Wyoming Minimum Auto Insurance Requirements for 2025 (Legal WY Coverage Simplified)

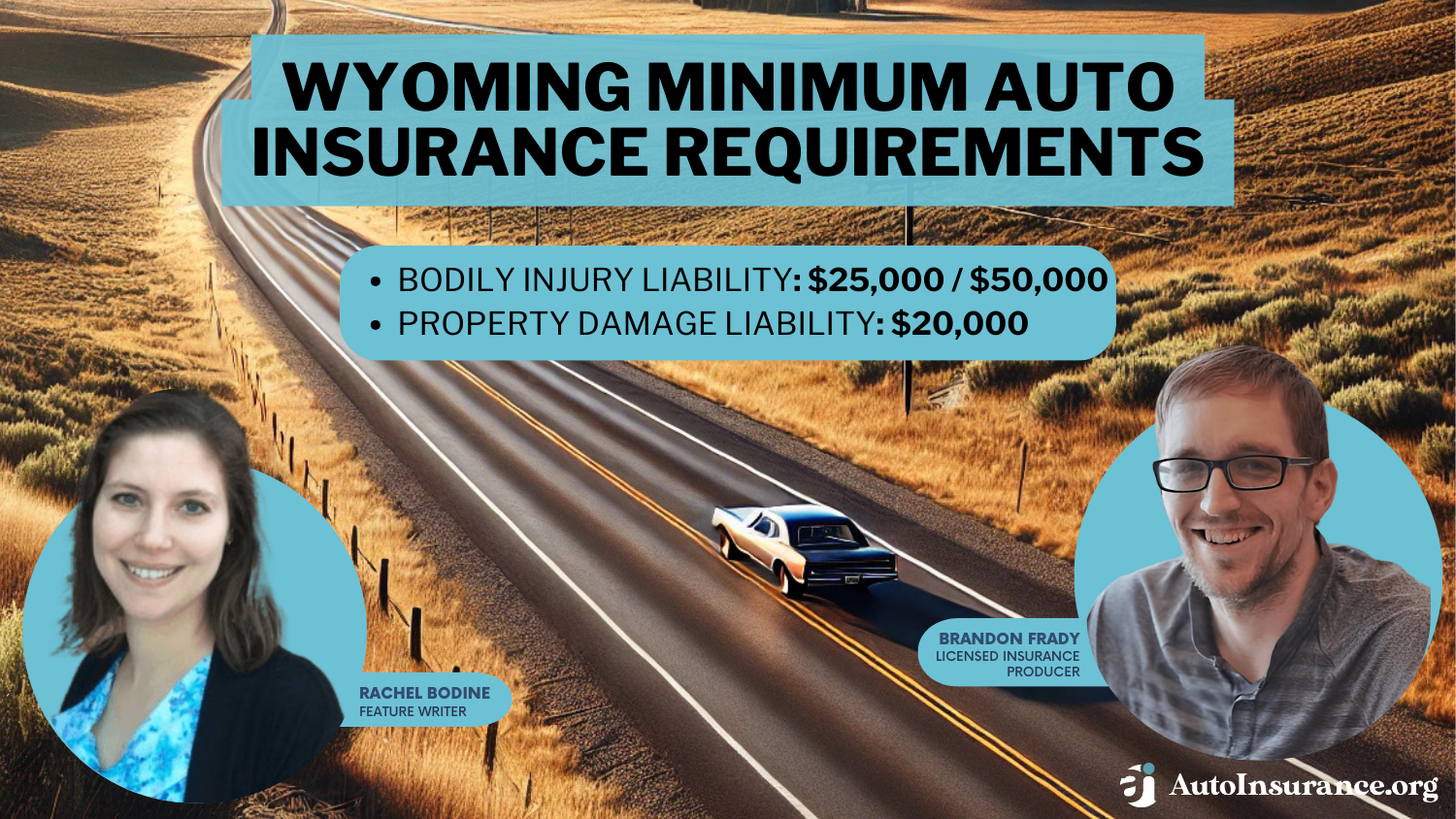

Wyoming minimum auto insurance requirements are 25/50/20, covering at least $25,000 per person for injuries, $50,000 per accident for all injuries, and $20,000 for property damage. WY drivers can obtain minimum car insurance at $13/month, providing budget-friendly coverage while meeting state legal requirements.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Understanding Wyoming minimum auto insurance requirements is essential, as the state mandates 25/50/20 basic liability coverage that is $25,000 for bodily injury liability per person, $50,000 for total bodily injury per accident, and $20,000 for property damage.

Monthly insurance rates in Wyoming start at just $13, making affordable coverage achievable for drivers. Some of the top providers offering competitive rates in Wyoming include Geico, USAA, and State Farm.

