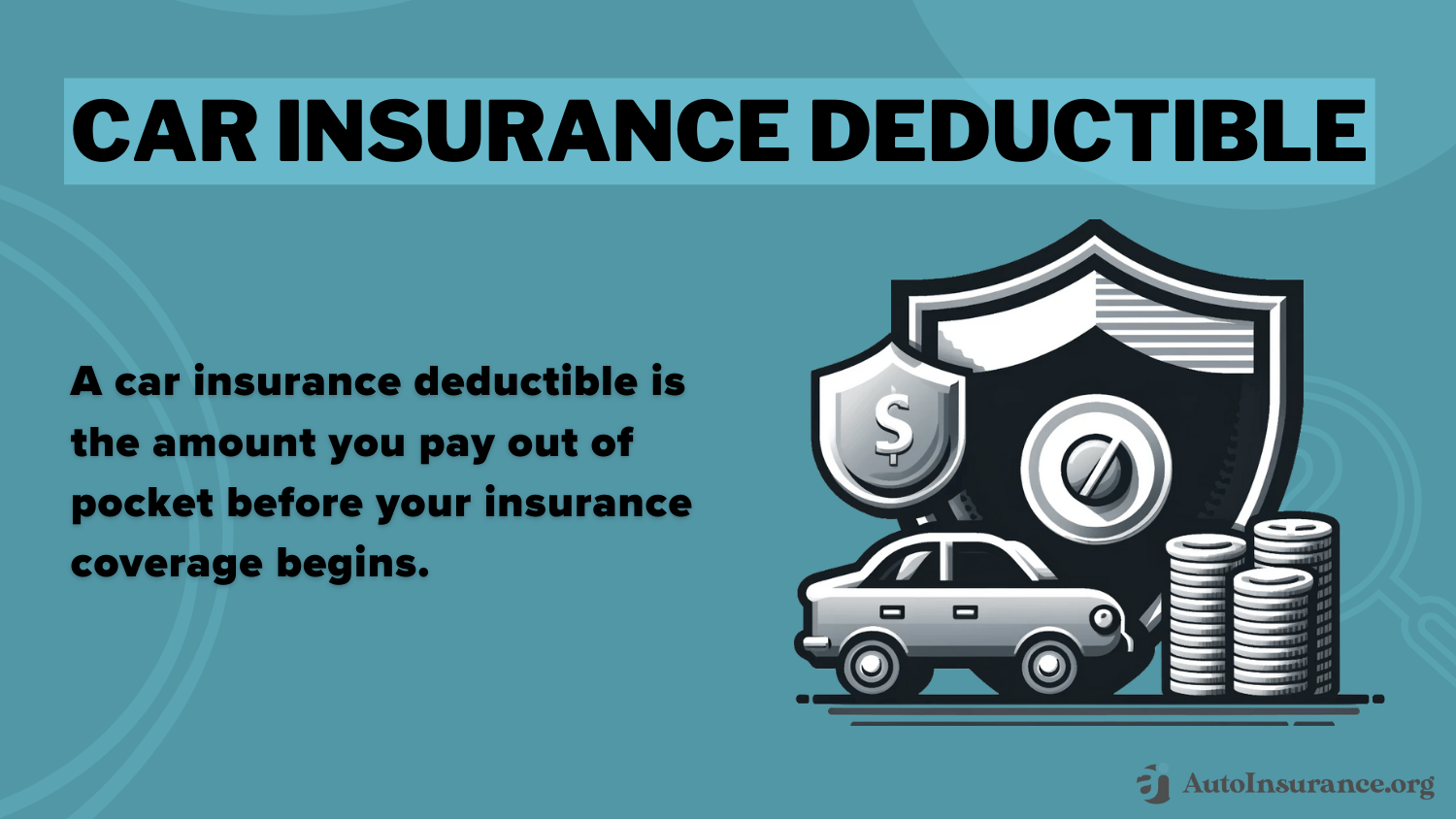

According to the three-tire rule, auto insurance won't pay for damages for slashing three tires and not four, but this isn't true. Comprehensive coverage will pay out for three slashed tires, though the cost of repairs could be lower than your deductible. So, always get an estimate before filing a claim.Schimri Yoyo Licensed Agent & Financial Advisor

Why won’t insurance cover three slashed tires? It does, but your liability-only insurance coverage won’t pay for any damage to tires. You need more than merely basic coverage to be fully protected. If they slash three tires, insurance only pays if you have full coverage or at least add comprehensive to your policy.

