Best Yakima, Washington Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

Starting at $41 per month, the best Yakima, Washington auto insurance providers are State Farm, Geico, and Progressive. State Farm excels with broad coverage, Geico with budget-friendly rates, and Progressive with adaptable plans. Compare these top Yakima options for reliable, cost-effective insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Yakima WA

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Yakima WA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage in Yakima WA

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Geico, and Progressive are the best Yakima, Washington auto insurance, each excelling in key areas.

State Farm is the go-to for robust coverage, Geico dominates with its unbeatable pricing, and Progressive offers unmatched flexibility in plans. These companies are the best choices for reliable and tailored coverage in Yakima.

Our Top 10 Company Picks: Best Yakima, Washington Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 13% B Local Agents State Farm

#2 14% A++ Affordable Rates Geico

#3 7% A+ Snapshot Program Progressive

#4 17% A+ Comprehensive Coverage Allstate

#5 12% A Local Presence Farmers

#6 11% A Customizable Policies Liberty Mutual

#7 14% A Family-focused Coverage American Family

#8 18% A+ Vanishing Deductible Nationwide

#9 13% A++ Broad Coverage Travelers

#10 15% A++ Military Benefits USAA

Compare these top providers to secure the most comprehensive and cost-effective insurance for your needs. Learn more in our article titled “Largest Auto Insurance Companies in the U.S.”

Before you buy Yakima, Washington auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Yakima, Washington auto insurance quotes.

- State Farm is the top pick for comprehensive auto insurance in Yakima

- Yakima, Washington plans address local driving and coverage needs

- Compare top Yakima providers for coverage meeting regional requirements

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Personalized Local Service: State Farm offers exceptional local agent support in Yakima, Washington, ensuring personalized service and a deep understanding of regional needs.

- Comprehensive Coverage Options: State Farm offers a diverse range of coverage options in Yakima, Washington, allows drivers to customize their policies to fit their specific needs, whether for personal or business use.

- Reliable Claims Process: State Farm is renowned for its reliable and efficient claims process in Yakima, Washington, offering peace of mind when you need it most. Read more in our full review our State Farm auto insurance review.

Cons

- Higher Premiums: State Farm’s premiums in Yakima, Washington, can be on the higher side, particularly for comprehensive coverage options, which may be a concern for budget-conscious drivers.

- Standardized Coverage Customization: While coverage options are comprehensive, Yakima, Washington, customers may find less flexibility in tailoring their policies to unique circumstances compared to other providers.

#2 – Geico: Best for Affordable Rates

Pros

- Top-Notch Affordability: Geico consistently offers some of the most affordable auto insurance rates in Yakima, Washington, making it an ideal choice for those looking to minimize their insurance expenses. Learn more by reading our Geico auto insurance review.

- User-Friendly Digital Experience: Geico excels in offering Yakima, Washington, residents a seamless digital experience, with an intuitive online platform and mobile app that simplify policy management, claims, and payments.

- Substantial Usage-Based Discounts: Through its DriveEasy program, Geico offers significant discounts to Yakima, Washington, drivers who maintain safe driving habits, rewarding them with lower premiums.

Cons

- Basic Coverage Customization: Geico’s policies in Yakima, Washington, offer fewer options for customization, potentially limiting the ability to tailor coverage to specific individual needs.

- Higher Deductibles for Savings: To achieve lower premiums, Yakima, Washington, residents may need to opt for higher deductibles, which could result in higher out-of-pocket costs in the event of a claim.

#3 – Progressive: Best for Snapshot Programs

Pros

- Snapshot Program Rewards: Progressive’s Snapshot program is a standout in Yakima, Washington, offering substantial savings to safe drivers by analyzing their driving habits and adjusting premiums accordingly.

- Strong Financial Backbone: Progressive’s A+ rating from A.M. Best provides Yakima, Washington, policyholders with confidence in the insurer’s financial health and ability to pay claims.

- Flexible Policy Structures: Progressive is known for its flexibility, offering Yakima, Washington, drivers a wide range of customizable coverage options to meet diverse needs and preferences. Our complete Progressive auto insurance review goes over this in more detail.