Wyoming Minimum Auto Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

By comparing quotes and exploring various coverage options, you can find the best car insurance rates while ensuring you meet state legal requirements.

If you’re ready to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates with leading insurers.

- Wyoming minimum auto insurance requires 25/50/20 liability coverage

- Drivers in Wyoming should compare rates to secure affordable coverage

- Understanding Wyoming insurance requirements helps drivers avoid legal penalties

Wyoming Minimum Coverage Requirements & What They Cover

Understanding Wyoming car insurance laws is essential for all drivers in the state. According to Wyoming auto insurance requirements, drivers must carry at least Wyoming liability insurance when determining fault in an accident. This includes $25,000 for bodily injury per person, $50,000 per accident for bodily injury, and $20,000 for property damage.

While minimum car insurance in Wyoming is mandatory, drivers can choose to waive uninsured motorist coverage by submitting a written request. However, keeping uninsured motorist coverage is recommended for added protection against uninsured drivers.

Use a Wyoming auto insurance guide to compare quotes and explore the average cost of car insurance in Wyoming to secure the best policy for your needs. Whether you’re looking for temporary car insurance in Wyoming or full coverage, understanding Wyoming insurance laws ensures you’re fully protected on the road.

Read more: Best Property Damage Liability (PDL) Auto Insurance Companies

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Wyoming

Finding cheap car insurance in Wyoming starts with comparing providers that meet Wyoming car insurance requirements while offering competitive rates. According to Wyoming auto insurance laws, drivers must carry a minimum of 25/50/20 basic liability coverage. Shopping around can help you secure lower rates while staying legally compliant.

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Wyoming

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsWyoming’s top auto insurance providers include USAA, Liberty Mutual, and State Farm. USAA offers the lowest rates, starting at $13/month in cities like Casper, while Liberty Mutual and State Farm follow closely with affordable premiums.

Wyoming car insurance rates can vary depending on where you live, with Jackson being the most expensive at $75/month and Evanston the cheapest at $63/month (Read more: Best Wyoming Auto Insurance).

Wyoming Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Casper | $70 |

| Cheyenne | $72 |

| Cody | $68 |

| Douglas | $64 |

| Evanston | $63 |

| Gillette | $66 |

| Green River | $64 |

| Jackson | $75 |

| Laramie | $68 |

| Powell | $66 |

| Rawlins | $65 |

| Riverton | $62 |

| Rock Springs | $67 |

| Sheridan | $65 |

| Worland | $63 |

If you’re wondering how much car insurance is in Wyoming, rates depend on your driving history, credit score, vehicle type, and coverage level. Knowing what you need to insure a car in Wyoming can help you find the best deals while meeting the minimum insurance requirements set by state law. Use a Wyoming auto insurance comparison tool to explore the best rates and policies that fit your needs.

Other Coverage Options to Consider in Wyoming

While Wyoming car insurance requirements mandate a minimum level of liability coverage, many drivers prefer additional protection for better financial security. Liability insurance only covers expenses for other parties involved in an accident, leaving your personal costs unpaid. To avoid costly out-of-pocket expenses, consider adding extra coverage to your auto insurance in Wyoming policy.

- Collision Coverage: Collision insurance pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive auto insurance covers non-collision-related damage like theft, fire, and natural disasters.

- Medical Payments Coverage: Helps pay for medical expenses for you and your passengers after an accident.

- Personal Property Coverage: Covers belongings damaged or stolen from your vehicle.

- Towing and Roadside Assistance: Provides towing services and help with roadside emergencies.

- Rental Car Reimbursement: Rental car reimbursement coverage pays for a rental vehicle while your car is being repaired after an accident.

Additionally, meeting Wyoming auto insurance laws includes always carrying proof of insurance. Once you purchase coverage, your provider will issue an insurance card or certificate, which typically lasts six to 12 months before renewal. You may receive this proof by mail, email, or through your insurance provider’s online platform.

Whether you finance your vehicle or simply want extra peace of mind, adding these coverage options can protect you from unexpected expenses. Stay ahead by keeping an updated proof of insurance in your wallet or glove compartment at all times. This small step ensures compliance with Wyoming auto insurance requirements and protects you legally on the road.