Learn More: Cheap Full Coverage Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comprehensive Coverage Pays if Someone Slashed Your Tires

Does insurance pay if three tires are slashed? There is a popular misconception that auto insurance will only cover slashed tires if a certain number are damaged. So, does insurance cover four slashed tires?

If you have the correct coverage, auto insurance will cover any number of slashed tires. You’ll need to add comprehensive auto insurance coverage to your policy for slashed tire protection.

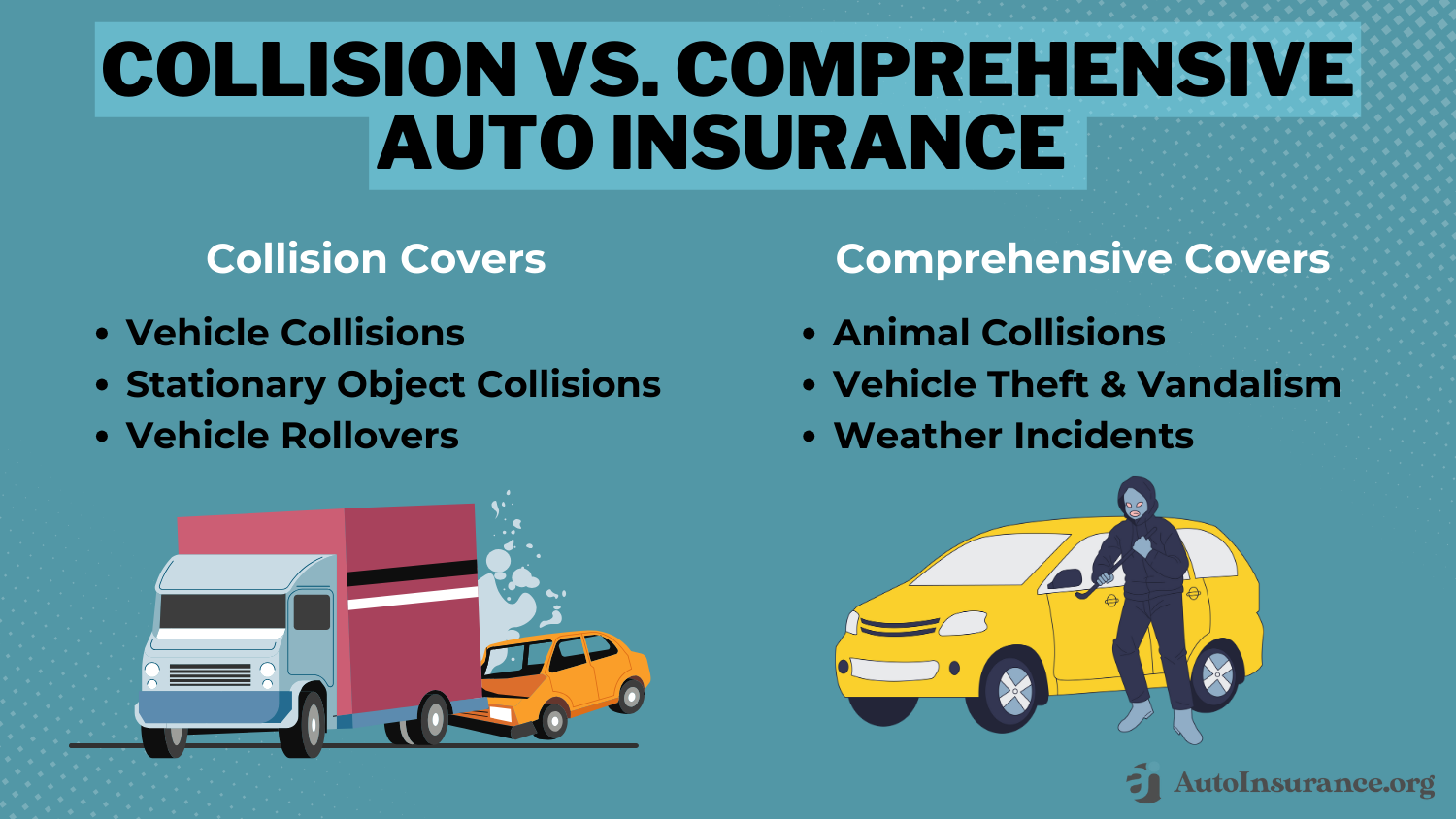

Does insurance cover nails in tires or tires slashed by road debris, spikes, or a vandal? You’ll need collision and comprehensive coverage in place to cover these types of events. So, that may lead you to wonder, “What is the difference between collision vs. comprehensive auto insurance?”