Cons

- Limited Bundling Savings: Progressive’s 7% bundling discount in Yakima, Washington, is relatively low compared to other providers, which might not offer as much financial incentive for combining policies.

- Inconsistent Claims Satisfaction: While generally reliable, Progressive’s claims satisfaction ratings in Yakima, Washington, vary, with some customers experiencing delays or issues in the process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Selections: Allstate provides one of the broadest arrays of auto insurance coverage in Yakima, Washington, ensuring drivers can find policies that meet their unique needs.

- Significant Bundling Discounts: Allstate offers a robust 17% discount for bundling policies in Yakima, Washington, allowing customers to save significantly on their overall insurance costs.

- Reliable Claims Assistance: Allstate is known for its dependable claims support in Yakima, Washington, offering efficient and responsive service during the claims process. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Premium Costs: Allstate’s premiums in Yakima, Washington, are often higher than those of other providers, which may be a disadvantage for those seeking the lowest possible rates.

- Limited Discounts: While offering solid bundling savings, Allstate provides fewer discounts overall in Yakima, Washington, which could result in higher costs for some customers.

#5 – Farmers: Best for Local Presences

Pros

- Strong Community Presence: Farmers is deeply rooted in the Yakima, Washington, community, with a strong network of local agents who provide personalized service and understand the specific needs of local residents.

- A-Rated Financial Stability: Farmers’ A rating from A.M. Best ensures Yakima, Washington, policyholders that the company is financially secure and capable of paying out claims.

- Responsive Customer Support: Farmers is known for its good customer service in Yakima, Washington, with local agents providing accessible and responsive support. Take a look at our Farmers auto insurance review to learn more.

Cons

- Limited Digital Offerings: Farmers lags behind competitors in offering digital tools, which might be a disadvantage for Yakima, Washington, residents who prefer managing their insurance online.

- Complex Policy Options: Some customers in Yakima, Washington, may find Farmers’ policy options complex and difficult to navigate without professional assistance.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Coverage: Liberty Mutual offers Yakima, Washington, residents the ability to fully customize their insurance policies to meet specific needs, providing flexibility unmatched by many competitors.

- Strong Financial Stability: With an A rating, Liberty Mutual ensures Yakima, Washington policyholders that their coverage is backed by a financially secure company.

- Accident Forgiveness: Drivers in Yakima, Washington, benefit from accident forgiveness, ensuring that their first accident won’t lead to premium increases. To see monthly premiums and honest rankings, read our Liberty Mutual auto insurance review.

Cons

- Potentially Higher Premiums: The highly customizable nature of Liberty Mutual’s policies can result in higher premiums for Yakima, Washington, drivers who select extensive coverage options.

- Average Customer Service: While the coverage is flexible, customer service in Yakima, Washington, is reported as average, not always meeting the expectations set by other top-tier providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Family-Focused Coverage

Pros

- Family-Centric Policies: American Family Insurance focuses on providing policies that cater specifically to the needs of families in Yakima, Washington, including options for young drivers and multi-vehicle households.

- Youth Driver Discounts: Special discounts for young drivers in Yakima, Washington make it more affordable for families to insure their teen drivers.

- Multi-Vehicle Savings: Yakima, Washington residents can save significantly with discounts when insuring multiple vehicles under one policy. Learn more about AmFam in our review of American Family auto insurance.

Cons

- Limited Coverage Options: Compared to other providers, American Family offers fewer specialized coverage options in Yakima, Washington, which may not suit all drivers.

- Higher Premiums for Singles: Single drivers in Yakima, Washington may find premiums higher compared to family plans, which are more competitively priced.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers a unique vanishing deductible feature for Yakima, Washington drivers, where the deductible reduces over time with safe driving, providing long-term savings.

- A+ Financial Strength: Nationwide’s A+ financial rating gives Yakima, Washington, residents confidence in the company’s ability to pay claims and maintain stability.

- Generous Bundling Savings: Nationwide provides one of the most competitive bundling discounts in Yakima, Washington at 18%, helping residents save when combining policies. Find out if Nationwide might have the lowest rates for you in our Nationwide auto insurance review.

Cons

- Premium Costs: Despite discounts and benefits, some Yakima, Washington residents may find Nationwide’s premiums to be higher compared to other local providers.