Penalties for Driving Without Insurance in Wyoming

Driving without Wyoming car insurance can lead to serious legal and financial consequences. According to Wyoming auto insurance laws, all drivers must maintain active liability coverage that meets the state’s minimum insurance requirements. Here are some possible penalties for not having insurance:

Penalties for Driving Without Auto Insurance in Wyoming

| Violation | Penalty |

|---|---|

| First Offense | - Fine: Up to $750 |

| - Suspension of driving privileges until proof of insurance is provided | |

| - Possible imprisonment for up to 6 months | |

| Second Offense | - Increased fine of up to $750 |

| - Suspension of vehicle registration and driving privileges | |

| - Possible imprisonment for up to 6 months | |

| Subsequent Offenses | - Fine: Up to $1,500 |

| - Longer suspension of driving privileges and vehicle registration | |

| - Possible imprisonment for up to 6 months | |

| Driving After Suspension | - Additional fines |

| - Possible extended suspension periods | |

| - Potential imprisonment | |

| Failure to Show Proof of Insurance | - Fine: Up to $250 |

| - Requirement to provide proof of insurance to reinstate privileges | |

| Involved in an Accident Without Insurance | - Personal liability for damages |

| - Potential lawsuits and civil penalties |

Failing to provide proof of insurance can result in fines, license suspensions, and even imprisonment, whether the lapse was intentional or accidental. For a first offense, drivers may face a fine of up to $750, suspension of driving privileges until proof of insurance is provided, and possible imprisonment for up to six months.

Carrying more than the minimum required coverage in Wyoming can protect you from costly out-of-pocket expenses after an accident.Michelle Robbins Licensed Insurance Agent

A second offense can lead to the same maximum fine, suspension of vehicle registration, and another six-month jail sentence. Repeat violations carry harsher penalties, including fines up to $1,500, longer suspensions, and additional jail time. Driving after a suspension due to lack of insurance may result in even steeper fines and extended license suspensions.

To avoid these severe penalties, drivers should prevent lapses in coverage. Paying premiums upfront, setting up auto-pay, enabling policy auto-renewal, and setting calendar reminders near renewal dates can help ensure continuous car insurance in Wyoming coverage.

Staying proactive about maintaining auto insurance in WY not only keeps drivers legally compliant but also prevents costly penalties and higher future premiums.

Read more: What is a DUI?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Find an Affordable Auto Insurance Policy in Wyoming

If you’re ready to purchase a new Wyoming car insurance policy or update your current coverage, now is the perfect time to explore your options. Start by comparing quotes from several reputable auto insurance in WY providers. Requesting quotes online makes the process quick and easy while helping you identify the best coverage at competitive rates.

Before choosing a policy, research each insurer’s financial strength and customer satisfaction ratings. Selecting a provider with a strong track record ensures reliable service when you need it most. Comparing rates from top-rated companies helps you secure affordable premiums while meeting Wyoming auto insurance laws.

Don’t wait, just use our free comparison tool today to find the best car insurance in Wyoming has to offer. A few minutes of research can lead to significant savings and better financial protection.

Frequently Asked Questions

What coverage options should Wyoming drivers consider beyond the state minimum?

Wyoming drivers should consider adding collision, comprehensive, uninsured motorist, and medical payments coverage to ensure greater financial protection in case of accidents, theft, or severe weather damage.

Read more: Does auto insurance cover vehicle theft?

How do Wyoming auto insurance laws handle at-fault accidents?

Wyoming follows an at-fault system, meaning the driver responsible for causing an accident must cover the other party’s damages through their liability insurance policy. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

How can drivers lower their car insurance premiums in Wyoming?

Drivers can lower premiums by maintaining a clean driving record, improving their credit score, bundling policies, and applying for discounts like safe driver, multi-vehicle, or low-mileage savings (Read more: Best Low-Mileage Auto Insurance Discounts).

When should drivers update their auto insurance policy in Wyoming?

Drivers should update their policy after significant life changes, such as moving to a new city, purchasing a new vehicle, adding a driver, or experiencing major changes in driving habits.

What factors affect car insurance rates in Wyoming the most?

Major factors include driving history, vehicle type, coverage level, location, credit score, and age. Drivers in cities with higher accident rates or theft incidents typically face higher premiums.

Read more: Does auto insurance cover vehicle theft?

What are the consequences of multiple uninsured driving offenses in Wyoming?

Multiple offenses result in increased fines of up to $1,500, longer license suspensions, higher insurance premiums, and possible imprisonment for up to six months per offense.

Is temporary car insurance available in Wyoming?

Yes, temporary car insurance in Wyoming is available for drivers needing short-term coverage, such as when borrowing or renting a vehicle, though it may cost more than standard policies.

Do Wyoming drivers need SR-22 insurance after a traffic violation?

Drivers with severe violations like DUIs or multiple at-fault accidents may be required to file an SR-22 auto insurance, proving they carry sufficient insurance as mandated by Wyoming auto insurance laws.

Can Wyoming drivers insure a vehicle they don’t own?

Yes, non-owner car insurance is available for drivers who frequently borrow or rent vehicles but don’t own one, offering liability protection in case of accidents.

What happens if you cause an accident while driving uninsured in Wyoming?

Causing an accident while uninsured can result in paying all damages out-of-pocket, license suspension, vehicle impoundment, and difficulty securing affordable insurance in the future. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.