Collision auto insurance covers damages to your vehicle from an accident that you caused. For example, if you are in an accident and your tire is damaged, your collision coverage would pay to replace it.

Comprehensive insurance covers damages to your vehicle that are not the result of an accident, such as fire, theft, and vandalism. Slashed tires are considered vandalism, so comprehensive coverage would kick in.

Does insurance only cover four tires? Learn more in our helpful guide, “How many tires does auto insurance cover?” to discover what coverages your vehicle’s tires have.

Comprehensive Auto Insurance Costs

Does insurance cover three slashed tires, and how much does it cost? Comprehensive car insurance will cover any number of tires, whether you had three or four of them slashed.

Adding this coverage isn’t very costly and gives you peace of mind. This table displays average rates of comprehensive coverage by state:

Comprehensive Auto Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $12 |

| Alaska | $12 |

| Arizona | $15 |

| Arkansas | $15 |

| California | $8 |

| Colorado | $13 |

| Connecticut | $11 |

| Delaware | $9 |

| Florida | $9 |

| Georgia | $13 |

| Hawaii | $8 |

| Idaho | $9 |

| Illinois | $10 |

| Indiana | $10 |

| Iowa | $14 |

| Kansas | $19 |

| Kentucky | $11 |

| Louisiana | $17 |

| Maine | $8 |

| Maryland | $12 |

| Massachusetts | $11 |

| Michigan | $12 |

| Minnesota | $14 |

| Mississippi | $16 |

| Missouri | $14 |

| Montana | $17 |

| Nebraska | $17 |

| Nevada | $10 |

| New Hampshire | $9 |

| New Jersey | $10 |

| New Mexico | $14 |

| New York | $13 |

| North Carolina | $10 |

| North Dakota | $19 |

| Ohio | $9 |

| Oklahoma | $17 |

| Oregon | $7 |

| Pennsylvania | $11 |

| Rhode Island | $10 |

| South Carolina | $14 |

| South Dakota | $19 |

| Tennessee | $11 |

| Texas | $16 |

| Utah | $9 |

| Vermont | $10 |

| Virginia | $11 |

| Washington | $9 |

| Washington, D.C. | $19 |

| West Virginia | $16 |

| Wisconsin | $11 |

| Wyoming | $19 |

| U.S. Average | $12 |

Will insurance pay for slashed tires? Does Geico cover slashed tires? Does State Farm cover slashed tires? What about Allstate or Progressive? The answer is yes if you have comprehensive coverage. For example, if you only have Allstate collision insurance, three tires slashed won’t be covered.

Are slashed tires covered by insurance? Collision coverage pays for tire damage in an accident, but you need comprehensive insurance to pay for slashed tires caused by vandals. You file a claim under comprehensive coverage, and your insurer will likely cover the cost of repairs or replacements, minus any deductible specified in your policy.

Read More:

Roadside Assistance Coverage Costs

Auto insurance won’t pay for normal wear and tear of your tires or cover flat tires. If you have roadside assistance, that service will cover changing a flat tire or towing your car to a repair facility.

For instance, AAA insurance roadside assistance includes AAA towing services that can help move your vehicle. You can also sign up for AAA flat tire repair to have your tires repaired at the scene

Read More: Does auto insurance cover flat tires?

Of course, adding any new coverages, including roadside assistance, will raise auto insurance rates, so read our AAA auto insurance review for more details. You can also check out the table below to compare roadside assistance costs from the top providers:

Roadside Assistance Monthly Rates by Provider

| Insurance Company | Basic Plan | Premium Plan |

|---|---|---|

| AAA | $4 | $10 |

| Allstate | $2 | $8 |

| American Family | $2 | $7 |

| Farmers | $3 | $8 |

| Geico | $1 | $7 |

| Liberty Mutual | $5 | $10 |

| MetLife | $4 | $9 |

| Nationwide | $3 | $8 |

| Progressive | $2 | $5 |

| State Farm | $4 | $9 |

| Travelers | $4 | $9 |

| USAA | $1 | $7 |

As you can see, roadside assistance is very affordable, costing only $1 per month at some of the top car insurance providers. Enter your ZIP code into our free quote tool below to compare roadside assistance rates near you.