- Complex Policy Navigation: The comprehensive nature of Nationwide’s policies can make it challenging for some Yakima, Washington residents to fully understand their options.

#9 – Travelers: Best for Broad Coverage

Pros

- Extensive Coverage Options: Travelers offers a broad range of insurance products in Yakima, Washington, ensuring that drivers can find coverage that suits their specific needs, from basic to comprehensive policies.

- Top Financial Stability: Travelers’ A++ financial rating means Yakima, Washington policyholders can rely on the company’s strong financial health to cover claims and stay secure.

- Multi-Policy Discount: Yakima, Washington residents can benefit from a 13% discount when bundling multiple policies, offering a balanced combination of coverage and savings. Read more about Travelers’ ratings in our Travelers auto insurance review.

Cons

- Discount Limitations: Some discounts may not be available to all Yakima, Washington residents, depending on their specific situation or insurance needs.

- Occasional Delays in Claims Processing: While generally good, some Yakima, Washington policyholders have reported occasional delays in the processing of their claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA provides unique coverage options and discounts tailored specifically for military members and their families in Yakima, Washington, offering unmatched support for this community.

- Exceptional Financial Strength: With an A++ rating, USAA ensures Yakima, Washington military families that their coverage is backed by a financially secure and reliable company. See how USAA’s rates compare to other insurance providers in our USAA auto insurance review.

- Highly Competitive Rates: USAA is known for offering some of the most competitive insurance rates to military families in Yakima, Washington, making it an economical choice.

Cons

- Restricted Eligibility: USAA’s coverage is exclusively available to military members and their families in Yakima, Washington, limiting access for the general public.

- Less Flexible Customization: USAA’s policies, while comprehensive, offer fewer customization options for non-military members in Yakima, Washington, compared to other providers.

Yakima Auto Insurance Cost Comparison by Provider

When comparing auto insurance in Yakima, Washington, it’s essential to evaluate both minimum and full coverage options across different providers to find the most cost-effective rates. Geico stands out as the most affordable option, offering the lowest rates for both minimum coverage at $41 per month and full coverage at $112 per month.

Yakima, Washington Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $140

American Family $46 $126

Farmers $50 $133

Geico $41 $112

Liberty Mutual $52 $138

Nationwide $49 $130

Progressive $53 $136

State Farm $48 $129

Travelers $51 $132

USAA $44 $121

American Family and USAA also provide competitive rates, with USAA being particularly attractive for military members seeking lower premiums. On the other hand, Allstate has the highest rates among the providers listed, charging $55 per month for minimum coverage and $140 per month for full coverage, reflecting its extensive policy offerings.

Liberty Mutual and Progressive also feature on the higher end for full coverage. By considering these rates, Yakima drivers can make informed decisions that balance their budget with their desired level of coverage. Our article, best Progressive auto insurance discounts provides more detail about what this provider has to offer.

Essential Auto Insurance Coverage Requirements in Yakima, Washington

Cheap Yakima, Washington Auto Insurance for Seniors

Senior auto insurance rates in Yakima, Washington, can vary depending on several factors, including driving history, coverage level, and the insurance provider. Generally, older drivers may experience slightly higher premiums due to age-related factors that insurers consider, such as the potential for slower reaction times or increased risk of certain health conditions.

Yakima, Washington Senior Auto Insurance Monthly Rates by Gender & Provider

Insurance Company Age: 60 Female Age: 60 Male

Allstate $141 $147

American Family $143 $143

Farmers $161 $182

Geico $128 $128

Liberty Mutual $124 $145

Nationwide $100 $104

Progressive $111 $113

State Farm $105 $105

USAA $87 $88

However, many providers offer discounts for seniors with safe driving records or for those who bundle policies. It’s important for older drivers in Yakima to compare monthly average rates across multiple providers to find the most cost-effective options that still offer adequate coverage.

Driving Record Impact on Yakima Auto Insurance Rates

Your driving record significantly influences your auto insurance rates, with insurers closely examining your history to assess risk. In Yakima, Washington, drivers with a clean record typically enjoy lower premiums, reflecting their lower risk of accidents or violations. Conversely, those with a history of traffic violations, accidents, or DUIs often face substantially higher rates due to the increased risk they pose to insurers.

Yakima, Washington Auto Insurance Monthly Rates by Driving Record & Provider

Insurance Company Clean Record One Accident One DUI One Ticket

Allstate $216 $268 $296 $240

American Family $239 $305 $353 $292

Farmers $205 $255 $275 $254

Geico $155 $199 $296 $155

Liberty Mutual $263 $330 $337 $300

Nationwide $129 $174 $218 $141

Progressive $210 $327 $244 $253

State Farm $168 $202 $185 $185

USAA $132 $191 $240 $156

Comparing the monthly auto insurance rates in Yakima, Washington reveals a stark difference between those with clean records and those with blemished driving histories, underscoring the importance of maintaining a safe driving record to keep your insurance costs manageable. Discover insights in our guide titled “Does a criminal record affect auto insurance rates?”

Cheap Yakima, Washington Auto Insurance Rates After a DUI

Securing affordable auto insurance after a DUI in Yakima, Washington is challenging due to higher premiums. However, by comparing rates from various insurers, you can find competitive options.

Yakima, Washington Auto Insurance Rates After a DUI

Insurance Company Monthly Rates

Allstate $296

American Family $353

Farmers $275

Geico $296

Liberty Mutual $337

Nationwide $218

Progressive $244

State Farm $185

USAA $240

Some providers offer discounts for completing DUI-related safety courses, which can further reduce costs. Diligent comparison shopping is key to finding the best coverage at a reasonable price.

Credit Impact on Yakima Auto Insurance Rates

Credit history plays a significant role in determining the cost of auto insurance, often leading to substantial differences in monthly premiums. In Yakima, Washington, drivers with excellent credit scores typically enjoy lower insurance rates, as they are perceived as less risky by insurers.

Yakima, Washington Auto Insurance Monthly Rates by Credit Score

Insurance Company Poor Credit Fair Credit Good Credit

Allstate $317 $241 $207

American Family $351 $286 $254

Farmers $301 $228 $212

Geico $240 $192 $173

Liberty Mutual $439 $271 $213

Nationwide $197 $155 $145

Progressive $285 $254 $236

State Farm $268 $161 $126

USAA $227 $166 $146

Drivers with poor or fair credit may face higher premiums due to perceived risk. Understanding this can help Yakima residents improve credit scores and secure better rates. Unlock details in our article titled “High-Risk Auto Insurance Defined.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding How ZIP Codes Influence Auto Insurance Rates in Yakima, Washington

Auto insurance rates in Yakima, Washington, can significantly vary depending on your ZIP code. Factors such as local traffic patterns, crime rates, and the frequency of accidents in different areas contribute to these variations.

Yakima, Washington Auto Insurance Monthly Rates by ZIP Code

ZIP Rates

98902 $233

98903 $228

98908 $228

98901 $235

98907 $230

98904 $232

98909 $229

Comparing the yearly auto insurance costs across different ZIP codes in Yakima, Washington, helps you see how your location influences your premiums. This analysis enables you to pinpoint areas with lower rates, allowing you to make informed coverage decisions based on your residence. Delve into our evaluation of our article titled “Can your car be registered at a different address than where you live?”

Impact of Commute Length and Mileage on Yakima Auto Insurance Rates

The length of your commute and the total mileage you drive significantly impact auto insurance rates in Yakima, Washington. Insurers consider longer commutes and higher mileage as indicators of increased risk, often resulting in higher premiums.

Yakima, Washington Auto Insurance Monthly Rates by Annual Mileage & Provider

Insurance Company 6,000 Miles 12,000 Miles

Allstate $255 $255

American Family $291 $303

Farmers $247 $247

Geico $199 $204

Liberty Mutual $307 $307

Nationwide $166 $166

Progressive $259 $259

State Farm $180 $190

USAA $178 $182

To secure the most affordable auto insurance in Yakima, it’s crucial to compare rates based on your specific commute length and driving habits. Compare provider rates to find the most cost-effective coverage tailored to your driving needs. Access comprehensive insights into our article titled “Does auto insurance cover someone else driving my car?”