How to Claim Slashed Tires on Insurance

Can you claim on insurance for slashed tires? Yes, as long as you have full or comprehensive coverage, you can file a claim. Whether or not you file an insurance claim, you should still file a police report. This way the damages are documented and the person responsible may have to pay for repairs.

Will insurance cover two slashed tires? Comprehensive insurance will cover all tires, so even if someone is slashing three tires vs. four, you can still file a claim.

Filing an auto insurance claim for slashed tires can be a frustrating experience, but knowing what you need to file a claim can ease your mind and speed up the process:

- Policy Information & ID: Your insurance policy details, including the policy number, coverage type (e.g., liability, comprehensive), and effective dates. You’ll also need personal identification, such as a driver’s license or ID card. Check out our guide titled, “How to Get a Copy of Your Auto Insurance Card” for more details.

- Vehicle Information: Details about your vehicle, including the make, model, year, VIN, and license plate number.

- Incident Details: Information about the incident leading to the claim, such as the date, time, location, and a description of what happened. Include visual evidence of the damage or incident, such as photos or videos taken at the scene and witness reports.

- Police Report: If the incident involved law enforcement, a copy of the police report may be required (Read More: Can I file an insurance claim without a police report?).

- Repair Estimates: Quotes from authorized repair shops to estimate the cost of repairs or replacements.

Are stolen tires covered by insurance? Yes, you can file a comprehensive insurance claim whether your tires were stolen or slashed. Providing accurate and thorough documentation can help expedite the claims process and ensure that your insurance company has all the information needed to assess and process your claim efficiently.

Even though comprehensive insurance can help replace your tires, there are a few things that you should know. First, filing an insurance claim can raise your rates for years. Between the auto insurance deductible and the rate increase, it may be less expensive if you pay for the new tires yourself.

Does car insurance cover three slashed tires? Yes, but it’s important to note that if you have custom wheels, your typical comprehensive insurance won’t cover them. You need to add custom parts and equipment coverage to your policy.

Second, your insurance will only pay to replace your tires in a comparable condition. This means that if your tires are older, insurance won’t pay for a brand-new set. They take into consideration the age and mileage on your tires when paying the claim.

How to Avoid Slashed Tires

Will insurance cover slashed tires? If you have comprehensive insurance, slashed tires should be covered. However, being proactive to protect your vehicle can help you avoid filing claims.

While you can’t control random acts of vandalism, there are ways you can protect your vehicle and save yourself money. Here are a few ways that you can prevent slashed tires:

- Park in well-lit areas

- Install security cameras on your property

- Install a car alarm

- Park in a garage if available

There are no guarantees that you can prevent someone from vandalizing your car, but you can do everything possible to make it more resistant to vandalism.

Does car insurance cover slashed tires? Be sure to have comprehensive coverage in place just in case. Adding the coverage is inexpensive and can help cover unexpected costs.

Read More: Does auto insurance cover vandalism?

What to Do if Someone Slashed Your Tires

If someone slashed your tires, does insurance cover it? Yes, insurance does cover all four tires, but dealing with slashed tire insurance claims can be frustrating. Taking these steps and protecting your vehicle from vandals can streamline the claims process:

- Document the Damage and Scene: Inspect your vehicle thoroughly to confirm the number of slashed tires. Take photos of the slashed tires and any other damage to your vehicle. This documentation will be crucial for insurance claims and police reports (Learn More: Where to Get Pictures of My Vehicle Taken for Auto Insurance).

- Contact the Authorities: Report the incident to the police immediately. Provide them with all the details, including the number of slashed tires and any suspicious activity. Obtain a copy of the police report for your records and insurance purposes (Find Out More: Can I file an insurance claim without a police report?).

- File a Comprehensive Claim: Does insurance pay for slashed tires? If you have comprehensive insurance, inquire about coverage for stolen tires and confirm if the insurance slashed tires are covered. Find out how to file an insurance claim here.

- Protect Your Vehicle for Lower Rates: Park your vehicle in a secure location to prevent further damage or vandalism. Consider installing security cameras or alarms for added protection. Keep an eye on your surroundings and report any suspicious activity near your vehicle to the police.