Impact of Coverage Levels on Auto Insurance Costs in Yakima, Washington

The coverage level you choose significantly impacts the cost of your auto insurance in Yakima, Washington. Higher coverage levels generally provide more protection but come with increased premiums.

Choosing minimum coverage can reduce your costs but may offer inadequate protection in a severe accident. Comparing different coverage levels in Yakima, Washington, helps you weigh cost versus coverage, enabling you to select the policy that best suits your budget and needs. Discover more about offerings in our guide titled “How to Settle a Car Accident Without Auto Insurance.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Yakima Auto Insurance Providers: Tailored Choices for Every Driver

To secure the most affordable auto insurance in Yakima, Washington, it’s crucial to assess the leading companies based on your specific needs and circumstances. For teenagers and drivers with a clean record, Nationwide offers competitive rates. Seniors also find favorable options with USAA, while those with one accident or a speeding violation may benefit from Nationwide’s policies.

However, if you have a DUI on your record, State Farm is recognized for providing the best coverage under those conditions. Comparing these options will help you determine the provider that best suits your unique situation.

Comparing these companies allows you to identify the most budget-friendly choices that offer the right balance of affordability and coverage, helping you make a well-informed decision that meets your financial and insurance needs. See more details on our article titled “How to Check if a Vehicle Has Auto Insurance Coverage.”

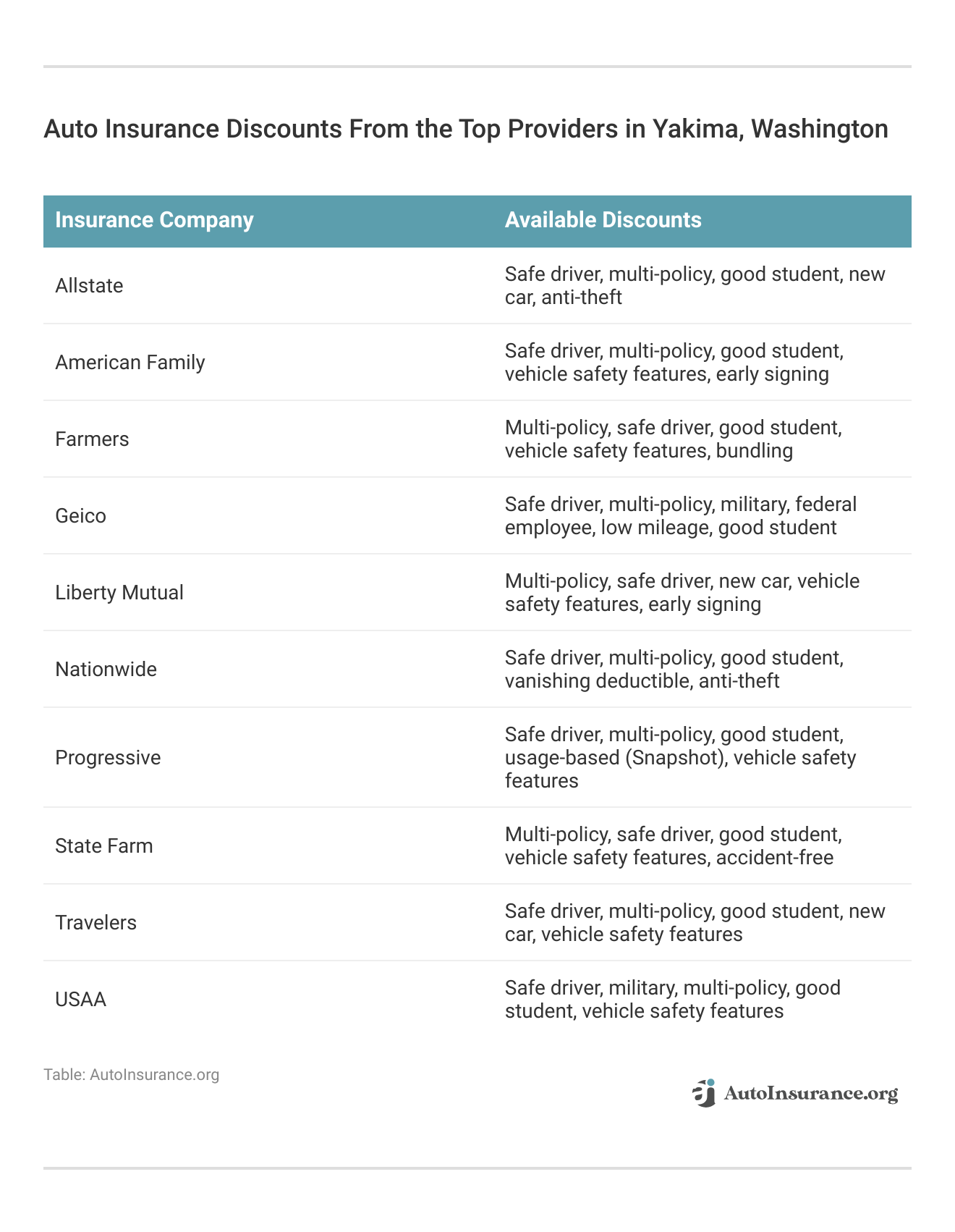

Maximize Savings with Yakima’s Cheapest Auto Insurance Options

If you’re looking for the most affordable auto insurance in Yakima, Washington, it’s essential to compare the top providers to identify the best rates. By evaluating the offerings from leading companies in the area, you can find policies that not only meet your coverage needs but also fit within your budget.

Factors like coverage level, discounts, and specific driver details can influence the monthly premiums, so a thorough comparison allows you to secure the most cost-effective option. Learn more in our guide titled “Auto Insurance Discounts to Ask for.”

Whether you’re seeking basic liability coverage or a more comprehensive plan, reviewing and comparing quotes from the cheapest auto insurance companies in Yakima will help you make an informed decision and maximize your savings.

Factors Impacting Auto Insurance Rates in Yakima, Washington

Auto insurance rates in Yakima, Washington, can fluctuate due to a variety of local factors unique to the area. Traffic density plays a significant role; areas with heavier traffic often see higher rates due to the increased likelihood of accidents.

Additionally, the rate of vehicle thefts in Yakima is a crucial factor, as higher theft rates lead to higher premiums to cover the increased risk. Other elements that can impact rates include the overall accident rate in the city, weather conditions that may cause hazardous driving, and even the average cost of vehicle repairs in the region.

Local laws and regulations, as well as the availability of insurance providers, also contribute to the variability in rates. By understanding these factors, Yakima drivers can better anticipate and potentially reduce their auto insurance costs.

Yakima Auto Theft

Higher auto insurance rates in Yakima, Washington, are directly influenced by the prevalence of auto theft, as insurers face increased claims payouts due to these incidents. The FBI’s annual report highlights that Yakima experienced 506 auto thefts, underscoring a significant risk factor that drives up premiums for local drivers.

This heightened risk leads insurance companies to adjust rates to mitigate the financial impact of potential theft-related claims, resulting in higher costs for policyholders. Explore more discount options in our guide titled “Best Auto Insurance Companies That Pay Dividends to Policyholders.”

Yakima Commute Time

Cities where drivers face longer average commute times often experience higher auto insurance costs due to increased exposure to potential accidents and road hazards. In Yakima, Washington, the average commute length is 17.3 minutes, according to City-Data.

While this commute time is relatively moderate, it still influences insurance premiums, as more time spent on the road typically correlates with a higher likelihood of incidents. Consequently, Yakima drivers may see insurance costs that reflect this added risk, making it important to consider commute time as a factor when comparing auto insurance rates in the area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Maximizing Savings: Comparing Auto Insurance Quotes in Yakima, Washington

Comparing auto insurance quotes in Yakima, Washington, is an essential step in securing the best coverage at the most competitive price. Each insurance provider offers different rates based on factors such as coverage level, driving history, and discounts.

State Farm’s 13% bundling discount in Yakima, Washington, makes it a top choice for comprehensive savings.Michelle Robbins Licensed Insurance Agent

Comparing quotes from multiple companies helps Yakima residents find the best options for their needs. Whether you prioritize affordability, comprehensive coverage, or additional perks like accident forgiveness or bundling discounts, comparing quotes allows you to make an informed decision. Learn more in our detailed analysis titled “How to Save Money by Bundling Insurance Policies.”