What happens if you slash someone’s tires? You could face felony charges and would be responsible for paying all costs, including fines and court fees, out of pocket.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

More About Three Slashed Tires Insurance Coverage

So, why are you supposed to slash three tires instead of four? There is no truth to the three-tire rule which claims that auto insurance won’t pay for tires if you only slash three.

Car insurance will pay out if you slash three or four tires. However, you must carry comprehensive coverage to receive a payout in the event of slashed tires.

Comprehensive coverage is affordable and covers many scenarios, including fire, theft, vandalism, and natural disasters. In addition, comprehensive pays out for any number of slashed tires.Daniel S. Young Insurance Content Team Lead

Ways that you can avoid having your tires slashed include parking in well-lit areas, adding a car alarm, and adding security cameras to your property. It’s also important to have the correct auto insurance coverage in place if your tires are slashed.

Insurance covers your car in the event of an accident, but what about vandalism or bad weather?😱That’s where comprehensive coverage comes in! At https://t.co/27f1xf131D, we want to help you decide if this coverage add-on is worth it! Learn more here👉: https://t.co/ii0sdamcEp pic.twitter.com/BSMBfTAaIx

— AutoInsurance.org (@AutoInsurance) May 31, 2023

Does insurance cover tires being slashed, and why only slash three tires instead of four? Find the best comprehensive auto insurance companies near you by entering your ZIP code into our free quote comparison tool below.

Frequently Asked Questions

What is the three-tire insurance rule?

A top question readers ask is, “Why do females only slash three tires?” It’s possible you’ve heard online that if you want to slash tires, slash only three. The three-tire rule is a misconception that claims auto insurance won’t cover damages if only three tires are slashed. However, this is not true.

Why should you only slash three tires rather than four?

You may also be asking yourself, “Why slash three tires instead of four?” A common myth is that slashing three tires instead of four means car insurance won’t pay for damages. However, this is false – comprehensive coverage would pay for the damages.

Is it true that insurance won’t cover three slashed tires?

How many tires do you slash for insurance not to cover it? Comprehensive insurance will always cover any number of slashed tires, whether it be three or four.

Does insurance cover slashed tires?

Yes, auto insurance can cover slashed tires if you have the appropriate coverage. You will need to add comprehensive coverage to your auto insurance policy to protect against vandalism, including slashed tires.

So, why do you slash three tires and not four? Slashing three tires instead of four is rooted in the false notion that car insurance won’t pay out for damages to only three tires. However, comprehensive always pays out for slashes tires, whether it was one or all four.

What is the difference between collision and comprehensive auto insurance?

Collision auto insurance covers damages to your vehicle caused by an accident you are at fault for. On the other hand, comprehensive insurance covers damages to your vehicle that are not the result of an accident, such as vandalism, theft, and fire. Slashed tires are considered vandalism, so comprehensive coverage would apply.

What does comprehensive insurance cover?

Comprehensive insurance covers slashed tires and other damages caused by non-collision events, such as fire, weather, theft, vandalism, or windshield damage.

How much does comprehensive auto insurance cost?

The cost of comprehensive auto insurance varies depending on factors such as your location, driving history, and the value of your vehicle. Adding comprehensive coverage is generally affordable and provides peace of mind.

Find the cheapest and best comprehensive auto insurance companies by entering your ZIP code into our free quote comparison tool below to instantly compare prices with providers near you.

Will insurance cover four slashed tires?

Yes, if you have comprehensive coverage, auto insurance will cover any number of slashed tires. There is no limit on the number of tires covered.

So, why do you slash three tires rather than four? A common misconception is that insurance won’t cover three slashed tires, but that isn’t true.

What should I do if someone slashes three of my tires?

Firstly, you should contact police and file a report. Then, you should get an estimate to see how much it would cost to replace your tires. If the estimate is higher than your deductible, you should consider filing a claim.

Is slashing three tires a felony?

Yes, if you slash tires, most states will consider it a felony. Laws may vary depending on the cost of the damage, as most states consider property crimes as felonies if the damage exceeds $1,000.

Does USAA cover tire damage?

USAA will pay out for tire damage if you have comprehensive insurance. Check out our review of USAA insurance to find out more.

Can you claim tires on insurance?

Normal wear and tear of your tires isn’t covered by insurance, but collision insurance covers tires damaged in an accident. However, if someone slashes three or all four of your tires, comprehensive insurance pays out since it’s considered vandalism.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.