Taking the time to compare quotes not only helps you find the lowest possible premium but also ensures that you get the best value for your money, with coverage that meets all your requirements. Enter your ZIP code below to get free Yakima, Washington auto insurance quotes.

Frequently Asked Questions

Can credit history affect auto insurance rates in Yakima, WA?

Yes, credit history can affect auto insurance rates in Yakima, WA. A good credit score is often associated with lower rates, while a poor credit score may result in higher premiums.

Access comprehensive insights into our guide titled “Best Auto Insurance Companies for Drivers With Bad Credit.”

How does driving record impact auto insurance rates in Yakima, WA?

Driving record has a significant impact on auto insurance rates in Yakima, WA. A clean driving record generally results in lower rates, while accidents, DUIs, and speeding violations can increase premiums.

What are the average auto insurance rates for seniors in Yakima, WA?

The average auto insurance rates for senior drivers in Yakima, WA are $125 per month.

How do age, gender, and marital status affect auto insurance rates in Yakima, WA?

Auto insurance rates in Yakima, WA are affected by age, gender, and marital status. Generally, married individuals and older drivers tend to have lower rates.

Learn more by reading our guide titled “Best Auto Insurance for Drivers with Dementia.”

Does my ZIP code affect my auto insurance rates in Yakima, Washington?

Yes, your ZIP code can influence your auto insurance rates in Yakima, Washington. Insurance companies consider factors such as the frequency of accidents, theft rates, population density, and local road conditions when determining premiums. Rates may vary depending on the specific risks associated with your ZIP code.

Can I add additional coverage options to my auto insurance policy in Yakima, Washington?

Yes, most insurance companies offer various additional coverage options that you can add to your auto insurance policy in Yakima, Washington. These options may include collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and roadside assistance. Speak with your insurance agent to explore the available options and determine what suits your needs.

What services does Allstate offer in Yakima, Washington?

Allstate in Yakima, Washington offers a range of auto insurance options, including liability, collision, and comprehensive coverage, along with personalized local agent support.

To find out more, explore our guide titled “Collision Auto Insurance Defined.”

How can I get American Family insurance in Yakima, Washington?

You can get American Family insurance in Yakima, Washington by contacting a local agent to explore coverage options tailored to your needs, including auto, home, and life insurance.

Where can I find the best auto insurance rates in Yakima, Washington?

To find the best auto insurance rates in Yakima, Washington, compare quotes from top providers like Geico, State Farm, and Progressive, considering both coverage options and discounts.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

How do I get auto insurance quotes in Yakima, Washington?

To get auto insurance quotes in Yakima, Washington, compare rates online from multiple providers or contact local agents for personalized quotes based on your specific driving history and coverage needs.

You can learn more in our article titled, “Cheap Auto Insurance in Washington.”

What is the best way to perform a auto insurance comparison in Yakima, Washington?

The best way to perform a auto insurance comparison in Yakima, Washington is to use online tools to compare quotes from multiple insurers based on coverage, customer service, and price.

What coverage does Geico insurance offer in Yakima, Washington?

Geico insurance in Yakima, Washington offers a wide range of coverage options, including liability, collision, comprehensive, and specialized coverage like roadside assistance.

For additional details, explore our comprehensive resource titled “Best Auto Insurance Companies for Roadside Assistance.”

Who offers the cheapest auto insurance in Yakima, Washington?

Geico and Progressive are known for offering the cheapest auto insurance in Yakima, Washington, but it’s best to compare quotes to find the most affordable option for your needs.

How can I get Nationwide insurance in Yakima, Washington?

To get Nationwide insurance in Yakima, Washington, contact a local agent or use their online platform to explore auto, home, and life insurance options.

What does Progressive insurance offer in Yakima, Washington?

Progressive insurance in Yakima, Washington offers customizable auto insurance policies with options for liability, collision, and comprehensive coverage, along with unique features like the Snapshot program.

Find out more in our comprehensive guide titled, “Progressive Snapshot Review.”

How can I find State Farm insurance in Yakima, Washington?

You can find State Farm insurance in Yakima, Washington by visiting local agent offices or using their website to get quotes and manage your insurance needs.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.